Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

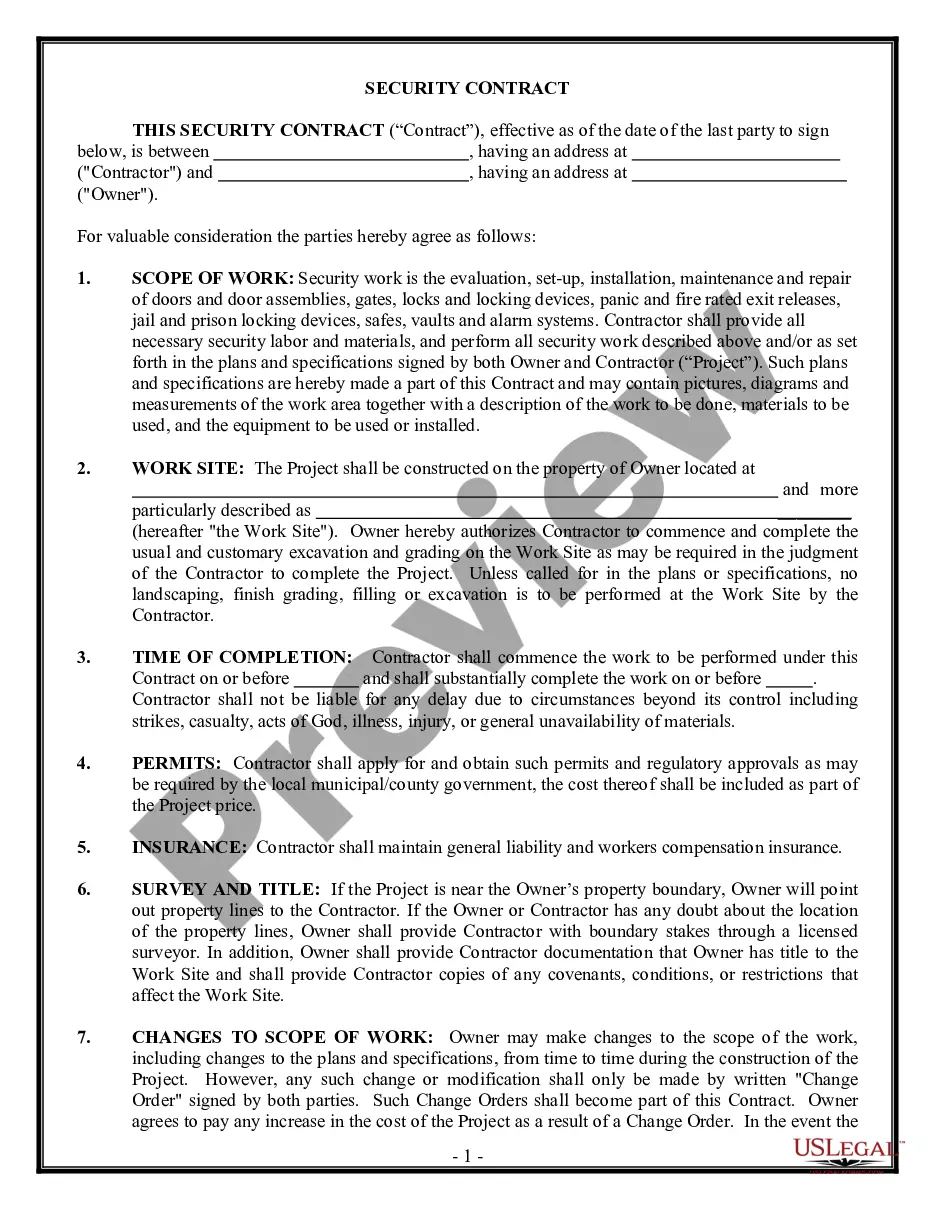

How to fill out Financial Services Agent Agreement - Self-Employed Independent Contractor?

Selecting the appropriate legal template can be quite challenging. Obviously, there are numerous forms accessible online, but how do you locate the legal document you need? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, suitable for both business and personal purposes. All documents are vetted by professionals and adhere to federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to retrieve the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor. Use your account to browse the legal documents you have obtained previously. Navigate to the My documents section of your account to acquire another copy of the document you wish.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have chosen the correct document for your city/state. You can preview the form using the Review button and examine the document outline to confirm it is suitable for your needs. If the document does not meet your criteria, utilize the Search field to find the appropriate form. Once you are confident that the document is satisfactory, click the Get now button to download the form. Select the pricing plan you require and fill in the necessary information. Create your account and process the payment using your PayPal account or credit card. Choose the file format and download the legal template to your device. Complete, modify, print, and sign the received Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest collection of legal templates where you can discover numerous document forms.

- Utilize the service to obtain professionally crafted paperwork that complies with state regulations.

- Access a wide range of templates for various legal needs.

- Enjoy a user-friendly interface for easy navigation.

- Receive expert-reviewed documents that meet legal standards.

- Ensure your legal documents are up-to-date and compliant.

Form popularity

FAQ

Independent contractors can be considered agents if they have the authority to act on behalf of a client or company. Specifically, under the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, this relationship allows you to represent and negotiate for clients. Being an agent gives you broader responsibilities in the financial services industry, highlighting your role in client representation. Clarifying your responsibilities in your agreements can ensure that all parties understand the terms of your agency role.

Yes, financial advisors can operate as independent contractors, giving them significant autonomy in their practice. Under the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, they are allowed to establish their business model, client base, and services offered. This independent status can lead to increased earning potential and business growth, as advisors can tailor their offerings to meet client needs. You can benefit from resources available on the uslegalforms platform, which can guide you in creating effective agreements.

Independent contractors fall under a distinct classification that separates them from traditional employees. You will find yourself categorized as a self-employed individual operating your business under the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor. This classification allows you to enjoy flexibility and autonomy in your work. It also involves specific tax obligations and regulatory responsibilities that you must adhere to as a business owner.

An agent is typically someone authorized to act on behalf of another entity, especially in financial services. Under the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, both individuals and businesses can be categorized as agents. This designation confers the authority to negotiate and finalize transactions for clients, thus enhancing your professional reputation. Ultimately, any licensed professional fulfilling these responsibilities can be called an agent.

To classify yourself as an independent contractor under the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, you need to establish your own business operations. This means setting your own hours, determining your rates, and working with multiple clients. Ensure that you maintain control over how you carry out your work and keep records of your income and expenses. By meeting these criteria, you can secure your status as an independent contractor.

Yes, having a contract as a self-employed individual is highly advisable. A contract protects both you and your client by clearly outlining terms, responsibilities, and payment details. Consider using an Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor to formalize your business relations, ensuring mutual understanding and commitment.

Filling out an independent contractor form involves providing your personal information, business structure, and details about the services offered. Be precise when describing the scope of work and include payment terms. Utilizing an Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor can also streamline this process by detailing essential terms.

In Indiana, independent contractors generally do not need a specific business license to operate. However, if your work falls under certain regulated industries, you may need to obtain a license or permit. Always check local regulations and consider an Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor to clarify your business's legal standing.

Yes, an independent contractor can serve as an agent of a company. This means they can represent the company in various activities, such as selling products or managing client relationships. However, it's essential to have a clear Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor in place to outline roles and responsibilities.

Yes, an independent contractor can act as an agent, depending on the specific terms of the agreement. In the context of the Indiana Financial Services Agent Agreement - Self-Employed Independent Contractor, the contractor may have the authority to make decisions or enter contracts on behalf of a company. However, clear definitions of the roles and responsibilities are crucial to avoid misunderstandings.