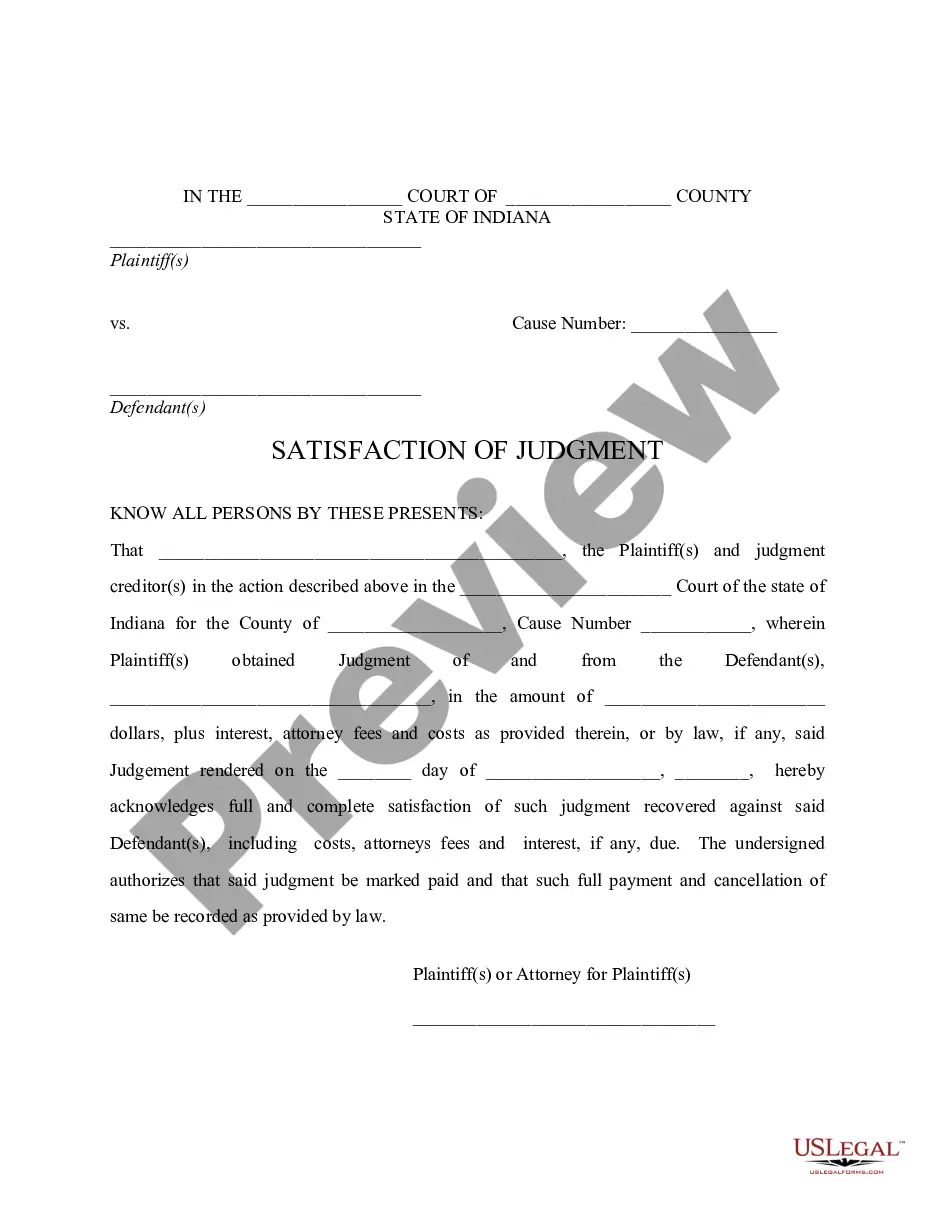

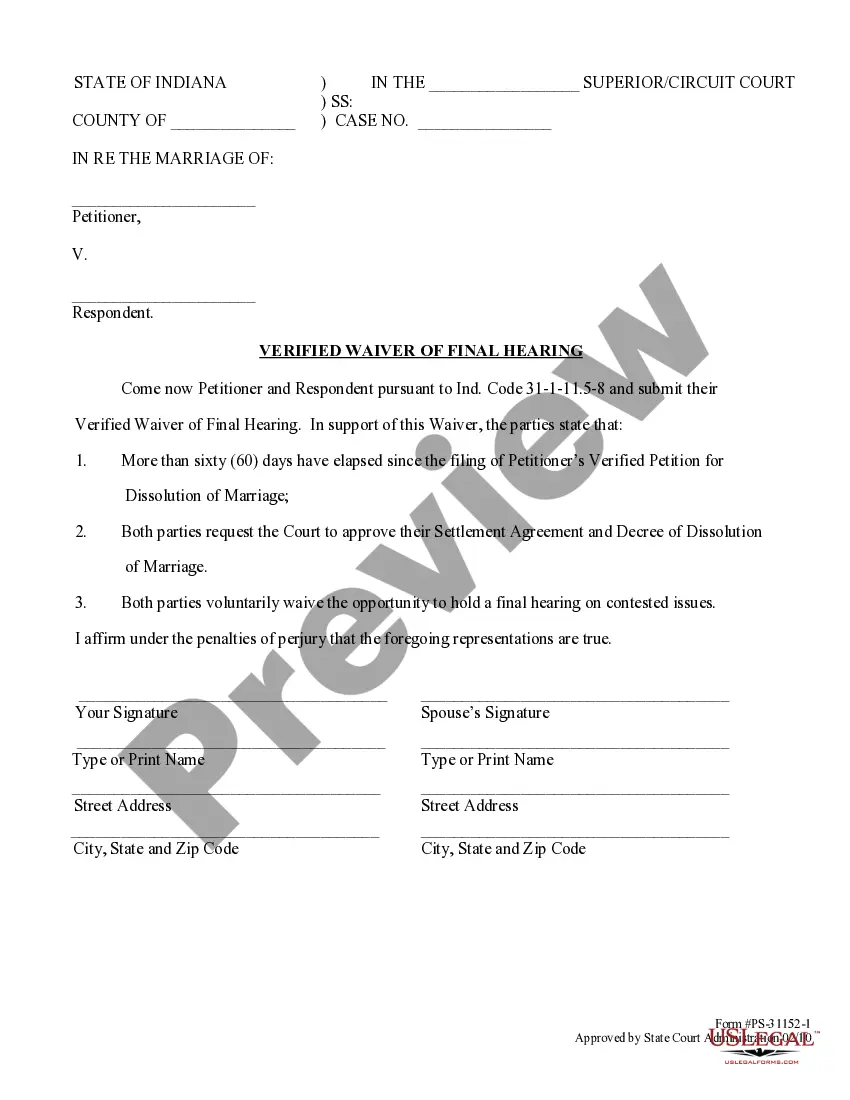

This is a Satisfaction of Judgment for the State of Indiana. A Satisfaction of Judgment simply states that Judgment Debtor has fully satisfied the Judgment rendered against him/her and is no longer liable to the Judgment Creditor.

Indiana Satisfaction of Judgment

Description

Key Concepts & Definitions

Indiana Satisfaction of Judgment refers to the legal document or process that officially certifies the full payment and settlement of a judgment debt in the state of Indiana. It formally indicates that the debtor has complied with the courts decision, either by paying the owed amount in full or through other court-approved means.

Step-by-Step Guide to Filing a Satisfaction of Judgment in Indiana

- Gather Required Documents: Collect the final judgment document, proof of payment, and any other relevant documentation.

- Complete the Satisfaction of Judgment Form: Fill in the necessary details on the form, typically found on the Indiana judiciary's website or obtained from the court where the judgment was issued.

