Indiana Debit Shipping Authorization

Description

How to fill out Debit Shipping Authorization?

US Legal Forms - one of the leading collections of legal templates in the United States - offers a vast selection of legal document patterns that you can download or print.

By utilizing the site, you can discover thousands of templates for commercial and personal use, organized by categories, states, or keywords. You can find the latest editions of documents such as the Indiana Debit Shipping Authorization in just moments.

If you already possess a membership, Log In and download the Indiana Debit Shipping Authorization from the US Legal Forms repository. The Download button will be visible on every document you examine. You can access all previously saved documents in the My documents section of your account.

If you are satisfied with the form, validate your choice by clicking the Buy now button. Following that, select the pricing plan you desire and provide your details to register for an account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Edit. Fill out, amend, print, and sign the saved Indiana Debit Shipping Authorization.

- If you're using US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have chosen the correct document for your city/state.

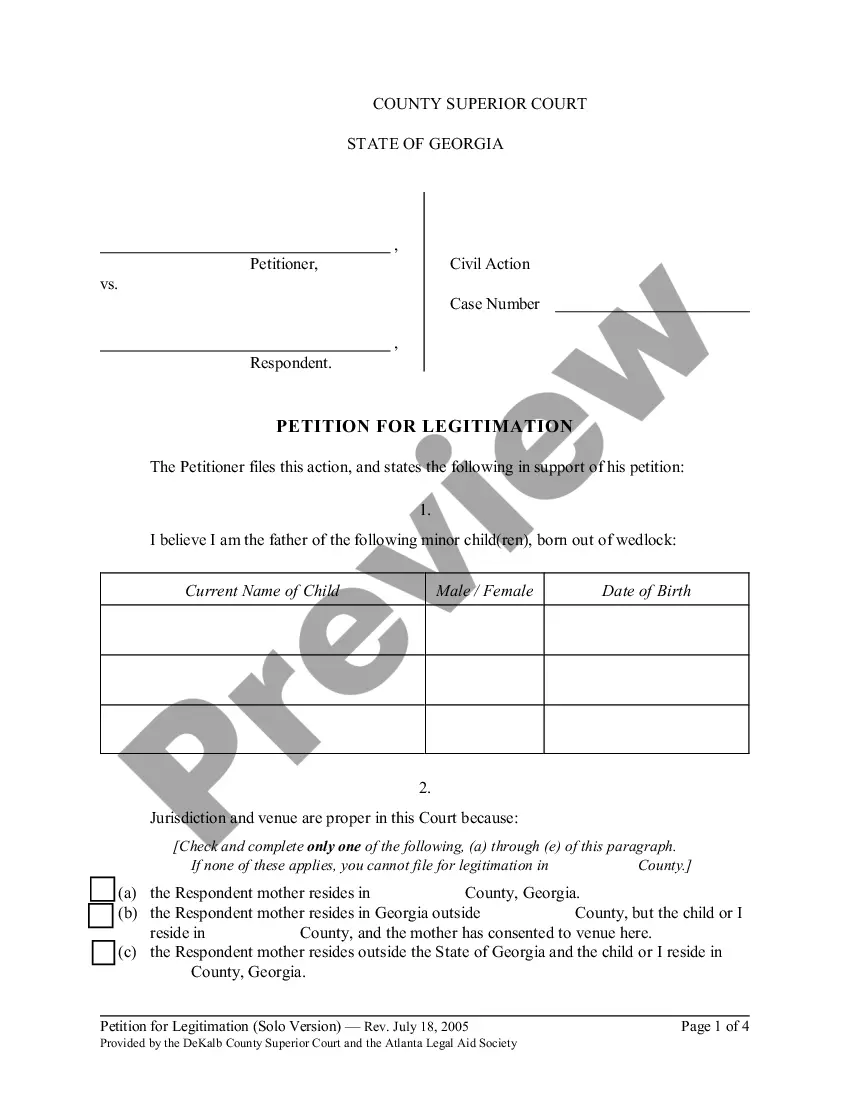

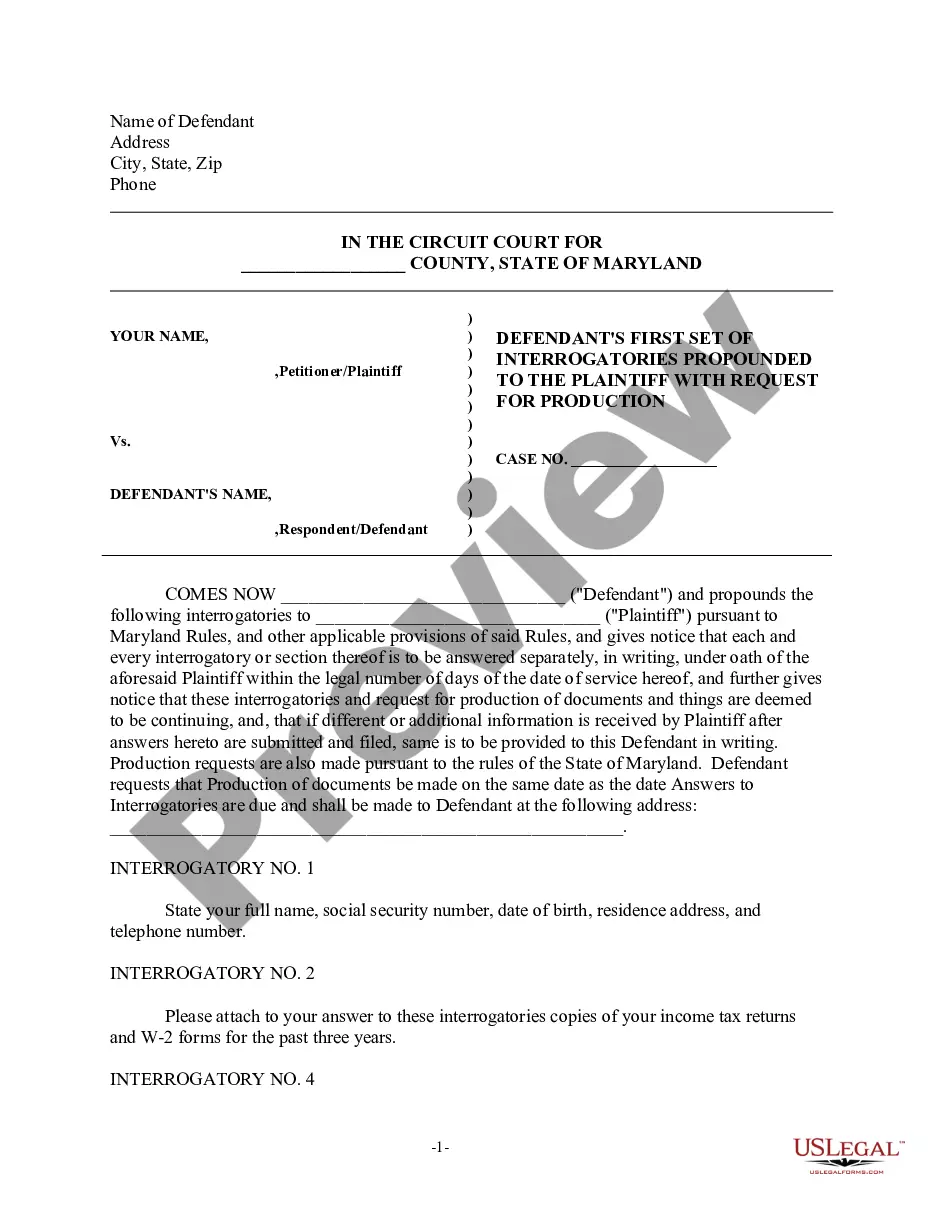

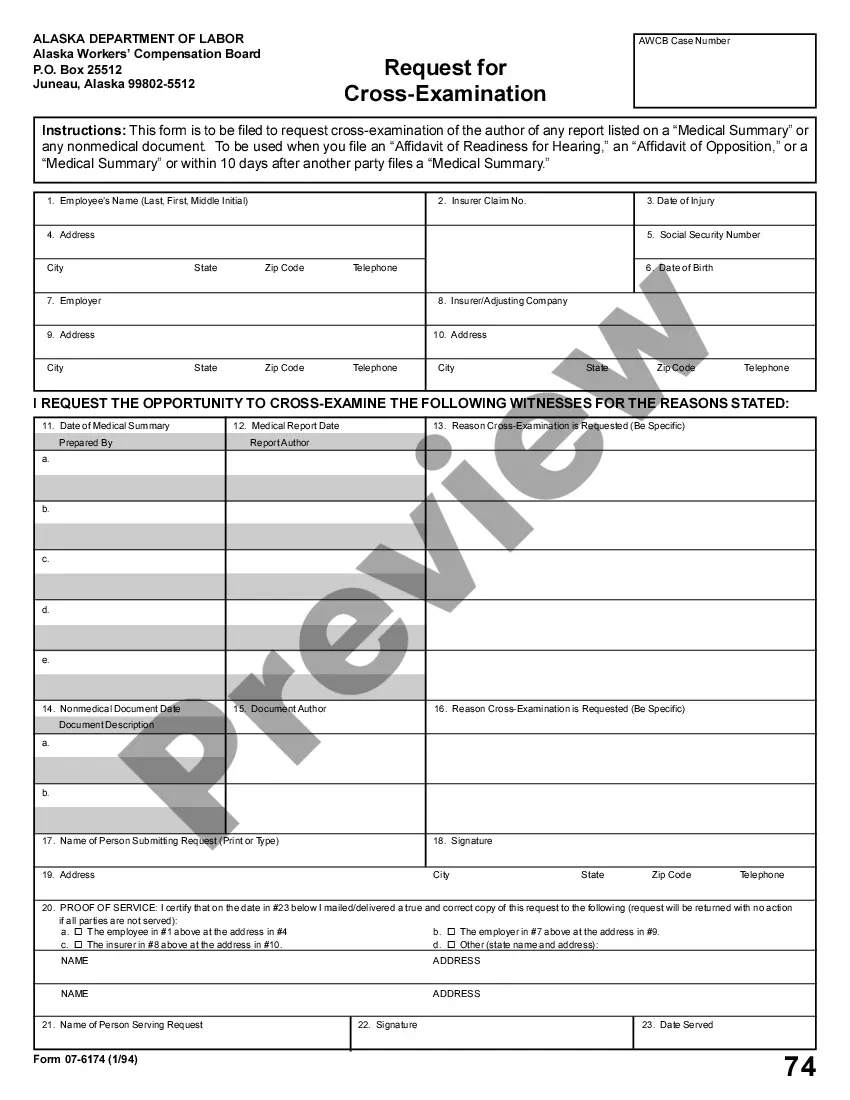

- Click the Preview button to review the content of the form.

