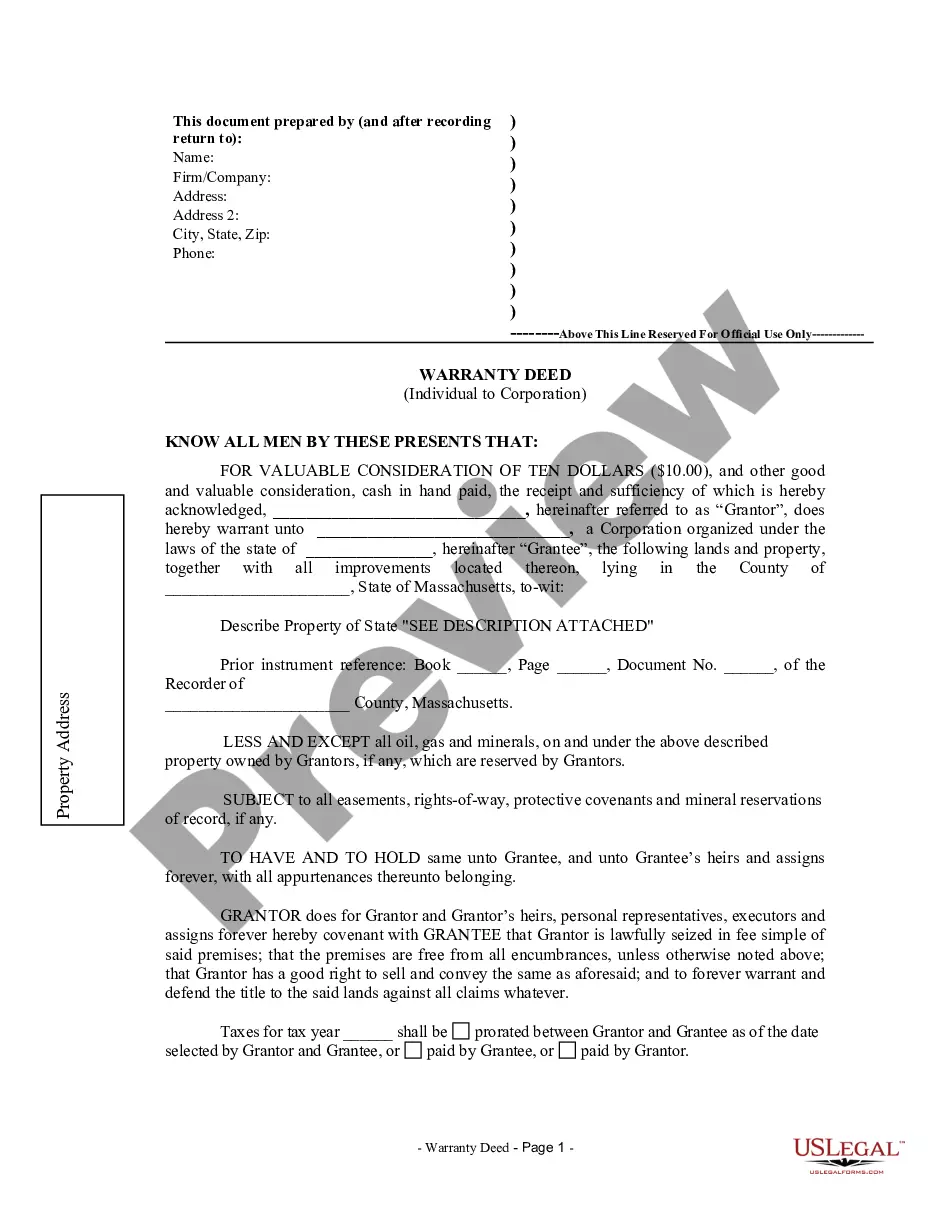

Massachusetts Warranty Deed from Individual to Corporation

Description

How to fill out Massachusetts Warranty Deed From Individual To Corporation?

Greetings to the most exceptional legal documents collection, US Legal Forms. Here, you can discover any template including Massachusetts Warranty Deed from Individual to Corporation documents and retain them (as many as you desire). Create official paperwork within a few hours, instead of days or even weeks, without needing to spend excessively on a lawyer. Obtain your state-specific template in a few clicks and feel assured knowing it was crafted by our certified legal experts.

