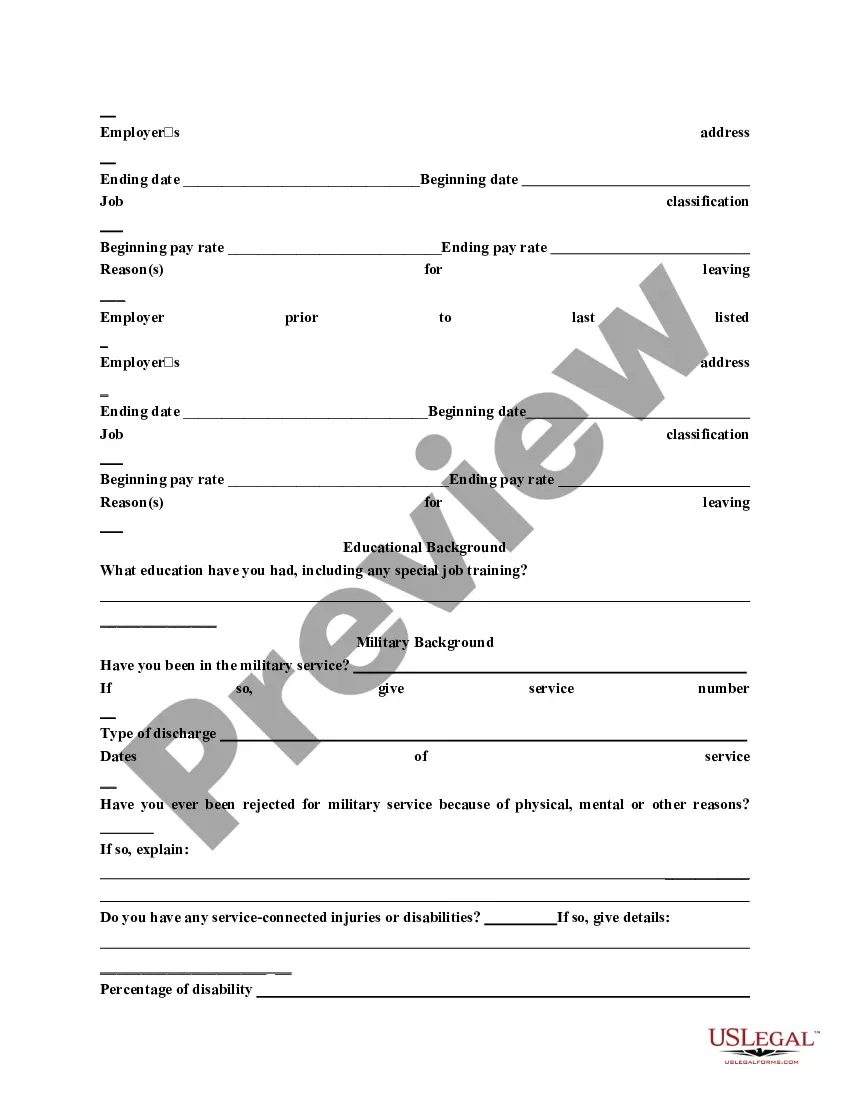

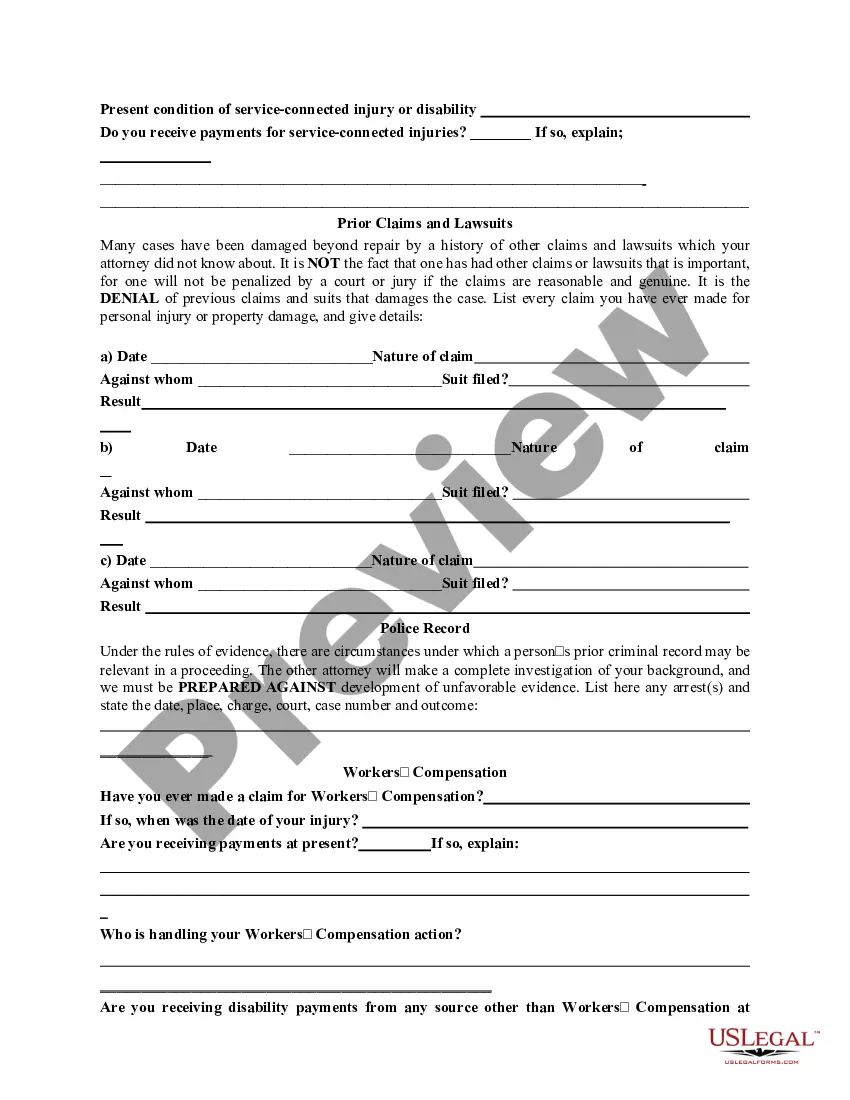

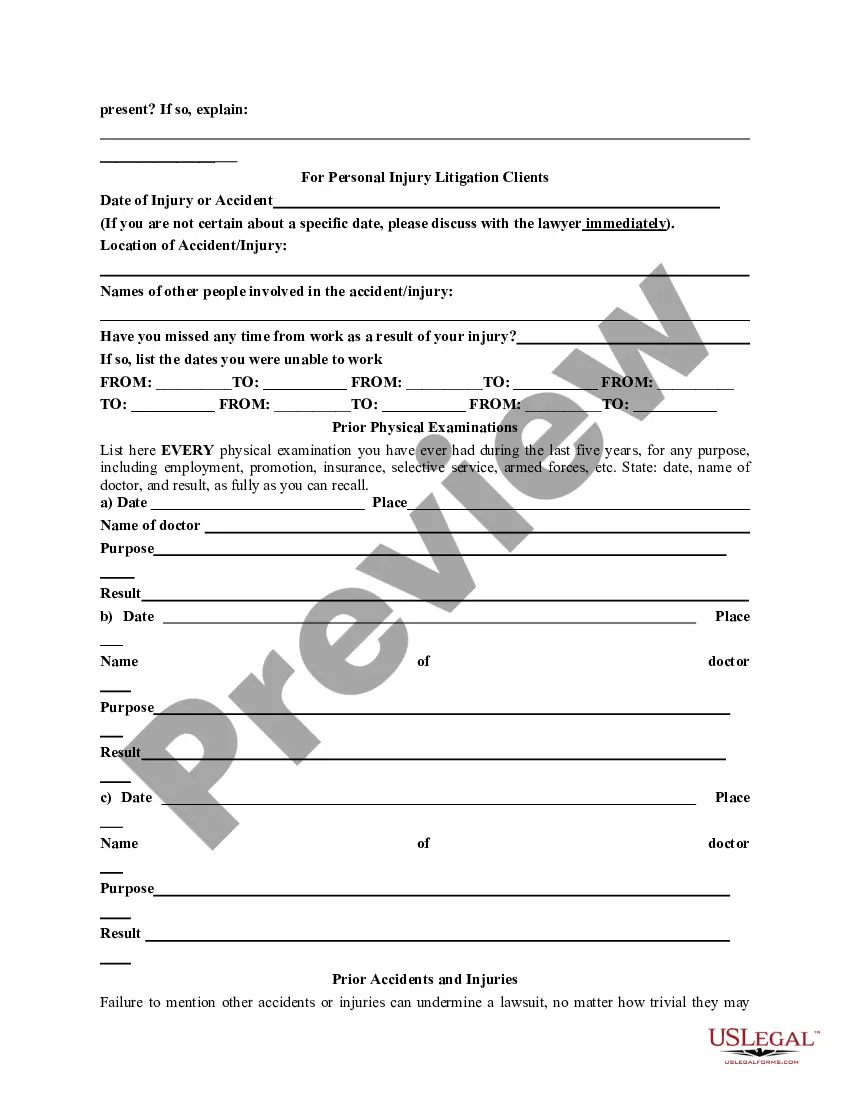

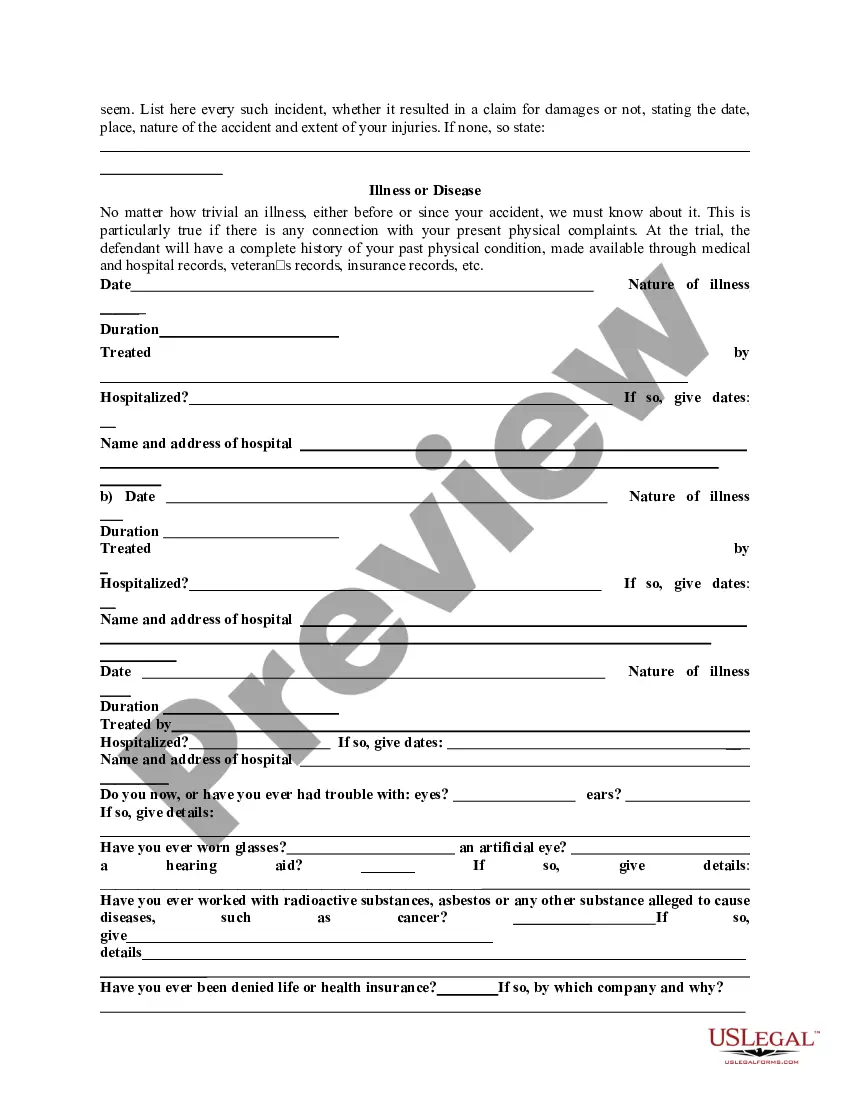

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Indiana General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Finding the appropriate official document template can be quite a challenge.

Clearly, there is a multitude of templates accessible online, but how can you locate the official document you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your state/region. You can preview the form using the Preview option and review the form outline to confirm it meets your needs. If the form does not fit your requirements, use the Search field to find the appropriate form. Once you are certain the form is correct, click on the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and process your order using your PayPal account or credit card. Select the file format and download the official document template