Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Are you currently in a situation where you frequently require documents for professional or personal purposes.

There are numerous legal document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms provides a vast selection of template forms, including the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, which is designed to comply with state and federal regulations.

Choose the pricing plan you want, complete the necessary details to set up your account, and purchase the order using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets anytime, if needed. Simply revisit the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct municipality/region.

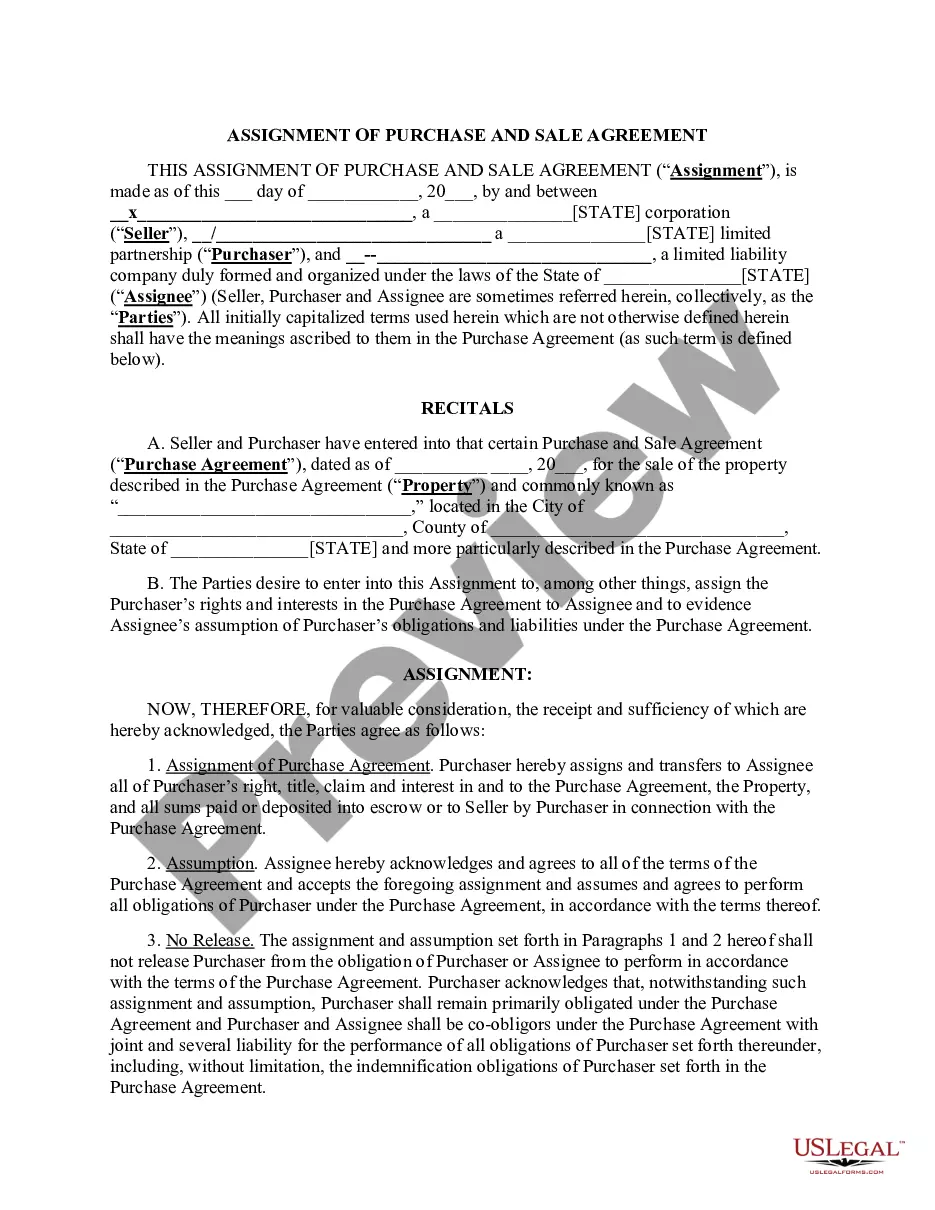

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

- Once you find the right form, click Get now.

Form popularity

FAQ

It is common for general partnerships to dissolve if any partner withdraws, dies, or becomes otherwise unable to continue their duties as a business partner.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

Under the UPA, the withdrawal of a partner from the partnership automatically causes a dissolution (a break-up) of the partnership. One of the major r introduced with RUPA was to allow a partner to withdraw from the partnership without automatically causing a dissolution of the partnership.