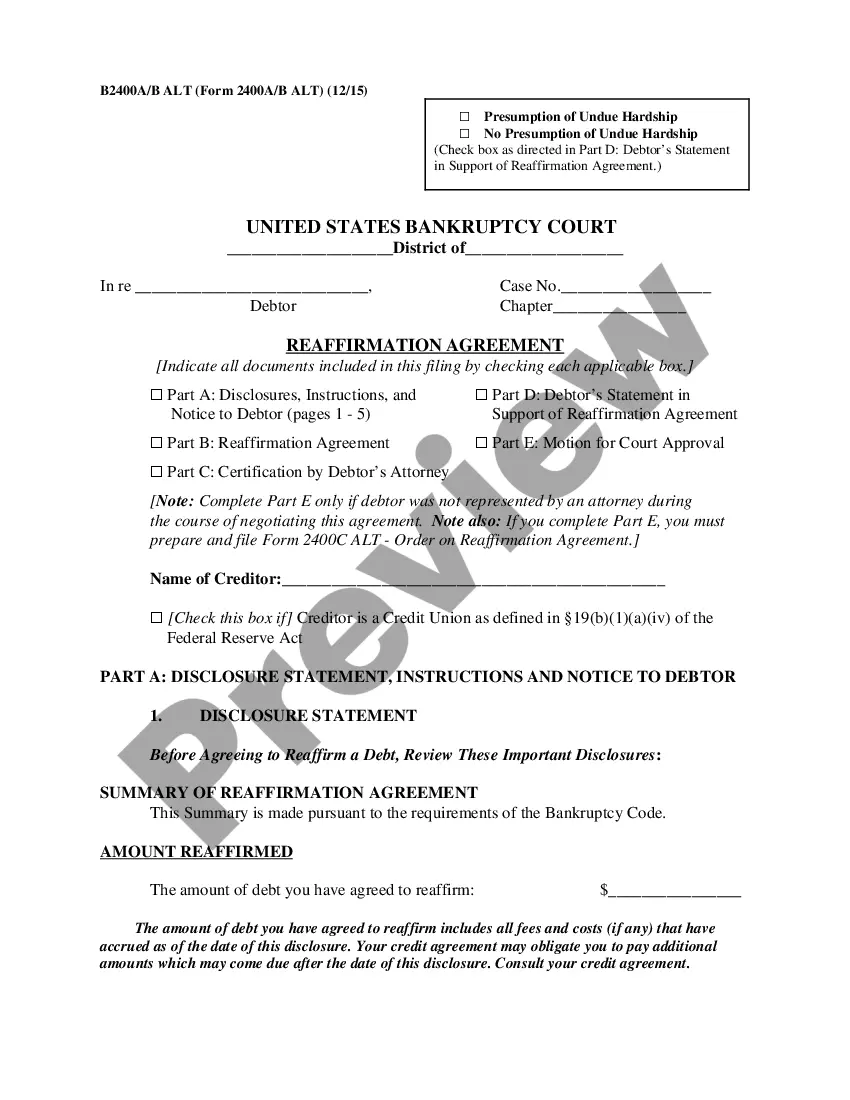

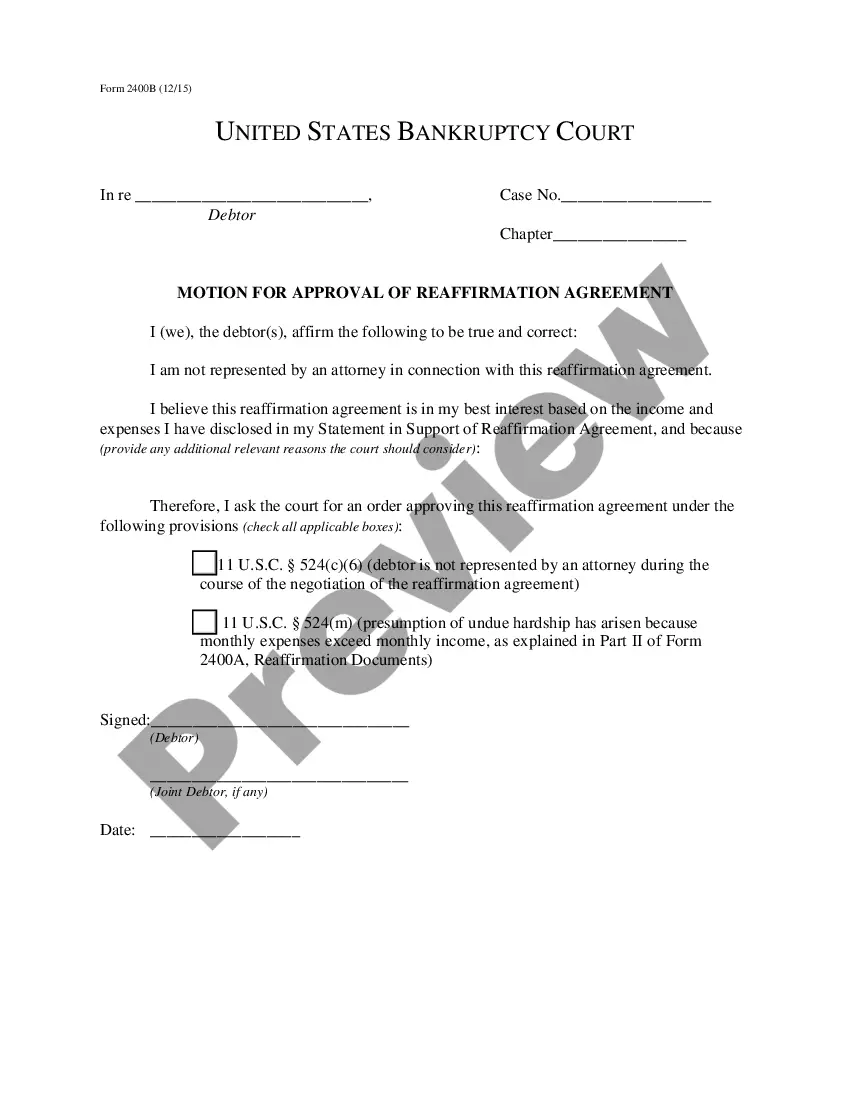

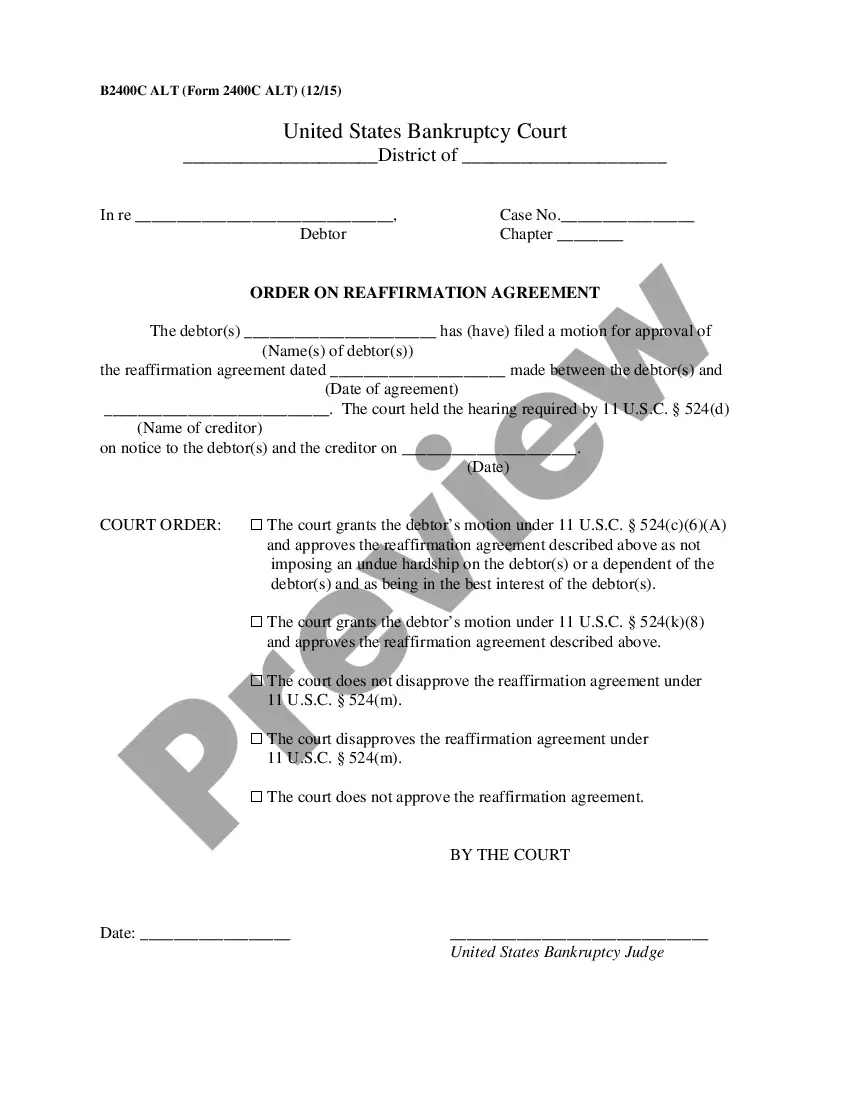

An Indiana Reaffirmation Agreement is a legal document used in the state of Indiana when a borrower wishes to reaffirm a debt or obligation that would have otherwise been discharged in a bankruptcy proceeding. In general, a Reaffirmation Agreement is a written agreement between a debtor and a creditor, in which the debtor agrees to continue to be liable for a specific debt that would otherwise have been discharged. This agreement allows the debtor to keep the property associated with the debt and remain liable for any payments due on the debt. There are two types of Indiana Reaffirmation Agreements: voluntary and court-ordered. A voluntary agreement is one in which both the debtor and creditor agree to the terms, and is typically the most common type of Reaffirmation Agreement. A court-ordered agreement, however, is one in which the court orders the debtor to enter into a Reaffirmation Agreement with a creditor. Both types of Reaffirmation Agreements must be approved by the court and require the debtor to demonstrate that the agreement is in their best interests.

Indiana Reaffirmation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Reaffirmation Agreement?

How much duration and resources do you generally allocate for creating formal documents.

