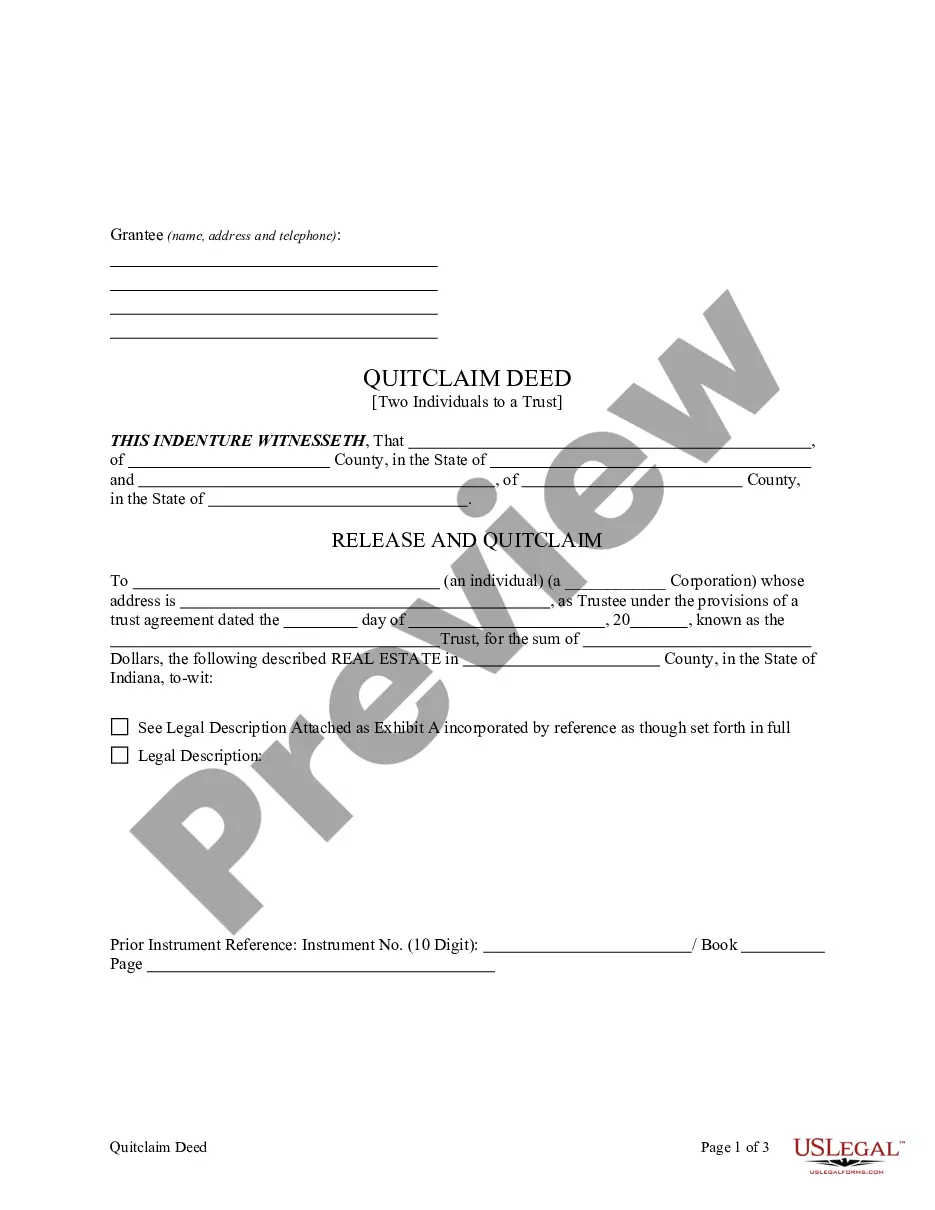

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is a revocable trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Indiana Quitclaim Deed - Two Individuals to a Revocable Trust

Description

How to fill out Indiana Quitclaim Deed - Two Individuals To A Revocable Trust?

Searching for Indiana Quitclaim Deed - Two People to a Revocable Trust example and completing them might be a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate example specifically for your state in just a few clicks.

Our lawyers prepare every document, so you merely need to fill them out. It's really that straightforward.

Select your plan on the pricing page and establish your account. Choose whether you wish to pay with a card or by PayPal. Download the file in the desired file format. Now you can print the Indiana Quitclaim Deed - Two Individuals to a Revocable Trust template or complete it utilizing any online editor. There's no need to worry about errors since your sample may be used and submitted multiple times as you wish. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to download the document.

- All of your saved templates are kept in My documents and they are available at all times for future use.

- If you haven’t signed up yet, you should register.

