New Jersey Certification of Seller

Description

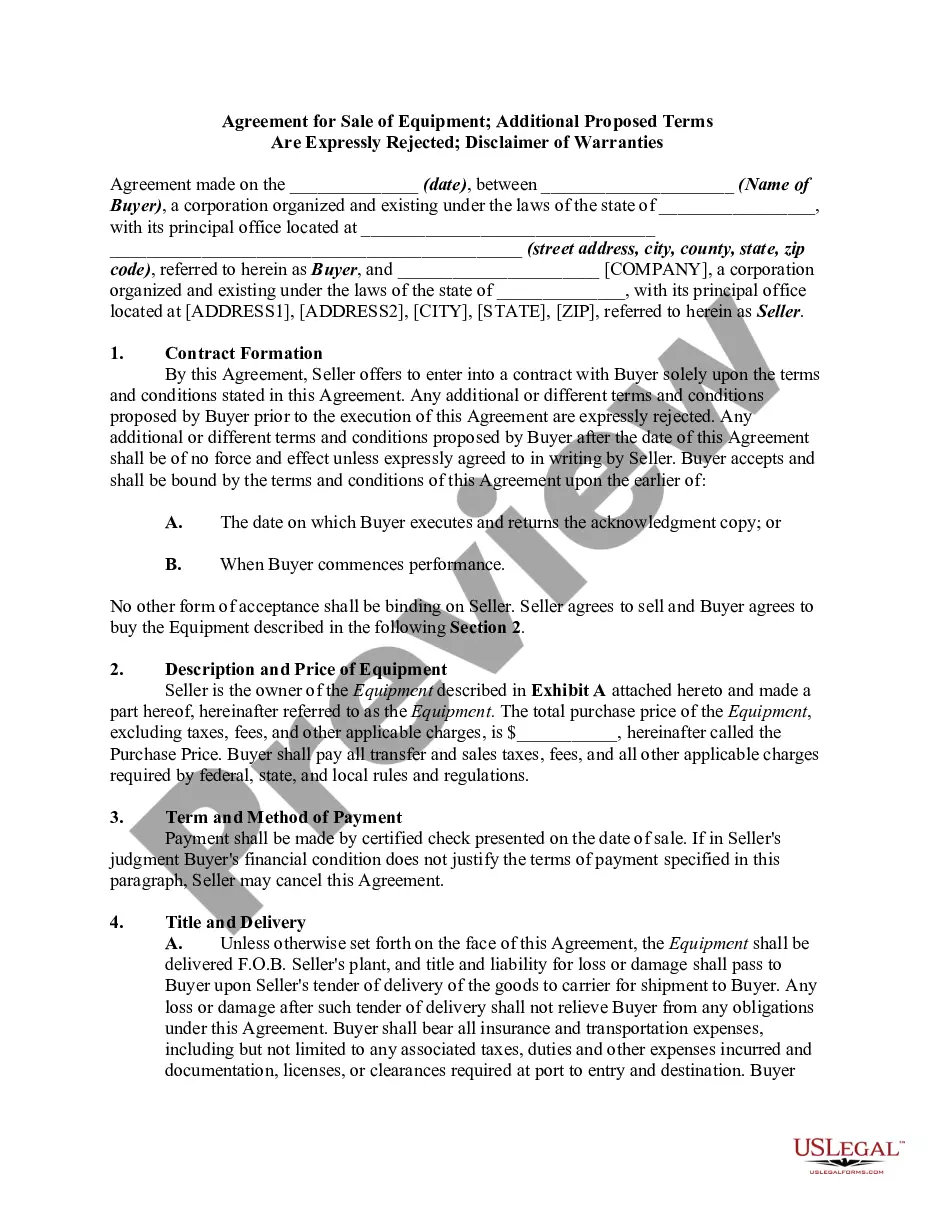

How to fill out Certification Of Seller?

Selecting the correct official document format can be challenging.

There is no shortage of templates available online, but how can you find the official document you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct document for your city/county. You can review the document using the Review button and read the document description to ensure it’s appropriate for your needs.

- The service offers a vast array of templates, such as the New Jersey Certification of Seller, which can be used for both business and personal purposes.

- All forms are verified by professionals and meet state and federal standards.

- If you are already registered, Log In to your account and click the Obtain button to download the New Jersey Certification of Seller.

- Use your account to search through the official documents you have previously ordered.

- Navigate to the My documents section of your account and retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some basic instructions to follow.

Form popularity

FAQ

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

State of New JerseyBusiness Licensing All businesses must register to receive a New Jersey Business Registration Certificate. During this registration process, businesses indicate if they are subject to paying state sales tax. If so, they will need a Certificate of Authority, also called a seller's permit.

In New Jersey, it is officially known as a Certificate of Authority. If you need a wholesale license in New Jersey, you can trust FastFilings to help you obtain one the fast, easy, and simple way.

To obtain the certificate, complete an Application for Public Records Filing for New Business Entities. For a copy of the application, call (609) 292-1730 or log onto .

To request a copy of a filed tax return, submit a request to the Division of Taxation. This optional service, which provides processing within 8.5 business hours is available for these requests received in person, by FAX or by courier service. All FAX requests are considered to be requests for expedited service.

You may validate any certificate that is issued by the Division and that contains a validation number under the printed seal of the State of New Jersey. For validation of a Certificate of Authority you will need to use the Document Locator Number.

FAQs on Gross Income Tax (GIT) Forms Required For Sale or Transfer of Real Property in New Jersey. What is a GIT/REP (real property) form? A GIT/REP form is a Gross Income Tax form required to be recorded with a deed when real property is transferred or sold in New Jersey. Several types of forms are in use.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

4. How much does it cost to apply for a sales tax permit in New Jersey? There is no fee required to file Form NJ-REG and register your business.

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).