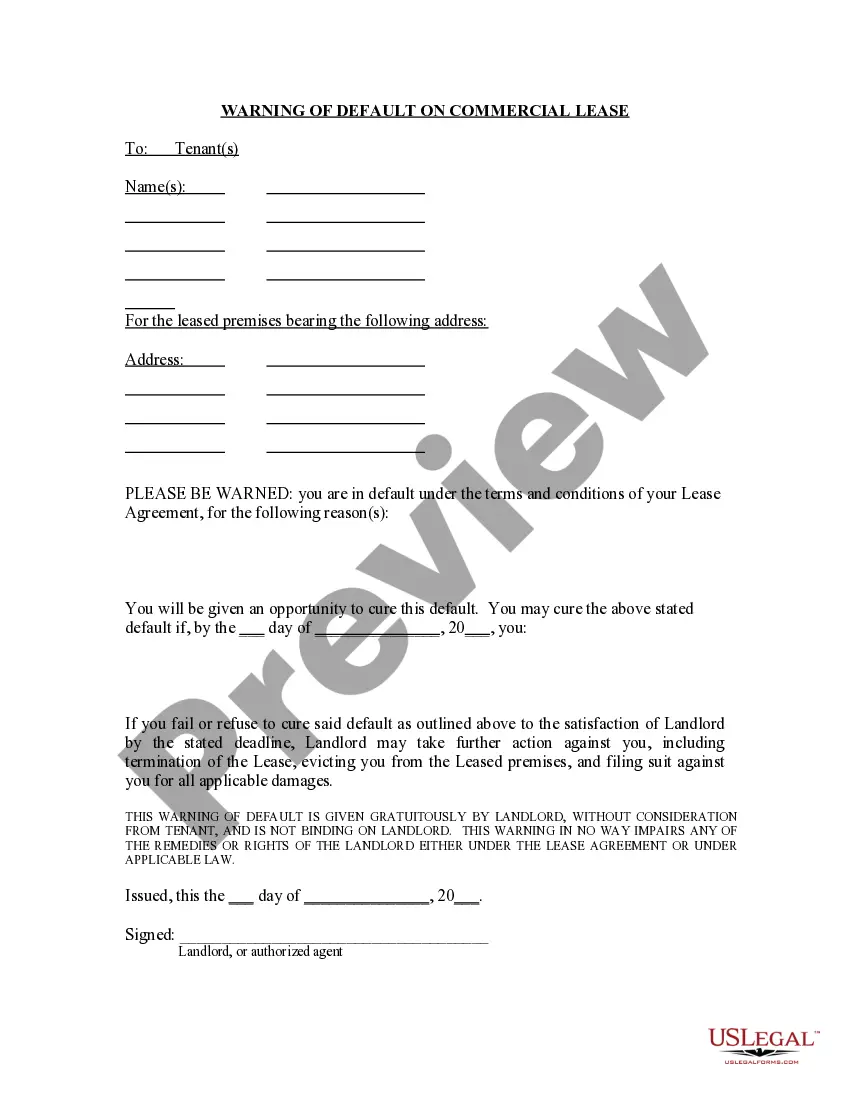

In landlord-tenant law, default usually refers to the failure of a tenant to timely pay rent due. In anticipation of such an occurence, landlords commonly require a new tenant to pay a security deposit, which may be used to remedy defaults in payment of rent and other monetary obligations under the rental agreement. In general, the landlord is required to give the tenant notice of the default before bringing eviction proceedings or applying security deposit proceeds to the payment in default. The fixing of a definite default date for payment of rent can be critical if it becomes necessary to evict a tenant for a default in the payment of rent. Landlords often require a background and/or reference check on prospective tenants in an attempt to minimize defaults in rent payments.