- Review our detailed instructions on how to acquire your Indiana Quitclaim Deed - Two Individuals to a Revocable Trust template in a few minutes.

- To obtain a titled example, verify its validity for your state.

- Examine the form using the Preview option (if available).

- If there's a description, read it to grasp the essential details.

- Click on Buy Now button if you found what you're searching for.

Form popularity

FAQ

You can file a quitclaim deed in Indiana at your local county recorder's office. This is the official place where property ownership changes are recorded, including the Indiana Quitclaim Deed - Two Individuals to a Revocable Trust. Be sure to prepare your document properly and gather necessary information, such as the property's legal description. After filing, consider using online services like US Legal Forms to ensure you complete the process accurately.

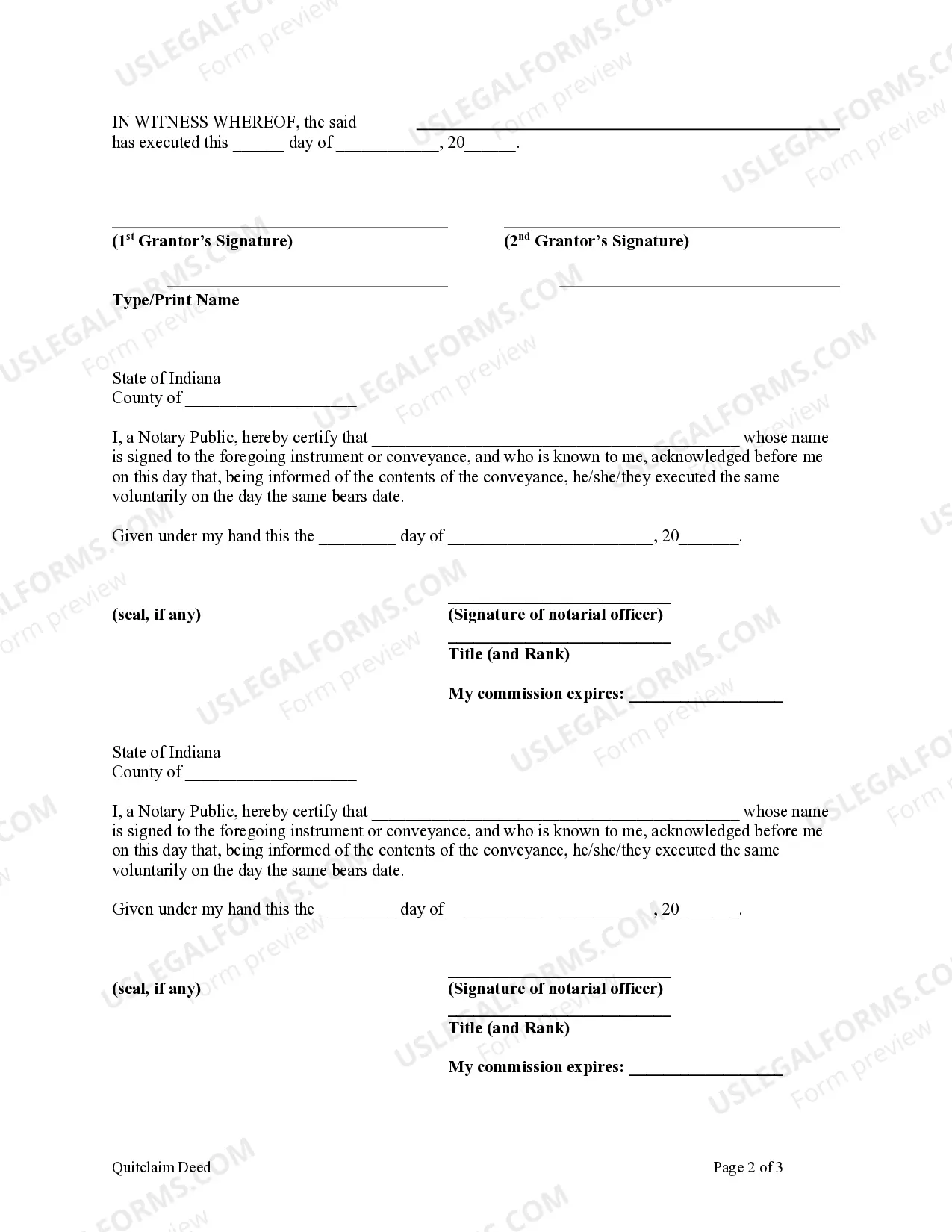

Step 1: Find your IN quitclaim deed form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: Enter the legal description of the property. Step 5: Have the grantor sign the document in the presence of a Notary Public.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.