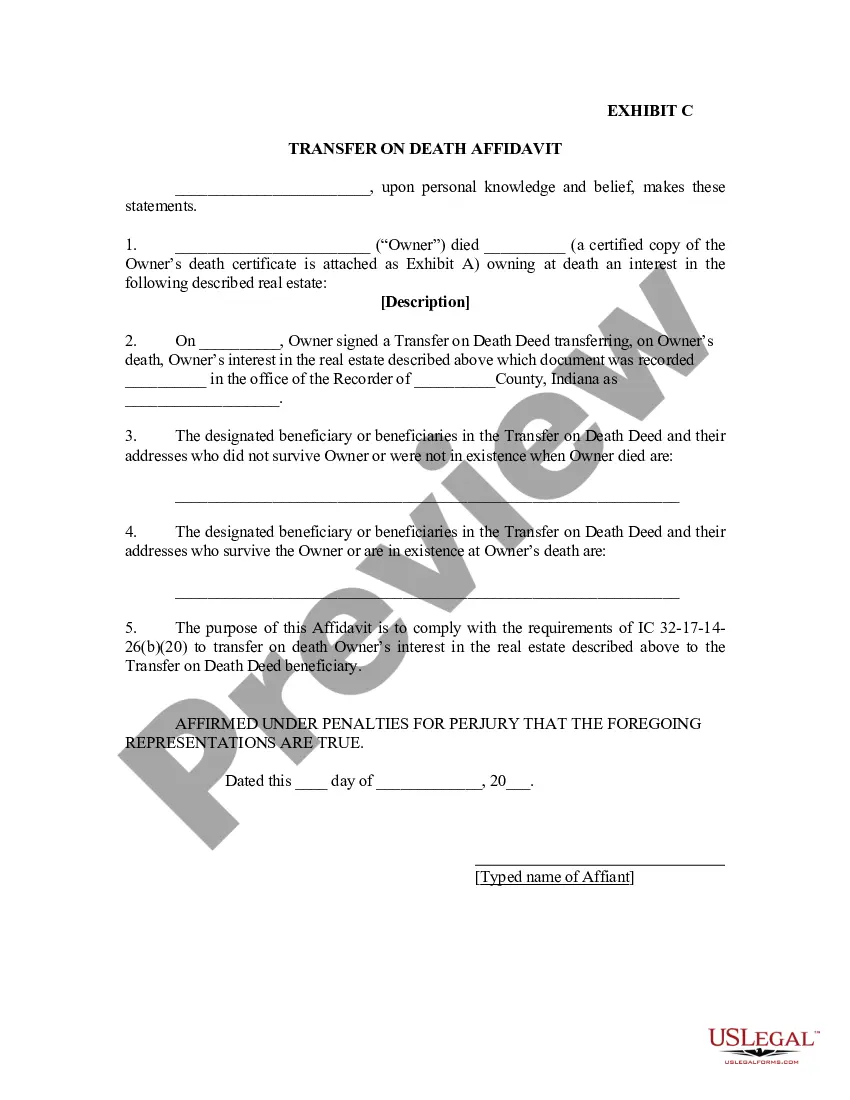

Indiana Transfer on Death Affidavit (ISDA) is a form of estate planning used in the state of Indiana, which allows individuals to transfer certain assets from one person to another upon their death. This form is also known as a “Transfer on Death” or ForsytheoISDAThe ITDA allows individuals to designate a beneficiary for their assets, such as real estate, bank accounts, stocks, bonds, and other securities, without having to go through the probate process. The ISDA also allows for the assets to be transferred without the need for a Last Will and Testament. There are two types of Indiana Transfer on Death Affidavit: an Individual Affidavit and a Joint Affidavit. The Individual Affidavit is used to designate a single beneficiary for the transfer of assets upon the death of the owner. The Joint Affidavit is used to designate two or more beneficiaries for the transfer of assets upon the death of the owner. Both forms must be properly completed, signed, and filed with the Indiana Secretary of State in order for the transfer to occur.

Indiana Transfer on Death Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Transfer On Death Affidavit?

Managing legal documents necessitates care, accuracy, and employing correctly-formulated templates.

US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Indiana Transfer on Death Affidavit template from our platform, you can trust it adheres to federal and state laws.

All documents are designed for multiple uses, similar to the Indiana Transfer on Death Affidavit displayed on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your account and fill out your document whenever necessary. Experience US Legal Forms and prepare your business and personal documentation quickly and in full legal compliance!

- Take the time to carefully review the content of the form and its alignment with general and legal standards by either previewing it or reading its description.

- Seek an alternative official template if the one you opened does not correspond to your circumstances or state requirements (the tab for this is located at the top corner of the page).

- Log in to your account and save the Indiana Transfer on Death Affidavit in your preferred format. If it’s your first time using our site, click Buy now to proceed.

- Establish an account, choose your subscription option, and pay with your credit card or PayPal account.

- Select the format in which you wish to obtain your form and click Download. Print the blank document or incorporate it into a professional PDF editor for a paperless completion.

Form popularity

FAQ

Yes, an Indiana Transfer on Death deed avoids probate. By designating a beneficiary through this deed, properties transfer directly to them upon your death, bypassing the lengthy probate process. This advantage significantly reduces the stress for your loved ones, providing a clear path for property ownership. Using the Indiana Transfer on Death Affidavit simplifies estate management.

Setting up an Indiana Transfer on Death Affidavit involves filling out the appropriate forms and signing them in the presence of a notary. You need to provide details about the property and the beneficiary. Once completed, you must file the affidavit with the county recorder's office. This process ensures that the property transfers smoothly to your desired beneficiary after your passing.

A TOD Beneficiary may be added to an Indiana Certificate of Title at the time of purchase (title transfer), or, if you already have title to the vehicle, you may apply for new title containing the TOD designation.

The Basics: Transfer on Death Deed Prior to the real property owner's death, the transfer on death deed must: (1) be executed by the owner of the real property, or their legal representative, and (2) be recorded in the county where the real property is located. Indiana Code Section 32-17-14-11.

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid. You can make an Indiana transfer on death deed with WillMaker.

An Indiana transfer on death deed is an estate planning tool that allows a property owner to designate who will receive their property in the event of their death. If properly executed, the deed will allow the beneficiary of the property to avoid a potentially long and arduous probate process.

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

Probate Avoidance ? A TOD deed allows the property to pass to the beneficiaries named in the deed without going through Indiana probate. Indiana law has a $50,000 limit on nonprobate transfers using the small estate procedure. The TOD deed can be used even if the value exceeds $50,000.

In Indiana, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).