Indiana Turnover is a pastry dish made with dough that has been rolled and folded over a fruit or other filling. It is believed to have originated in the state of Indiana in the United States. The most common fillings used for Indiana Turnover are apples, cherries, and blueberries. However, other fruits or ingredients may also be used. The dough is often coated with an egg wash and sprinkled with sugar before baking. The pastry can be served plain or with a variety of toppings, including ice cream, whipped cream, or a glaze. There are two main types of Indiana Turnover, the open-faced turnover and the closed-faced turnover. The open-faced turnover is a single pastry crust filled with a variety of sweet fillings, while the closed-faced turnover is a double crust turnover with an additional layer of pastry on top.

Indiana Turnover

Description

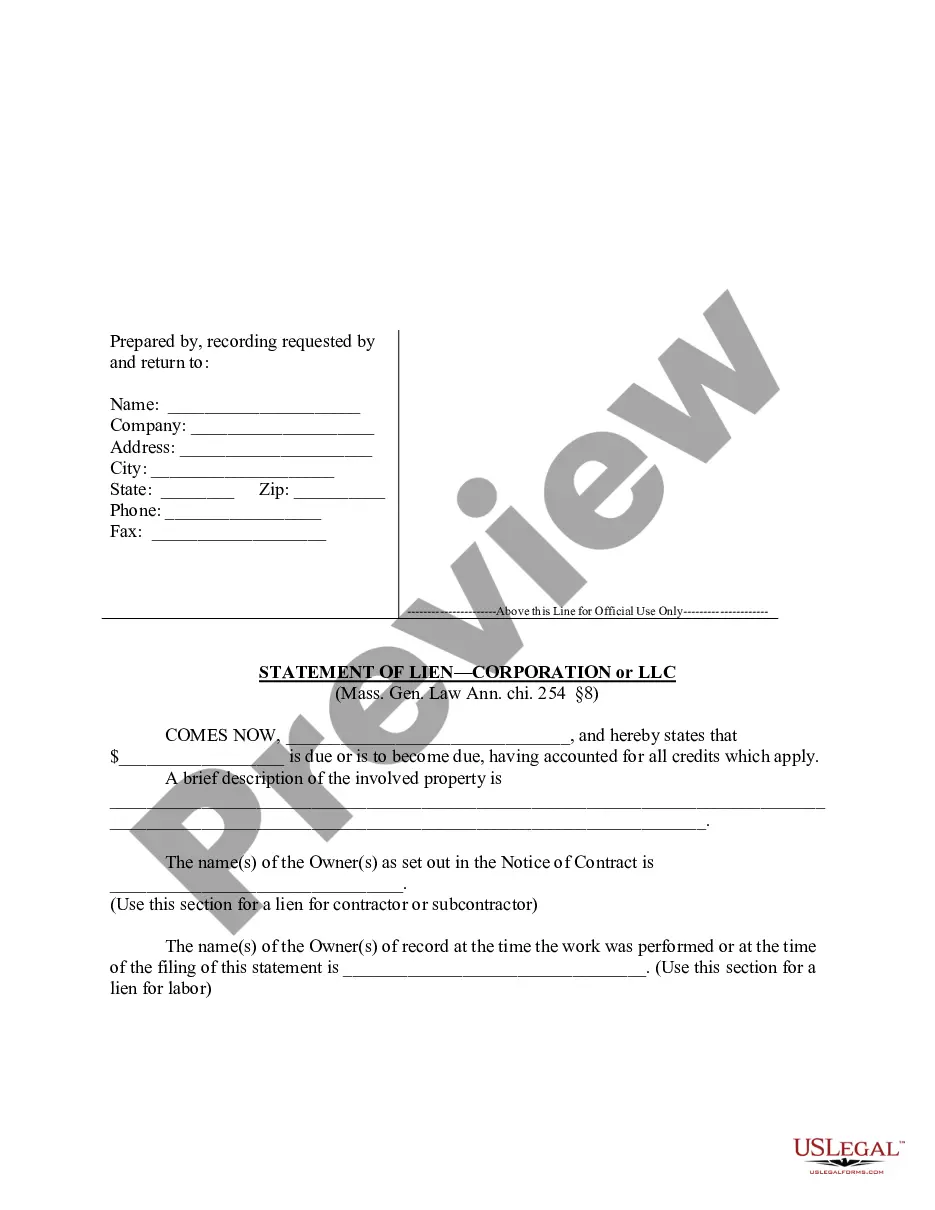

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Turnover?

Drafting official documentation can be quite overwhelming if you lack accessible fillable templates. With the US Legal Forms online repository of formal papers, you can trust the documents you find, as they all align with federal and state guidelines and are validated by our experts.

Acquiring your Indiana Turnover from our platform is as simple as ABC. Previously registered users with an active subscription just need to Log In and click the Download button after finding the appropriate template. Afterwards, if necessary, users can retrieve the same document from the My documents section of their account. Nevertheless, even if you are a newcomer to our service, registering with a valid subscription will only take a few minutes. Here's a brief guide for you.

Haven't you utilized US Legal Forms yet? Register for our service now to access any formal document swiftly and effortlessly whenever you require it, and maintain your paperwork organized!

- Document compliance verification. You should thoroughly examine the content of the form you wish to use and ensure that it meets your requirements and adheres to your state legislation. Reviewing your document and checking its general description will assist you in doing just that.

- Alternative search (optional). If you encounter any discrepancies, explore the library through the Search tab at the top of the page until you locate a suitable document, and click Buy Now when you identify the one you prefer.

- Account registration and form acquisition. Create an account with US Legal Forms. After your account is verified, Log In and select your most appropriate subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further utilization. Select the file format for your Indiana Turnover and click Download to save it on your device. Print it to finish your paperwork manually, or utilize a multi-functional online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

To fill out the state of Indiana employee's withholding exemption and county status certificate, enter your personal information, including your name, address, and Social Security number. Then, indicate whether you wish to claim any exemptions and select your county of employment. Ensuring accuracy in this form is essential for compliance with state withholding requirements related to Indiana turnover.

The Indiana form IT-40 is the state's individual income tax return form. Residents use this form to report their income and calculate the amount of tax owed to the state. By accurately completing the IT-40, you ensure proper reporting of your earnings and Indiana turnover, which contributes to the economic health of the state.

States With Highest Sales Tax California ? 7.25% Tennessee ? 7% Rhode Island ? 7% Mississippi ? 7% Indiana ? 7% Minnesota ? 6.88% Nevada ? 6.85% New Jersey ? 6.63%

Indiana's combined state and local general revenues were $69.6 billion in FY 2020, or $10,258 per capita. National per capita general revenues were $10,933.

Only those who filed an Indiana resident tax return for the 2020 tax year by Dec. 31, 2021, qualified for the $125 ATR. DOR issued direct deposits beginning in May 2022 for those who qualified for the $125 refund and provided direct deposit information for their tax refund on their 2021 Indiana Income Tax return.

2023 List of Indiana Local Sales Tax Rates. Indiana has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to N/A.

Indiana sales tax details The Indiana (IN) state sales tax rate is currently 7%.

Call 317-232-2240 (option 3) to access DOR's automated refund line. Please allow two to three weeks of processing time before calling.

Indiana's actual retail sales tax (comparable with other state retail sales taxes) was enacted in 1963 (see here for more information).

Financial Institutions Tax (replaced former bank taxes) TimeframeRate1990 ? 20138.5%January 1, 2014 ? December 31, 20148.0%January 1, 2015 ? December 31, 20157.5%January 1, 2016 ? December 31, 20167.0%7 more rows