Indiana Sample Letter transmitting Cancellation and Satisfaction of Promissory Notes

Description

How to fill out Sample Letter Transmitting Cancellation And Satisfaction Of Promissory Notes?

Are you currently in a situation where you require documents for either business or personal reasons virtually every day.

There are numerous legal form templates available online, yet finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Indiana Example Letter sending Cancellation and Satisfaction of Promissory Notes, which are designed to meet state and federal requirements.

Choose your desired pricing plan, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can obtain the Indiana Example Letter sending Cancellation and Satisfaction of Promissory Notes template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it matches your specific city/state.

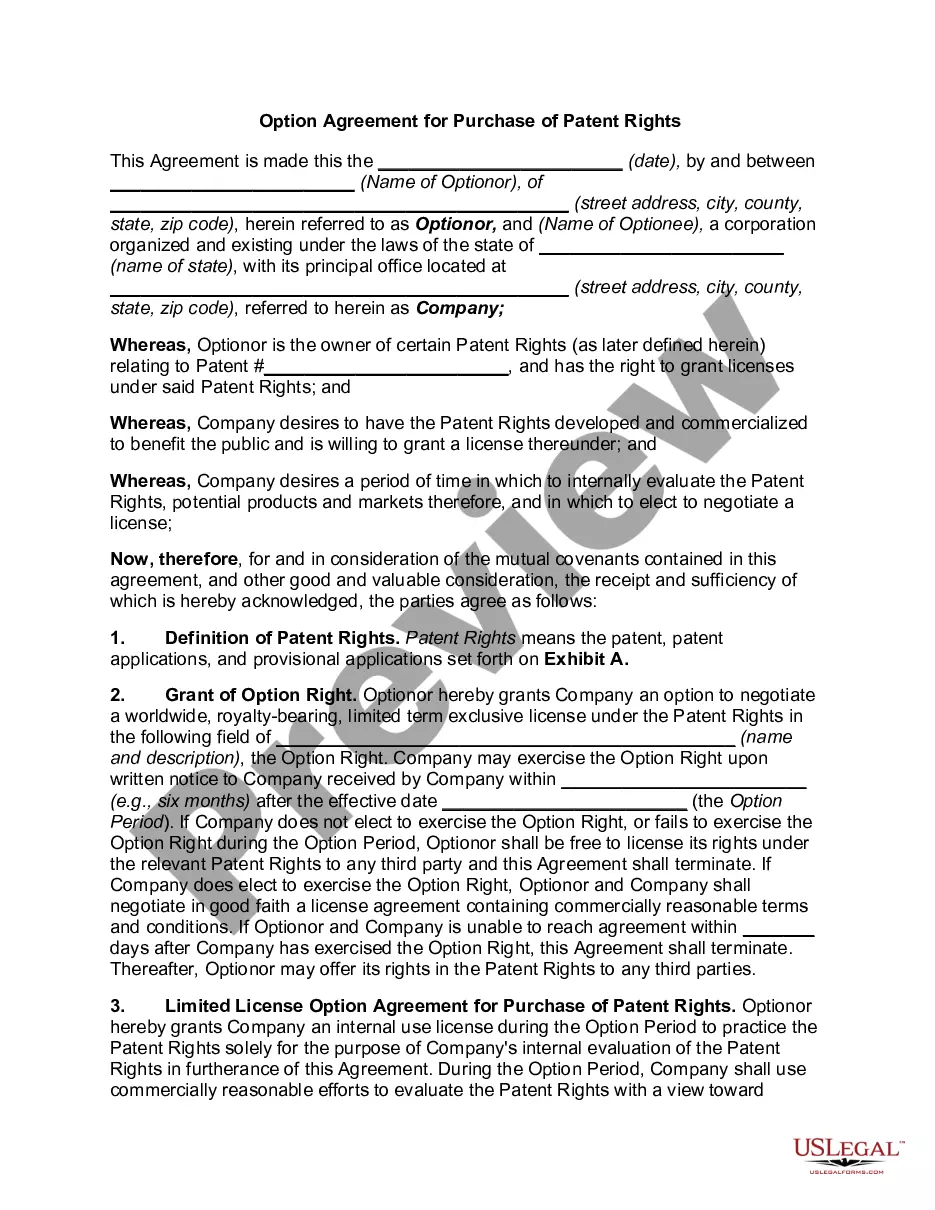

- Utilize the Preview button to view the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re searching for, employ the Search box to find the form that fulfills your requirements.

- When you find the appropriate form, click Acquire now.

Form popularity

FAQ

Forgiveness of a promissory note refers to the lender deciding to cancel the debt without requiring repayment. This process can be documented with an Indiana Sample Letter transmitting Cancellation and Satisfaction of Promissory Notes to formalize the agreement. Clear documentation eliminates future confusion and ensures that both parties understand that the obligation has been removed.

Give the borrower the original promissory note, with a notation on it that says CANCELLED or PAID IN FULL. Keep a copy of this note for your records.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Whether a promissory note is hand written or typed and signed, it is a legally, binding contract. LendingTree quoted Vincent Averaimo for saying, However, it would be foolish to sign a handwritten promissory note as it is easier to add language to a handwritten note after the fact as opposed to a typewritten one.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.