Indiana Warning of Default on Commercial Lease

Description

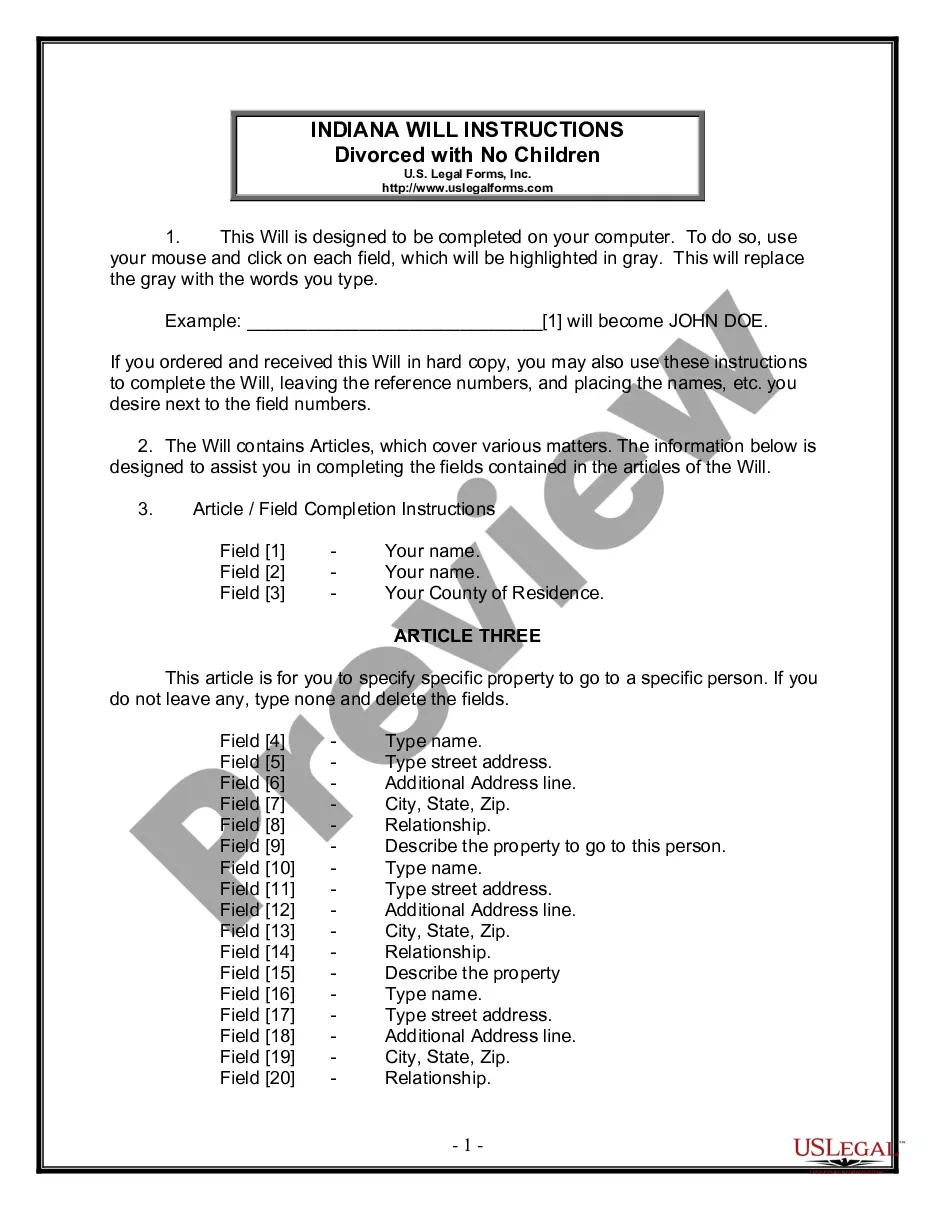

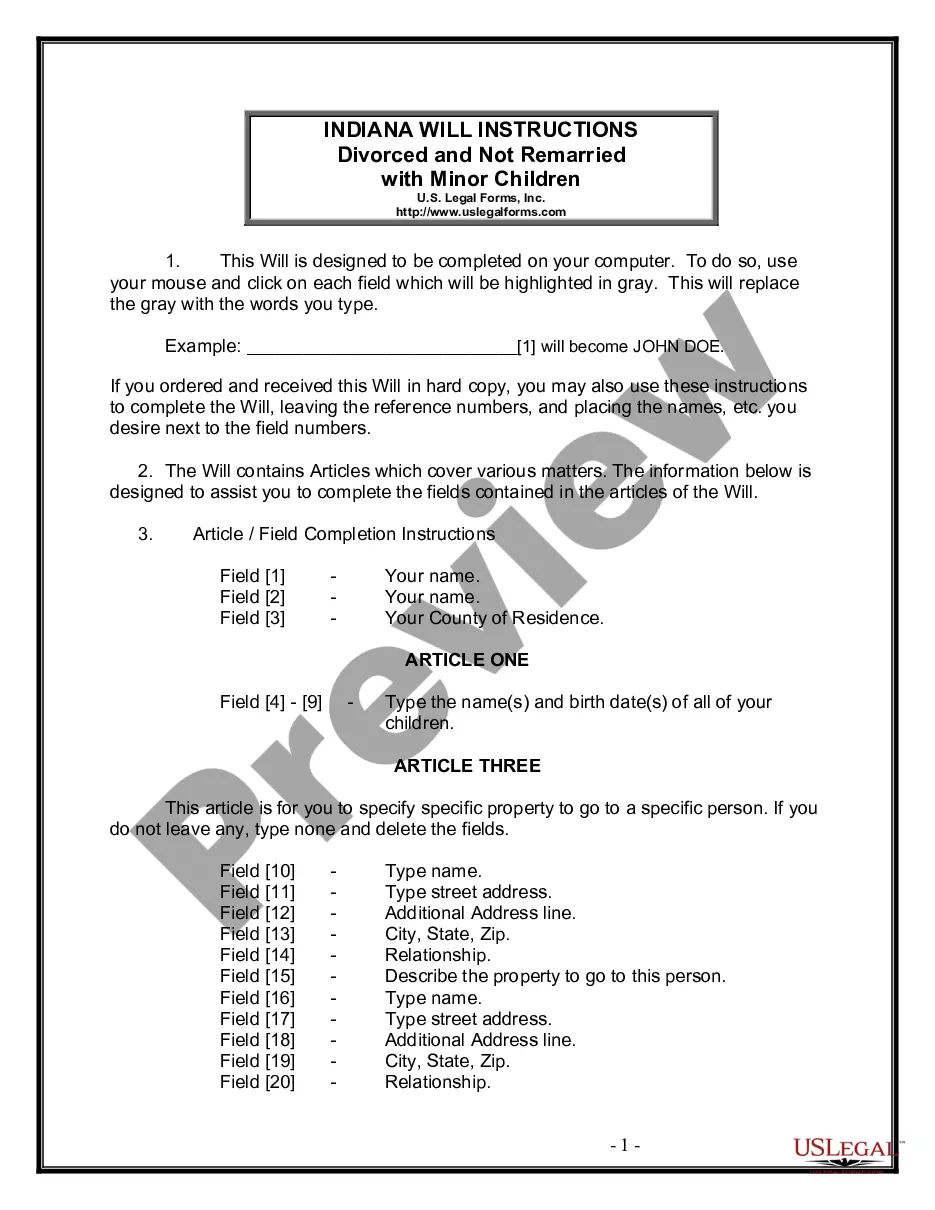

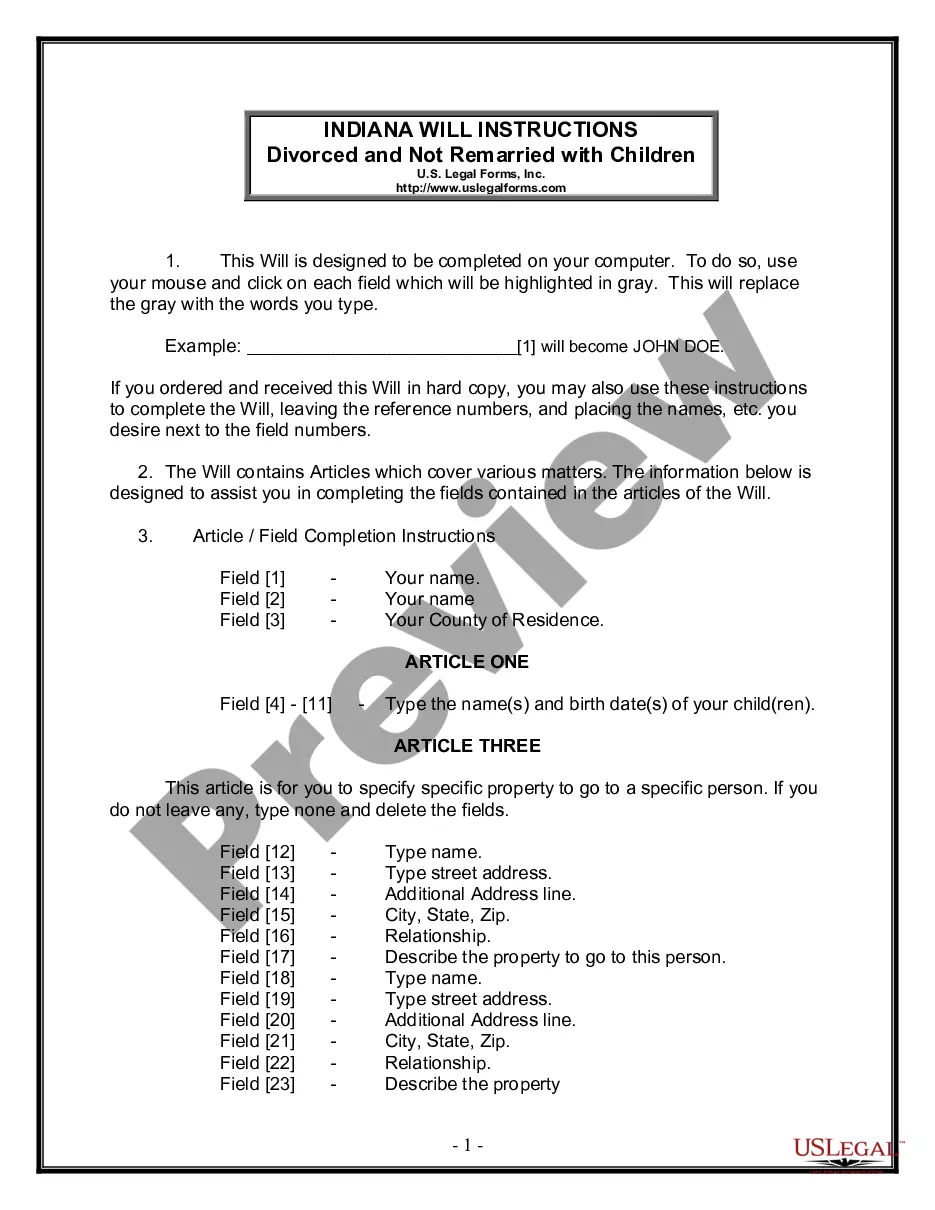

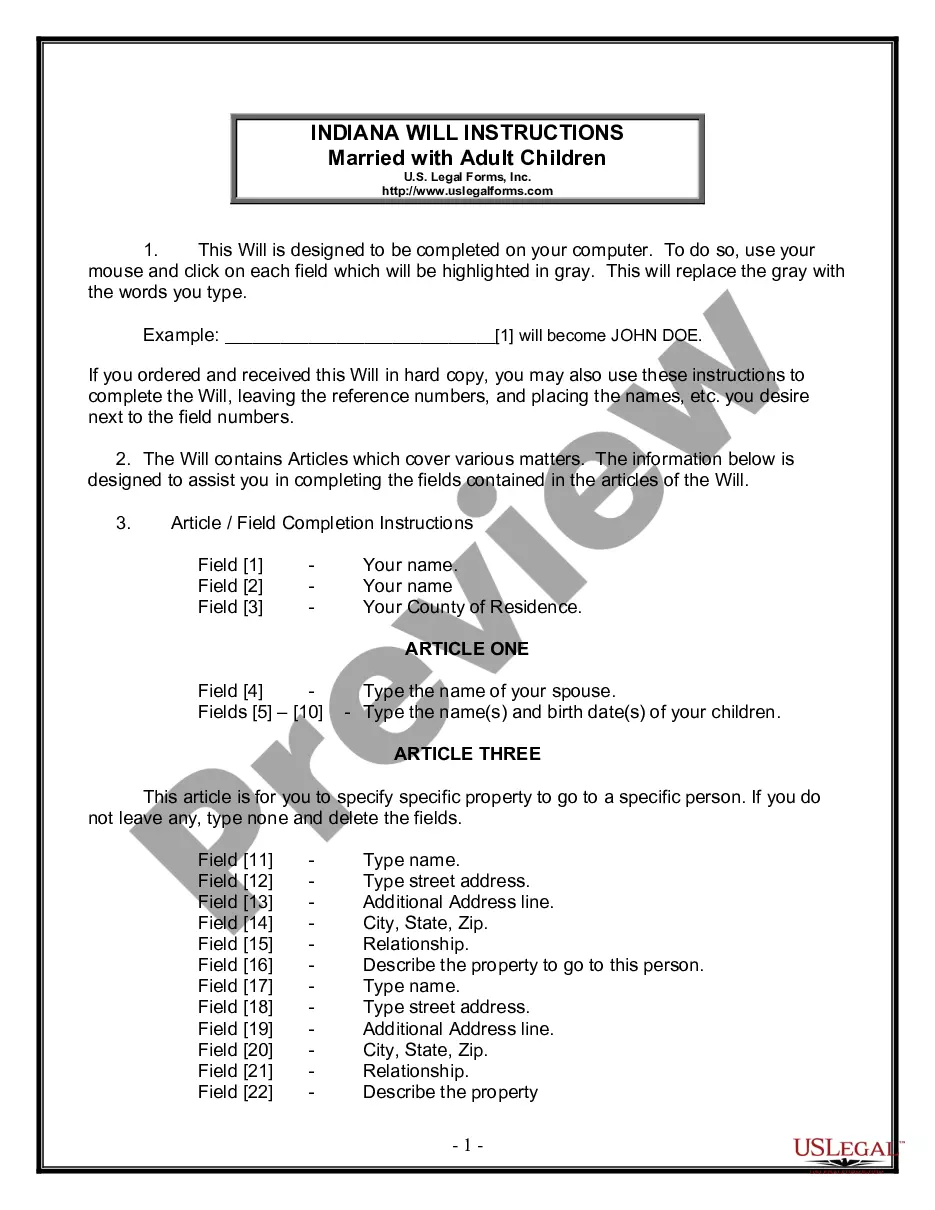

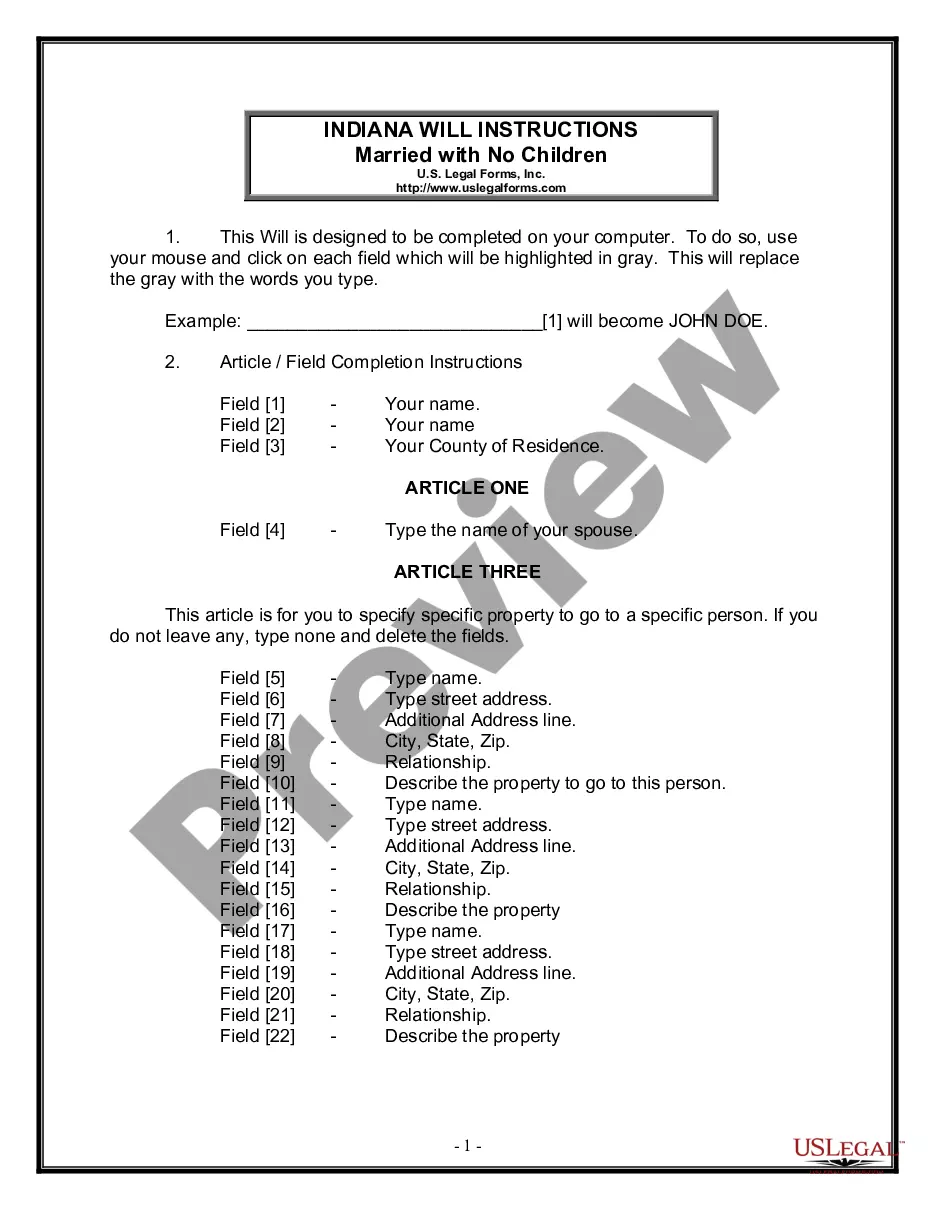

How to fill out Indiana Warning Of Default On Commercial Lease?

Attempting to locate Indiana Notification of Default on Commercial Lease templates and completing them may pose a difficulty.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and discover the appropriate sample tailored for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It is truly straightforward.

