The Indiana Notice of Chapter 11 Bankruptcy Case (For Individuals or Joint Debtors) is a legal document that is filed with the court in order to formally initiate a Chapter 11 bankruptcy case. It is issued by the debtor or debtors to provide notice to creditors of the bankruptcy filing and of the debtor(s)’s intentions to reorganize their financial affairs under the protection of the court. It includes the debtor(s)’s name, address, and social security number, the bankruptcy court in which the case was filed, the case number, and a statement that the debtor(s) has/have filed a Chapter 11 bankruptcy case. Furthermore, it also includes a list of creditors and their addresses, and a brief statement about the debtor(s)’s proposed plan of reorganization. The Notice of Chapter 11 Bankruptcy Case is typically sent to all creditors listed in the debtor(s)’s bankruptcy paperwork. There are two types of the Indiana Notice of Chapter 11 Bankruptcy Case (For Individuals or Joint Debtors): the voluntary petition and the involuntary petition. A voluntary petition is filed by the debtor(s) to initiate their own bankruptcy case, while an involuntary petition is filed by creditors against the debtor(s). Both types of petitions are filed with the court and provide the creditors with notice of the bankruptcy filing.

Indiana Notice of Chapter 11 Bankruptcy Case (For Individuals or Joint Debtors)

Description

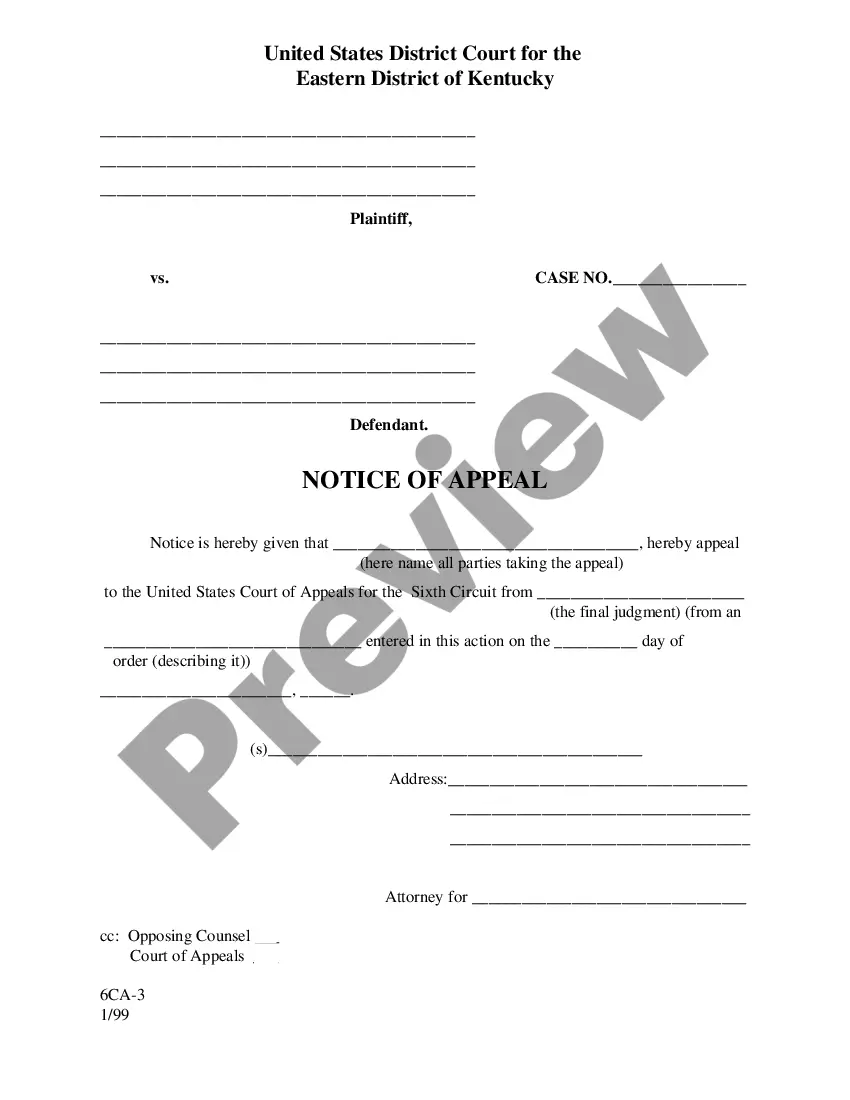

How to fill out Indiana Notice Of Chapter 11 Bankruptcy Case (For Individuals Or Joint Debtors)?

Drafting formal documents can be quite a hassle unless you have pre-made fillable templates available. With the US Legal Forms online repository of official forms, you can be assured of the accuracy of the templates you receive, as all of them adhere to federal and state laws and are verified by our specialists.

Therefore, if you wish to obtain the Indiana Notice of Chapter 11 Bankruptcy Case (For Individuals or Joint Debtors), our platform is the ideal resource to download it.

Document compliance review. You should carefully review the details of the template you wish to use and ensure it meets your requirements and conforms to your state’s legal standards. Previewing your document and checking its overall description will assist you in that.

- Acquiring your Indiana Notice of Chapter 11 Bankruptcy Case (For Individuals or Joint Debtors) from our collection is as simple as 1-2-3.

- Registered users with an active subscription just need to Log In and click the Download button after locating the correct template.

- Subsequently, if needed, they can also retrieve the same document from the My documents section of their account.

- Even if you are not acquainted with our service, signing up with a valid subscription will only take a few moments. Here’s a brief guide for you.

Form popularity

FAQ

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

In a Chapter 11 proceeding, for an individual debtor, the court may order discharge at any time after the plan is confirmed.

Nearly everyone can file for Chapter 11 bankruptcy, including individuals, businesses, partnerships, joint ventures, and limited liability companies (LLCs). There is no specified debt-level limit and no required income.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

Business owners and individuals struggling under the weight of debt may find new life under Chapter 11 bankruptcy. Commonly called reorganization bankruptcy, Chapter 11 allows businesses to continue operating while the business owner and creditors reorganize the debts so the business can be profitable once again.

The primary purpose of a Chapter 11 bankruptcy is to give business entities and individuals with large amounts of debt an opportunity to reorganize their financial affairs. The debtor in Chapter 11 ordinarily files a plan of reorganization to be voted on by its various classes of creditors.

Chapter 11 bankruptcy is usually for corporations because of its complexity, but individuals can file too. The debtor usually keeps their assets and continues to operate the business while working on a plan to pay off the creditors.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.