Indiana Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

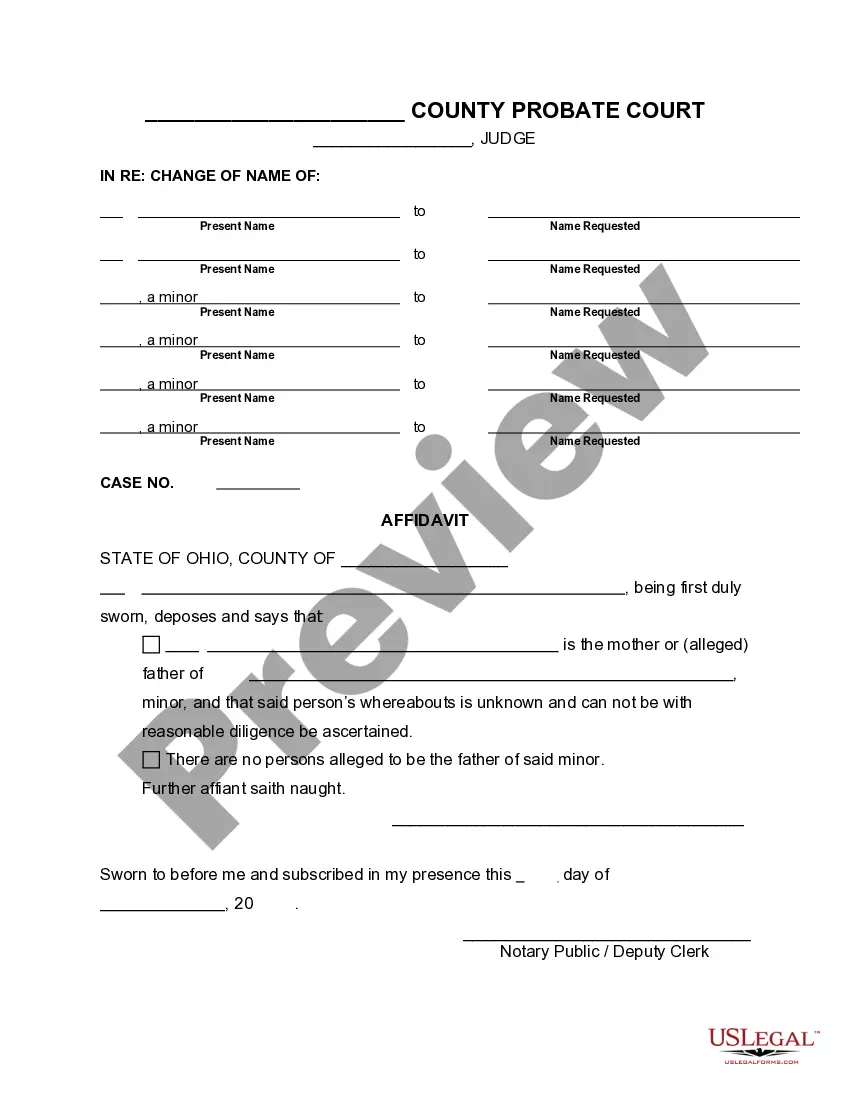

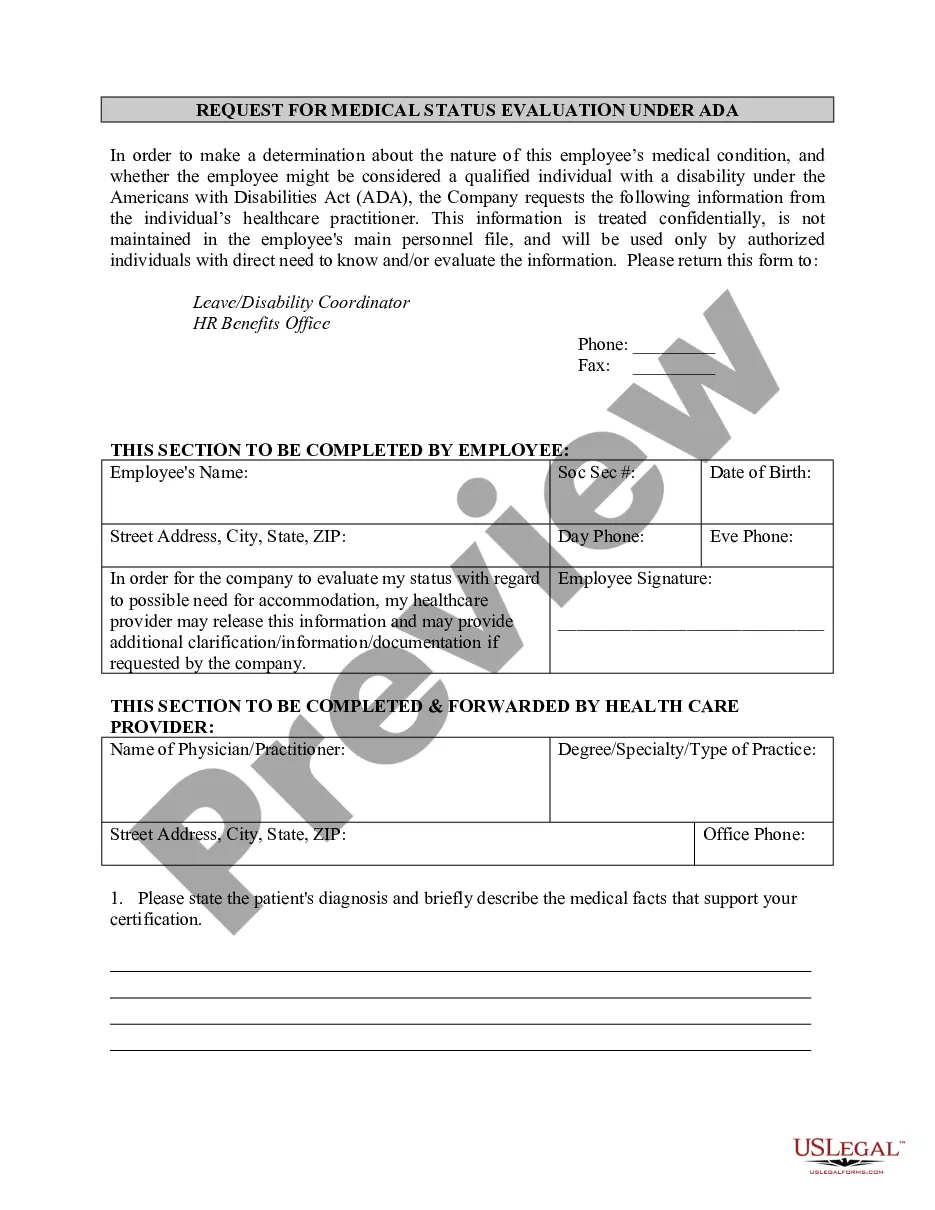

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

US Legal Forms - one of many biggest libraries of authorized kinds in the United States - gives an array of authorized record layouts you can acquire or print out. Utilizing the website, you may get 1000s of kinds for enterprise and individual uses, categorized by groups, states, or search phrases.You can get the newest models of kinds much like the Indiana Sample Letter for Request for IRS not to Off Set against Tax Refund within minutes.

If you already have a monthly subscription, log in and acquire Indiana Sample Letter for Request for IRS not to Off Set against Tax Refund through the US Legal Forms catalogue. The Acquire button can look on each form you view. You have access to all earlier downloaded kinds from the My Forms tab of your bank account.

In order to use US Legal Forms initially, here are simple recommendations to get you began:

- Be sure you have chosen the correct form for your area/state. Go through the Review button to analyze the form`s articles. Browse the form explanation to ensure that you have selected the appropriate form.

- In the event the form does not match your needs, utilize the Search discipline near the top of the display screen to get the the one that does.

- When you are satisfied with the form, confirm your option by clicking on the Get now button. Then, pick the prices prepare you want and supply your references to sign up for the bank account.

- Method the transaction. Make use of your bank card or PayPal bank account to finish the transaction.

- Find the structure and acquire the form on your system.

- Make alterations. Fill up, revise and print out and indication the downloaded Indiana Sample Letter for Request for IRS not to Off Set against Tax Refund.

Each and every format you included with your bank account does not have an expiry particular date which is your own property eternally. So, if you would like acquire or print out another version, just check out the My Forms section and then click around the form you require.

