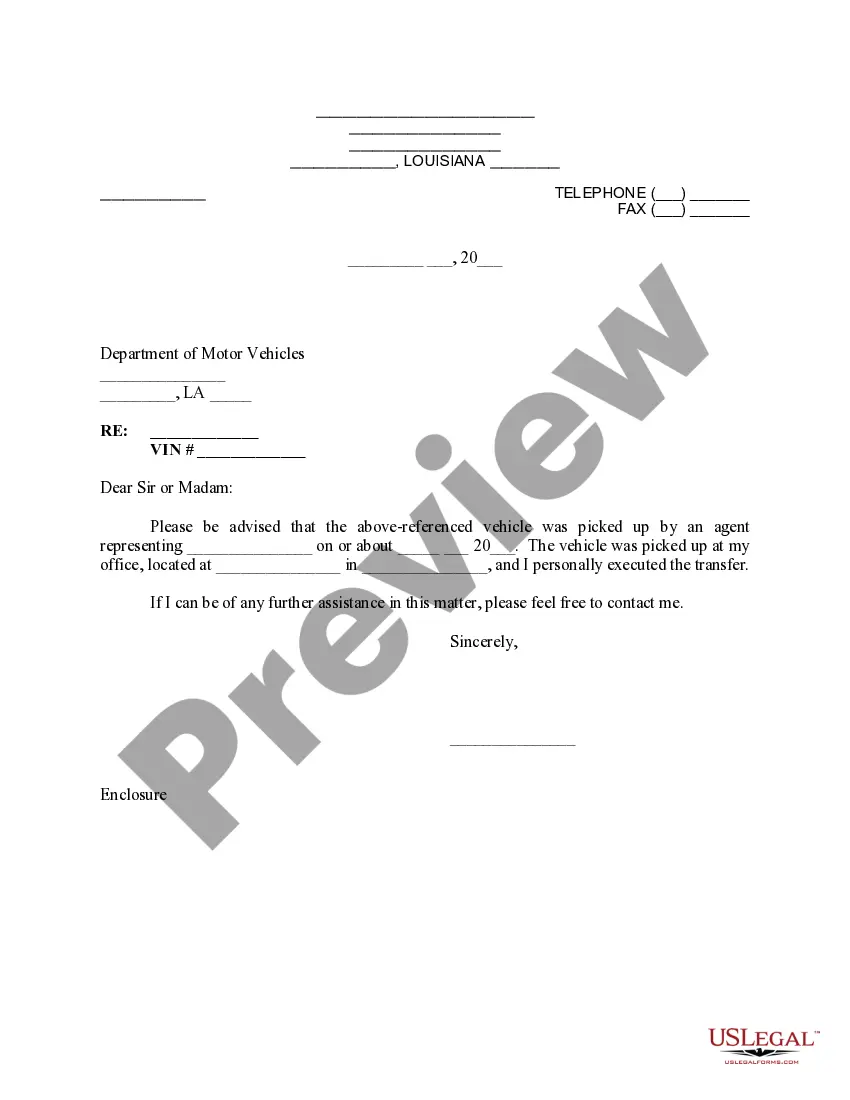

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Indiana Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