There’s a better option to obtain such documents than employing legal professionals or wasting hours searching online for an appropriate template. US Legal Forms is the premier online repository that offers expertly drafted and validated state-specific legal papers for any purpose, like the Indiana Reaffirmation Agreement.

Another benefit of our service is that you can access previously acquired documents that you safely store in your profile in the My documents tab. Retrieve them at any time and re-complete your paperwork as often as necessary.

Save time and energy preparing official documents with US Legal Forms, one of the most reliable online solutions. Join us today!

- Review the form content to ensure it aligns with your state stipulations. To do this, inspect the form description or utilize the Preview option.

- If your legal template doesn’t fulfill your requirements, find an alternative using the search bar at the top of the page.

- If you are already registered with our service, sign in and download the Indiana Reaffirmation Agreement. If not, continue to the next steps.

- Click Buy now once you identify the correct blank. Choose the subscription plan that best fits your needs to access our library’s full features.

- Register for an account and pay for your subscription. You can complete the transaction with your credit card or through PayPal - our service is entirely secure for that.

- Download your Indiana Reaffirmation Agreement onto your device and finalize it on a printed hard copy or electronically.

Form popularity

FAQ

If the reaffirmation agreement is not filed with the bankruptcy court prior to the discharge date, it may be ineffective and the bankruptcy court can deny approval of the reaffirmation agreement altogether. It is totally voluntary that a debtor and creditor sign a reaffirmation agreement.

By the Court not approving the Reaffirmation Agreement, you will still receive a Discharge to the underlying debt! You merely continue to make the regular payments and the creditor is unable to repossess the collateral as there is no basis for repossession? just like if the Reaffirmation Agreement was approved.

If the reaffirmation agreement is not filed with the bankruptcy court prior to the discharge date, it may be ineffective and the bankruptcy court can deny approval of the reaffirmation agreement altogether.

Reaffirmation agreements are voluntary, so you're not required to sign one. It's unnecessary to have one if you want to voluntarily repay a debt instead of including it in your bankruptcy.

Creditors frequently do not automatically generate reaffirmation agreements. Sometimes creditors may not even file a reaffirmation agreement even after you have signed and returned the agreement to them.

If you choose not to reaffirm, your lender will not report any of your home payments to the credit agencies. This is because your account no longer legally exists because you did not reaffirm, and there is, essentially, nothing to report. This can make it challenging to repair your credit post-bankruptcy.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.