Indiana Loss Mitigation Order is a legal document issued by the state of Indiana that requires a mortgage service to reduce or lessen the amount of money owed on a mortgage loan. This order is typically issued when the borrower is facing foreclosure and has an inability to make the current mortgage payments. The order requires the service to accept a lower payment or modify the loan terms in an effort to make the loan more affordable. There are two types of Indiana Loss Mitigation Orders: the Standard Loss Mitigation Order (SUMO), which applies to all non-judicial foreclosures, and the Judicial Loss Mitigation Order (ELMO), which applies to judicial foreclosures. The SUMO requires the service to evaluate whether the borrower qualifies for a loan modification or repayment plan, while the ELMO requires the service to evaluate the borrower’s eligibility for a loan modification, repayment plan, forbearance, or other loss mitigation option. Both orders require the service to provide the borrower with a written notice regarding the loss mitigation order within 10 days of the issuance of the order.

Indiana Loss Mitigation, Order

Description

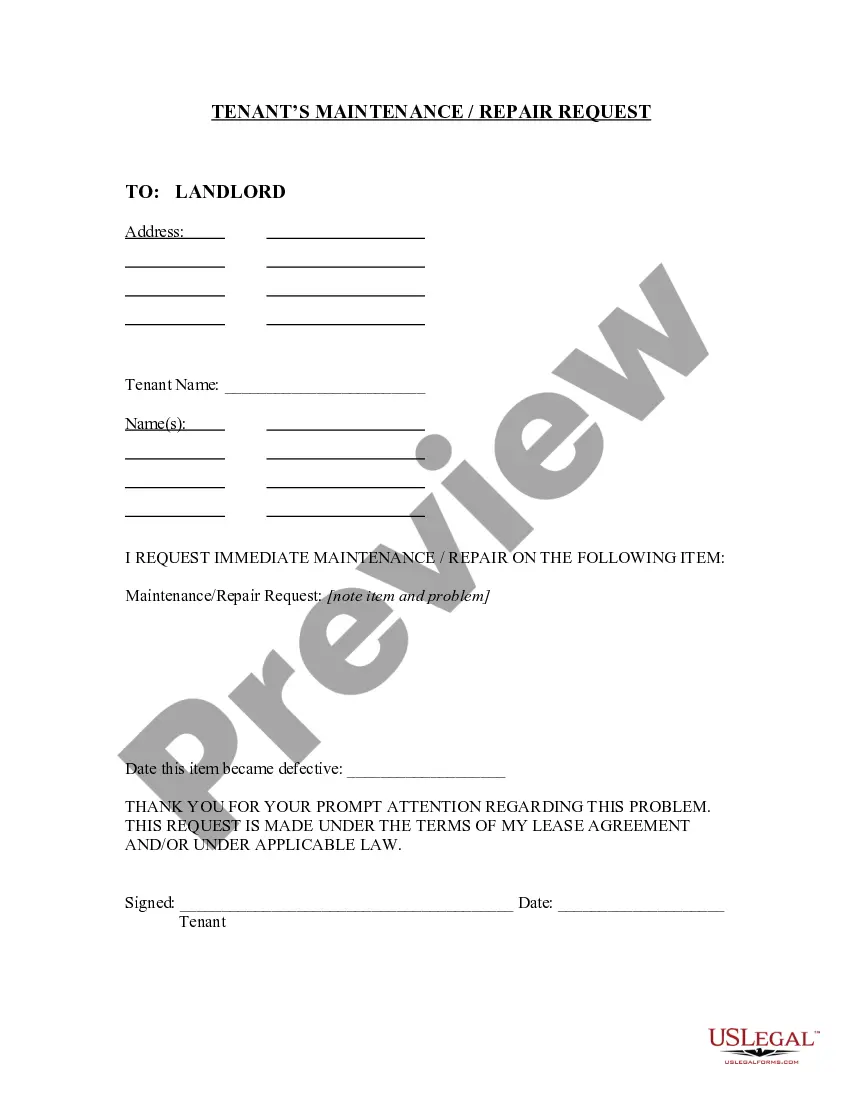

How to fill out Indiana Loss Mitigation, Order?

