Kentucky Amendment to Living Trust

About this form

The Amendment to Living Trust is a legal document that enables a Trustor to modify the terms or provisions of an existing living trust. Living trusts are crucial instruments in estate planning, as they manage assets placed within the trust during the Trustor's lifetime. This amendment allows for adjustments without altering the purpose of the trust, ensuring all other provisions remain effective and intact. Unlike a new trust creation, this amendment simplifies the process of updating trust specifics while maintaining its overall structure.

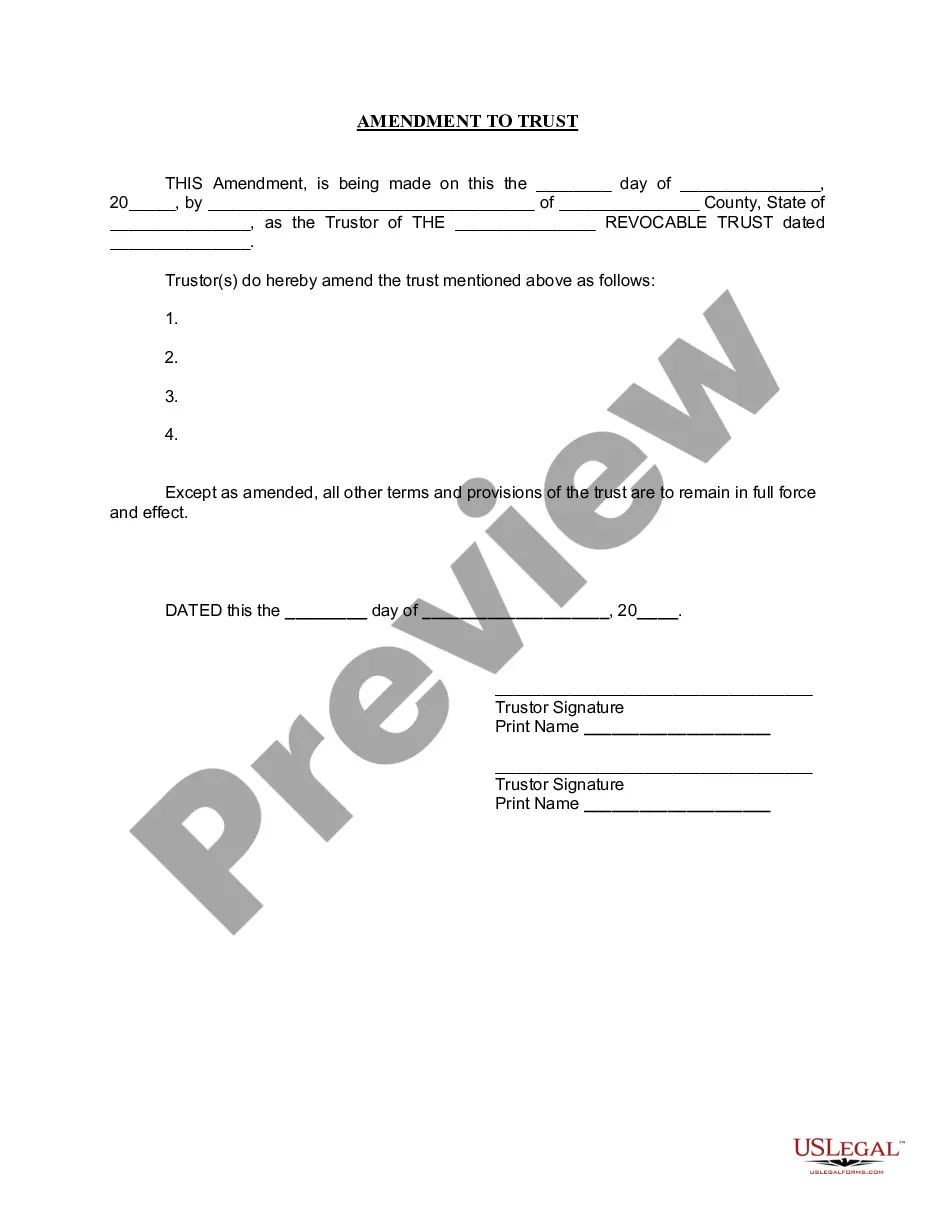

Key components of this form

- Date of the amendment.

- Name and County of the Trustor.

- Reference to the original revocable trust, including its date.

- Specific changes or amendments to the trust provisions.

- Trustor's signature and printed name.

