This form is a Warranty Deed where the Grantor is a Trust and the Grantee is an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

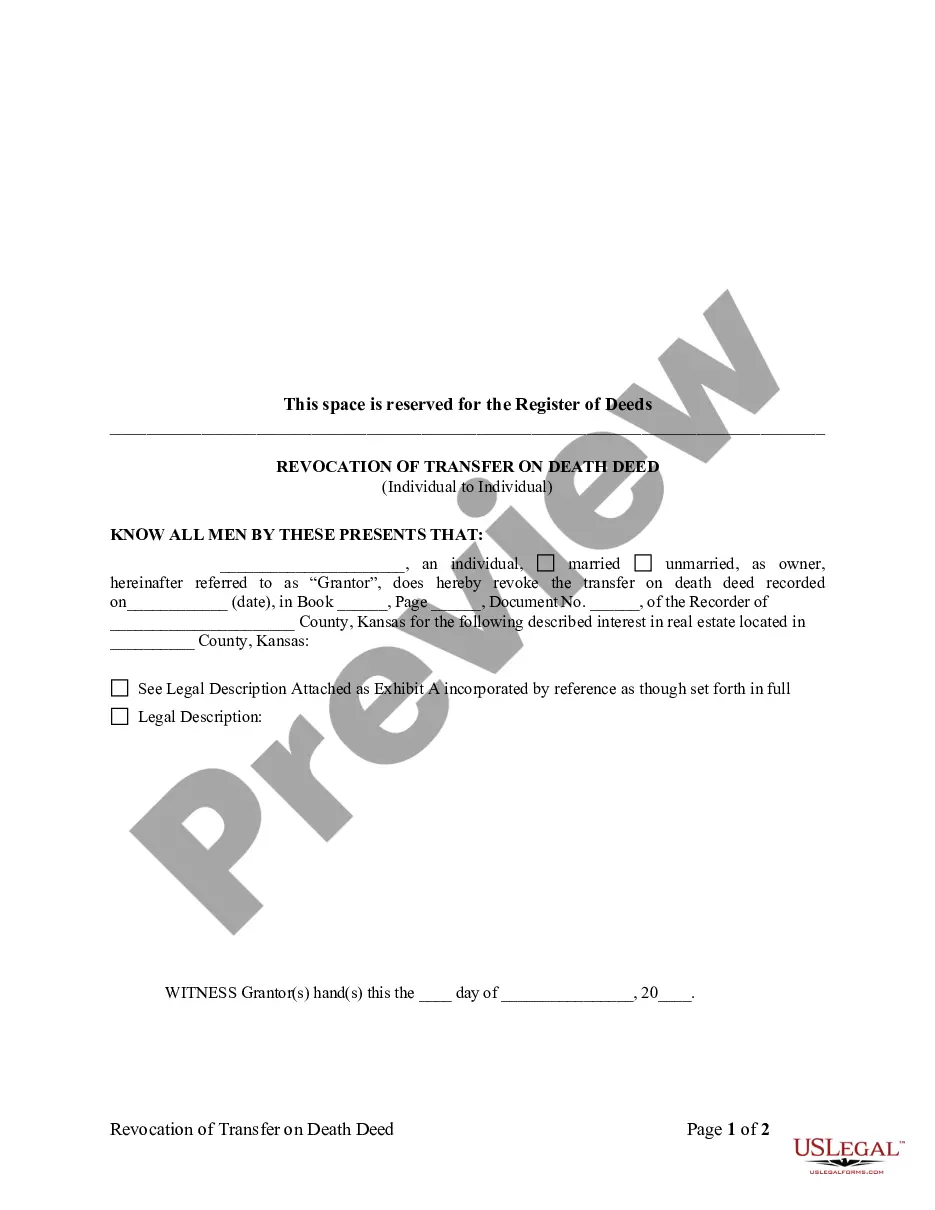

Kansas Revocation of Transfer on Death Deed - Beneficiary Deed for Individual to Individual

Description

How to fill out Kansas Revocation Of Transfer On Death Deed - Beneficiary Deed For Individual To Individual?

Searching for Kansas Cancellation of Transfer on Death Deed - Beneficiary Deed for Individual to Individual forms and completing them can be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable sample specifically for your state in just a few clicks.

Our attorneys draft each document, so you only need to fill them in. It truly is that straightforward.

You can print the Kansas Cancellation of Transfer on Death Deed - Beneficiary Deed for Individual to Individual form or fill it out using any online editor. Don’t worry about making mistakes since your template can be utilized, sent, and printed as many times as needed. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your saved templates are stored in My documents and are available at all times for future use.

- If you haven’t signed up yet, consider registering.

- Review our comprehensive instructions on how to obtain the Kansas Cancellation of Transfer on Death Deed - Beneficiary Deed for Individual to Individual sample in a matter of minutes.

- To acquire an eligible form, verify its relevance for your state.

- View the example using the Preview function (if available).

- If there's a description, read it to understand the details.

- Click Buy Now if you've found what you're looking for.

Form popularity

FAQ

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die.Or, beneficiaries and family members can sue each other to take the property entirely. In this case, a court proceeding may be required to resolve the issue.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.