Indiana Reaffirmation Documents are legal documents that are used to reaffirm a debt that has been discharged in bankruptcy. This type of document is used by debtors in the state of Indiana who have had their debts discharged in bankruptcy and are now looking to pay back a portion of the original debts. There are two types of Indiana Reaffirmation Documents: a Reaffirmation Agreement and a Motion to Reaffirm Debt. The Reaffirmation Agreement is a written contract between the debtor and the creditor that outlines the terms of the repayment plan. The Motion to Reaffirm Debt is a court filing that states the debtor's intent to pay back the debt in question. By signing a Reaffirmation Agreement or filing a Motion to Reaffirm Debt, the debtor agrees to pay back the debt in full and resumes all the original obligations associated with the debt.

Indiana Reaffirmation Documents

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Reaffirmation Documents?

Filling out official documents can be a significant strain if you lack convenient pre-made templates. With the US Legal Forms digital collection of formal paper, you can rest assured about the forms you access, as they all adhere to federal and state regulations and have been validated by our specialists.

Acquiring your Indiana Reaffirmation Documents from our repository is as simple as 1-2-3. Previously registered members with an active subscription just need to Log In and click the Download button upon finding the appropriate template. Later on, if needed, members can utilize the same form from the My documents section of their account. Nevertheless, even if you are new to our service, signing up with a valid subscription will only require a few minutes. Here’s a quick guide for you.

Haven’t given US Legal Forms a try yet? Register for our service now to access any formal document swiftly and effortlessly whenever you require, and keep your paperwork organized!

