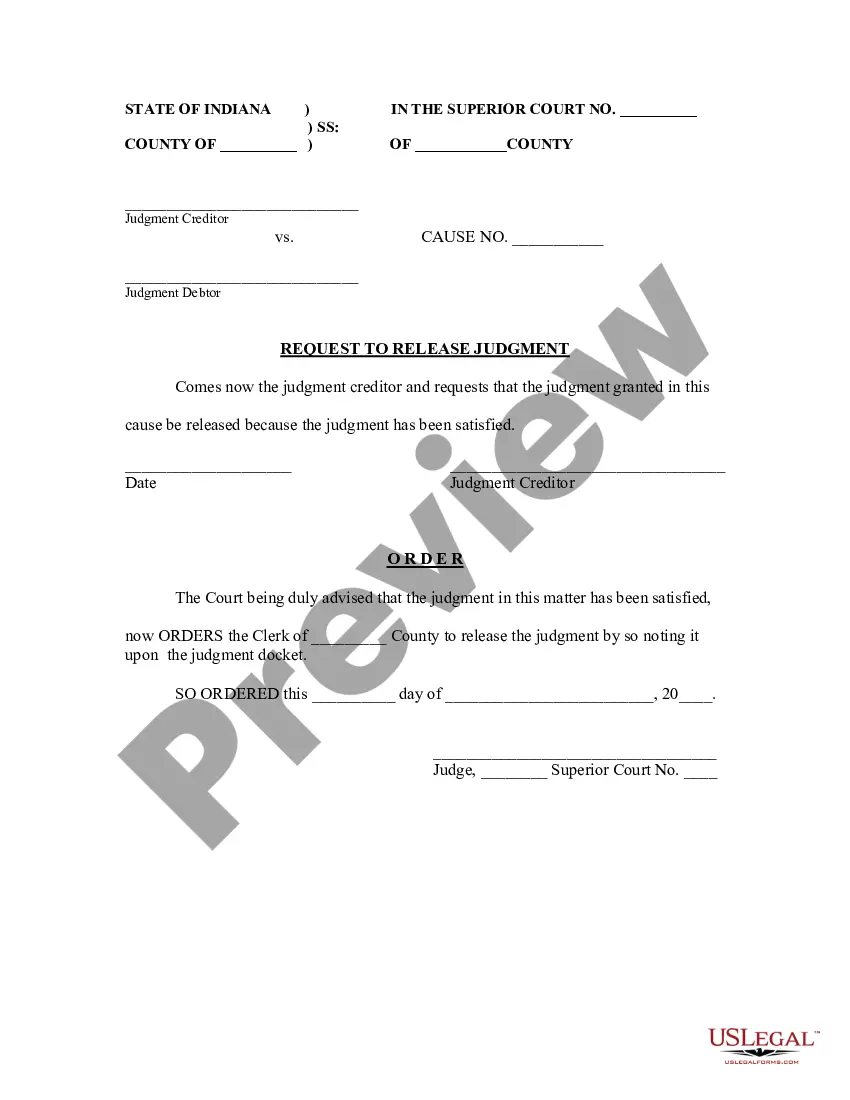

Indiana Plaintiff's Petition to Release Judgment

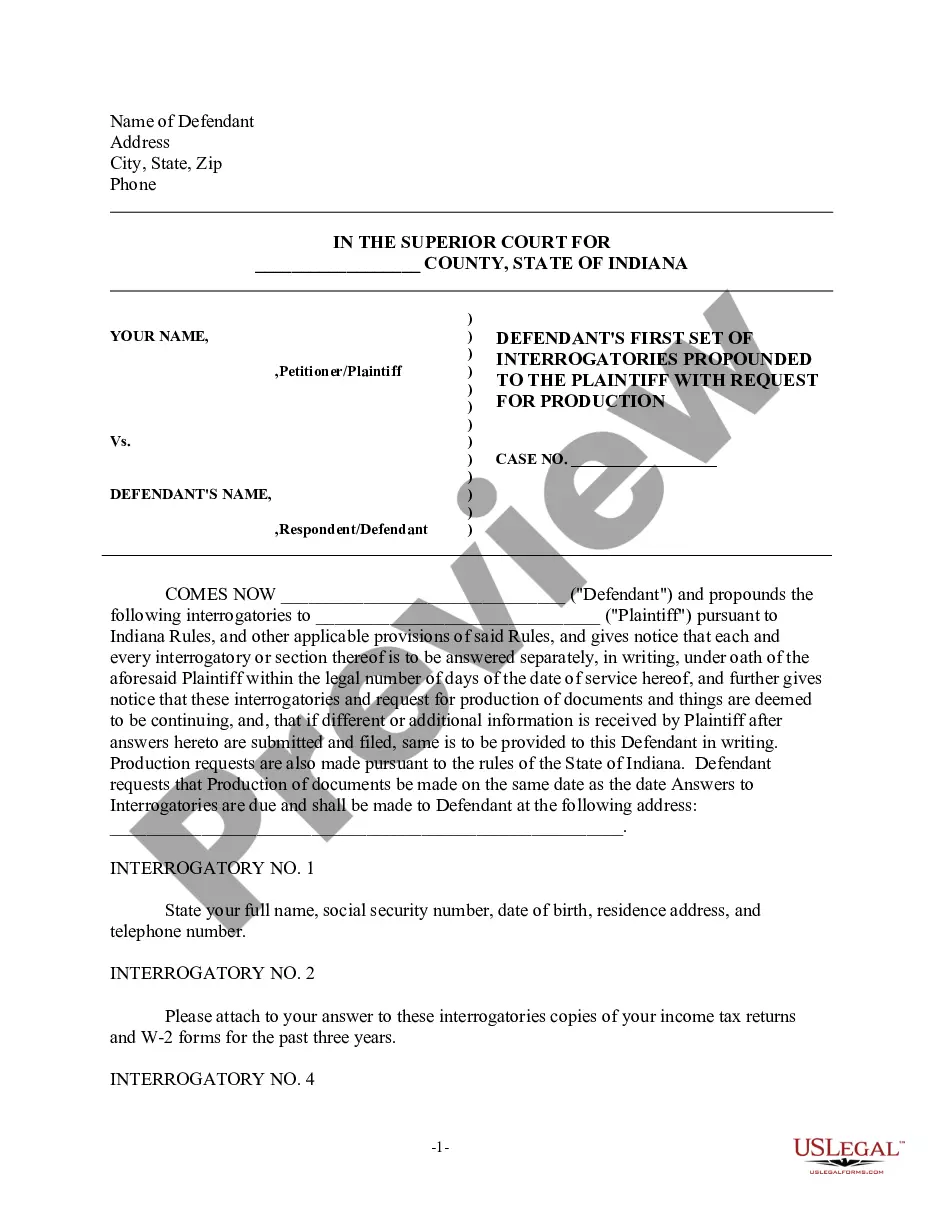

What is this form?

