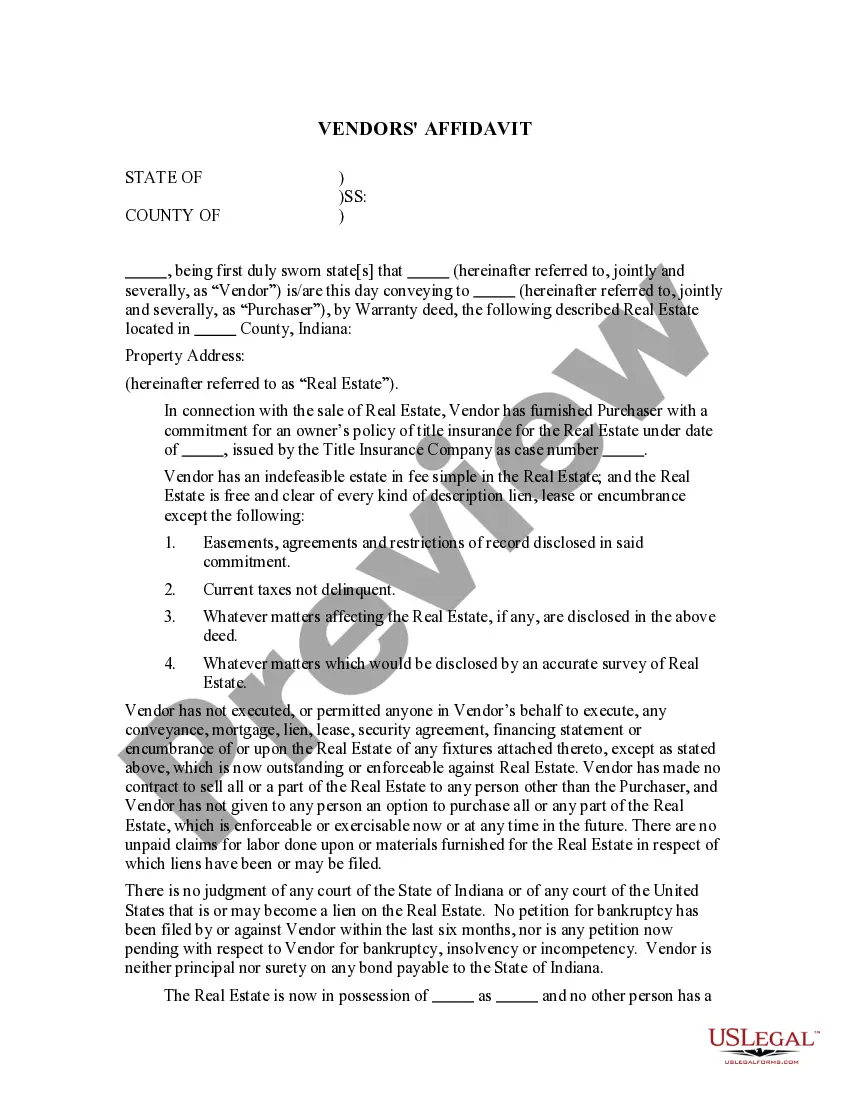

The Indiana Vendor's Affidavit is a legal document used by businesses in the state of Indiana to certify that all applicable taxes related to the sale of goods or services have been paid. It is also used to verify that the vendor has complied with all applicable laws and regulations. The Indiana Vendor's Affidavit is commonly used by businesses that are selling goods or services to other businesses or individuals in Indiana. There are two types of Indiana Vendor's Affidavit: 1. The General Indiana Vendor's Affidavit: This form is used to certify that all applicable taxes related to the sale of goods or services have been paid and all applicable laws and regulations have been complied with. 2. The Indiana Tax-Exempt Vendor's Affidavit: This form is used to certify that the vendor is exempt from paying taxes on the sale of goods or services. This form must be signed by the vendor and a representative of the Indiana Department of Revenue.

