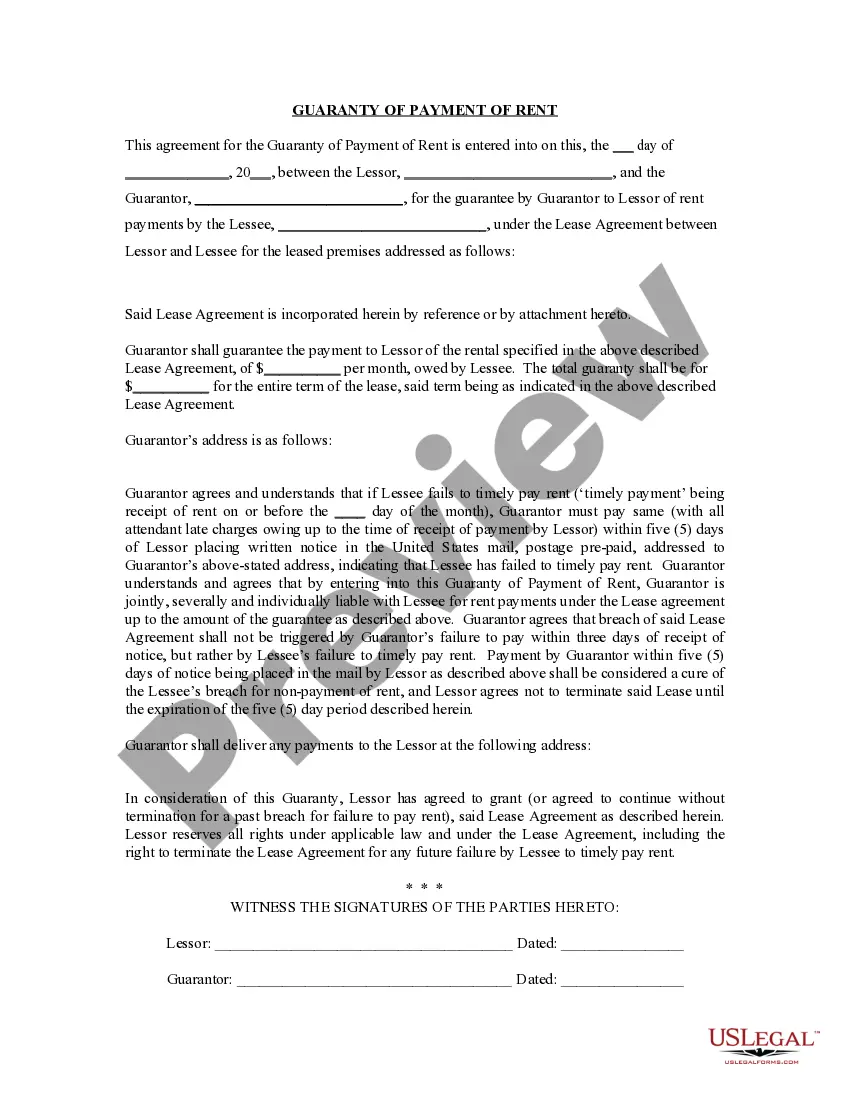

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Kansas Guaranty or Guarantee of Payment of Rent

Description

How to fill out Kansas Guaranty Or Guarantee Of Payment Of Rent?

Searching for Kansas Guaranty or Assurance of Rental Payment formats and completing them could pose an issue.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate format specifically for your region in just a few clicks.

Our legal experts prepare each document, so you merely need to fill them out. It truly is that simple.

Select your plan on the pricing page and create an account. Choose your payment method with a credit card or via PayPal. Save the document in the desired format. Now you can print the Kansas Guaranty or Assurance of Rental Payment form or complete it using any online editor. No need to be concerned about typing errors because your template can be utilized and sent, and printed as often as you like. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your downloaded formats are stored in My documents and are accessible anytime for future use.

- If you haven’t subscribed yet, you must register.

- Review our comprehensive instructions on how to obtain your Kansas Guaranty or Assurance of Rental Payment example in a few minutes.

- To acquire a valid template, verify its applicability for your state.

- Examine the sample using the Preview option (if available).

- If there’s a description, read it to understand the details.

- Press the Buy Now button if you found what you were searching for.

Form popularity

FAQ

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.

If you're renting in London, you'll need to go through credit checks and referencing as part of the rental application process. If you're new to renting or you can't provide a reference from a previous landlord, you might be asked to provide a guarantor.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.

Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

You're guaranteeing the full amount for the length of the agreement the tenant is signing for. Tenants often sign up for six to 12 months on a new agreement. After this time there will be rolling notice period, which can vary. As a guarantor, you have full responsibility to pay what's owed.

This means that you're only liable for up to an amount agreed upon by you and the lender. For instance, if the size of the loan is $500,000 and your limited guarantee is for only $150,000 then you're only liable to cover up to $150,000, which is the agreed amount.

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

One approach is as follows: a landlord and tenant agree that the guarantor is to be fully responsible for the performance of all tenant obligations and payment of all charges due under the lease for the entire term; if, however, the tenant does not default under any of the terms of the lease during some initial portion