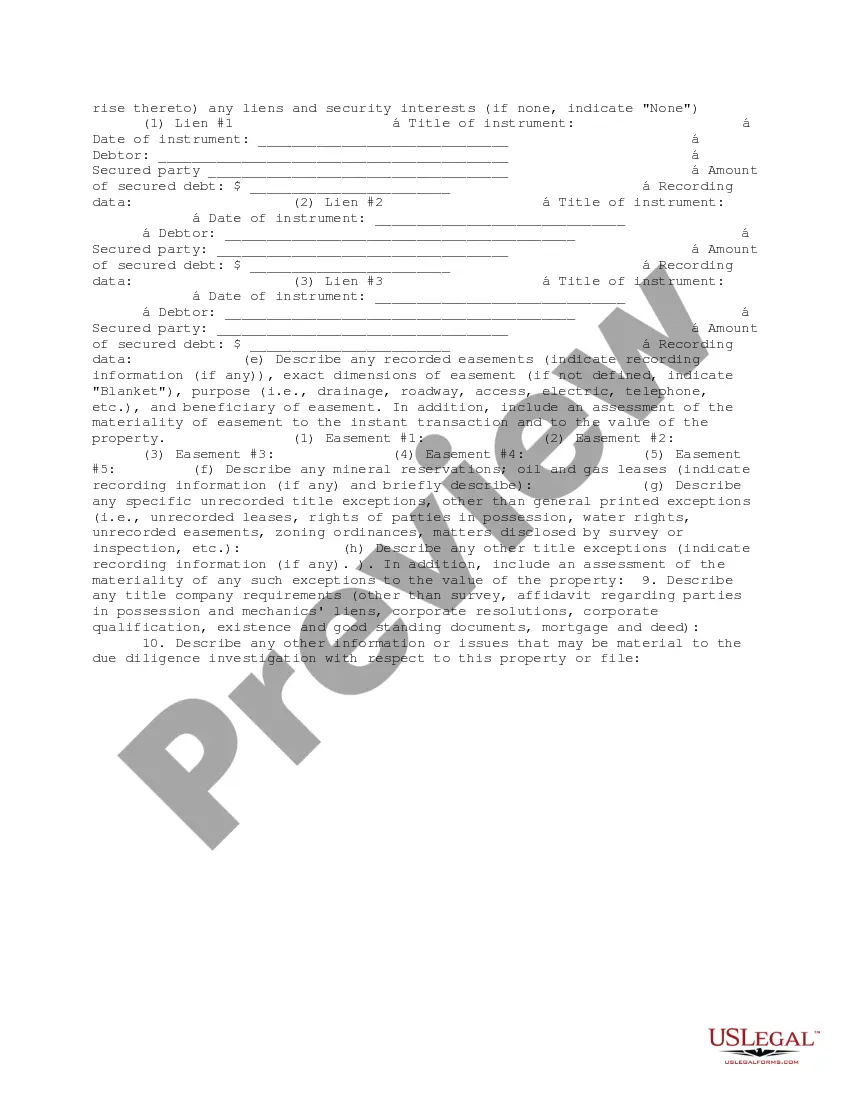

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Washington Fee Interest Workform