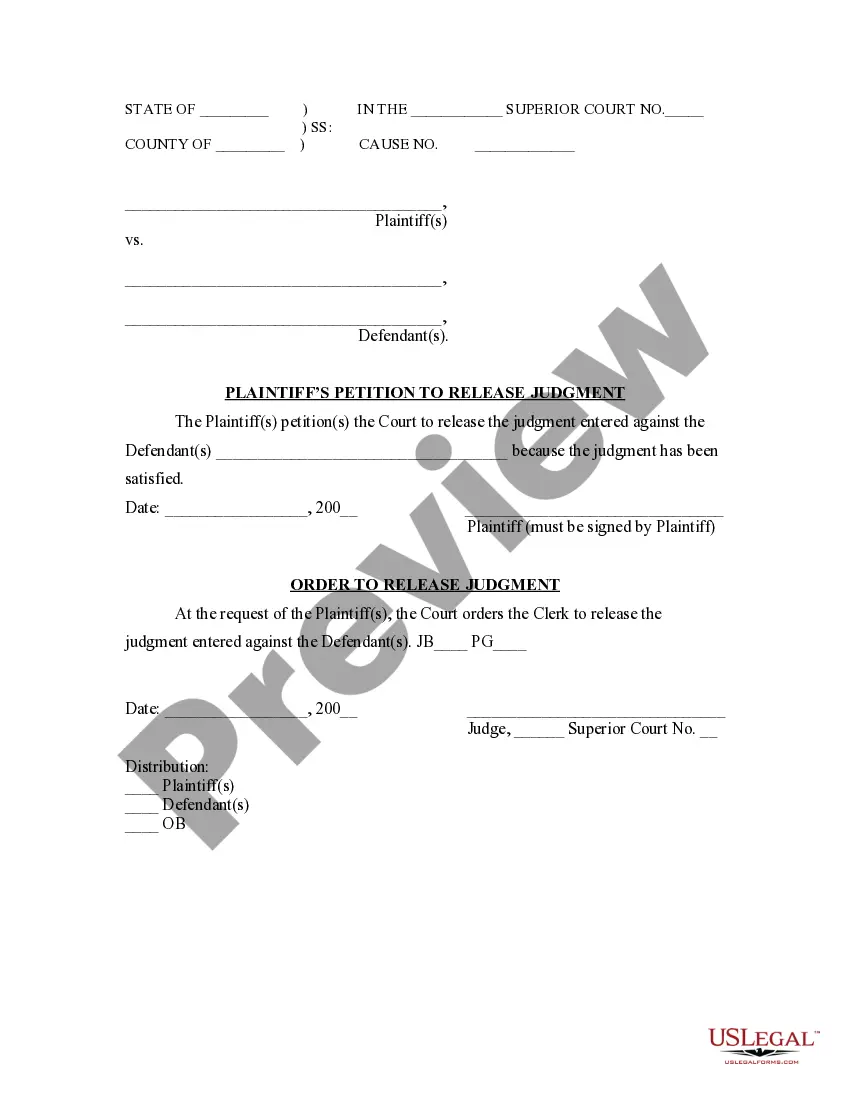

The Plaintiff's Petition to Release Judgment is a legal document used in Small Claims Court in Indiana. It allows a plaintiff to formally ask the court to release a judgment against a defendant when that judgment has been satisfied. This form is distinct as it specifically addresses the process of removing a judgment rather than creating or enforcing one.

What’s included in this form

- Identification of the parties involved: Plaintiffs and Defendants.

- Specification of the court where the petition is filed, including cause number.

- Statement indicating that the judgment has been satisfied.

- Date of the petition and the signature of the plaintiff.

- Order section where the court grants the request for judgment release.

When this form is needed

Use this form when you have received a judgment in your favor and the defendant has fulfilled the required obligations, such as paying a debt or settling a claim. This petition is necessary to formally document that the judgment is no longer enforceable and to clear the defendant's record.

Who this form is for

- Individuals or businesses that have obtained a judgment against a defendant.

- Those who have confirmed that the defendant has satisfied the judgment.

- Plaintiffs looking to formally release the court judgment to clear the defendant's legal standing.

Steps to complete this form

- Identify all parties involved by filling in the names of the plaintiffs and defendants.

- Enter the cause number provided by the court for the small claims case.

- Clearly state that the judgment has been satisfied.

- Include the date of the petition and sign in the space provided for the plaintiff.

- Submit the completed petition to the court along with any required copies for the defendants.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the cause number, which can delay processing.

- Not signing the petition, leading to it being deemed invalid.

- Using vague language that does not clearly indicate that the judgment has been satisfied.

- Neglecting to check the specific court requirements for submission in Indiana.

Why complete this form online

- Convenience: Download and fill out the form at your own pace.

- Editability: Make changes as needed before finalizing the document.

- Reliability: Access forms drafted by licensed attorneys, ensuring accuracy and compliance with Indiana law.

Legal use & context

- This petition is a formal request to correct the public record regarding a judgment.

- Filing this form protects the defendant's rights and provides evidence that the judgment has been resolved.

