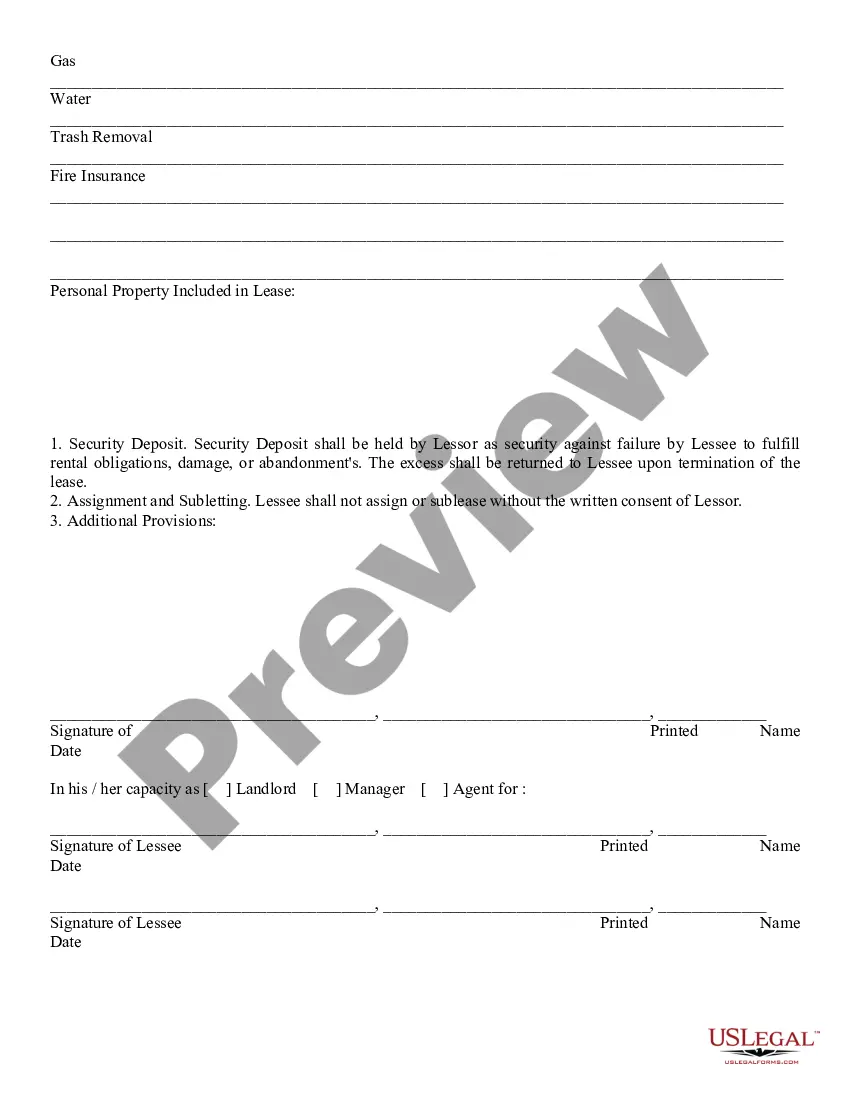

Kansas Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Kansas Nonresidential Simple Lease in no time.

If you have an account, Log In and download the Kansas Nonresidential Simple Lease from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Continue with the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form onto your device. Edit, fill out, print, and sign the downloaded Kansas Nonresidential Simple Lease. All templates you add to your account have no expiration date and are yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Kansas Nonresidential Simple Lease with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Make sure you have chosen the correct form for your city/state.

- Click the Review button to check the content of the form.

- Read the form description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

While it's not strictly necessary to hire a lawyer to draft a lease agreement, doing so can ensure compliance with local laws. If you are unsure about the legal requirements, especially for a Kansas Nonresidential Simple Lease, consider consulting a lawyer or using a platform like UsLegalForms for professional guidance.

In Kansas, there are generally no rent control laws that limit how much a landlord can increase rent. However, landlords must provide proper notice before raising the rent, usually 30 days for month-to-month agreements. When drafting a Kansas Nonresidential Simple Lease, clarify any rent increase terms to avoid misunderstandings.

Evicting someone in Kansas without a lease can be complex. Generally, a landlord must provide notice to the tenant, often referred to as a notice to quit. When dealing with a Kansas Nonresidential Simple Lease situation, be sure to follow local laws and consider using UsLegalForms to find proper legal notices you may need.

A handwritten lease agreement can be legally binding in Kansas, provided it includes all the essential terms agreed upon by both parties. It's vital to ensure that your Kansas Nonresidential Simple Lease contains clear language and mutual consent. Always keep a signed copy for your records to avoid disputes.

Absolutely, you can draft your own lease agreement. When creating a Kansas Nonresidential Simple Lease, it's essential to address key details, including the rental period and payment schedules. Utilizing platforms like UsLegalForms can help simplify this process while ensuring that your lease meets state regulations.

Yes, you can create a lease yourself using templates or resources available online. A Kansas Nonresidential Simple Lease template can guide you through the necessary elements to include, such as terms, rental amounts, and responsibilities. However, ensure that your lease complies with Kansas state laws to be enforceable.

Renting without a lease is possible, but you should proceed with caution. Verbal agreements can work, but they often lack the protections that formal leases provide. It’s wise to document any agreements in writing to avoid disputes down the line. A Kansas Nonresidential Simple Lease from USLegalForms can provide a simple, clear contract that secures your rental arrangement.

To evict someone from your home in Kansas, you must first provide a written notice detailing the reason for the eviction. If the tenant does not leave within the specified time, you may file for eviction in court. Being informed about the legal process can save you time and frustration. Utilizing a Kansas Nonresidential Simple Lease can prevent these issues by setting clear expectations from the start.

In Kansas, a guest may be considered a tenant if they stay for an extended period, generally around a month, and establish residency. This transition often depends on the landlord's policies. It's essential to communicate with your landlord regarding guests’ stays. Using a Kansas Nonresidential Simple Lease can clarify guest policies and limit unexpected liabilities.

Yes, you can live in a property without being listed on the lease, but this can lead to potential complications. The landlord may not recognize your rights as a tenant. It's advisable to have a clear agreement with the primary tenant or the landlord to avoid misunderstandings. A Kansas Nonresidential Simple Lease can help define everyone’s roles and rights.