Kentucky Assignment to Living Trust

Overview of this form

The Assignment to Living Trust form is a legal document used to transfer ownership of property to a living trust. A living trust is created during a person's lifetime and is designed to hold assets, ensuring a smooth transition of property upon death. This form serves a critical role in estate planning by legally assigning the assignorâs rights and interests in specific property to the trust, thereby aiding in the management and distribution of assets as per the trust's terms.

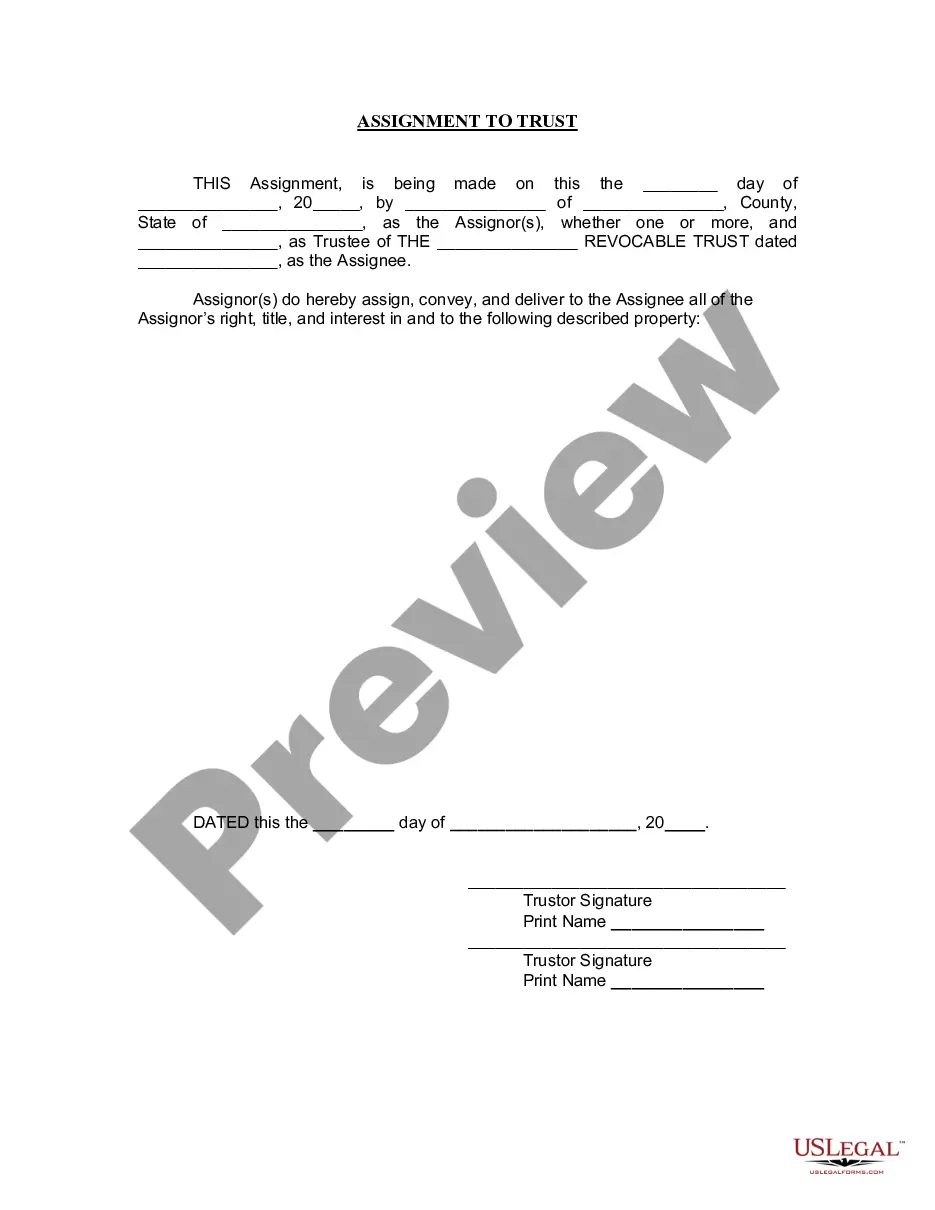

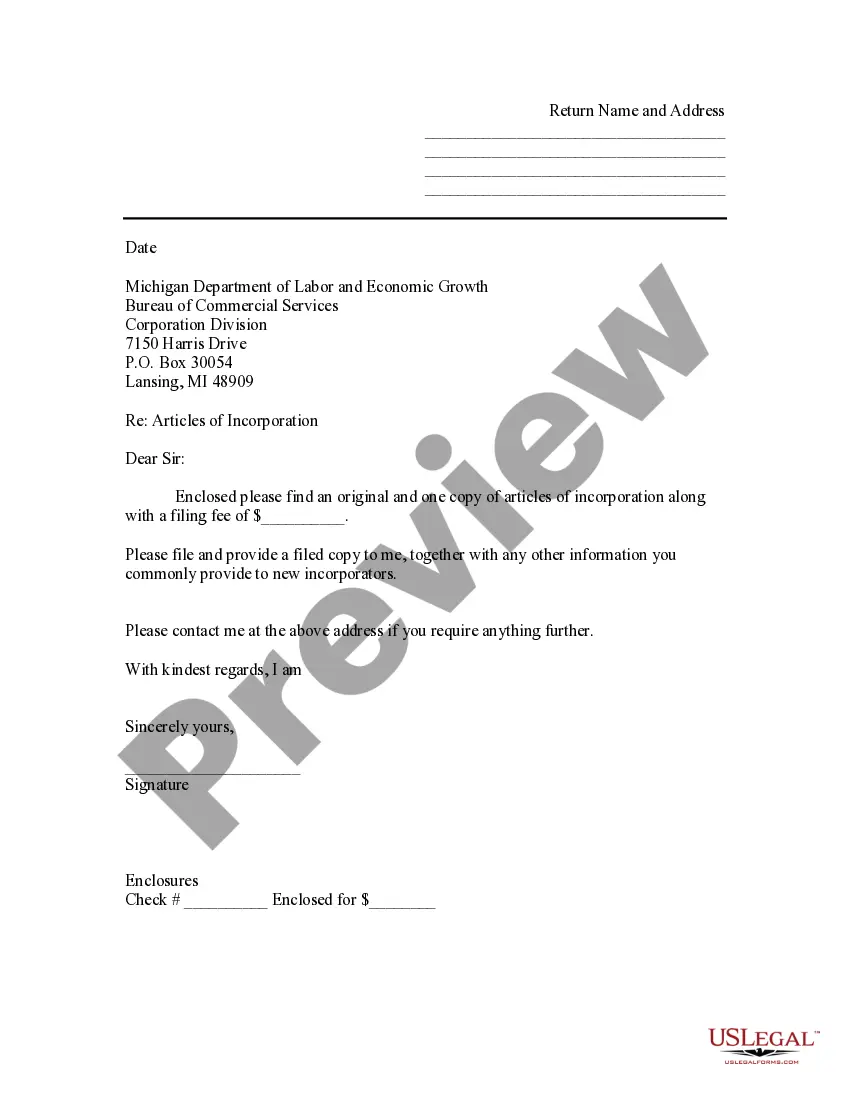

What’s included in this form

- Date of assignment

- Name and address of the assignor

- Name of the trustee and trust information

- Description of the specific property being assigned

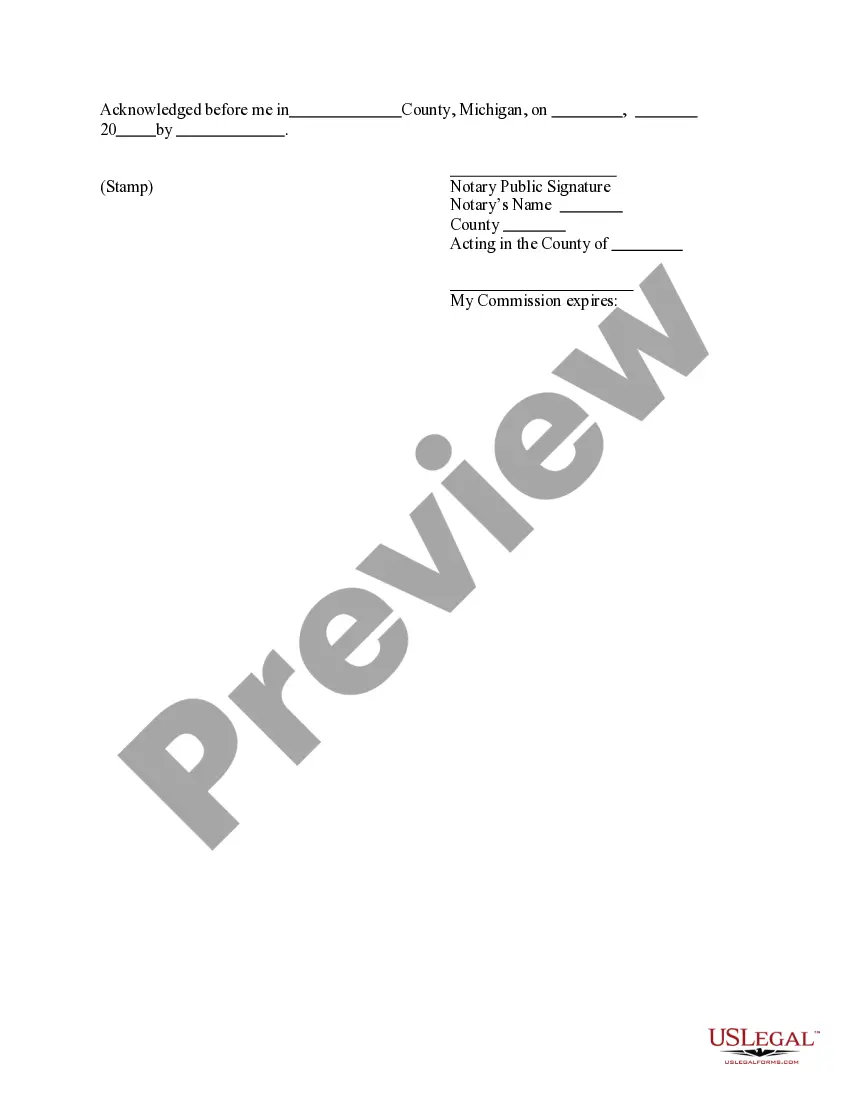

- Notary acknowledgment section

Common use cases

This form should be used when an individual, known as the assignor, wishes to assign property to a living trust to manage their assets effectively. It is commonly used during estate planning to facilitate a smooth transfer of property and to avoid probate. Use this form when you have set up a living trust and want to ensure that specific property is included within that trust.

