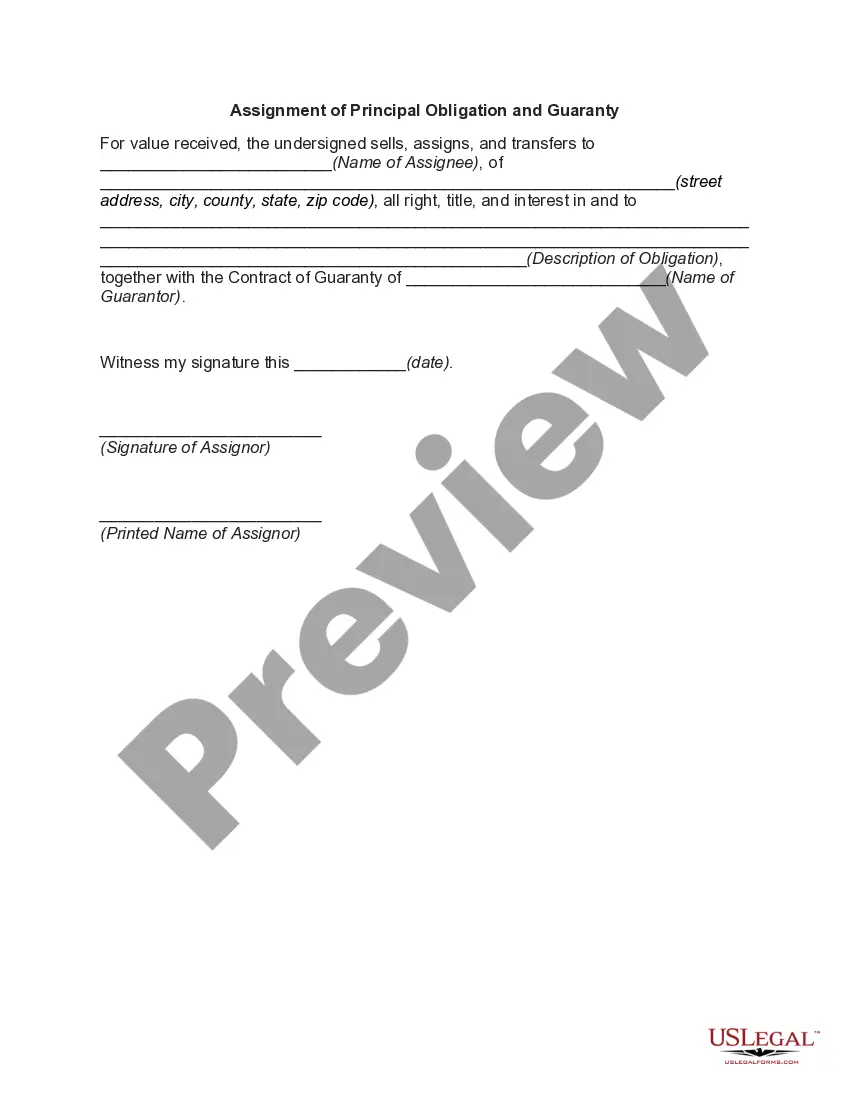

Kansas Assignment of Principal Obligation and Guaranty

Description

How to fill out Assignment Of Principal Obligation And Guaranty?

You can invest hours on the web searching for the authorized document format that suits the state and federal requirements you require. US Legal Forms gives a large number of authorized kinds which can be evaluated by specialists. It is possible to down load or produce the Kansas Assignment of Principal Obligation and Guaranty from the assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click on the Down load key. Next, it is possible to comprehensive, change, produce, or indicator the Kansas Assignment of Principal Obligation and Guaranty. Each and every authorized document format you acquire is the one you have eternally. To get an additional backup associated with a obtained kind, visit the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site the first time, keep to the basic instructions beneath:

- Very first, make sure that you have selected the right document format for that area/city of your liking. Browse the kind explanation to make sure you have picked out the appropriate kind. If accessible, utilize the Preview key to check from the document format too.

- If you want to locate an additional model from the kind, utilize the Look for field to find the format that fits your needs and requirements.

- Once you have found the format you need, click Get now to proceed.

- Select the pricing plan you need, type your credentials, and register for your account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal profile to fund the authorized kind.

- Select the structure from the document and down load it to your device.

- Make adjustments to your document if necessary. You can comprehensive, change and indicator and produce Kansas Assignment of Principal Obligation and Guaranty.

Down load and produce a large number of document templates utilizing the US Legal Forms site, that offers the biggest collection of authorized kinds. Use professional and state-particular templates to deal with your small business or specific requirements.

Form popularity

FAQ

The advantages are mainly to the borrower: increased chance of loan approval, better loan terms, and possible improvement of credit score, while the disadvantages are primarily to the guarantor: liability to pay if the borrower defaults, risk of lowering credit score, and lesser chance of getting approved for their own ...

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

What does being a guarantor mean? Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you ?guarantee? someone else's loan or mortgage by promising to repay the debt if they can't afford to. It's wise to only agree to being a guarantor for someone you know well.

A guarantor is a financial term describing an individual who promises to pay a borrower's debt if the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

A guaranty agreement is a two-party contract in which the first party agrees to perform a stipulated action in the event that a second party fails to perform.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.