- Review the document description to confirm that you have selected the right template.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find one that does.

Form popularity

FAQ

To obtain a retail merchant certificate in Indiana, register your business with the Indiana Department of Revenue by submitting the appropriate application, either online or by mail. This certificate is imperative for tax collection and can aid in understanding the Indiana Debit Shipping Authorization, streamlining your retail operations.

Yes, if you plan to sell goods online in Indiana, you will need a seller's permit. This permit allows you to collect sales tax from customers and ensure compliance with state regulations. It's also helpful to understand the Indiana Debit Shipping Authorization when managing payments and shipping for your online sales.

DOR frequently sends letters to customers to request needed information to process a tax return. Not responding to an information request can cause a tax return to remain unprocessed, generating an overdue payment with penalties and interest owed. Additionally, any potential refund could be delayed.

When obtaining over-the-phone authorization, you must include the following with the script:Date of debit.Payer's name.Payer's contact number.The amount or how the amount is determined.Account that will be debited.Checking or savings account.Account number.Routing number.More items...?

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of- State Use Tax, Food and Beverage Tax, County Innkeepers Tax, Tire Fee, and Motor Vehicle Rental Excise Tax, or a combination of these taxes.

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. When completed correctly, this form ensures that a business's withholding taxes by county are reported accurately and timely.

Typically it contains:The cardholder's credit card information. Card type. Name on card. Card number. Expiration date.The merchant's business information.Cardholder's billing address.Language authorizing the merchant to charge the customer's card on file.Name and signature of the cardholder.Date.

The script you use to obtain authorization must include:The date of debit.The amount (or alternatively, the method of determining the amount)Payer's name.Payer's contact number.The account to be debited:Date of authorization.A statement that the authorization is for a Single Entry ACH debit (for one-off payments)More items...

An ACH template is a set of instructions that once created and saved, can be used in the future as the starting point from which to send payments. Using ACH templates helps reduce errors and save time when users create ACH submissions.

Cardholder's card information, including card type, name on card, card number, and expiration date. Your business information. Cardholder's billing address. Verbiage that states cardholder is authorizing your business to charge their card.