Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

It is feasible to dedicate time online attempting to locate the approved document template that aligns with the state and federal stipulations you require.

US Legal Forms provides a vast array of legal forms that are vetted by experts.

It is straightforward to obtain or print the Kansas Agreement to Terminate and Wind up Partnership with Sale to Partner by Retiring Partner from your service.

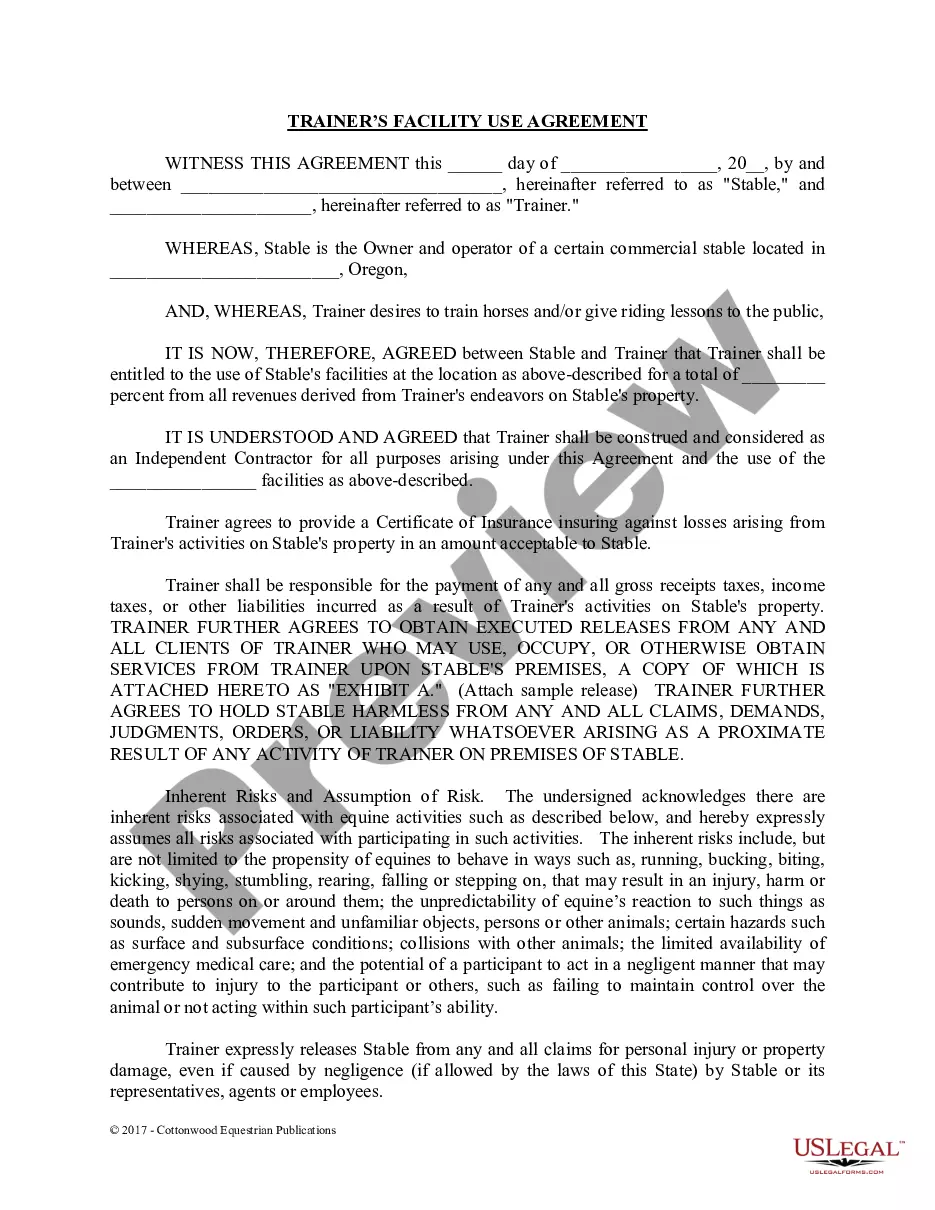

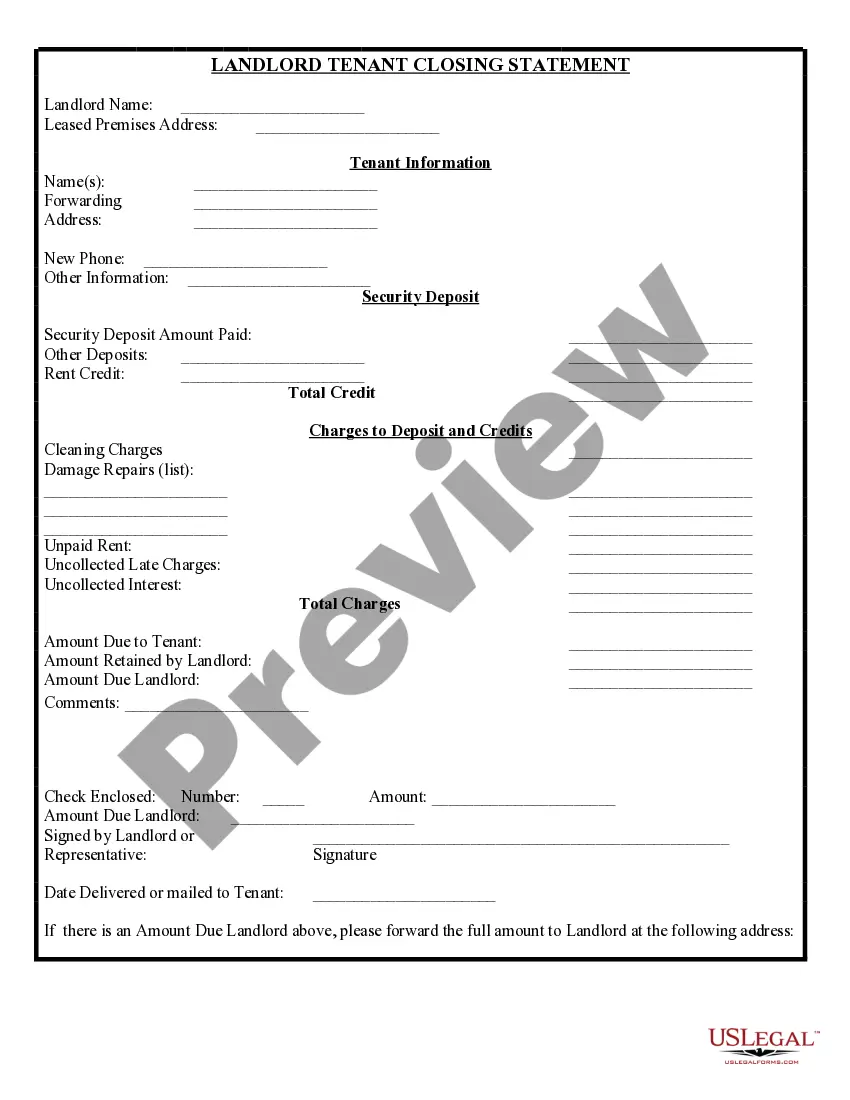

If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Kansas Agreement to Terminate and Wind up Partnership with Sale to Partner by Retiring Partner.

- Each legal document template you obtain remains your property indefinitely.

- To acquire another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

Winding up a partnership firm involves several steps to ensure a smooth conclusion of business affairs. First, the partners must agree on the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which outlines the terms of the dissolution and sale. Then, the firm must settle all outstanding debts, liquidate assets, and distribute any remaining capital among partners. Finally, filing the necessary paperwork with the appropriate state authorities will formally conclude the partnership.

Walking away from a partnership without proper legal procedures can lead to significant consequences. It is wise to utilize a Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to ensure a fair exit. This approach not only protects you legally but also respects the interests of the remaining partner and the business.

Generally, a partner can initiate the dissolution of the partnership, but it should be governed by the terms in your partnership agreement. If you have a Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, it will stipulate the conditions under which a partner may exit. Make sure to review your agreement and understand all implications before proceeding.

To dissolve a partnership firm, partners typically need to draft a Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This process includes outlining the reasons for dissolution, details on asset distribution, and how the business will handle any outstanding debts. Consulting with legal experts can help you navigate this procedure effectively.