Description

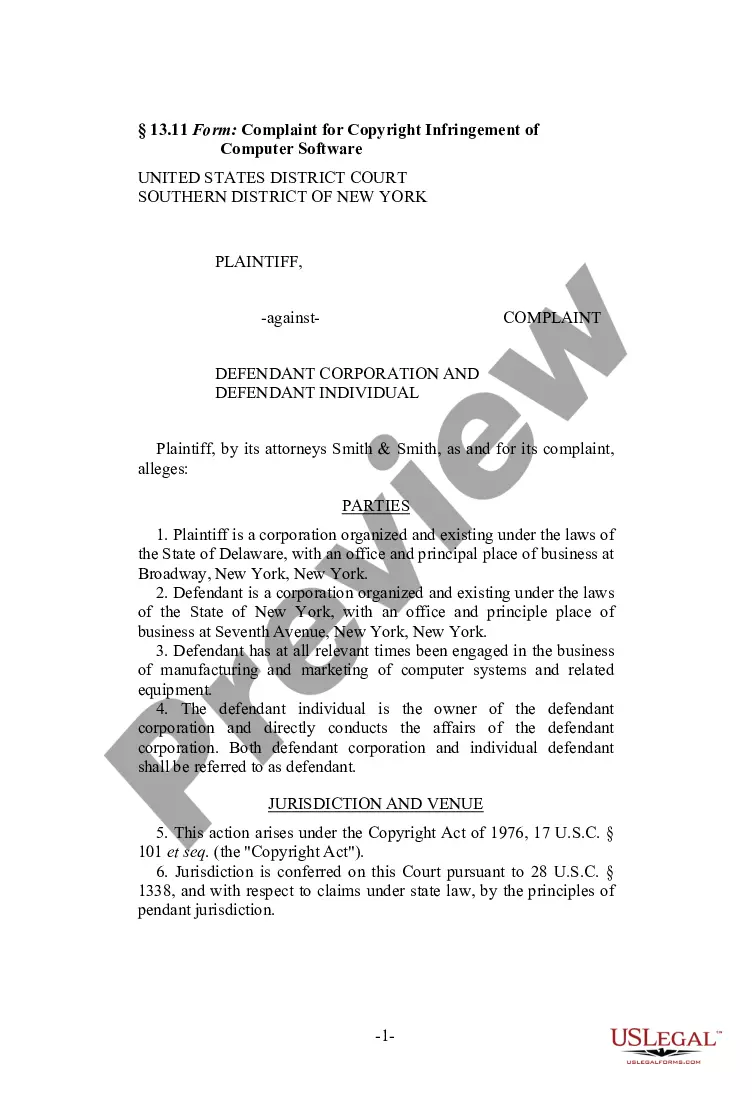

How to fill out Fee Interest Workform?

Are you in a circumstance where you require documents for various business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms offers thousands of form templates, such as the Washington Fee Interest Workform, that are designed to comply with state and federal regulations.

Utilize US Legal Forms, one of the largest collections of legitimate forms, to save time and minimize mistakes.

The service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Washington Fee Interest Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it’s for the correct city/area.

- Use the Preview button to examine the form.

- Review the information to confirm that you’ve selected the right form.

- If the form is not what you are looking for, utilize the Search field to locate the form that fits your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, complete the necessary details to create your account, and place an order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

- Locate all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Washington Fee Interest Workform at any time, as needed. Simply click the relevant form to download or print the document template.

Form popularity

FAQ

The filing fee for establishing an LLC in Washington state is generally $200 when filed online, and $180 if filed by mail. This fee secures your business name and structure, allowing you to operate legally within the state. It's best to prepare your Washington Fee Interest Workform and other necessary documentation ahead of time. For additional information on setting up your LLC, the uslegalforms platform provides helpful guides and templates.

To file Washington state excise tax, you must use the Department of Revenue's online portal or submit your forms by mail. This process often requires accurate reporting of your business income and sales figures. Ensure you have the proper forms on hand, including your Washington Fee Interest Workform, if needed for owning an entity. For a smooth filing experience, consider consulting the uslegalforms platform for step-by-step instructions and resources.

The Washington Fee Interest Workform is used to control the transfer of interests in specific entities in Washington state. This form ensures that ownership changes are documented properly and comply with state regulations. Completing the Washington Fee Interest Workform helps maintain accurate records and avoid potential disputes. For guidance on filling out this form, you can visit the uslegalforms platform, which offers detailed resources.

The $1200 payment in Washington is a fee associated with business licensing and renewal, particularly for certain business structures. This fee is often required to keep your business in good standing within the state. Being aware of this obligation can save you from fines or legal issues. Utilizing the Washington Fee Interest Workform can make it easier to stay organized and compliant with your business's financial duties.

In Washington, the form used for controlling interest transfer is typically the Washington Fee Interest Workform. This form captures critical details about the transfer and helps ensure compliance with state regulations. Filling out this form accurately is essential for avoiding any potential legal complications later. Be sure to consider consulting a professional if you have questions about completing this form.

Filing an Annual Report in Washington requires you to provide updated information about your business, including its registered agent and address. You can file this report online through the Washington Secretary of State's website. Timely submission is necessary to maintain good standing for your business. Remember, having the Washington Fee Interest Workform on hand can simplify information organization for the report.

