Indiana Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

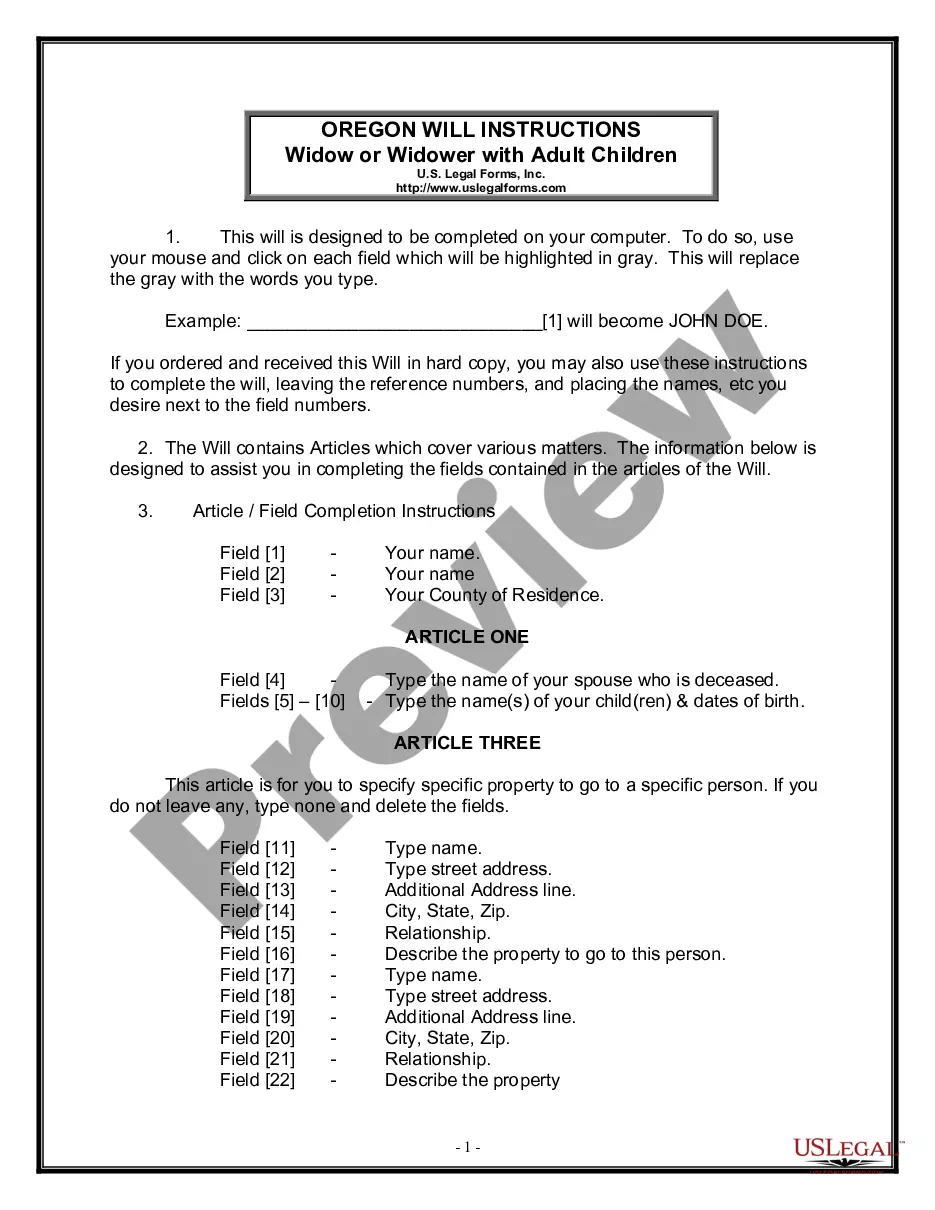

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

You can dedicate time online trying to locate the sanctioned document template that satisfies the federal and state requirements you will require.

US Legal Forms offers thousands of legal forms that can be reviewed by attorneys.

You can easily download or print the Indiana Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions from my service.

First, make sure you have chosen the correct document template for the county/city of your choice. Check the form outline to ensure you have selected the correct form. If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Indiana Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions.

- Each legal document template you acquire is yours for an extended period.