Yes, you can dissolve a partnership through a Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This legal document allows partners to formally end the partnership, clarifying the steps to take regarding the division of assets and liabilities. It is important to follow the correct procedures to ensure that all legal obligations are met.

When one partner wants to leave, it can lead to the need for a Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This agreement outlines how the partnership will be dissolved, including how assets will be divided and if the leaving partner will sell their share to the remaining partner. Properly addressing this situation can help avoid disputes and ensure a smooth transition.

Ending a partnership gracefully requires respectful communication and a focus on fair treatment. Discuss and agree upon asset distribution and debt repayment openly. Utilizing the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner helps to formalize and document the process. Always aim to preserve professional relationships while concluding the partnership.

The easiest way to dissolve a partnership firm involves clear communication and a well-structured approach. Reviewing your partnership agreement will inform you of all necessary steps. Opting for the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can streamline the process. This ensures all legal requirements are met with minimal stress for all parties involved.

In most cases, a partner can initiate the dissolution of a partnership; however, the actions should align with the partnership agreement. Some agreements may require a mutual decision or specific conditions to be met before dissolution can occur. Utilize the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner for a clear framework. Always discuss intentions with your partners to avoid conflict.

Dissolving a partnership agreement begins with reviewing the terms outlined in the agreement itself. You will need to follow the procedures mentioned, ensuring all partners consent to the dissolution. Utilizing the Kansas Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can make this process more efficient. Document all steps taken to avoid any potential misunderstandings in the future.