Illinois Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

You might spend countless hours online attempting to locate the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

You can download or print the Illinois Self-Employed Independent Contractor Agreement from their services.

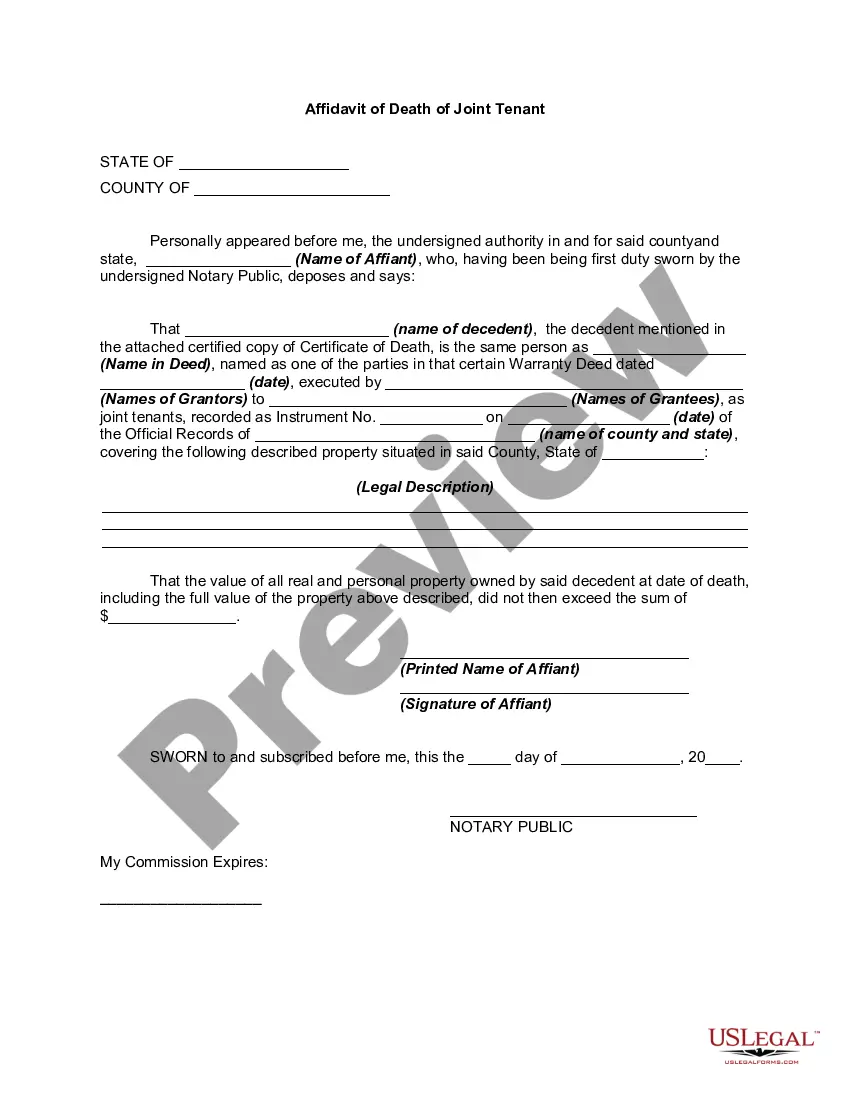

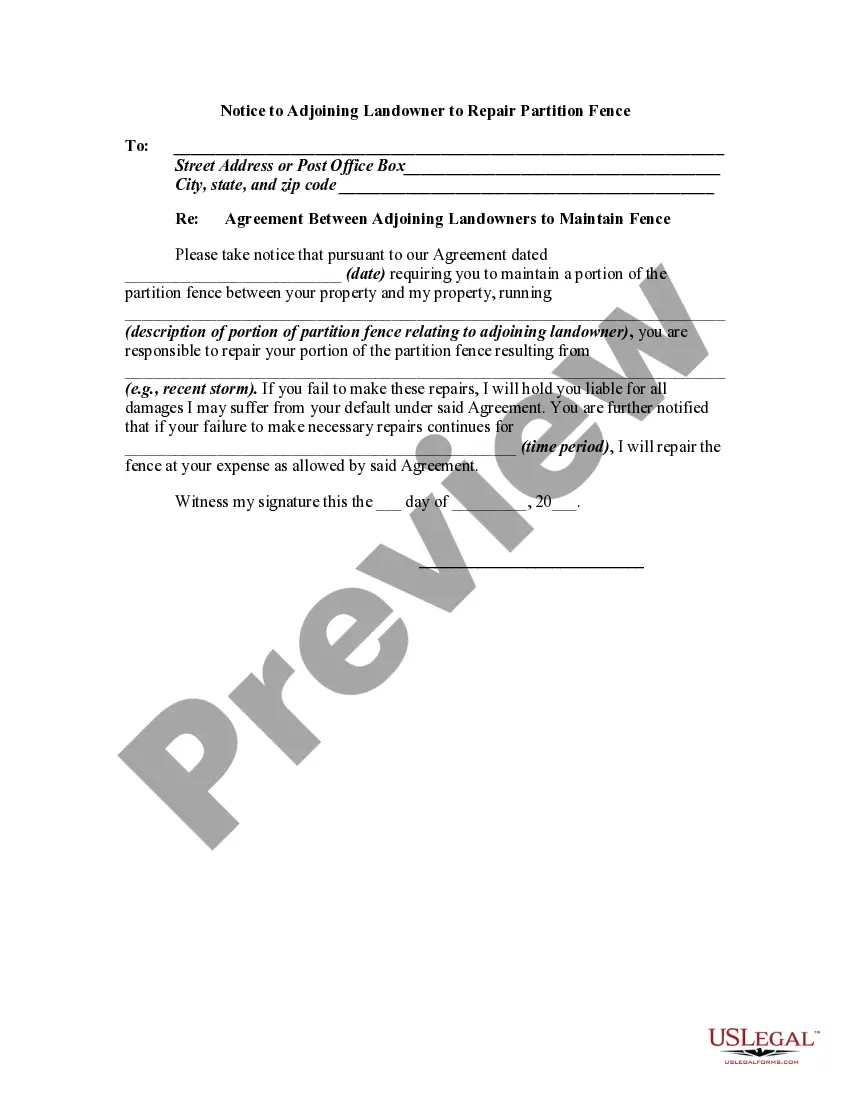

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and press the Download button.

- Then, you can complete, modify, print, or sign the Illinois Self-Employed Independent Contractor Agreement.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you’re visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city you choose.

- Review the form summary to confirm you have chosen the right form.

Form popularity

FAQ

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

As an independent contractor, you may have more freedom to choose how you complete your work, but you are responsible for paying your own taxes, getting your own health insurance, and paying into unemployment and workers comp funds if you wish to access those benefits.

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.