- To obtain another copy of the obtained form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

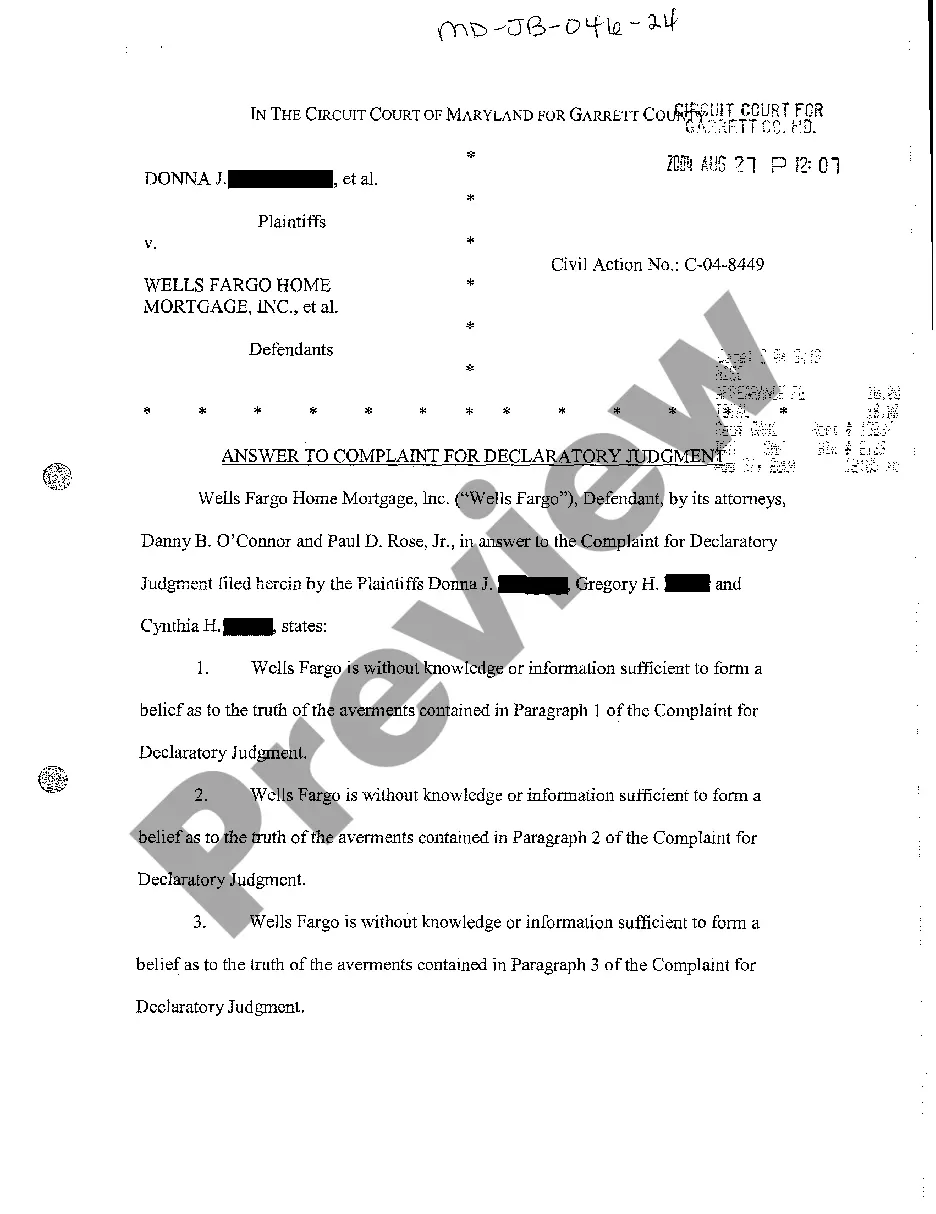

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

Use this form to designate additional authorized individuals to act on behalf of the Licensee.

A resolution is a document stands as a record if compliance comes in to question. A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity. The length of the resolution isn't important.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

Letter of Resolution means a letter advising the party accused, and any person who, in writing informed or complained to the Executive Director concerning any such violation, that the alleged violation has been resolved and the manner by which it was resolved.

A granted authority that will put a firm into debt that is passed by a resolution of stock holders.

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.