You can print the Indiana Notification of Default on Commercial Lease template or fill it out using any online editor. Don’t stress about making errors because your form can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All of your downloaded samples are saved in My documents and are always accessible for future use.

- If you haven't subscribed yet, you must register.

- Review our detailed instructions on how to obtain the Indiana Notification of Default on Commercial Lease template in minutes.

- To find an eligible sample, verify its relevance for your state.

- Examine the form using the Preview option (if it’s available).

- If there is a description, read it to comprehend the specifics.

- Click Buy Now if you have found what you need.

- Select your plan on the pricing page and create your account.

- Choose how you prefer to pay with a card or through PayPal.

- Download the sample in your desired file format.

Form popularity

FAQ

CALGARY -- The province says commercial landlords will no longer be allowed to evict business tenants without first applying for rental relief from the government.

A break-early fee is a lump sum payment. The amount of the break-early fee will vary greatly depending upon the commercial tenant's specific circumstances. In exchange for the break-early fee, the landlord will agree to release the commercial tenant from all of its obligations under the commercial lease.

The CARES Act provides no direct relief for such tenants. Several executive orders issued by governors and mayors have purported to impose moratoria on evictions that would extend to commercial tenants.

A lease is automatically void when it is against the law, such as a lease for an illegal purpose. In other circumstances, like fraud or duress, a lease can be declared void at the request of one party but not the other.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.

For example, the lease may provide that in case of default, the landlord can recover late fees and interest. If the lease is a net lease, it may provide for the landlord to recover such things as property taxes, insurance, utilities, maintenance and repairs.

One option for getting out of your commercial lease early is to approach your landlord and request to surrender the lease. A surrender of lease is when both you and the landlord agree to end the lease.However, if the landlord agrees to surrender your lease, you will often have to pay their legal costs.

Anyone renting a building, whether for commercial or personal use, has the right to privacy. You are entitled to do anything on the property that you wish, so long as whatever you are doing is legal. The landlord cannot prevent you from operating your business nor from allowing guests or patrons on the property.

Paying the remainder of the rent still owed on the lease in full; Paying a specified amount of liquidated damages as outlined in the contract terms; Paying an additional amount of punitive damages, dependent on local state laws; and/or.