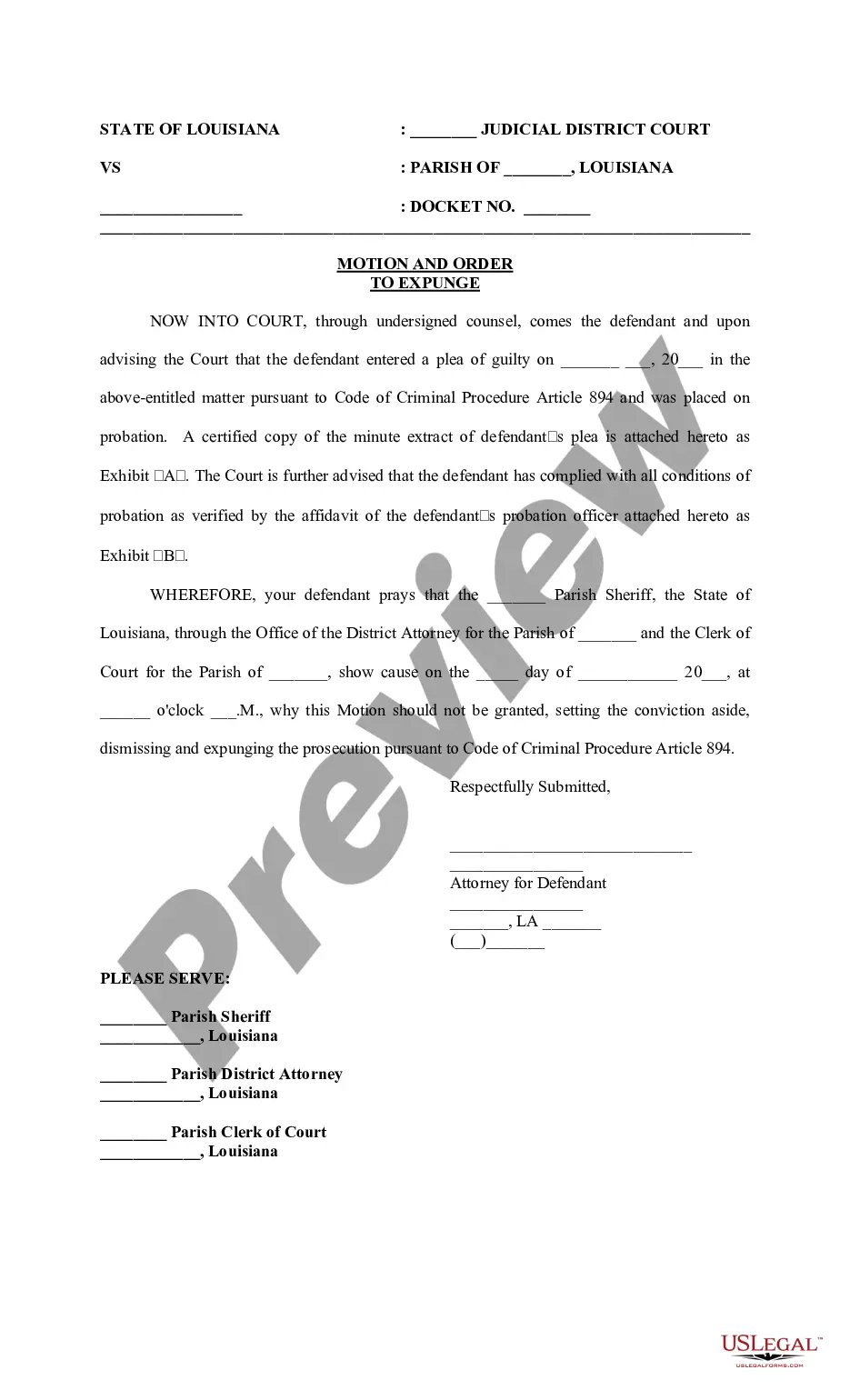

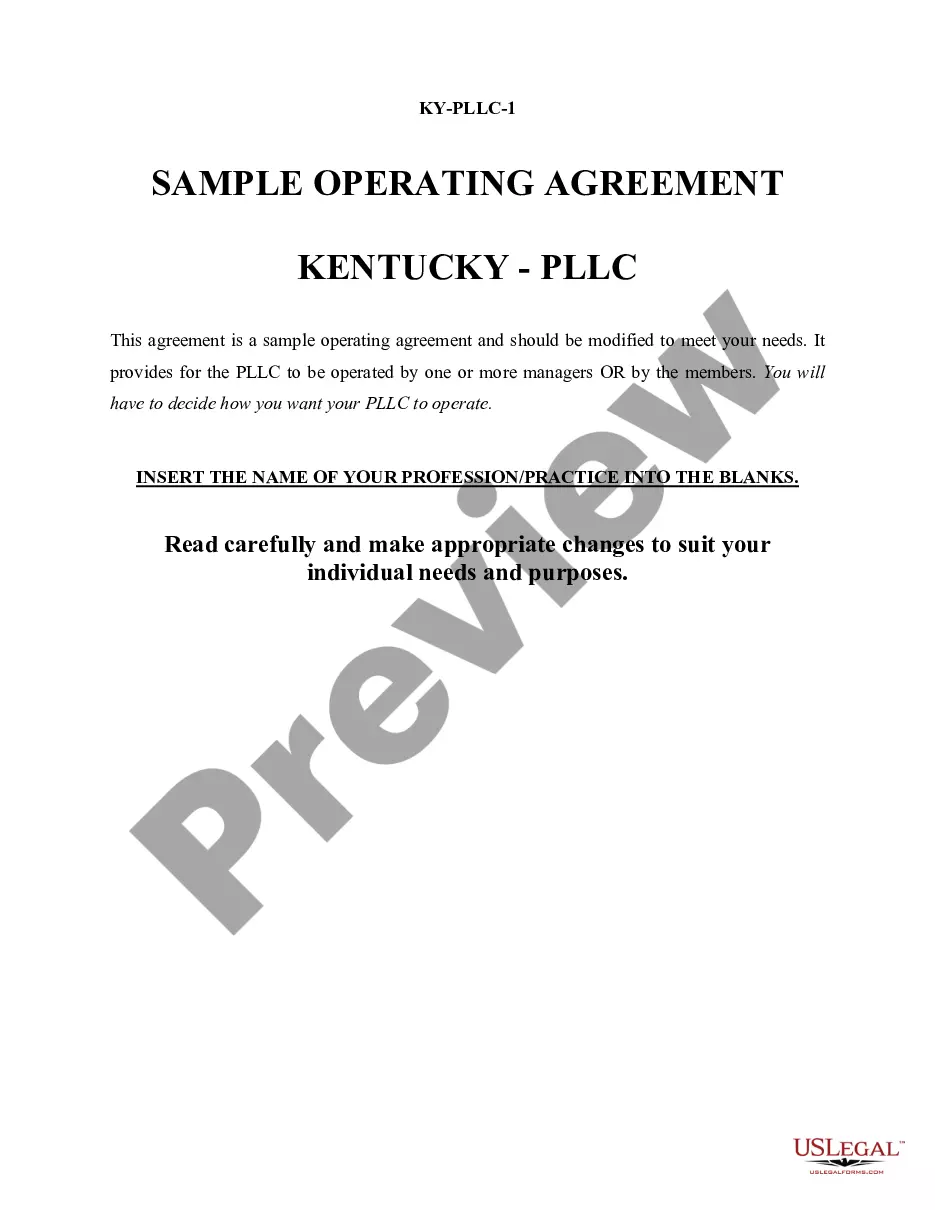

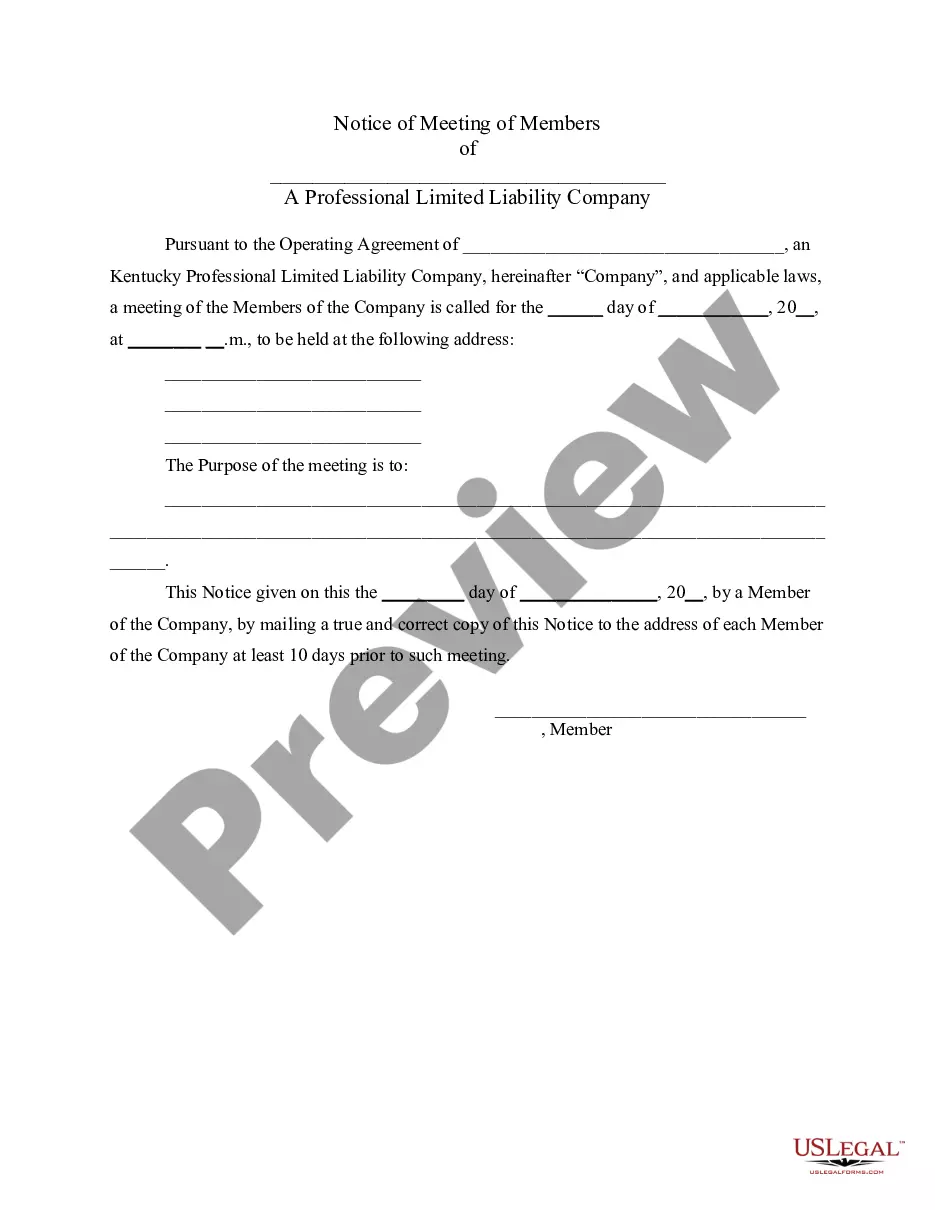

- Document adherence verification. You should thoroughly check the content of the form you wish to ensure that it meets your requirements and complies with your state laws. Previewing your document and evaluating its overall description will aid you in doing just that.

- Alternative search (optional). If you notice any discrepancies, explore the library using the Search tab above until you discover an appropriate form, and click Buy Now when you find what you seek.

- Account creation and form acquisition. Register for an account with US Legal Forms. After account validation, Log In and choose your desired subscription plan. Complete your payment to move forward (PayPal and credit card options are available).

- Template retrieval and further utilization. Choose the file type for your Indiana Reaffirmation Documents and click Download to save it to your device. Print it to finalize your forms physically, or make use of a versatile online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

To collect on a judgment in Indiana, you must first ensure that the judgment is properly recorded and then pursue methods such as wage garnishment or bank levies. You may also consider filing a lien against the debtor's property. Using Indiana Reaffirmation Documents can assist you in understanding the legal avenues available for effective collection.