Who needs this form

- Individuals establishing a living trust

- Estate planners managing asset transfers

- Property owners looking to simplify the transfer process upon death

- Trustees acting on behalf of the trust

Instructions for completing this form

- Identify the date of the assignment.

- Fill in the names and addresses of the assignor(s) and the trustee.

- Detail the specific property that is being assigned to the trust.

- Ensure all parties sign the form in the presence of a notary public.

- Complete the notary acknowledgment section as required.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to properly identify the property assigned.

- Not having the form notarized, if required.

- Omitting signatures from any necessary parties.

- Incorrectly filling out the trustee's information.

Benefits of completing this form online

- Immediate access to a professionally drafted document.

- Easy customization to fit your specific needs.

- Time-saving â no need to visit a lawyerâs office for form creation.

- Download and store securely for future use.

Looking for another form?

Form popularity

FAQ

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Registration of a living trust doesn't give the court any power over the administration of the trust, unless there's a dispute.To register a revocable living trust, the trustee must file a statement with the court where the trustee resides or keeps trust records.

Identify what should go into the trust. Choose the type of living trust. Next, name your trustee, the person will manage the trust. Now create a trust agreement. Then sign the trust document in front of a notary public. Finally, transfer your property into the trust by putting deeds and titles in the name of the trust.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

When to See a Lawyer While many people can make a living trust without the help of an attorney, there are some situations require individualized legal advice. For example, don't try to make your own living trust if: You don't have anyone to name as trustee.See a lawyer for advice.

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.