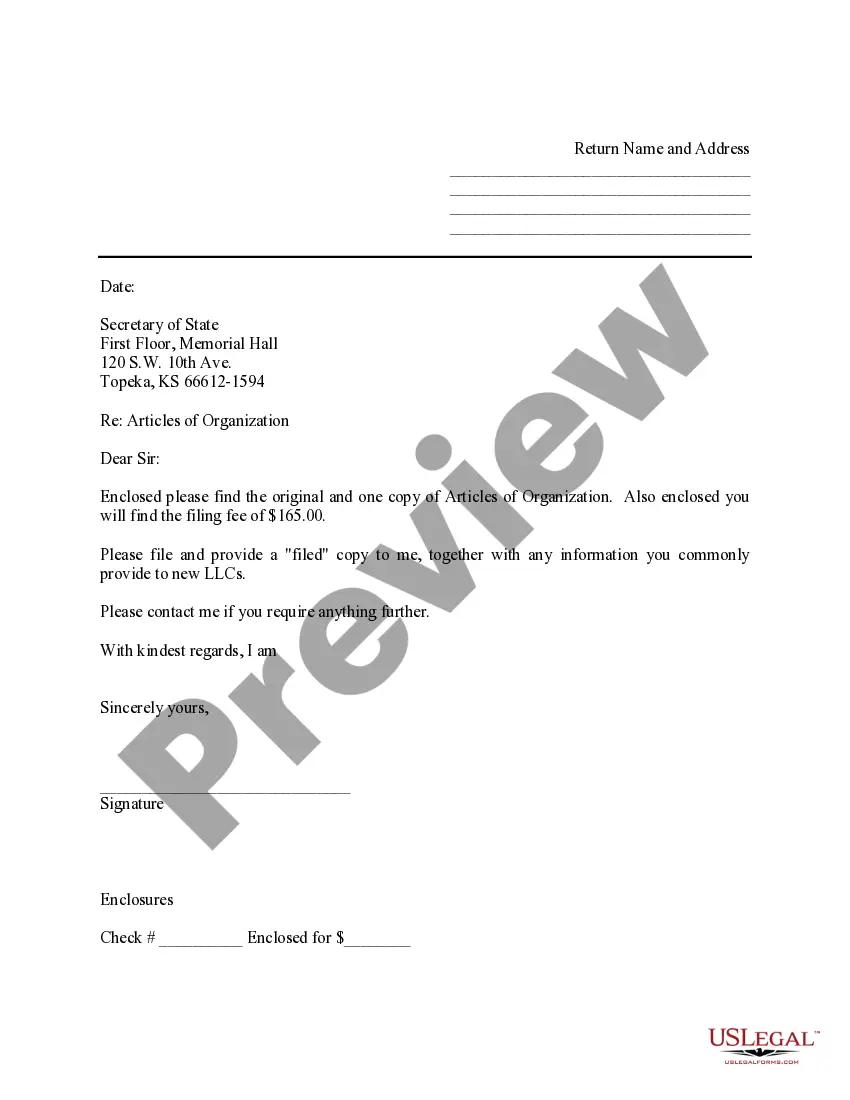

Kansas Sample Cover Letter for Filing of LLC Articles or Certificate with Secretary of State

Description

How to fill out Kansas Sample Cover Letter For Filing Of LLC Articles Or Certificate With Secretary Of State?

In pursuit of a Kansas Sample Cover Letter for Submitting LLC Articles or Certificate with Secretary of State documents and completing them can be quite a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare each document, so you only need to complete them. It's truly effortless.

Select your plan on the pricing page and create your account. Choose how you wish to pay, either by credit card or PayPal. Save the form in your preferred file format. You can now print the Kansas Sample Cover Letter for Submitting LLC Articles or Certificate with Secretary of State document or fill it out using any online editor. Don’t worry about making errors because your form can be utilized, submitted, and printed as often as you like. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax templates.

- Log in to your account and navigate back to the form's page to save the sample.

- All your downloaded templates are stored in My documents and are accessible anytime for future use.

- If you haven’t subscribed yet, you must register.

- Review our comprehensive instructions on how to obtain the Kansas Sample Cover Letter for Submitting LLC Articles or Certificate with the Secretary of State sample within minutes.

- To access a valid sample, verify its relevance for your state.

- Examine the example using the Preview feature (if available).

- If there's a description, read it to understand the key points.

- Click Buy Now if you have found what you're looking for.

Form popularity

FAQ

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

Save time and money by filing your articles of incorporation online at www.sos.ks.gov. There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses. Instructions: All information must be completed or this document will not be accepted for filing.

LLC stands for limited liability company". It combines the most sought after characteristics of a corporation (credibility and limited liability) with those of a partnership (flexibility and pass-through taxation).LLCs are technically formed, while corporations (S corporation or C corporation) are incorporated.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs. The articles of organization are similar to those for a standard LLC, but extra steps are necessary to file.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

You need to file Articles of Incorporation or Articles of Organization to start your business for all types of business entities, whether you are forming an LLC, starting a C Corporation, or starting a nonprofit corporation.Some business entities have additional filing requirements throughout the year or at tax time.