Indiana MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

If you need to download, obtain, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you require. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to retrieve the Indiana MHA Request for Short Sale in just a few clicks.

Every legal document template you download is yours forever. You have access to every form you stored in your account. Go to the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Indiana MHA Request for Short Sale with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Indiana MHA Request for Short Sale.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

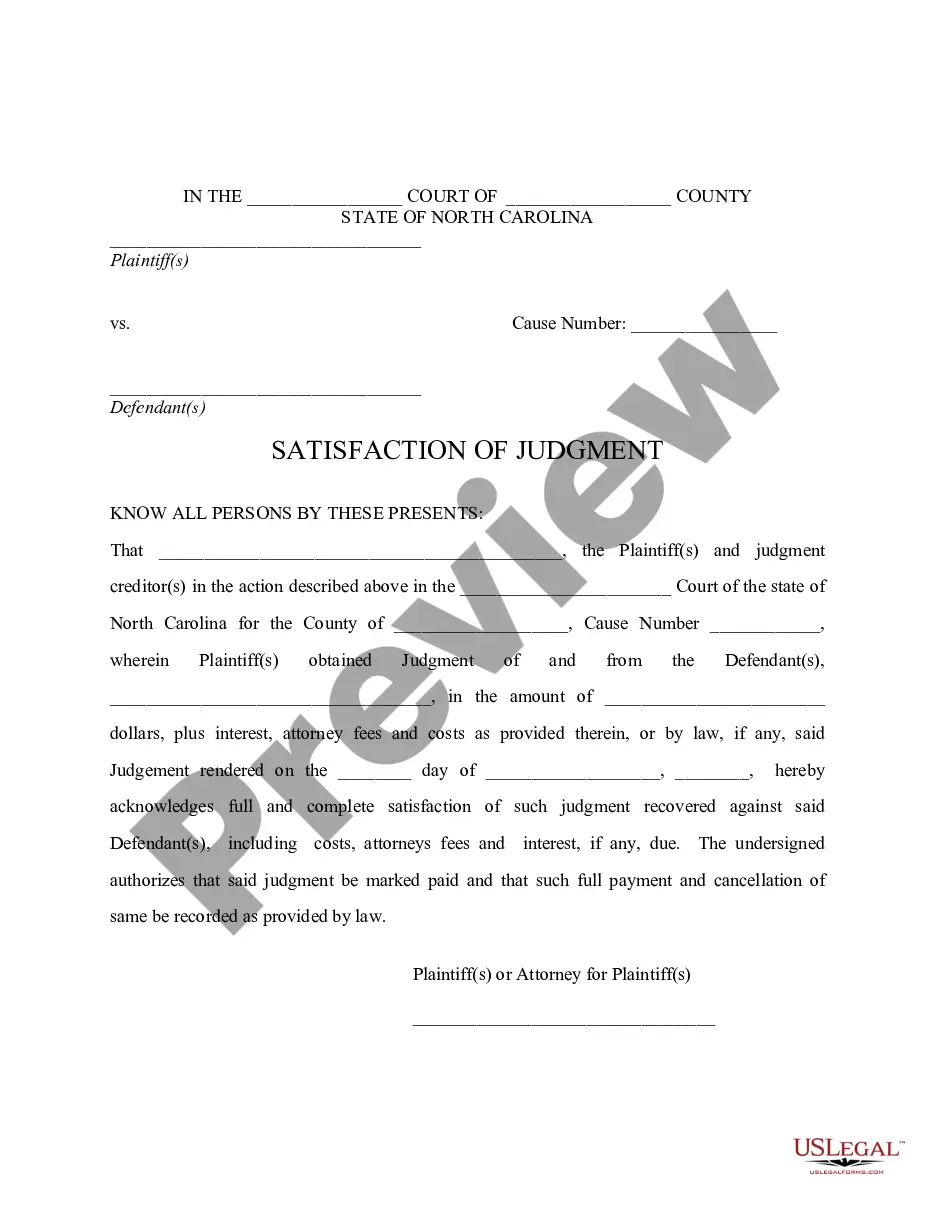

- Step 2. Utilize the Preview option to review the form's contents. Remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Download now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Indiana MHA Request for Short Sale.

Form popularity

FAQ

To buy foreclosed homes in Indiana, start by researching available properties and understanding the foreclosure process. Attend auctions, often held by the county, to place bids on foreclosed homes. Using resources like the Indiana MHA Request for Short Sale can inform you about potential properties and the risks involved in purchasing these homes.

Typically, you can be late on your mortgage for about three months before your lender initiates foreclosure proceedings. However, this timeframe can differ based on your lender's policies. It’s advisable to consider the Indiana MHA Request for Short Sale if you find yourself in trouble, as it creates avenues to halt foreclosure actions.

You usually need to miss at least three payments before the foreclosure process kicks in. This rule underscores the importance of addressing your financial situation quickly. By utilizing the Indiana MHA Request for Short Sale, you can explore alternatives to foreclosure and possibly find relief.

In Indiana, the foreclosure process typically begins after you miss three consecutive mortgage payments. However, the exact timeline can vary depending on your lender. Understanding the Indiana MHA Request for Short Sale can help you navigate your options and potentially avoid foreclosure.

When writing a hardship letter for an Indiana MHA Request for Short Sale, be honest and concise about your financial difficulties. Clearly explain your situation, including changes in income or unexpected expenses, and express your willingness to cooperate with the lender. This letter can significantly influence the approval decision.

To qualify for a short sale, homeowners should demonstrate financial difficulty that prevents them from making mortgage payments. Lenders will look for proof of income, list of debts, and reasons for hardship. Using the Indiana MHA Request for Short Sale can clarify eligibility and streamline the process.

The process typically begins with the homeowner submitting an Indiana MHA Request for Short Sale to the lender, along with documentation of hardship. Once the lender reviews and accepts the request, buyers can submit offers. After negotiations and approvals, the sale can close, finalizing the arrangement.

Banks might deny a short sale if they consider the offer too low or if they suspect that the homeowner is not genuinely experiencing financial hardship. Furthermore, incomplete paperwork or failure to respond to the lender's requests can also lead to a denial. You can avoid this by preparing a strong Indiana MHA Request for Short Sale.

To get an Indiana MHA Request for Short Sale approved, first collect all relevant documentation, including proof of income and financial hardship. Next, present a comprehensive short sale package to your lender, detailing your situation. Clear communication and timely follow-ups can enhance your chances of approval.

To qualify for a short sale, homeowners must demonstrate financial hardship that prevents them from making mortgage payments. This can include job loss, medical expenses, or other significant life changes. Utilizing the Indiana MHA Request for Short Sale can help you understand the qualifying criteria and navigate the necessary steps effectively.