Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

Are you in a location where you need documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but locating reliable ones is challenging.

US Legal Forms offers thousands of form templates, including the Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to, which are designed to comply with state and federal regulations.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

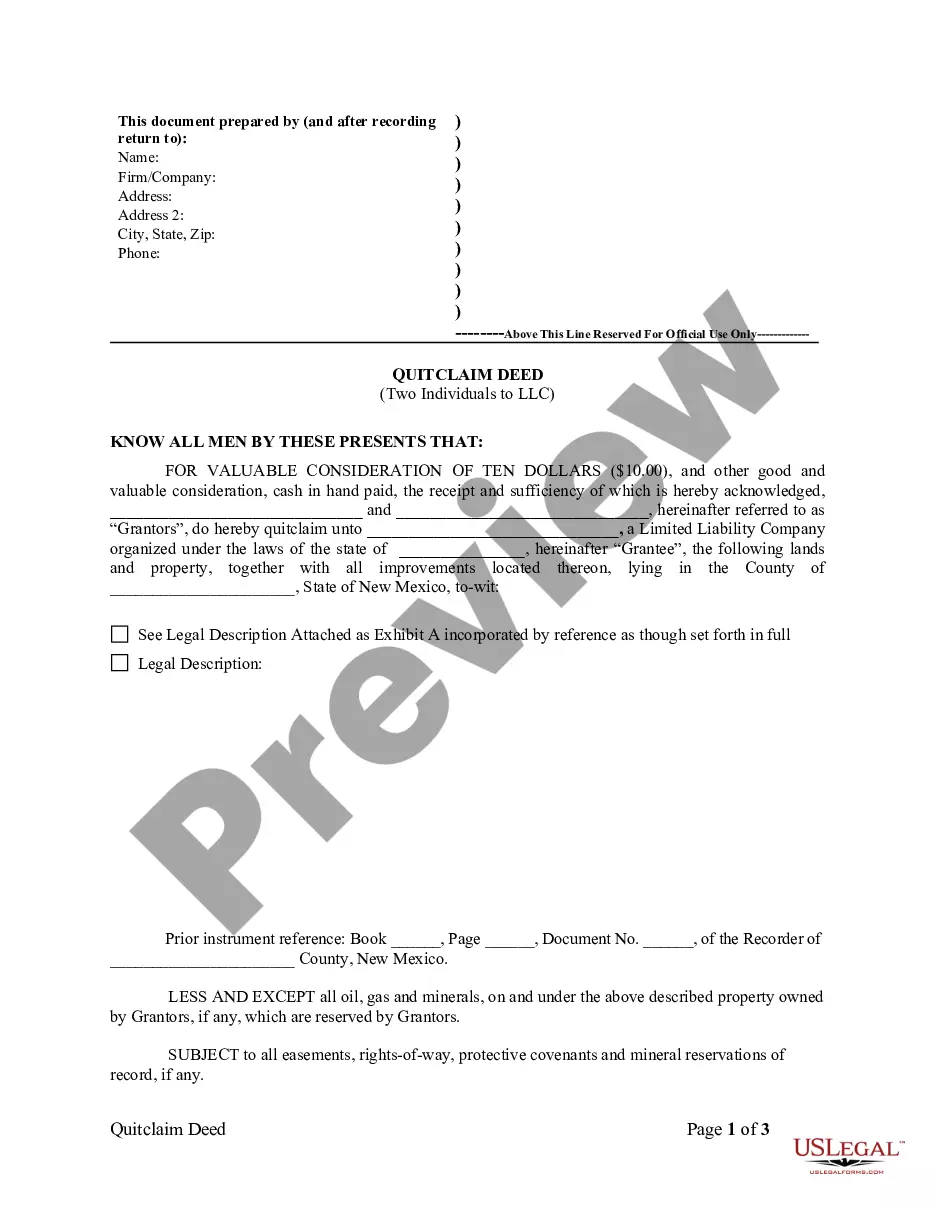

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you are looking for, utilize the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Setting up a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to involves several straightforward steps. First, you should choose the right trust document and clarify your goals. Next, work with a qualified attorney or use a reliable platform like uslegalforms to ensure all legal requirements are met. Finally, fund the trust by transferring your assets into it, which is essential for making the trust effective.

A revocable trust has some limitations, even with its many benefits. One downside is that it does not provide asset protection from creditors, meaning your assets could be at risk in a lawsuit. Additionally, if you do not fund the trust properly, your intentions for the Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to may not be fully realized, leading to complications in execution.

A revocable trust is usually taxed as a pass-through entity, meaning the income is reported on the trustors' personal tax returns. This structure as laid out in a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to offers simplicity, as there are generally no taxes owed at the trust level. Consequently, trustors can manage their tax obligations effectively while benefiting from the flexibility of the trust.

A joint revocable trust is generally taxed similarly to individual income tax, as income generated by the trust typically passes through to the trustors. Therefore, both spouses report the income on their personal tax returns. In many cases, there are no separate tax filings for the trust itself, simplifying the process for those involved.

Yes, in a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both spouses can serve as trustees. This arrangement empowers both partners to manage the trust assets and make decisions together. It fosters collaboration and ensures that each spouse is involved in the trust management process.

A joint revocable trust offers several advantages, especially for couples. Firstly, it provides a seamless way to manage assets together, avoiding the probate process upon death. Additionally, a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to allows both partners to maintain flexibility, enabling changes to the trust during their lifetimes as needed.

Yes, two people can indeed own a revocable trust. In the context of a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both spouses can establish a joint trust. This setup allows for shared control and management of assets, simplifying estate planning while ensuring both parties' interests are protected.

Whether married couples should have separate revocable trusts depends on their individual circumstances and financial goals. In some cases, separate trusts can protect personal assets and clarify individual wishes, while a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to can help consolidate management. It's essential to weigh the benefits and consult with legal professionals to determine the best approach for your needs.

Yes, married couples can absolutely have a revocable trust, and it's quite common. A Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to allows both spouses to jointly manage their assets while maintaining the flexibility to alter the trust as needed. This arrangement often leads to efficient estate planning and asset protection.

Putting a house in a trust can provide significant benefits, such as avoiding probate and ensuring privacy regarding asset distribution. For married couples, a Kansas Revocable Trust Agreement with Husband and Wife as Trustors and Income to can simplify the management of shared property and clarify intentions. It's advisable to consult with a legal expert to evaluate the best option for your specific situation.