- Improper use or failure to file correctly may lead to legal complications for both parties.

Quick recap

- The Plaintiff's Petition to Release Judgment is essential for formally closing a satisfied judgment in Indiana.

- Accurate completion and submission of the form ensure clarity in legal records.

- Understanding common mistakes and benefits can streamline the process significantly.

Looking for another form?

Form popularity

FAQ

A Satisfaction of Judgment or Release and Satisfaction is a legal document that shows that the plaintiff has been paid all that he or she is owed, based upon the original judgment against the defendant.

How Long Does a Judgment Stay on My Credit Report? In most cases, judgments can stay on your credit reports for up to seven years. This means that the judgment will continue to have a negative effect on your credit score for a period of seven years.

Contact the creditor that filed the lien. Make payment arrangements if you cannot pay in full. Pay the lien amount in full or as agreed. Request a satisfaction of lien. File the satisfaction of lien if mailed to you. Consult a bankruptcy attorney.

In California, you must file a notarized "Acknowledgement Of Satisfaction of Judgment" with the Court. The law ignores the real world possibility of bounced checks and bankruptcy, and requires you to file the Satisfaction within 14 days.

You Can Appeal for a Vacated Judgment This can often be done with little trouble by disputing the judgment with the bureaus. Remember that you'll need to file a separate dispute for each one of the three major credit bureaus Equifax, Experian, and TransUnion to remove the judgment from all three reports.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

Paying off Judgments Will not Improve your Credit Score While the Fair Credit Reporting Act states that a judgment may stay on your credit report for as long as the statute of limitations in your state is in effect, all three bureaus remove judgments at the 7-year mark whether or not they are paid.

If you pay the full amount owed before that time, the judgment will be removed from your credit report as soon as the credit bureau receives either proof of payment from the credit provider or a valid court order rescinding the judgment.

If you've had a judgment taken against you for a debt, there are a few ways you can remove judgments from your credit report. You can appeal for a vacated judgment, dispute the inaccuracies, or simply pay it.Judgments usually show up under the public records section of your credit report.