Indiana Shipping Reimbursement

Description

How to fill out Shipping Reimbursement?

If you need to obtain, acquire, or print sanctioned document templates, use US Legal Forms, the largest collection of legal forms that are accessible online.

Make use of the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Indiana Shipping Reimbursement.

- Use US Legal Forms to get the Indiana Shipping Reimbursement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Indiana Shipping Reimbursement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

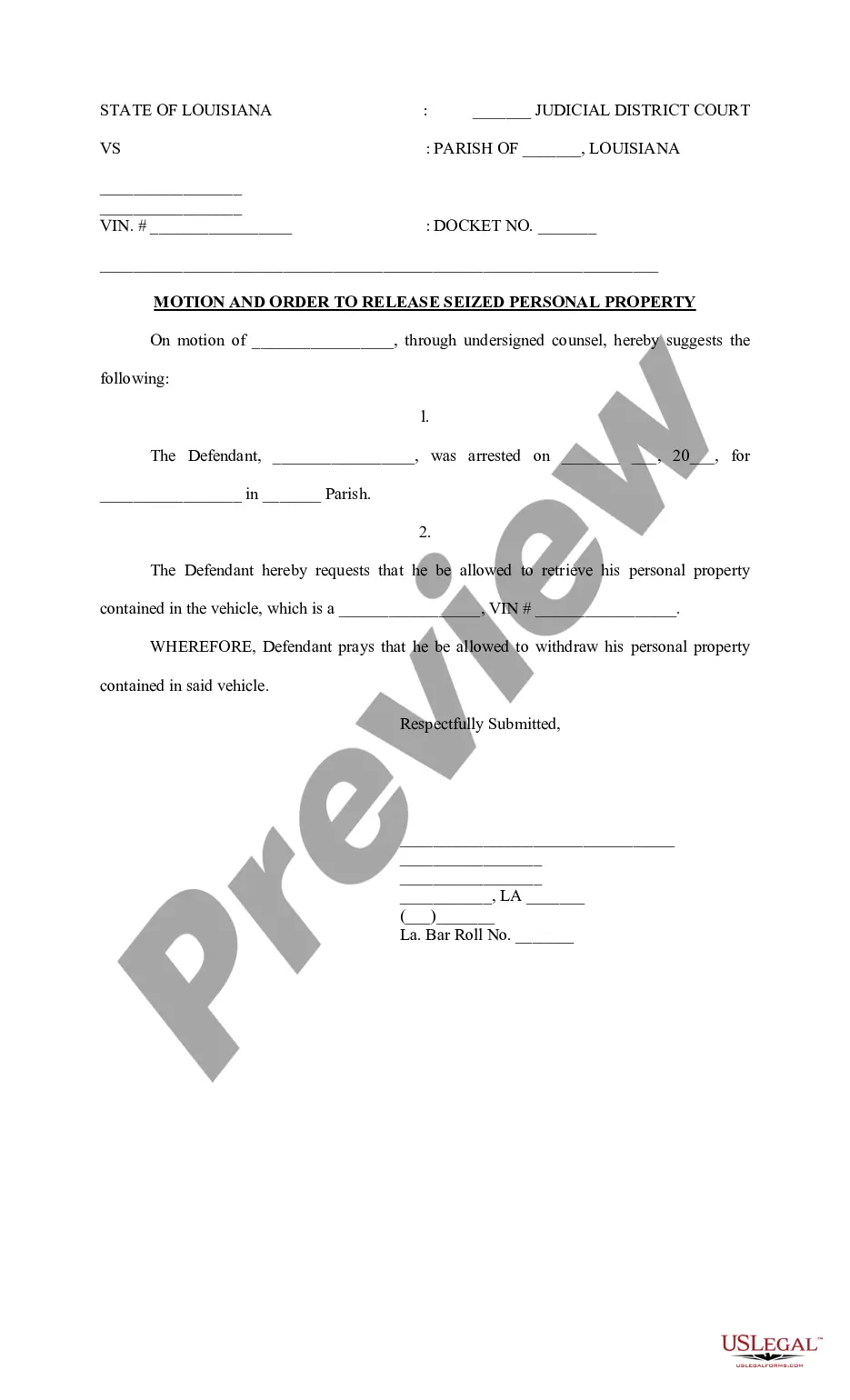

- Step 2. Use the Preview option to review the form’s content. Remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Of the 11 states, all but two (Alabama and Indiana) exempt entities for five year periods. Alabama and Indiana require an annual update to maintain exemption. Most states do not require a renewal application, but entities must keep officer, address, and other entity information up to date.

The IT-6WTH is a payment voucher that should be submitted to the Indiana Department of Revenue (DOR) only when there is a remittance with the voucher. Why do the IT-65 and IT-20S have both a Total amount of pass-through withholding line and an IT-6WTH line?

COMPOSITE WITHHOLDING PAYMENTS (FORM IT-6WTH) Amounts withheld from nonresident owners included in the composite return should be remitted. with Form IT-6WTH. Payment is due the 15th day of the 4th month following the close of the pass. through entity's tax period.

Indiana Tax Nexus Generally, a business has nexus in Indiana when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

ALL businesses in Indiana must file and pay their sales and withholding taxes electronically. Any corporation doing business and having gross income in Indiana must file a corporation income tax return. It must do this regardless of whether it has taxable income. Including but not limited to the following: 1.

If you are gifting a vehicle to a relative, the transaction could be exempt from sales tax and requires filling out Indiana BMV form 48841. A bill of sale cannot be used to transfer vehicle ownership for a vehicle that requires a certificate of title by law.

Qualifying for sales tax exemption requires the completion and filing of an application form prescribed by the Indiana Department of Revenue. The taxpayer Identification Number (TID) above must be provided to the retailer if purchases are to be exempt from sales tax.

The Indiana use tax rate is seven percent, the same as our sales tax rate. If you paid state sales tax of seven percent or more to the other state, you do not owe use tax to Indiana.

Full-time residents of Indiana use form IT-40 to file state income tax. IT-40 will consist of entering some information from your federal tax return to determine what your total tax liability is for Indiana taxes.

Shipping charges in Indiana are not taxable as of July 1, 2013. The Department of Revenue now declares that there is no tax obligation on shipping charges as long as they are stated separately on the invoice. If you choose to deliver goods yourself or through a private delivery service, then your shipping is taxable.