Kansas Sample Letter for Judgment Confirming Tax Title

Description

How to fill out Sample Letter For Judgment Confirming Tax Title?

Finding the right legitimate papers template can be a have a problem. Naturally, there are a variety of templates available on the Internet, but how do you get the legitimate develop you need? Take advantage of the US Legal Forms site. The assistance offers a huge number of templates, for example the Kansas Sample Letter for Judgment Confirming Tax Title, that you can use for enterprise and private requires. Every one of the varieties are inspected by experts and meet up with federal and state needs.

If you are presently authorized, log in to the account and click the Obtain key to find the Kansas Sample Letter for Judgment Confirming Tax Title. Make use of your account to check throughout the legitimate varieties you may have bought in the past. Check out the My Forms tab of your respective account and get another copy of your papers you need.

If you are a brand new user of US Legal Forms, listed here are basic recommendations that you should adhere to:

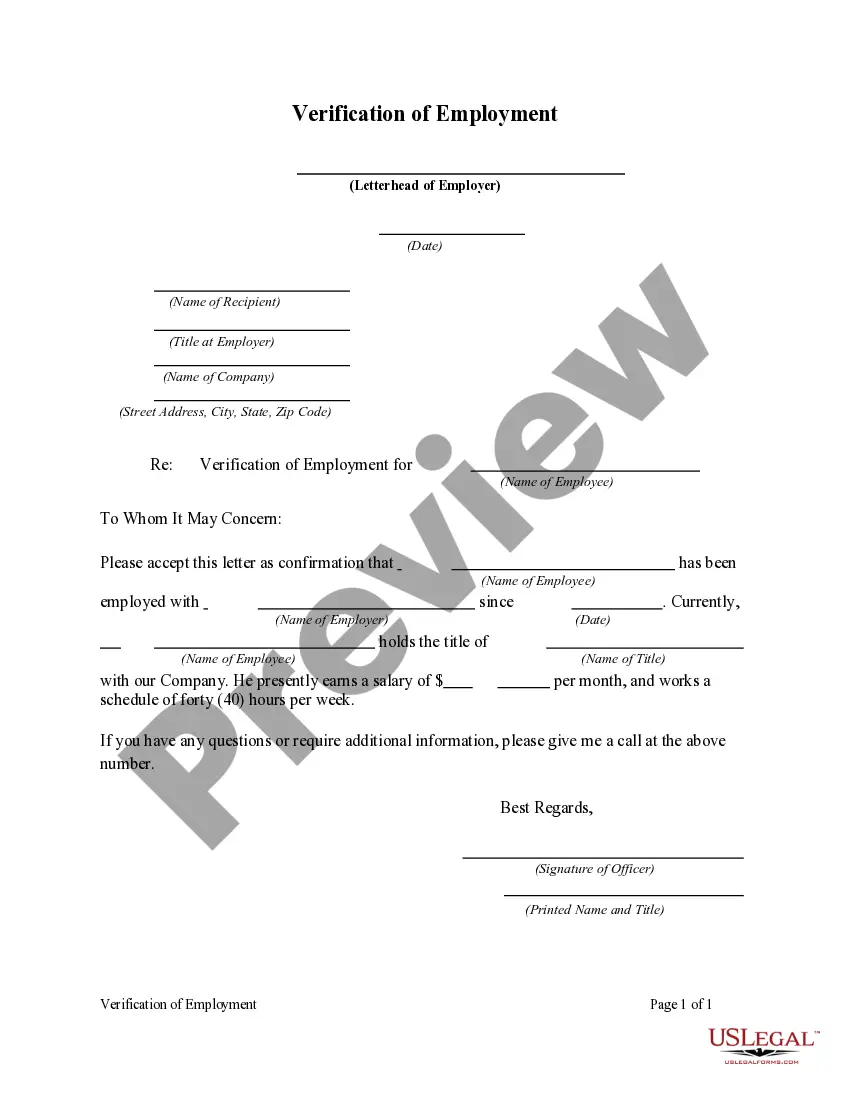

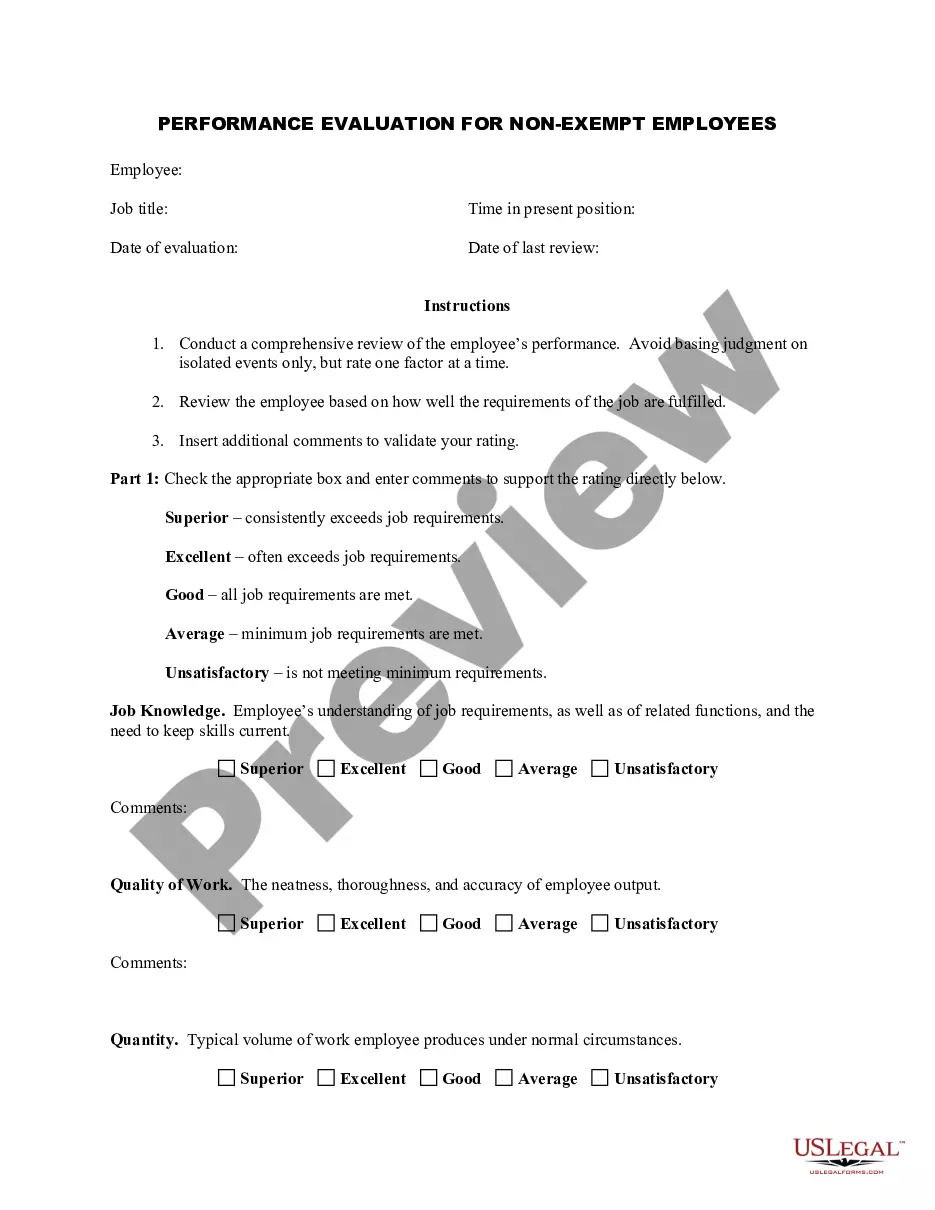

- Initially, make certain you have selected the appropriate develop for the town/region. You can examine the form making use of the Review key and browse the form explanation to guarantee this is basically the best for you.

- When the develop does not meet up with your needs, utilize the Seach field to obtain the appropriate develop.

- Once you are positive that the form would work, select the Get now key to find the develop.

- Opt for the prices prepare you would like and type in the required information. Build your account and pay money for your order using your PayPal account or bank card.

- Pick the submit format and down load the legitimate papers template to the system.

- Comprehensive, modify and print out and sign the obtained Kansas Sample Letter for Judgment Confirming Tax Title.

US Legal Forms may be the most significant catalogue of legitimate varieties that you can find a variety of papers templates. Take advantage of the service to down load skillfully-produced paperwork that adhere to condition needs.