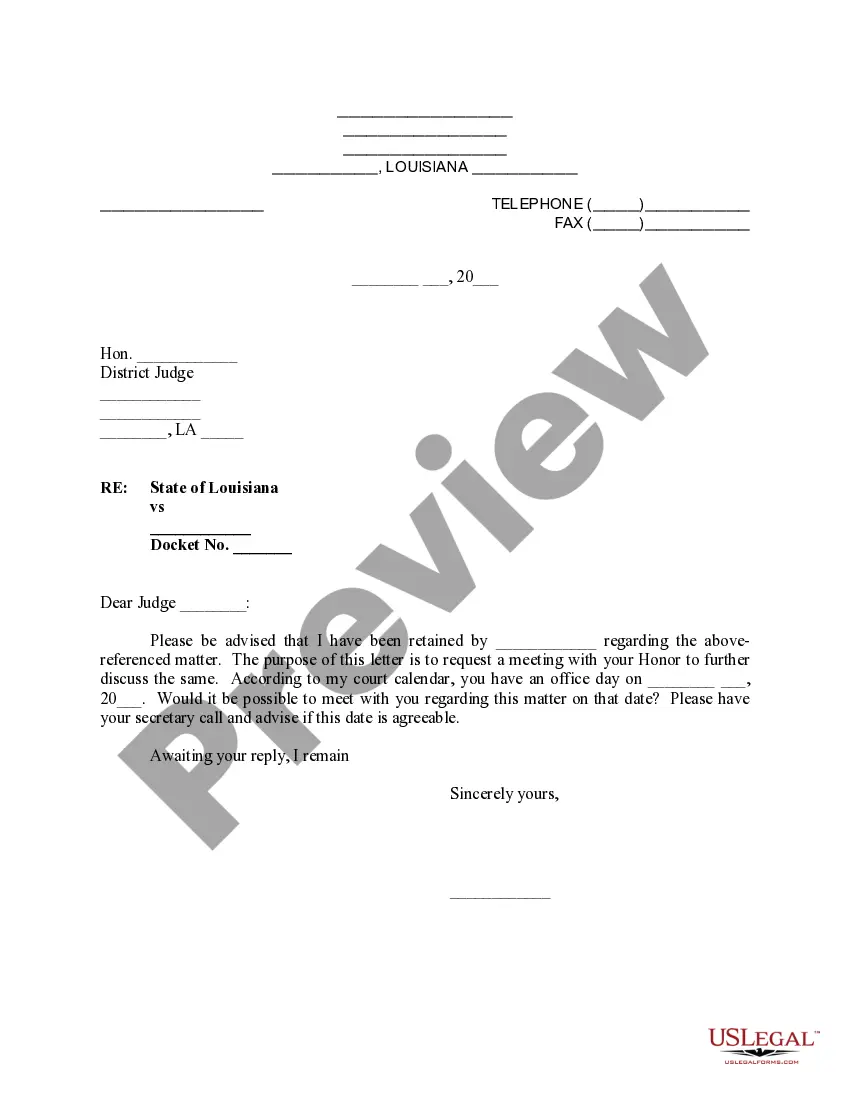

How to fill out Indiana Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

Searching for a Sample Transmittal Letter to file Articles of Incorporation with the Secretary of State's Office in Indiana can be quite difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state within just a few clicks.

Our attorneys create every document, so you only need to complete them. It's truly that straightforward.

You can print the Sample Transmittal Letter to Secretary of State's Office for Articles of Incorporation - Indiana form or fill it out using any online editor. Don't worry about making mistakes, as your form can be used, submitted, and printed as many times as you need. Explore US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's page to download the document.

- Your saved files are stored in My documents and are accessible anytime for future use.

- If you haven’t registered yet, you must sign up.

- Review our comprehensive instructions on how to quickly obtain your Sample Transmittal Letter to Secretary of State's Office for Articles of Incorporation in Indiana.

- To acquire a specific sample, check its applicability for your state.

- View the form using the Preview option (if it’s available).

- If there's an explanation, read it to understand the essential details.

- Press the Buy Now button if you've found what you're looking for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you prefer to pay via credit card or PayPal.

- Download the document in your desired file format.

Form popularity

FAQ

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

The articles of organization document typically includes the name of the LLC, the type of legal structure (e.g. limited liability company, professional limited liability company, series LLC), the registered agent, whether the LLC is managed by members or managers, the effective date, the duration (perpetual by default

You can form your Indiana LLC by filing Articles of Organization online or by mail. Form an Indiana LLC online: The state filing fee is $95 and the processing time is 24 hours.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