Indiana Vendor's Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Vendor's Affidavit: A legal document used primarily in real estate transactions in the United States, confirming that a vendor has fulfilled all the contractual obligations, and the purchaser can make the final payment. It often includes custom clauses related to green building certifications, and disclosures about any existing legal forms or contracts related to the property.

Step-by-Step Guide: Using a Vendor’s Affidavit in a Property Closing

- Identify the Need: Determine if your real estate transaction requires a vendors affidavit, commonly needed in construction projects and property closings.

- Collect Information: Gather all necessary documents, such as contracts management data, previous payments, and any specifics about the project like green building features.

- Prepare the Document: Utilize online paperwork services to draft the affidavit, incorporating all necessary custom clauses and legal jargon.

- Review and Finalize: Have all parties, especially legal professionals, review the document to ensure all information is accurate before signing.

- Execute and Use: Sign the affidavit and use it to facilitate the final payment and completion of the property transaction.

Risk Analysis: Pitfalls in Utilizing Vendor’s Affidavits

- Incomplete Details: Missing information can delay the process or lead to disputes over final payments.

- Legal Non-Compliance: Incorrect legal terminology or missing clauses tailored to specific states or projects can render the document invalid.

- Lack of Transparency: Not disclosing full information about the environmental sustainability measures in green building projects may lead to future legal complications.

Pros & Cons of Vendor’s Affidavits

- Pros:

- Facilitates smooth final payments and transactions.

- Ensures all parties are aware of their obligations and conditions met.

- Can be tailored with custom clauses for specific project needs.

- Cons:

- Requires meticulous attention to legal details.

- Potentially time-consuming if information is inadequate.

- Legal validity depends on correct execution and compliance.

FAQ

What is a green building clause in a vendor's affidavit? It refers to custom clauses in the affidavit that specify the environmental performance or sustainability practices adhered to in a construction project. Is an online vendors affidavit legally valid? Yes, as long as it meets state-specific legal requirements and is signed by all relevant parties, an online vendor's affidavit is just as legally valid as its paper counterpart.