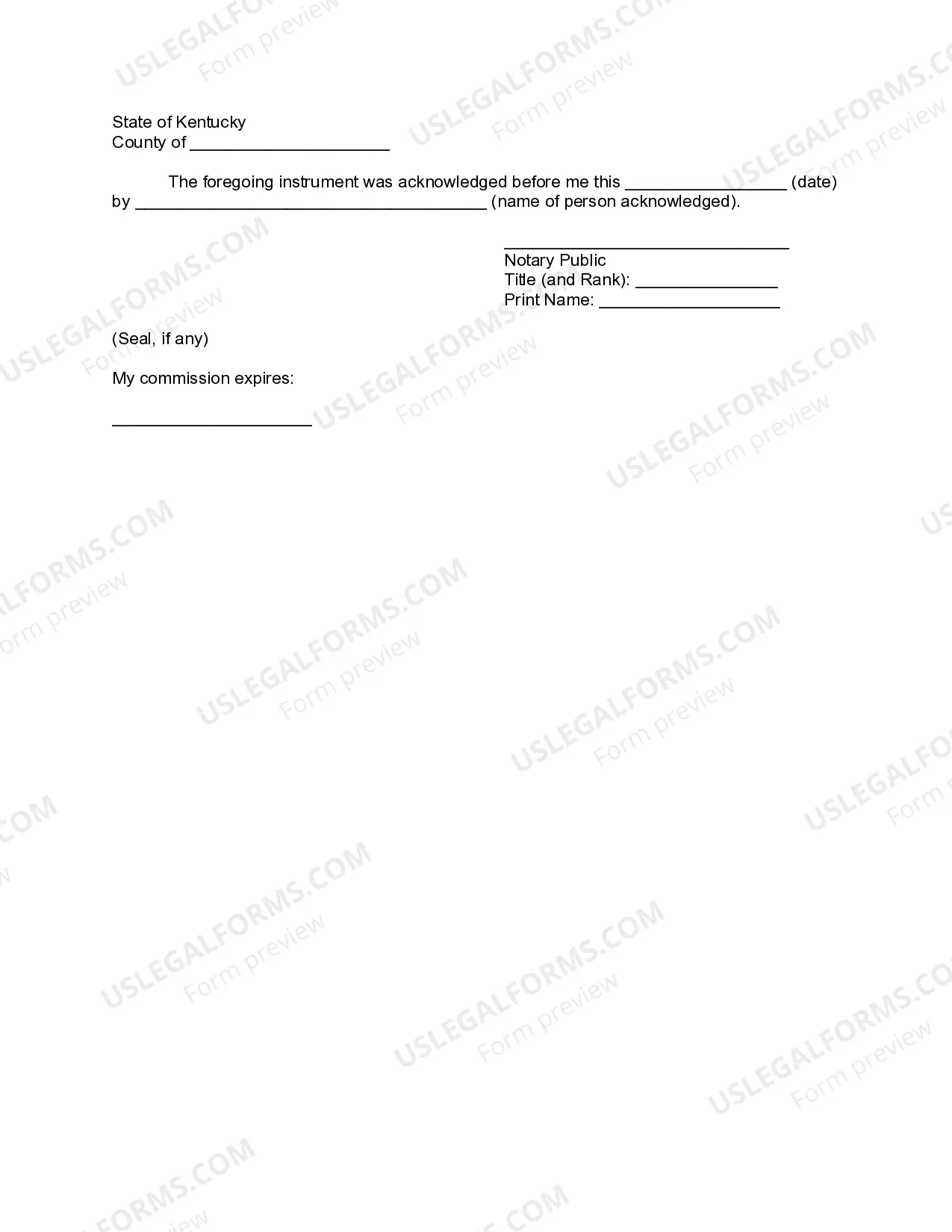

- Notary acknowledgment section.

Common use cases

This form is useful in various situations, such as when the Trustor wishes to add or remove beneficiaries, modify asset distribution, change management duties, or update terms concerning the trust structure. If circumstances surrounding the Trustor's estate have changed or if they simply wish to clarify provisions, this amendment is appropriate.

Who should use this form

This form is intended for:

- Individuals who are the Trustor of an existing living trust.

- Estate planners looking to make modifications to trust documents.

- Attorneys assisting clients with trust management.

Steps to complete this form

- Provide the date of the amendment.

- Fill in the name of the Trustor and their county and state location.

- Reference the original revocable trust and include its date for identification.

- Clearly specify the amendments being made to the trust.

- Obtain signatures from all Trustors and print their names accordingly.

- Complete the notary acknowledgment section with the notary's details.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Typical mistakes to avoid

- Failing to specify all amendments clearly.

- Not obtaining notarization, if necessary.

- Omitting signatures from all Trustors involved.

- Not referencing the original trust correctly.

Benefits of completing this form online

- Immediate access to professionally drafted legal forms tailored to your needs.

- Convenient download or print options from any location.

- Editable fields allow for easy customization before printing.

- Reliable legal templates vetted by licensed attorneys.

Summary of main points

- The Amendment to Living Trust is a crucial document for updating trust provisions.

- This form is vital for maintaining accurate estate planning as circumstances change.

- Proper completion requires clear identification of changes and notarization.

Form popularity

FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.