Form popularity

FAQ

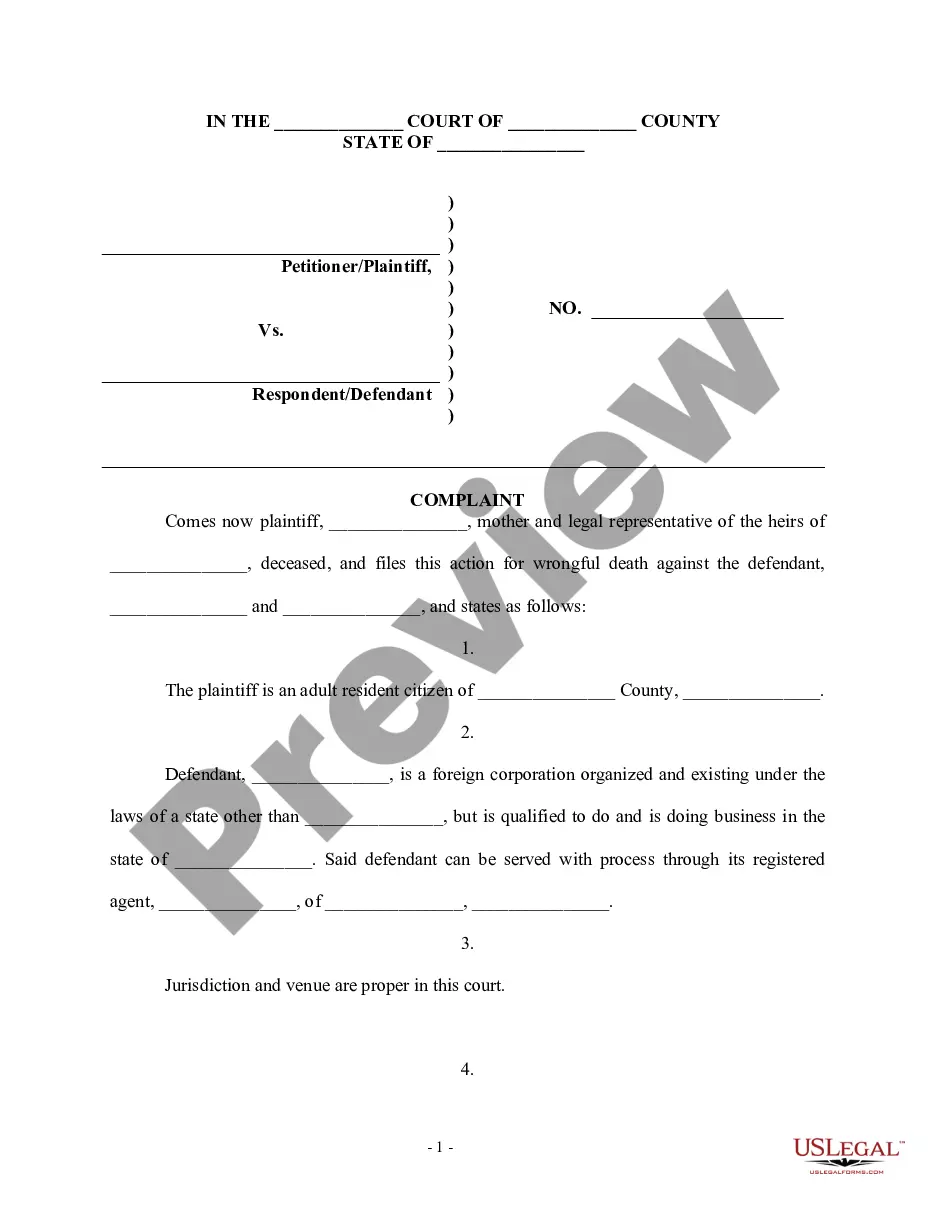

The tax warrant amount is recorded with the court and becomes a lien upon the real property title and interest of the taxpayer(s) named on the tax warrant. What methods does the Director of Revenue use to collect the taxes due? Tax warrants are treated as civil cases.

If any tax imposed by this act or any portion of such tax is not paid within 60 days after it becomes due, the secretary or the secretary's designee shall issue a warrant under the secretary's or the secretary's designee's hand and official seal, directed to the sheriff of any county of the state, commanding the ...

