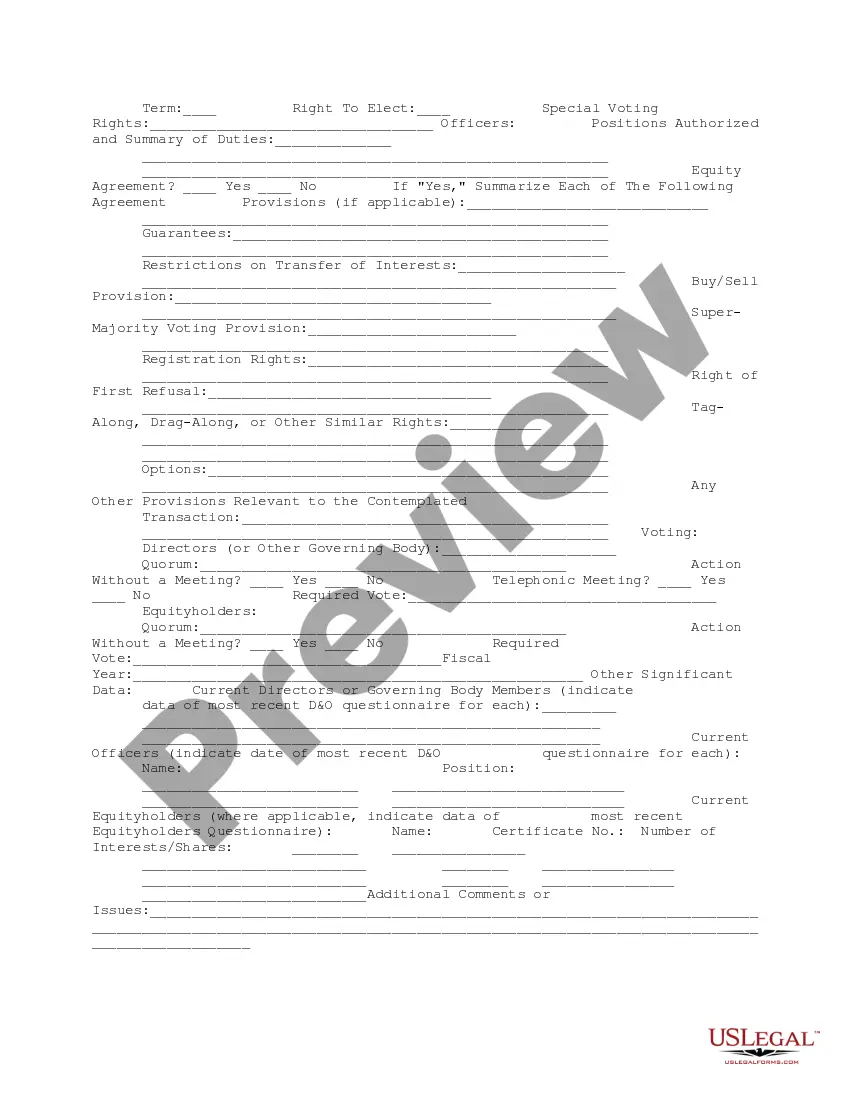

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Indiana Company Data Summary

Description

How to fill out Company Data Summary?

You might spend multiple hours online searching for the official document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been examined by experts.

It is easy to acquire or create the Indiana Company Data Summary through our service.

If available, utilize the Preview button to browse through the document format as well.

- If you already possess a US Legal Forms account, you can Log In and press the Obtain button.

- After that, you can complete, modify, create, or sign the Indiana Company Data Summary.

- Every legal document format you purchase is yours forever.

- To acquire another copy of the accessed form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the state/region of your choice.

- Check the form outline to confirm you have selected the right document.

Form popularity

FAQ

In Indiana, business entities must file a business entity report every two years. This filing ensures that your business information, reflected in the Indiana Company Data Summary, remains current and accurate. Failing to file on time can lead to penalties or loss of good standing. Utilize platforms like USLegalForms to stay organized and compliant with these reporting requirements.

Yes, Indiana requires LLCs to file an annual report. This report is essential for maintaining good standing with the state. It updates the Indiana Company Data Summary to reflect any changes in the LLC's structure or status. You can easily handle this annual requirement through platforms like USLegalForms, making the process smooth and straightforward.

An LLC does need to file an annual report to maintain compliance with state regulations. This process ensures that your business details are accurate in the Indiana Company Data Summary. By filing this report, you further establish your credibility and commitment to lawful business practices.

Yes, filing an annual report for your LLC in Indiana is mandatory. This report contributes essential details to the Indiana Company Data Summary. It's a straightforward process that helps keep your business compliant and allows you to receive vital updates from the state.

Failing to file your annual report for an LLC can lead to penalties or potential dissolution. The state may strip your LLC of its active status, making it challenging to legally conduct business. To avoid these issues, ensure you adhere to the annual reporting requirements to maintain your standing in the Indiana Company Data Summary.

Yes, if you operate an LLC in Indiana, you are required to file an annual report. This requirement keeps your business information current in the Indiana Company Data Summary. Missing this obligation can result in penalties, so it's best to stay informed and timely with your filings.

If you do not file a business entity report in Indiana, your business may face penalties and administrative dissolution. This means your business could be officially closed, impacting your ability to operate legally. It's crucial to stay in compliance to maintain your business standing in the Indiana Company Data Summary.

To report a business in Indiana, you can visit the Indiana Secretary of State's website. There, you will find detailed instructions on how to submit your business information. Ensuring accurate reporting is essential, as it contributes to the Indiana Company Data Summary, which is necessary for public records and business transparency.

A business entity is a broad term that encompasses various types of businesses, including LLCs, corporations, and partnerships. An LLC, or Limited Liability Company, is a specific type of business entity that provides limited liability protection to its owners. Understanding this distinction is essential for accurately maintaining your Indiana Company Data Summary. Choosing the right structure for your business can affect liability and tax obligations.

In Indiana, you must file a business entity report every year. This annual requirement helps ensure that your Indiana Company Data Summary is accurate and up to date. Timely filing is crucial for maintaining your company's good standing with the state. You can set reminders to help you stay on track with these important deadlines.