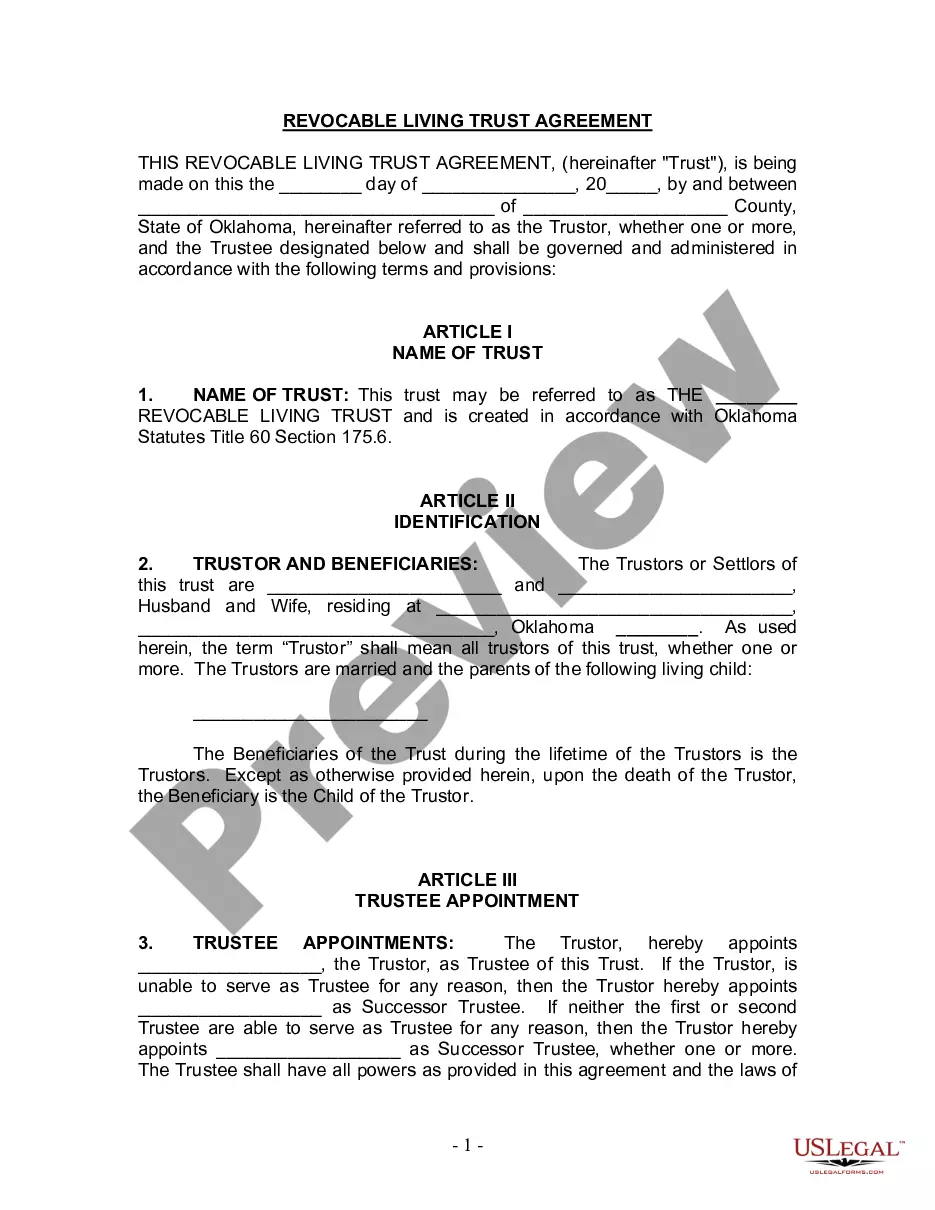

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

For now, all business and UCC filings must be submitted online at OhioBusinessCentral.gov. Records filings such as Apostille requests and Minister License applications and other documents that you are unable to submit online may be mailed to 22 N. Fourth Street, Columbus, Ohio 43215 or submitted in person.

The LLC Organizer is the individual or entity that files the Articles of Organization (referred to as a Certificate of Formation in some states) on behalf of a Limited Liability Company.A member is defined as an owner of the LLC, and an organizer merely facilitates the technical formation of the LLC.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.