If you’re seeking a method to accurately finalize the Indiana Loss Mitigation, Order without employing a legal expert, then you have landed in the ideal location.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official documents for every personal and commercial circumstance. Every piece of paperwork available on our online service is crafted in accordance with federal and state statutes, ensuring that your documents are properly arranged.

Another excellent feature of US Legal Forms is that you will never lose the documents you purchased - you can retrieve any of your downloaded templates in the My documents section of your profile whenever necessary.

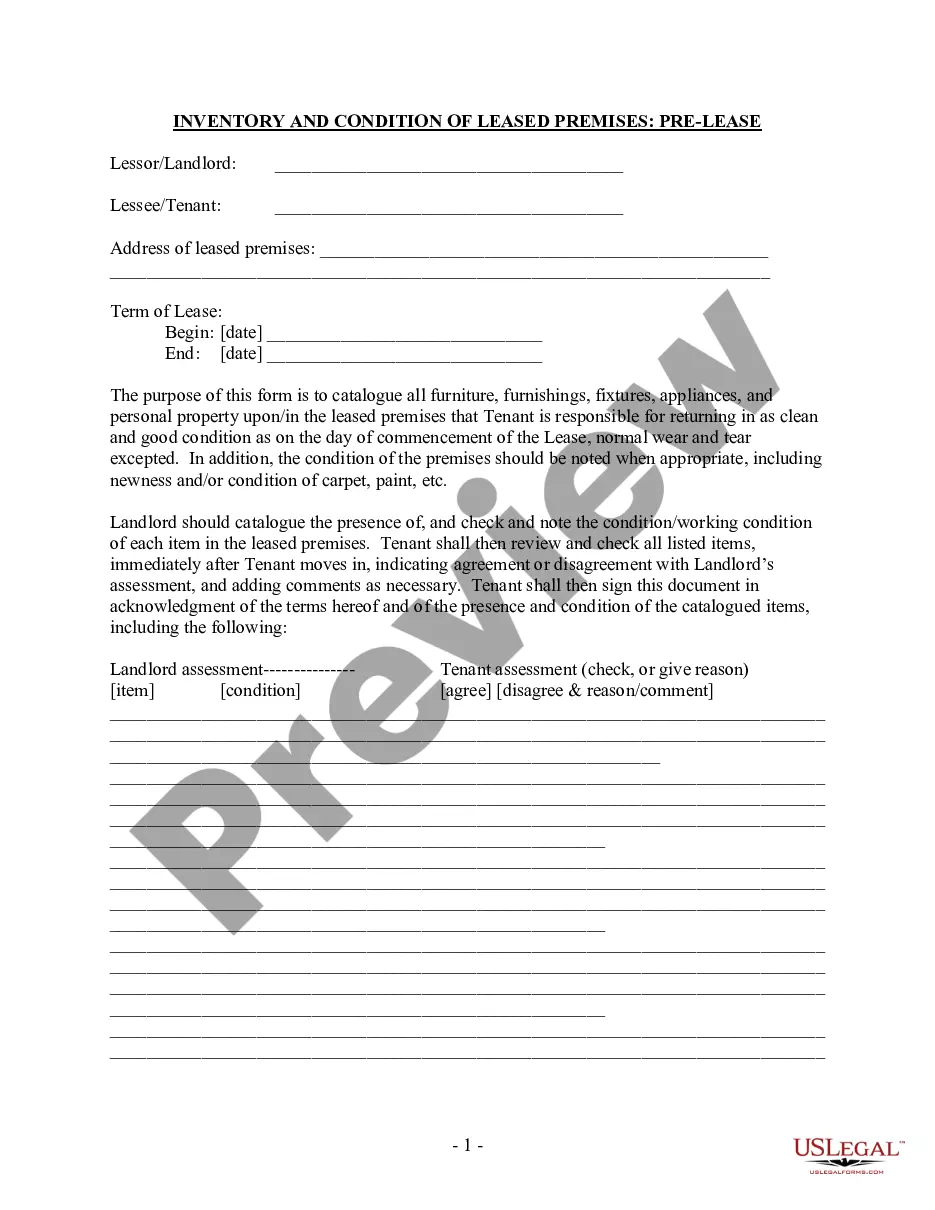

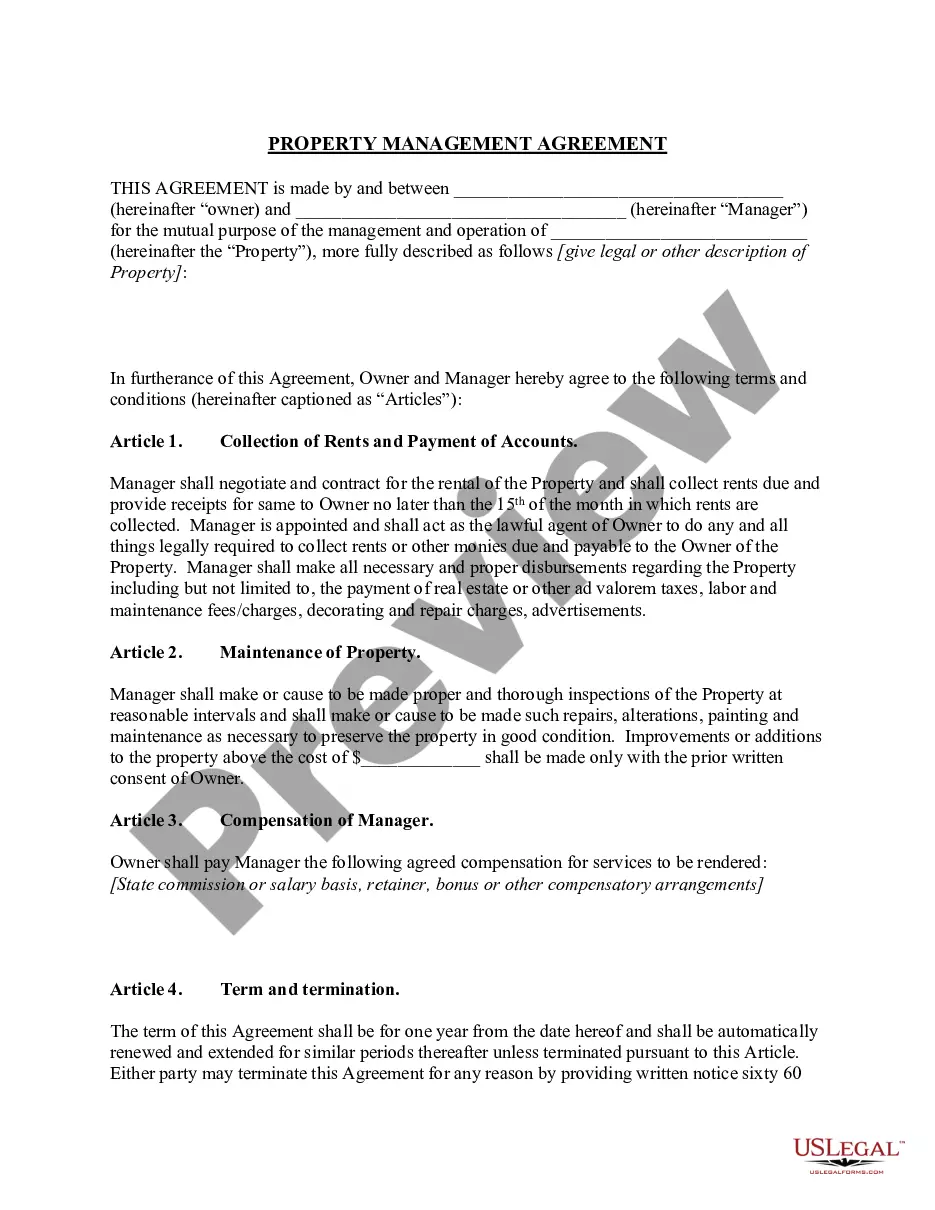

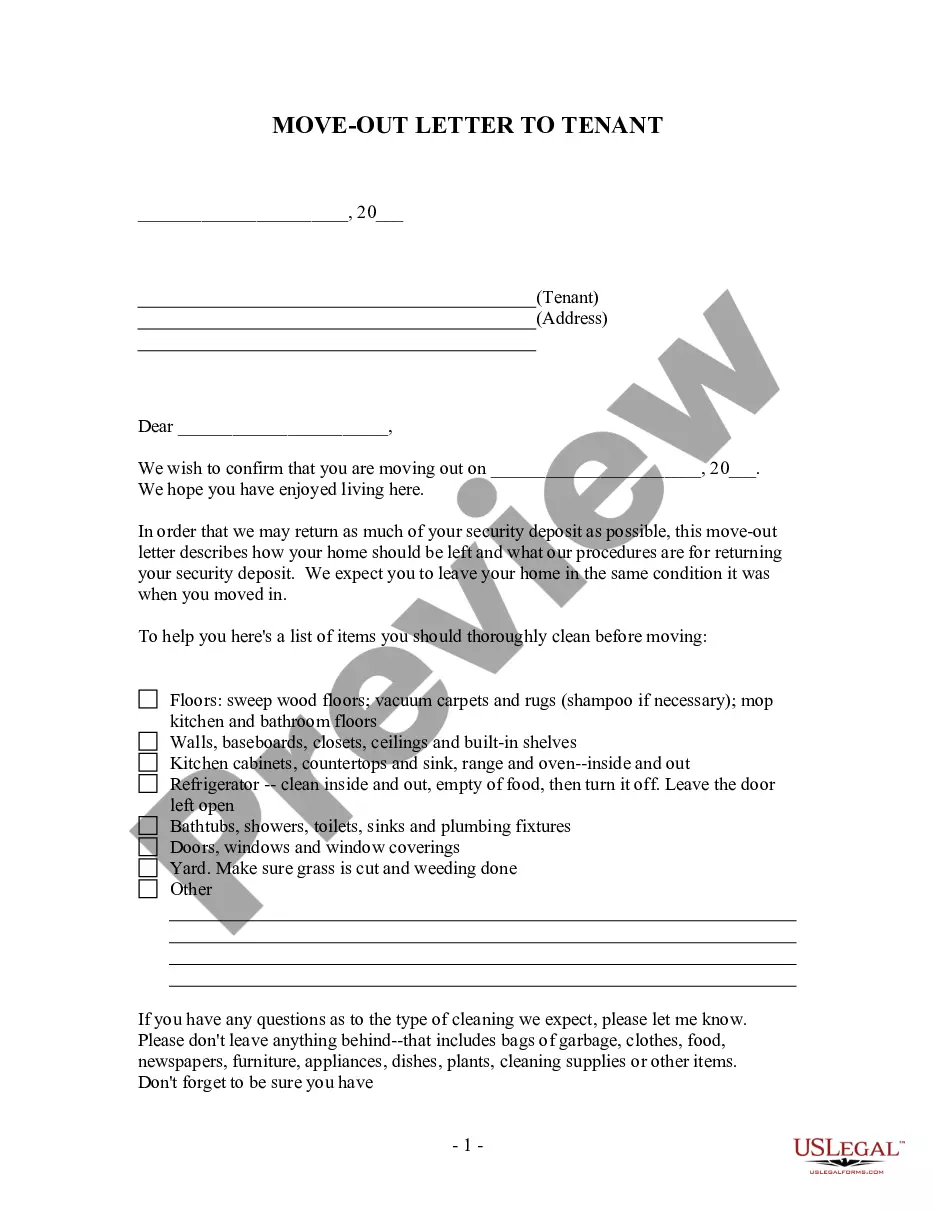

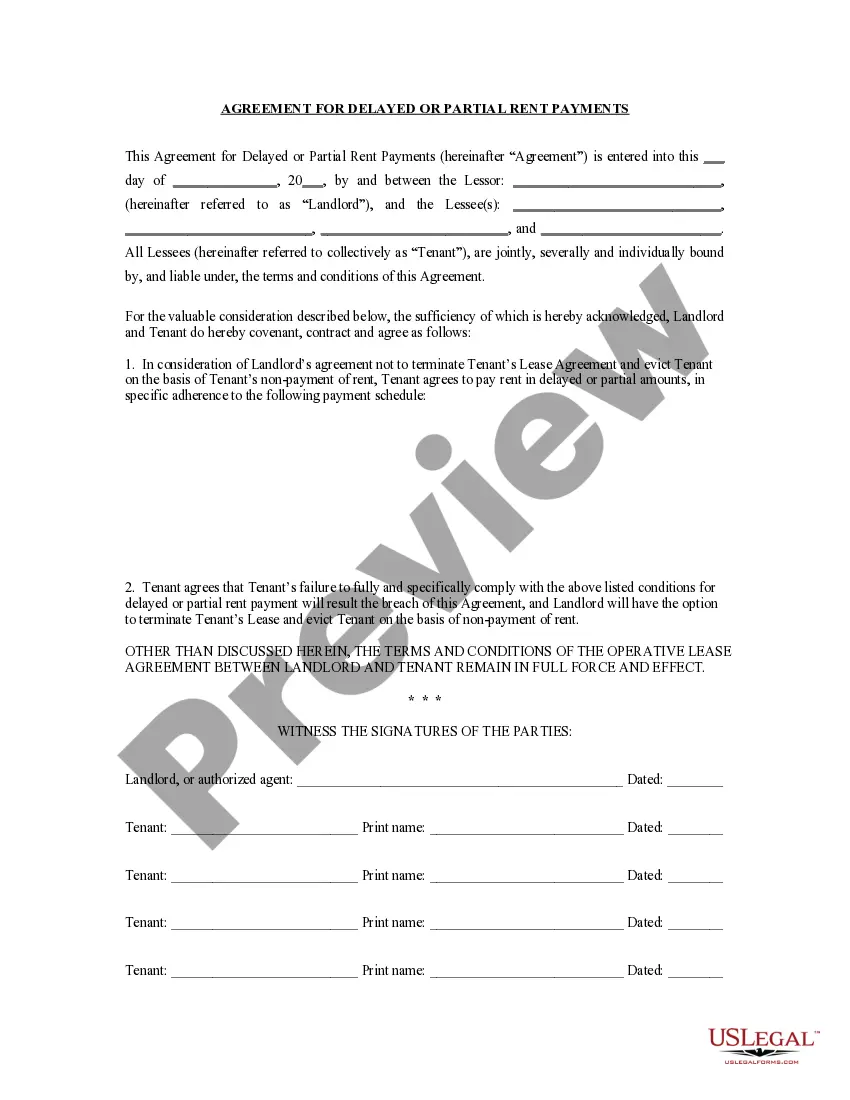

- Verify that the document you view on the page matches your legal circumstances and state statutes by reviewing its textual description or examining the Preview mode.