Delinquent real estate taxes not paid within 3 years are referred to the Legal Department for foreclosure action, thus putting the property in jeopardy of being sold at auction.

Tax warrants are filed by the Kansas Department of Revenue for recovery of delinquent tax obligations. If any tax due to the State of Kansas is not paid within 60 days after it becomes due, the Director of Revenue or their designee issues a warrant.

The Department of Revenue may place a lien on the property of any delinquent taxpayer. The lien attaches on November 1 of the year in which the taxes are levied. After the lien is filed, as much of the property as is necessary to pay the taxes may be seized and sold to the county.

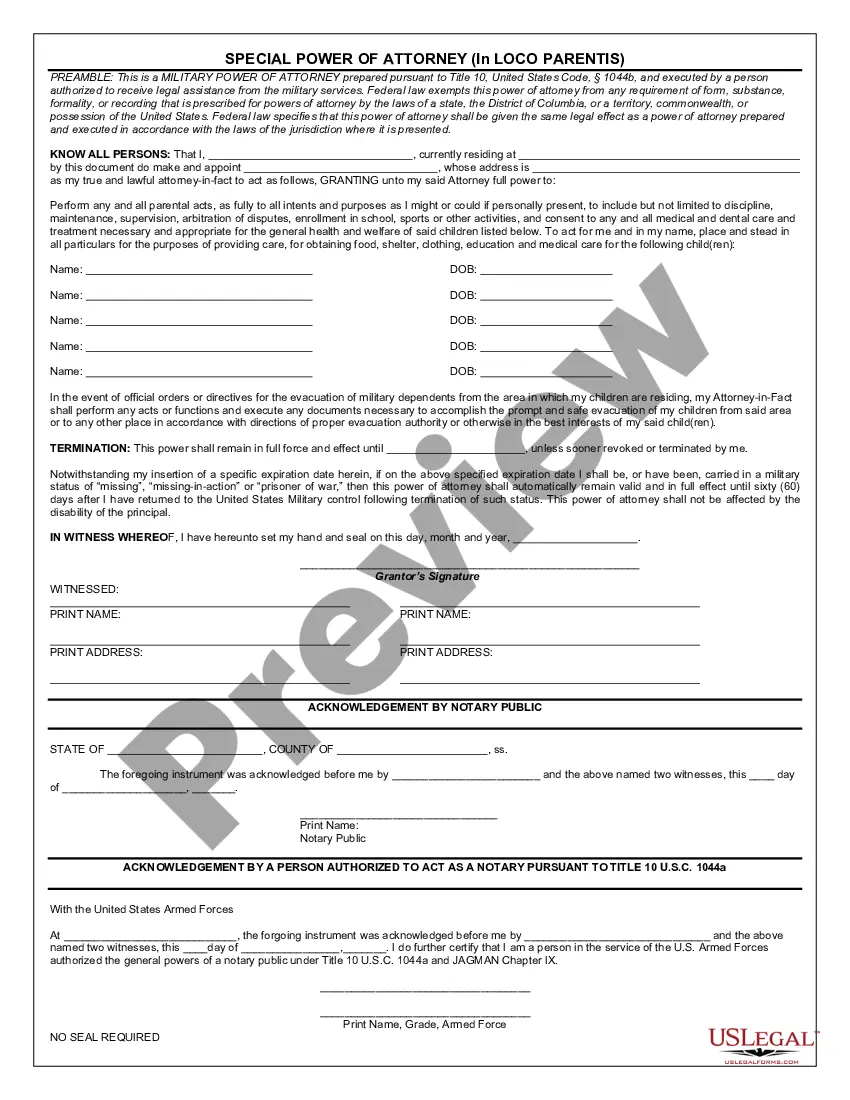

Notes on Filing a Quiet Title Action. ? A Quiet Title Action can be used to clear up the ownership of any vehicle on which a Title is given by the State of Kansas. ? This can include a car, motorcycle, travel trailer, or manufactured home.

Statute of Limitations on Kansas Tax Debt Collection Tax liens can stay in place for up to 20 years after they are filed. This means the state can act on the lien for up to 20 years. After that, tax liens typically go dormant.

The first opportunity you have to appeal is when you receive the notice of your property's value in the spring (generally in March). You can appeal your notice by contacting the county appraiser within 30 days from the date notice was mailed. Once you start this appeal, be sure to pursue it to your satisfaction.