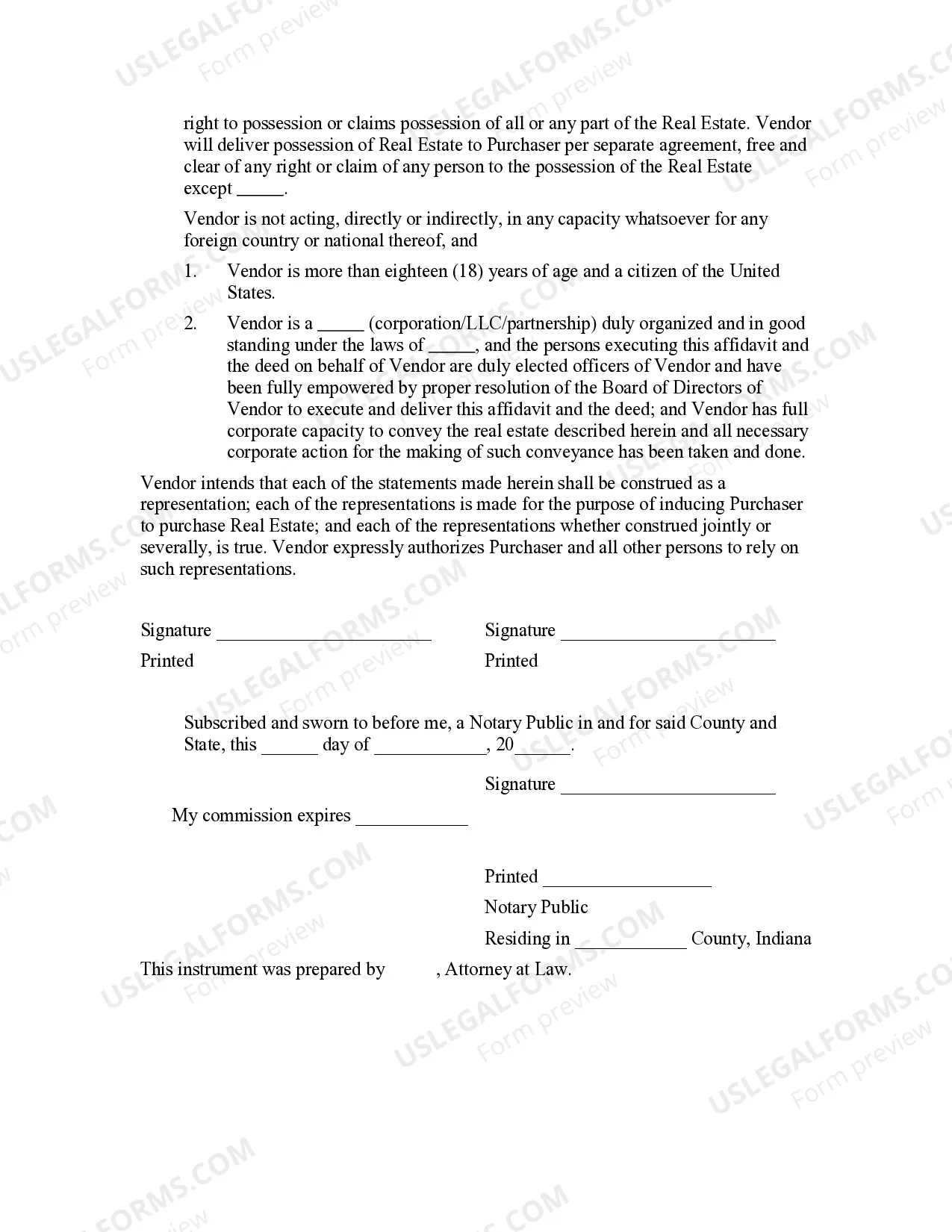

How to fill out Indiana Vendor's Affidavit?

Drafting legal documents can be quite a burden if you lack accessible fillable templates. With the US Legal Forms digital repository of official paperwork, you can trust the forms you acquire, as they all adhere to federal and state regulations and have been vetted by our specialists.

So, if you require the Indiana Vendor's Affidavit, our platform is the ideal destination to download it.

Here’s a quick guide for you.

- Obtaining your Indiana Vendor's Affidavit from our inventory is as simple as 1-2-3.

- Established users with a valid subscription simply need to Log In and click the Download button once they find the appropriate template.

- Subsequently, if necessary, users can access the same document from the My documents section of their account.

- Nonetheless, even if you are new to our service, registering with a valid subscription will only take a few moments.

Form popularity

FAQ

The Indiana state requires you to notarize the small estate affidavit. Unlike other states, where the form must be filed with the court, an Indiana small estate affidavit for bank accounts is a legal option.

In Indiana, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than $100,000. The affidavit cannot be filed earlier than forty-five (45) days after the date of death and must be signed in front of a notary public.

In Indiana, the small estate affidavit does not have to be filed with the court. A completed affidavit can be presented to the bank, organization or person holding estate assets to get them released. The small estate affidavit form can be downloaded from the Indiana website.

If there are no other conflicting statutes or requirements, the estate attorney may be able to use a devolution-type of affidavit to show the legal transfer of ownership from the person who died to that person's heirs as a matter of law without the need to use the probate system.

Step 1 ? Wait Forty-five (45) Days. A period of forty-five (45) has to pass before you can use a small estate affidavit in the State of Indiana. Step 2 ? Prepare Affidavit. Download Form 54985.Step 3 ? Notify Every Person Identified.Step 4 ? Get It Notarized.Step 5 ? Collect the Assets.

Signing and Notarizing The Indiana state requires you to notarize the small estate affidavit. Unlike other states, where the form must be filed with the court, an Indiana small estate affidavit for bank accounts is a legal option.