Illinois Affidavit of Compliance with Terms of Oil and Gas Lease by Lessee

Description

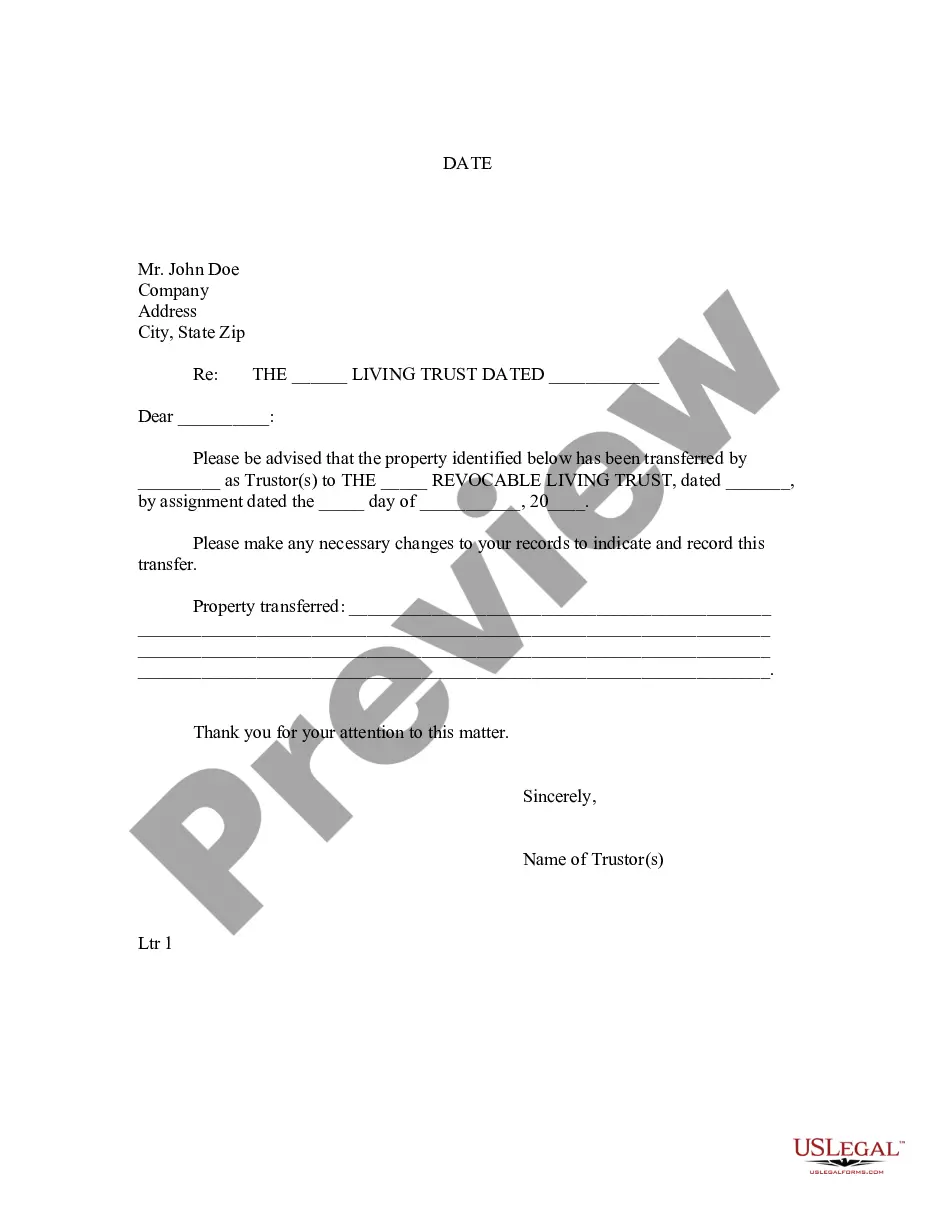

How to fill out Affidavit Of Compliance With Terms Of Oil And Gas Lease By Lessee?

Discovering the right legitimate file format could be a struggle. Obviously, there are a lot of layouts accessible on the Internet, but how do you find the legitimate develop you will need? Use the US Legal Forms site. The services provides 1000s of layouts, like the Illinois Affidavit of Compliance with Terms of Oil and Gas Lease by Lessee, which you can use for business and private requires. All of the varieties are checked out by experts and satisfy state and federal requirements.

When you are already authorized, log in to the account and click on the Acquire key to get the Illinois Affidavit of Compliance with Terms of Oil and Gas Lease by Lessee. Use your account to look throughout the legitimate varieties you possess acquired earlier. Visit the My Forms tab of the account and get another backup of the file you will need.

When you are a fresh user of US Legal Forms, here are straightforward guidelines that you should comply with:

- Initially, ensure you have chosen the proper develop for your town/state. You may look through the form while using Review key and look at the form information to ensure this is the best for you.

- When the develop fails to satisfy your requirements, take advantage of the Seach field to get the correct develop.

- When you are certain the form would work, select the Get now key to get the develop.

- Opt for the costs prepare you want and type in the essential information and facts. Make your account and pay for your order making use of your PayPal account or Visa or Mastercard.

- Pick the data file structure and download the legitimate file format to the product.

- Total, modify and print out and indication the obtained Illinois Affidavit of Compliance with Terms of Oil and Gas Lease by Lessee.

US Legal Forms is definitely the most significant local library of legitimate varieties that you can discover different file layouts. Use the company to download skillfully-produced paperwork that comply with status requirements.

Form popularity

FAQ

Illinois Oil and Gas Act (225 ILCS 725) provides for the conservation of oil and gas resources through the protection of correlative rights, proper well spacing, integration and unitization of mineral interests; and for the regulation of the drilling, construction, operation, and plugging of oil and gas production ...

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

Once granted, an oil and gas lease gives the lessee a primary term ranging from 5 to 10 years, depending on water depth, to explore and develop the lease. A lessee must relinquish the lease if no activity has occurred within that specified amount of time.

These basic lease terms ? bonus, royalty, term, delay rental (if any) and shut-in royalty --are typically the "deal terms" negotiated between the Lessor and Lessee. The Lessor typically wants the highest bonus, delay rental and royalty fraction he can get, and the shortest primary term. The Lessee wants the opposite.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

Oil leases are agreements between an oil and gas company known as the lessee and mineral owners known as a lessor, in which the lessor grants the lessee the permission to explore, drill, and produce those minerals for a specified period known as a primary term or as long as the minerals continue to be productive.

The primary term on average is 3 years. Companies can add a 2-year extension if they wish. The company that executed the lease uses this time period to achieve drilling the well. Once that is completed, the secondary term begins and lasts for as long as the well is producing.