Gain access to the Indiana Sample Letter for Request for IRS not to Off Set against Tax Refund with US Legal Forms, one of the most substantial catalogue of authorized record layouts. Use 1000s of professional and status-distinct layouts that fulfill your company or individual demands and needs.

Form popularity

FAQ

Prevent an offset Pay the full amount listed on the Intent to Offset Federal Payments (FTB 1102). Use the payment coupon included in the letter when you send your check or money order. To make a payment online, visit Payment options .

To determine whether an offset will occur on a debt owed (other than federal tax), contact BFS's TOP call center at 800-304-3107 (800-877-8339 for TTY/TDD help).

The IRS may, for example, choose not to offset an overpayment against an outstanding federal tax refund because of undue hardship. However, the IRS's authority not to offset generally disappears once the offset has been done?it cannot reverse an offset.

To be eligible for the forgiveness program, taxpayers must demonstrate that they can't fully repay their taxes due to financial hardship. Hardship could include job loss, illness, or disability.

The Treasury Offset Program (TOP) collects past-due (delinquent) debts (for example, child support payments) that people owe to state and federal agencies. TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

In order to request an offset bypass refund, the taxpayer, or representative, should make the request when the return is filed. The request must occur prior to assessment. The request needs to demonstrate the financial hardship the taxpayer faces. The amount of the offset limits the amount of the OBR.

Prevent an offset Use the payment coupon included in the letter when you send your check or money order. To make a payment online, visit Payment options . For any changes to your balance for payments you make to us, we send updated account information to BFS weekly.

The intent to offset notice is a letter that the IRS sends out to taxpayers when the agency plans to keep their tax refunds and apply them to outstanding debts. You may also receive a notice of intent to offset if the government decides to take seize a federal payment due to unpaid liabilities.