To set aside a default judgment in Indiana, you typically need to demonstrate a valid reason for its issuance, such as not receiving proper notice. Additionally, presenting a meritorious defense can strengthen your case. Understanding the legal framework around Indiana Reaffirmation Documents can aid you in effectively challenging a default judgment.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

If you want to request a reaffirmation agreement, you must agree after filing for bankruptcy but before any collateral is discharged to the lender. An agreement is filed by submitting a Statement of Intent to the court. Then, you must also send the Statement of Intent to the lender.

For example, if a replacement used car costs $5,000 at a 5% interest rate and the reaffirmation agreement would require the debtor to pay $6,000 at a 5% interest rate or $5,000 at a 6% interest rate, then the debtor should not enter into the reaffirmation agreement.

Reaffirming a mortgage debt requires a comprehensive multi-page reaffirmation agreement that must be filed with the court. The reaffirmation agreement also requires the debtor's bankruptcy attorney to indicate that he or she has read the agreement and that it does not impose any undue hardship on the client.

A reaffirmation agreement is a legally-binding document that establishes the legal obligations of a borrower to repay some or all of it during bankruptcy.

A reaffirmation agreement is an agreement by which a bankruptcy debtor becomes legally obligated to pay all or a portion of an otherwise dischargeable debt.

To ensure that creditors do not defraud their debtors, reaffirmation agreements must be: In writing; Filed with the court; and. Certified by the debtor's attorney.