to your device. Complete, modify, print, and sign the obtained Indiana General Information Questionnaire. US Legal Forms is the largest repository of legal forms where you can find various document templates. Leverage the service to obtain professionally crafted documents that meet state requirements.

- The platform offers thousands of templates, including the Indiana General Information Questionnaire, suitable for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Indiana General Information Questionnaire.

- Use your account to access the official forms you have previously purchased.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

Form popularity

FAQ

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

To register for nonprofit status with the state of Indiana, submit a Nonprofit Application for Sales Tax Exemption (Form NP-20A) through DOR's e-services portal at INTIME.dor.in.gov. For more information, call 317-232-0129.

What Is Indiana's TID Number? Your business may also need a TID number in Indiana, which is a different kind of tax ID number. It operates at the state level, serving as Indiana's version of a tax ID number. It, too, is used for identification and tax accounting purposes, but it's distinct from the federal tax ID.

Indiana Form ST-105, General Sales Tax Exemption Certificate.

Full-Year Residents If you were a full-year resident of Indiana and your gross income (the total of all your income before deductions) was greater than certain exemptions*, you must file an Indiana tax return. Full-year residents must file Form IT-40, Indiana Full-Year Resident Individual Income Tax.

Form ST-105, the Indiana general sales tax exemption certificate, allows property to be purchased exempt from tax if the property fits under one of the agricultural exemptions provided by Indiana law.

Tax-exempt customers Some customers are exempt from paying sales tax under Indiana law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.