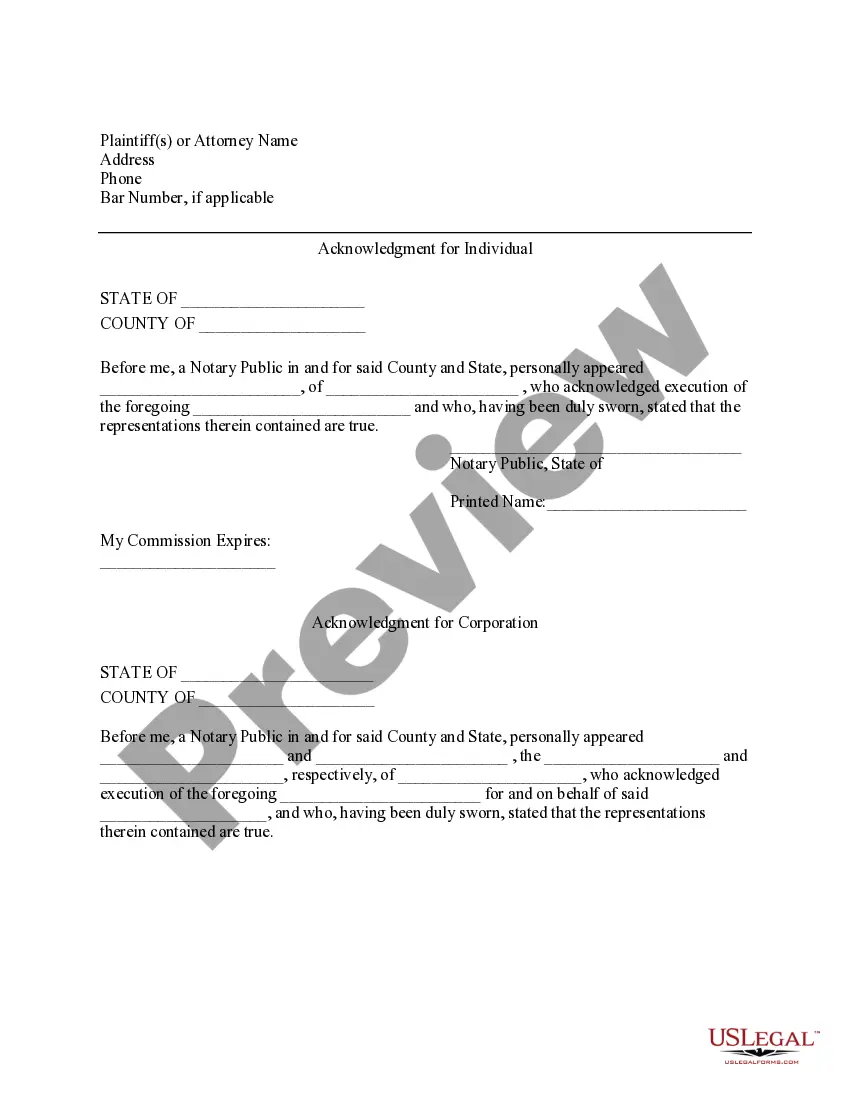

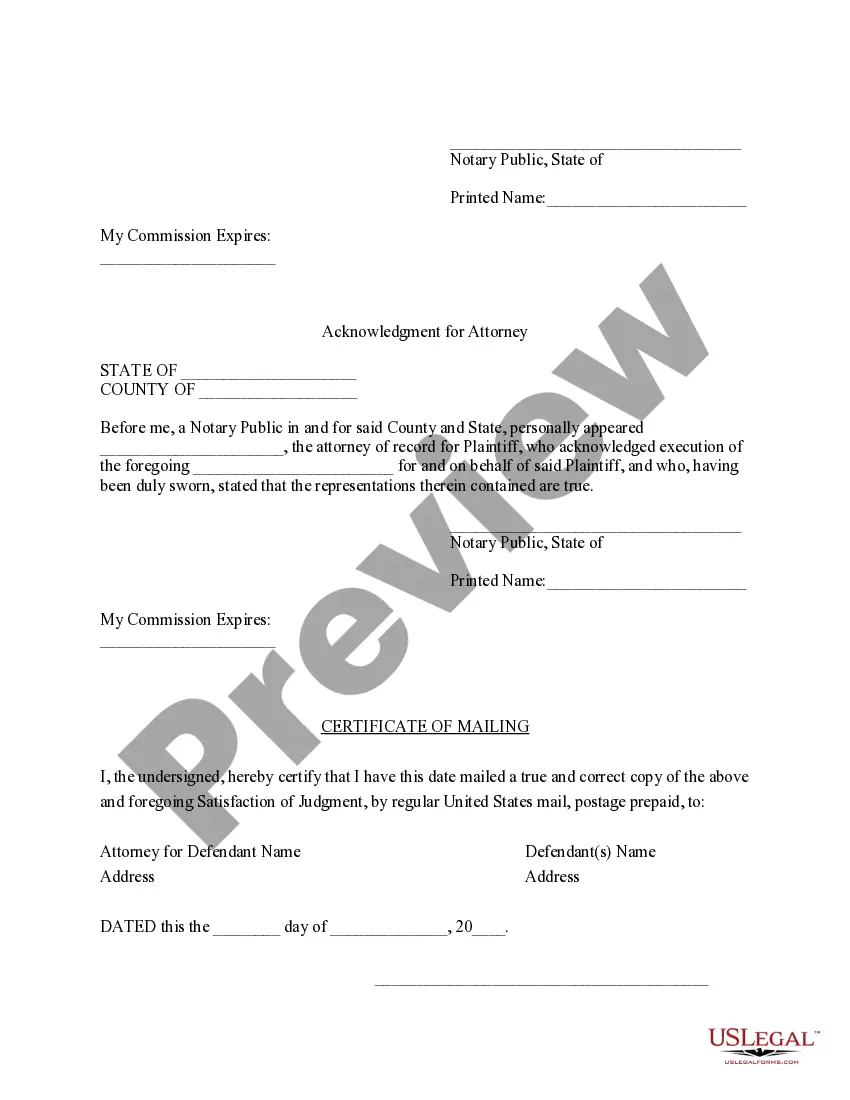

- Obtain Notarization: Have the completed form notarized to verify the authenticity of the signatures and the document.

- File with the Court: File the notarized form at the clerks office of the court that issued the original judgment. Pay any filing fees required by the court.

- Notify Involved Parties: Send copies of the filed satisfaction of judgment to all interested parties, including the creditor and debtor.

Risk Analysis of Delays in Filing a Satisfaction of Judgment

- Legal Compliance Risks: Delaying the filing can result in non-compliance with court orders and possible legal penalties.

- Credit Impact: The debtors credit score may continue to suffer if the satisfaction of judgment is not filed, as the resolution of the debt may not be reflected in credit reports.

- Reputational Risks: Creditors that fail to file timely may adversely affect their reputation, potentially impacting future legal proceedings and credit relationships.

Key Takeaways

Timeliness and accuracy in filing the satisfaction of judgment are crucial to ensuring compliance with legal requirements and in avoiding unnecessary risks. Engaging with knowledgeable legal counsel is advised to navigate the process effectively.

FAQ

- What happens if a satisfaction of judgment is not filed in Indiana? - The judgment debtors obligations may remain enforceable, and their credit profile can continue to reflect the outstanding judgment.

- Can the filing of a satisfaction of judgment be contested in Indiana? - Yes, if inaccuracies are found or if fraudulent actions are suspected, parties can contest the satisfaction of judgment.

