Indiana Assignment of Interest in Trust

Description

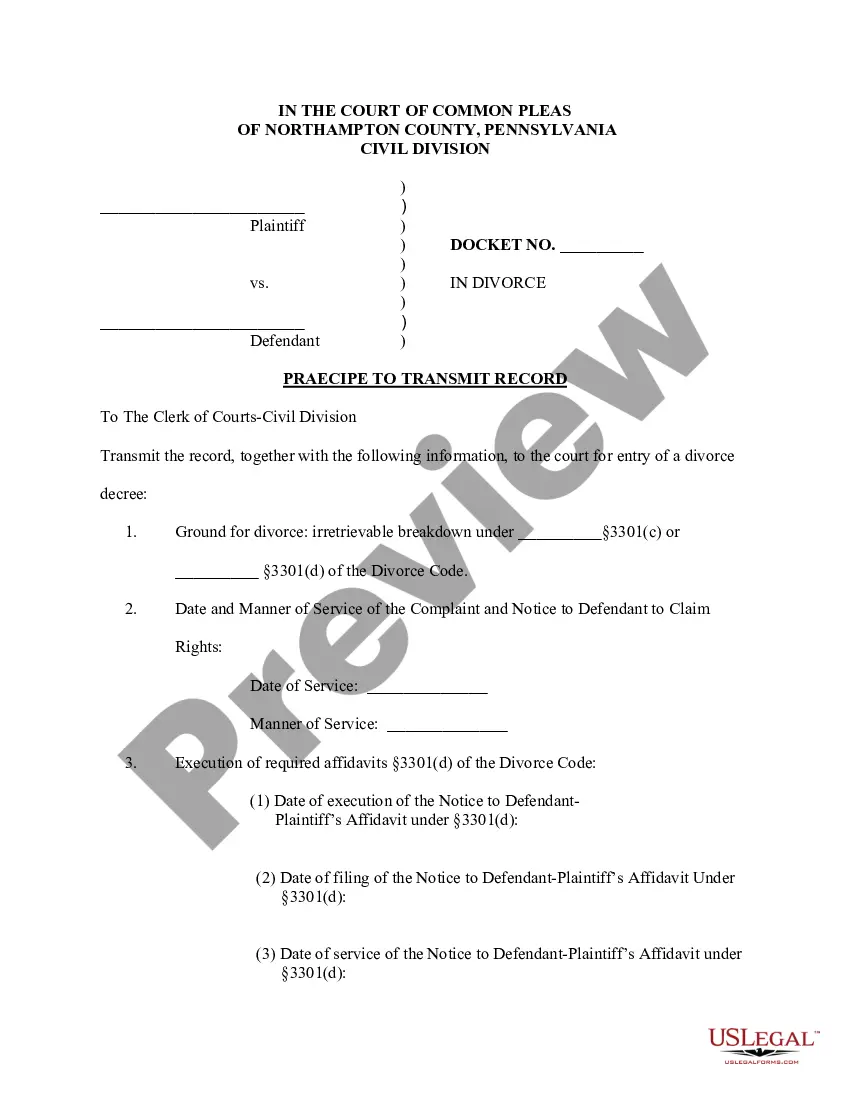

How to fill out Assignment Of Interest In Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide selection of legal form templates that you can download or print.

By utilizing the website, you will obtain thousands of forms for both business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of forms such as the Indiana Assignment of Interest in Trust in moments.

If you already possess a subscription, Log In and access the Indiana Assignment of Interest in Trust from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the saved Indiana Assignment of Interest in Trust.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just head to the My documents section and click on the form you desire.

Access the Indiana Assignment of Interest in Trust with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to begin.

- Ensure you have selected the correct form for your city/region.

- Hit the Review button to examine the form’s content.

- Check the form summary to confirm you have picked the right form.

- If the form doesn’t meet your needs, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

You don't need to have your document witnessed or notarized to make it valid. However, many people choose to sign their document in the presence of a notary public to help authenticate the document.

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

The cost of establishing a living trust in Indiana varies, from about $200 if you do it yourself with computer software to over $1,000 if you hire a lawyer. Don't be dissuaded by the cost of hiring a lawyer in establishing a living trust in Indiana. A trust is a legal document.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

Creating a living trust in Indiana is simple. There is no specific form required and your trust document must simply be clear in its terms. You sign the document in front of a notary and then fund the trust by placing ownership of assets in its name.

Ways a Trust Can End Indeed, trusts can and do end when the grantor specifies an end date or condition, and that condition is met. For example, the grantor can say that a child gets the benefit of cash in a trust until the child turns 18, or, alternatively, until the child graduates from college.

To make a living trust in Indiana, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

The trustee then holds and protects the property until the child turns 25. While there are many different types of trusts, the most common is the living trust. This is a trust created during a person's life, rather than one created in a will.

To terminate a living trust using §30-4-3-24.5 you must first petition the appropriate court and then convince the court that terminating the trust is the best option.

Unlike other states, Indiana law does not require a will to be notarized. Instead, it should be self-proving, meaning that the validity has been affirmed by both the deceased and the witnesses through their signing.