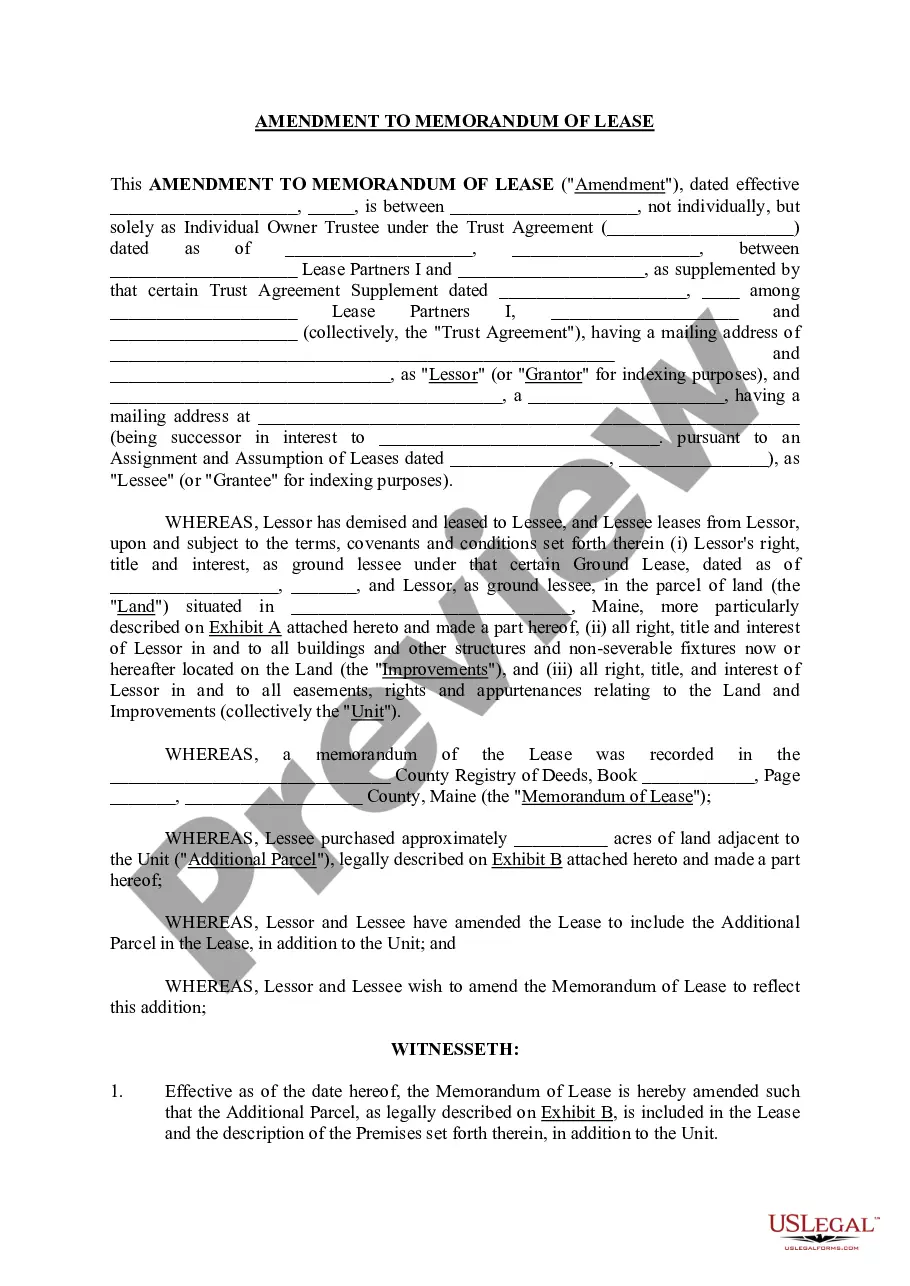

To transfer ownership of property in Washington, you need to complete a deed that outlines the transfer details and submit it to the local county recording office. This process ensures that the title to the property is legally recognized. Using the Washington Fee Interest Workform can help streamline this process, ensuring all necessary information is properly recorded.

Transferring ownership of a business in Washington involves certain legal steps, including drafting a bill of sale or an operating agreement. It's important to notify the state and any stakeholders about the change in ownership. For proper documentation, the Washington Fee Interest Workform can serve as a valuable tool. Make sure to consult with a legal expert to ensure compliance with state requirements.

To avoid transfer tax in Washington, you may consider certain exemptions that apply to specific transactions. Additionally, structuring your transactions correctly can minimize tax obligations. It's advisable to consult legal or tax professionals who can help you navigate these options effectively. Utilizing the Washington Fee Interest Workform may further assist in documenting your transaction appropriately.

A controlling interest transfer involves the sale or transfer of ownership stakes in a business that grants control over it. This can affect how the business operates and is particularly relevant for tax implications. It's crucial to understand the specifics related to controlling interests, especially in Washington. For a smooth process, consider using the Washington Fee Interest Workform.