Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Finding the correct legal document template can be quite challenging.

Certainly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, which you can use for both business and personal purposes.

You can review the form using the Preview button and read the form description to confirm it's the right one for you.

- All forms are verified by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click the Obtain button to find the Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure.

- Utilize your account to access the legal forms you may have obtained previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

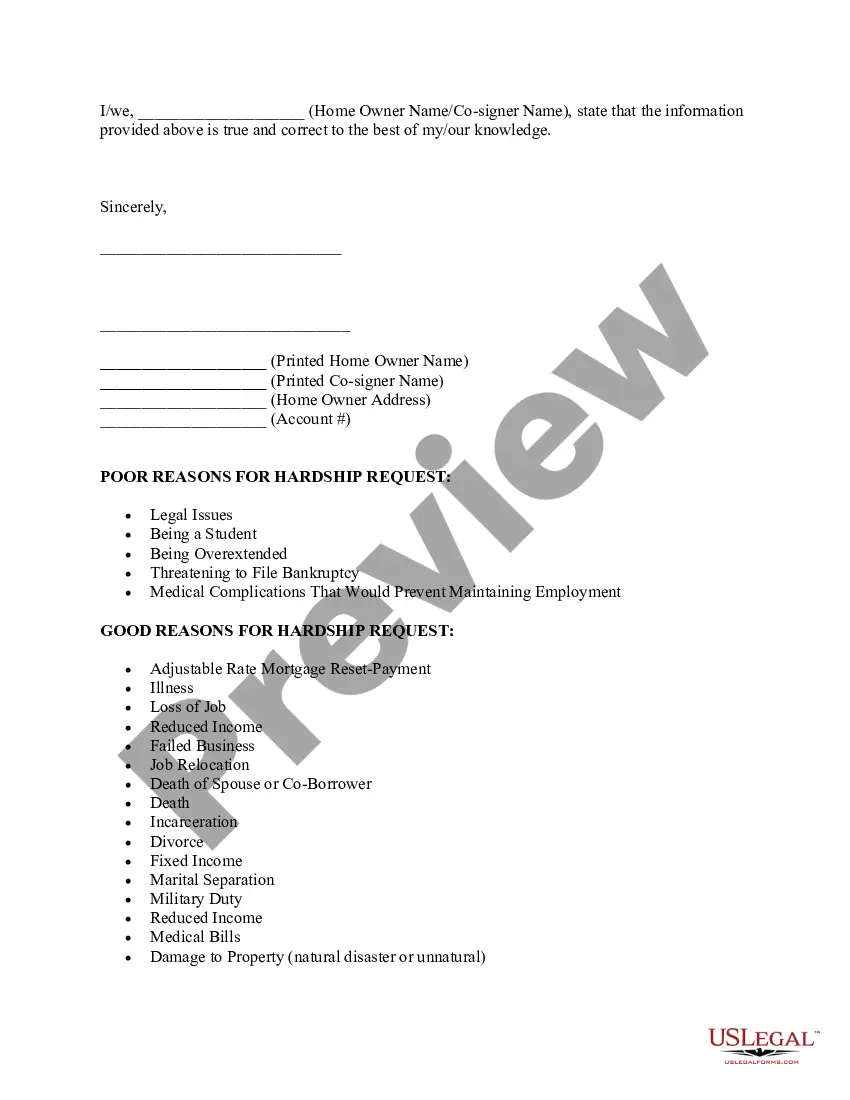

An example of a hardship letter for a mortgage includes a detailed explanation of your circumstances that have led to financial difficulties. You should express your intention to maintain your mortgage and explain how you plan to improve your situation. The letter should include relevant details about your income, expenses, and any supporting documents. Utilizing the Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template can help you create a compelling case.

When writing a hardship letter to stop foreclosure, start with a clear statement of your intent and the reasons for your financial difficulties. Utilize your Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure to effectively communicate your circumstances. Highlight any changes in financial status and express your willingness to work collaboratively towards a solution.

In Indiana, stopping foreclosure involves communicating with your lender as soon as possible about your financial difficulties. Writing an effective Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is crucial in this process, as it can open dialogue for possible solutions. You may also explore options like filing for bankruptcy, which can temporarily halt foreclosure proceedings.

To craft a foreclosure hardship letter, begin with a brief introduction that explains your situation. Your Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should include details about your financial hardship, the steps you are taking to improve your situation, and any assistance you seek. Review your letter for clarity and professionalism before sending it.

When writing an Indiana Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, avoid including unnecessary personal information or emotional pleas. Focus on clear, factual information about your financial situation. Do not include blame or negativity, as this can detract from your main message of seeking assistance.

All foreclosures in Indiana take place through the judicial system. Accordingly, the length of time it takes to foreclose on a property is, in part, dependent on the court's schedule. On average, it takes about 150 days to foreclose on an Indiana property.

A "hardship letter" is a letter that you write to your lender explaining the circumstances of your hardship. The letter should give the lender a clear picture of your current financial situation and explain what led to your financial difficulties. The hardship letter is a normal part of the loss mitigation process.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

A hardship letter explains why a mortgage holder is defaulting on their loan and needs to sell their home for less than what they owe. Hardship may arise from unemployment, reduced income, a death in the family, divorce, military service, incarceration, or other situations.

6 Ways To Stop A ForeclosureWork It Out With Your Lender.Request A Forbearance.Apply For A Loan Modification.Consult A HUD-Approved Counseling Agency.Conduct A Short Sale.Sign A Deed In Lieu Of Foreclosure.