If you’re already a registered user, simply Log In to your profile and click Download next to the Massachusetts Warranty Deed from Individual to Corporation you require. Being that US Legal Forms is an online platform, you’ll consistently have access to your downloaded documents, regardless of the device you’re using. View them in the My documents section.

If you haven't set up an account yet, what are you waiting for? Follow our instructions below to begin.

After you’ve completed the Massachusetts Warranty Deed from Individual to Corporation, forward it to your attorney for verification. It’s an additional step but a crucial one for ensuring you’re fully protected. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific template, confirm its legitimacy in your state.

- Examine the description (if available) to determine if it’s the correct form.

- Explore further details using the Preview feature.

- If the document fulfills all of your requirements, click Buy Now.

- To establish an account, select a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Download the file in the format you need (Word or PDF).

- Print the document and complete it with your/your organization’s information.

Form popularity

FAQ

In Massachusetts, a warranty deed and a quitclaim deed serve different purposes in property transfers. A warranty deed guarantees that the seller holds clear title to the property and provides legal protection if issues arise later. On the other hand, a quitclaim deed simply transfers whatever interest the seller has, if any, without providing any warranties. Therefore, when considering a Massachusetts Warranty Deed from Individual to Corporation, you benefit from added security.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

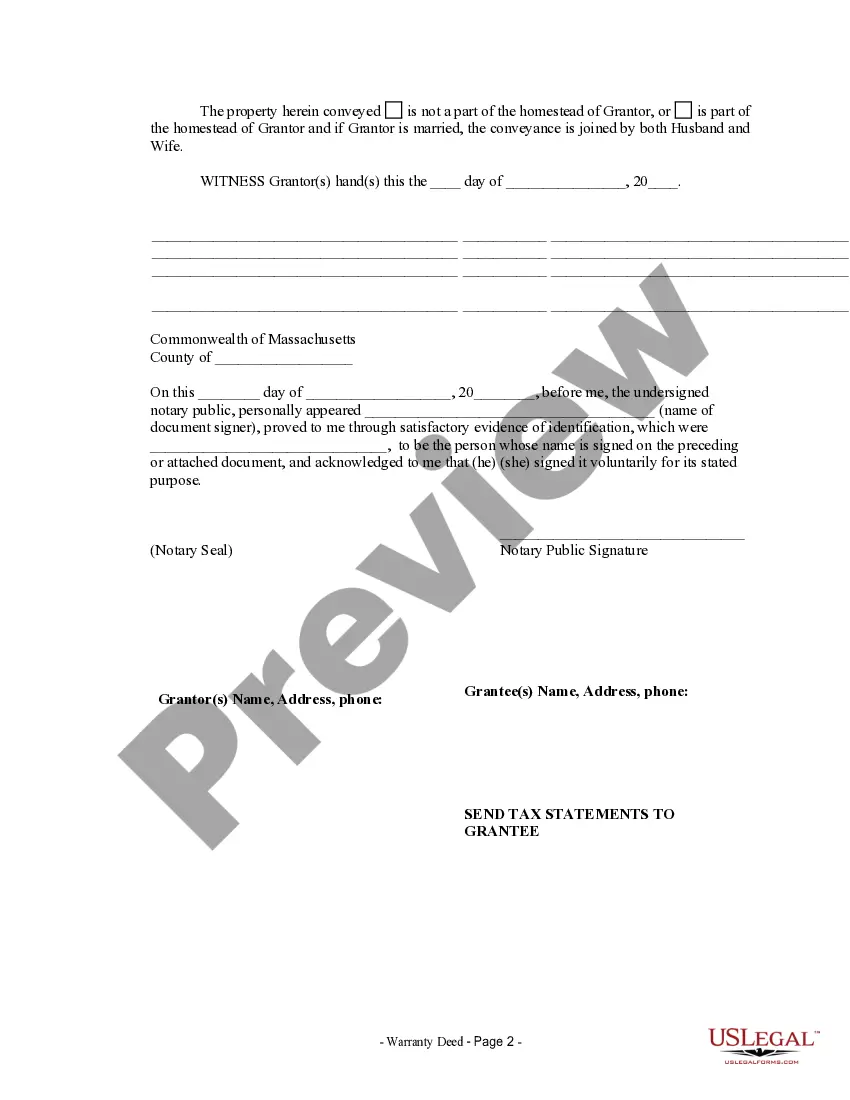

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.