- Enter the form title in the Search tab located at the top of the page and select your state from the dropdown menu to discover alternative templates if there are any discrepancies.

- Repeat the content verification and click Buy now when you feel assured about the document's compliance with all requirements.

- Log in to your account and click Download. Register for the service and select a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available for download immediately afterward.

- Decide which format you prefer to save your Indiana Loss Mitigation, Order and download it by selecting the appropriate button.

- Incorporate your template into an online editor to complete and sign it swiftly or print it out to prepare your hard copy manually.

Form popularity

FAQ

Loss mitigation helps investors, lenders and borrowers avoid the unwanted process of foreclosure. Loss mitigation is when the lender and borrower work together to find an agreeable alternative for both parties to avoid a foreclosure.

If you're struggling to make payments on your mortgage, you might be eligible for loss mitigation. Loss mitigation has flexible mortgage repayment terms based on your financial hardship, giving you the chance to keep your home and avoid foreclosure.

Your investor does not offer loan modifications as a loss mitigation option. Your Loan to Value (LTV) ratio is too high or too low. You defaulted too close to the origination date of your mortgage or too close to your last loan modification.

Loss mitigation can include temporary or ongoing solutions that continue until the end of your loan term. Some options, like a loan modification, short sale, deferral or deed in lieu of foreclosure, only end when the loan is paid off or the house is sold.

The application process is normally 37-60 days, including 30 days to review a complete loss mitigation request. An alternative may take an additional 30-180 days to finalize. As with early intervention, investor's guidelines and financial circumstances determine the option available and its terms.

To apply for loss mitigation, contact your loan servicer. It's critical to contact your servicer when you think you might have trouble making your upcoming mortgage payments.

(1) The loss mitigation option permits the borrower to delay paying covered amounts until the mortgage loan is refinanced, the mortgaged property is sold, the term of the mortgage loan ends, or, for a mortgage loan insured by the Federal Housing Administration, the mortgage insurance terminates.

Loss mitigation refers to the steps mortgage servicers take to work with a mortgage borrower to avoid foreclosure . Loss mitigation refers to a servicer's responsibility to reduce or ?mitigate? the loss to the investor that can come from a foreclosure. Certain loss-mitigation options may help you stay in your home.