Washington Electronic Software Distribution Agreement

Description

How to fill out Electronic Software Distribution Agreement?

You might invest hours on the web trying to discover the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of authentic forms that have been evaluated by experts.

You can download or print the Washington Electronic Software Distribution Agreement from my services.

If available, utilize the Review button to browse through the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Then, you may complete, edit, print, or sign the Washington Electronic Software Distribution Agreement.

- Every authentic document template you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

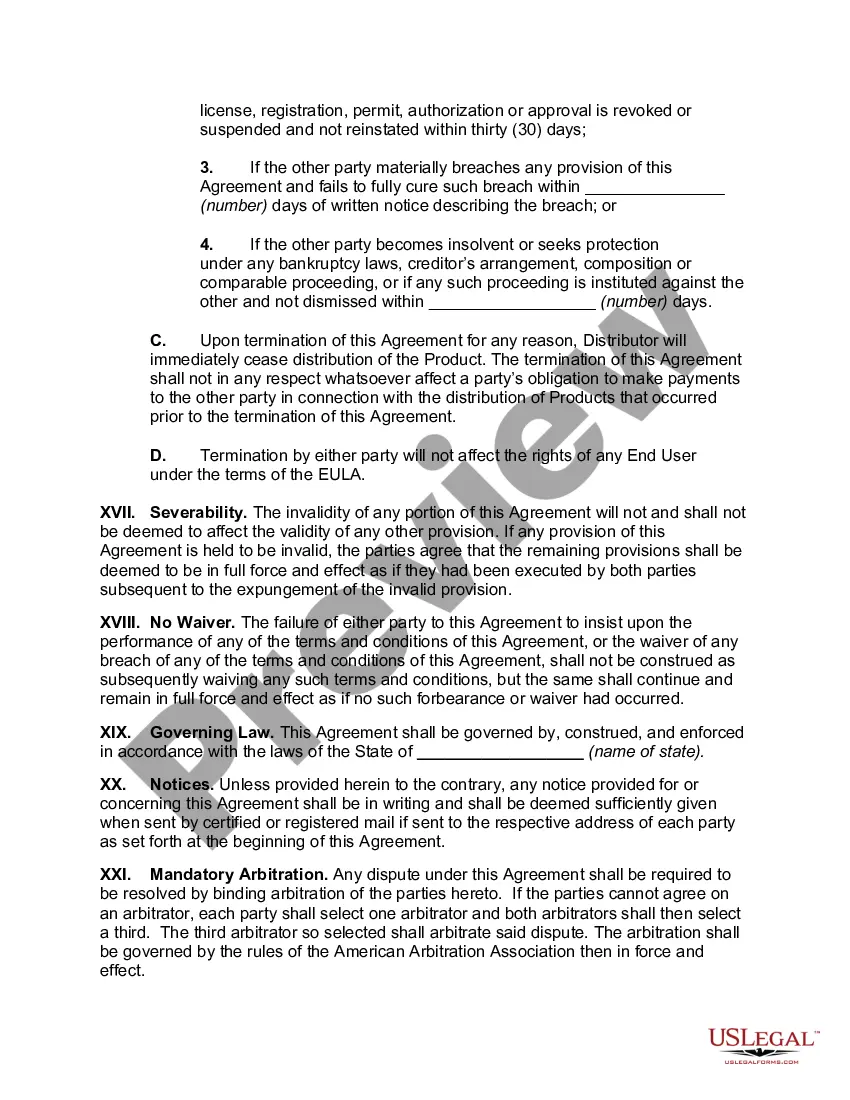

The Distributor Agreement should clearly set forth the duties, responsibilities and expectations of each of the parties. The Distributor Agreement should also set forth provisions related to limitations and protections that each party can understand.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

Sales of custom software - downloaded are exempt from the sales tax in Washington. Sales of customization of canned software are exempt from the sales tax in Washington. In the state of Washington, any digital goods that are streamed or remotely accessed are considered to be taxable.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Software distribution agreements specifically allow distributors to market and sell the developer's software to end users. A software distribution agreement sets forth the rights and duties of both the developer and the distributor to avoid disputes later on.

Below is a basic distribution agreement checklist to help you get started:Names and addresses of both parties.Sale terms and conditions.Contract effective dates.Marketing and intellectual property rights.Defects and returns provisions.Severance terms.Returned goods credits and costs.Exclusivity from competing products.More items...

Should your business charge sales tax on SaaS in Washington? SaaS is generally always taxable in Washington. Washington refers to SaaS as remotely accessed software (RAS) and says: RAS is prewritten software provided remotely.

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.