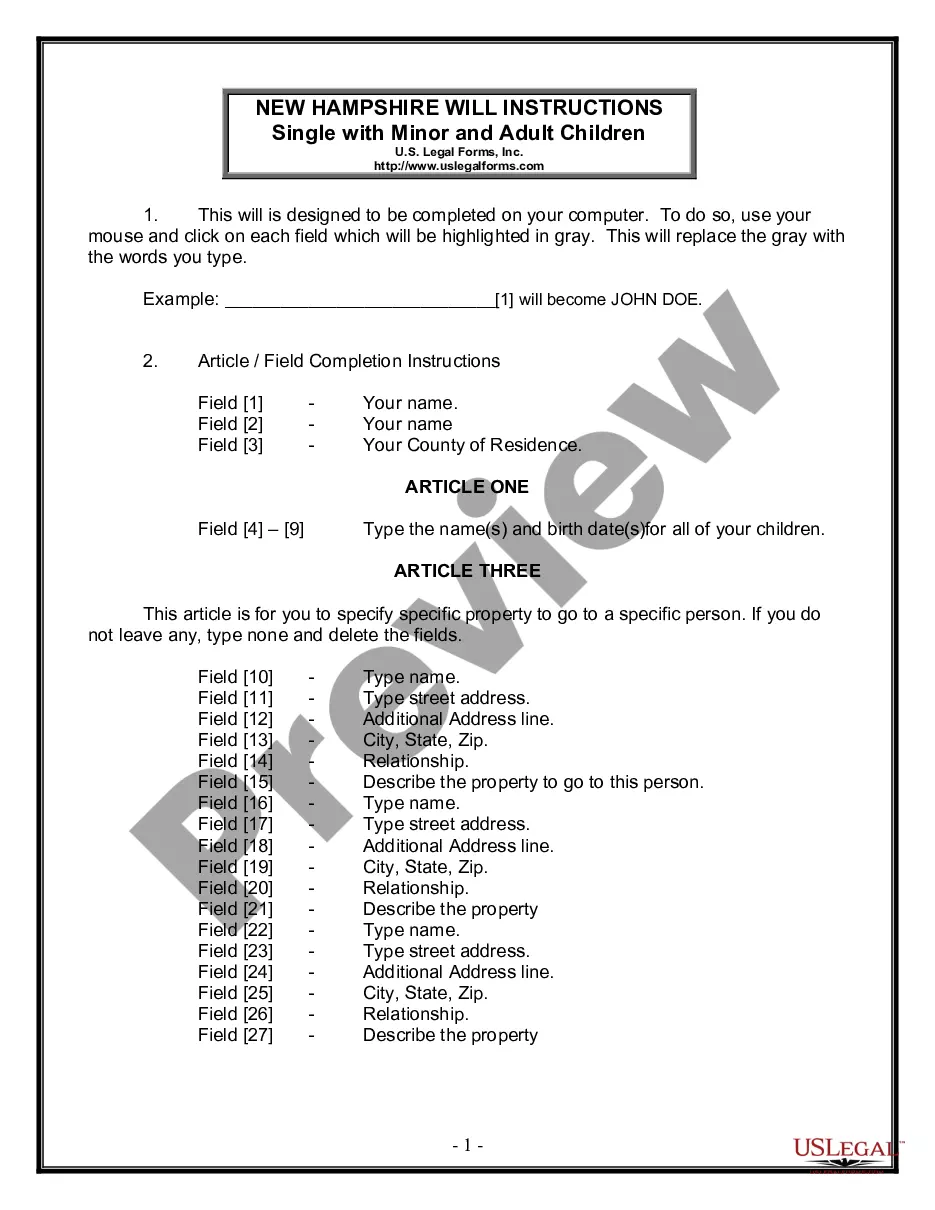

How to fill out Indiana Satisfaction Of Judgment?

Searching for a sample of Indiana Satisfaction of Judgment and completing them could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so all you need to do is complete them. It really is that easy.

Click on the Buy Now button if you’ve found what you are looking for. Select your plan on the pricing page and create an account. Choose whether you want to pay by card or PayPal. Save the document in your preferred format. You can either print the Indiana Satisfaction of Judgment form or complete it with any online editor. Don’t worry about making errors since your template can be used and submitted, and printed out as many times as needed. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's page to download the template.

- All your saved templates are stored in My documents and are accessible anytime for future reference.

- If you haven’t signed up yet, it’s advisable to register.

- Review our comprehensive guidelines on how to obtain your Indiana Satisfaction of Judgment form in mere minutes.

- To acquire a valid sample, verify its relevance to your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to understand the details.

Form popularity

FAQ

To file a judgment lien in Indiana, you need to submit a specific form to the county recorder where the debtor resides or where the property is located. This lien secures the debt against the debtor’s property, ensuring that you can seek compensation in the future. Learning about the nuances of the Indiana Satisfaction of Judgment process can help you effectively manage your claim.

While it can be challenging, there are strategies to address a judgment. Options may include negotiating a payment plan, contesting the judgment if you believe it is unjust, or seeking legal advice. A solid understanding of the Indiana Satisfaction of Judgment process can empower you to explore your options and find a resolution.

When a judgment is satisfied, it means the debtor has fulfilled their obligation, either by paying the amount owed or through an agreement with the creditor. In Indiana, this process leads to the official release of the judgment, highlighting that the debtor no longer has any legal obligations. Understanding the Indiana Satisfaction of Judgment process can provide clarity and help avoid potential complications.

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later.

Satisfied Judgments A satisfied judgment is the opposite of an unsatisfied judgment. It means that your debt is either paid or settled. While you may not have completely paid off your debt in full, you can satisfy a judgment by making a new payment plan and paying what you and the lender agreed on.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.