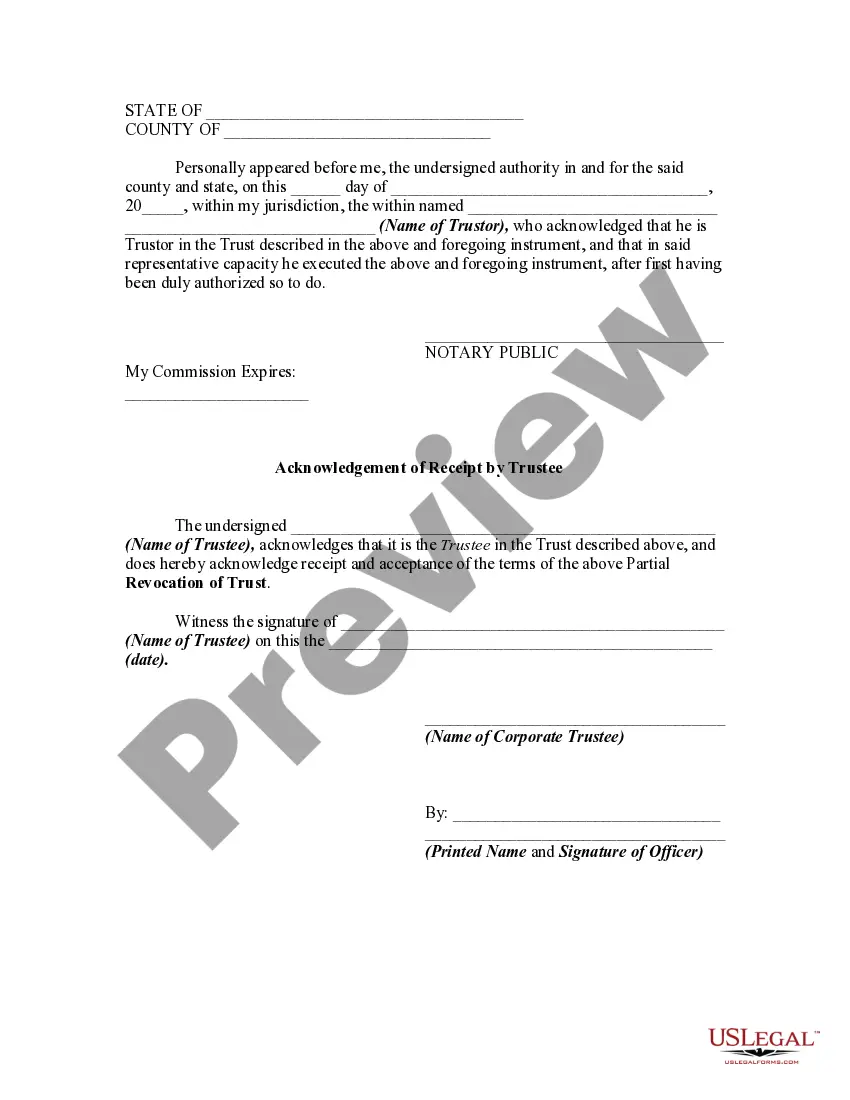

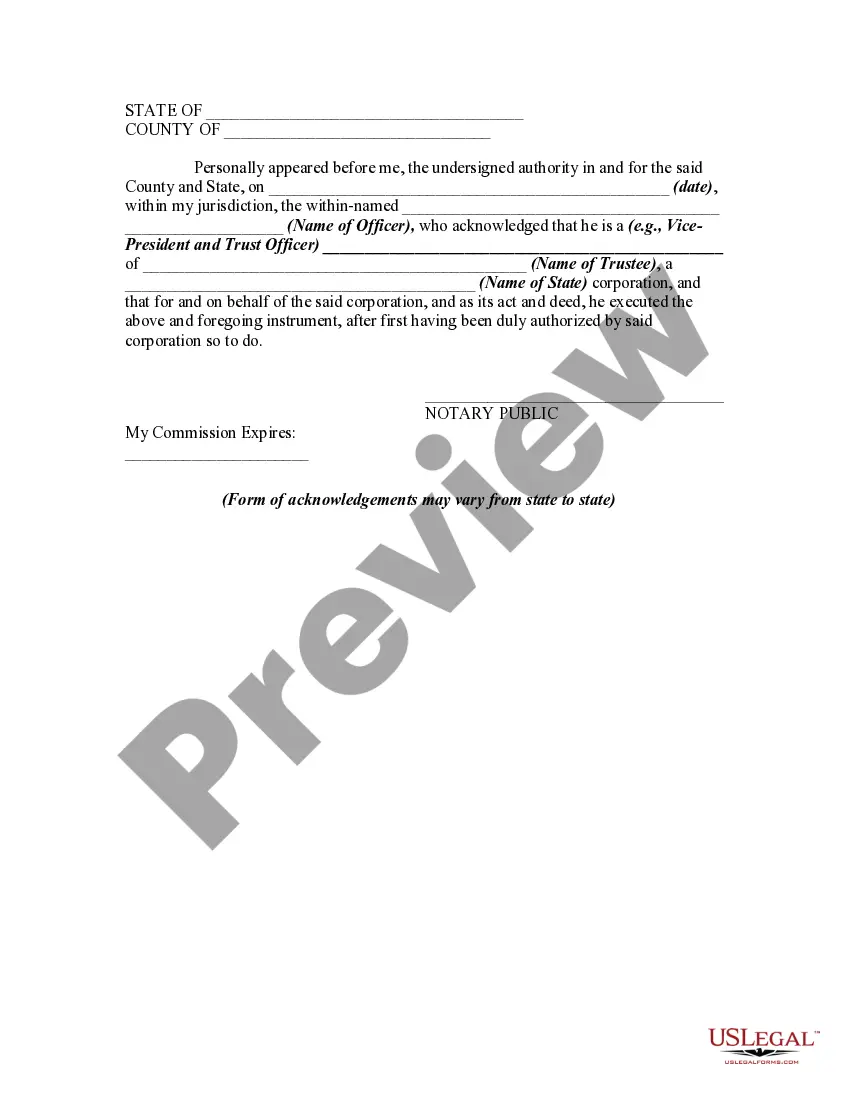

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Selecting the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, that you can use for both business and personal purposes.

If the form does not meet your needs, use the Search field to locate the right form. Once you are certain that the form is suitable, click the Buy now button to access the form. Choose the pricing plan you need and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Take advantage of this service to acquire professionally crafted paperwork that adhere to state regulations.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Use your account to view the legal documents you have previously ordered.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

- First, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and review the form description to confirm it is right for you.

Form popularity

FAQ

The best trust for your house often depends on your specific needs and goals. A revocable living trust is commonly recommended, as it allows you to retain control during your lifetime while avoiding probate. Consider how the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can assist you in maintaining this control while also clarifying your intentions for your heirs.

In Illinois, a living trust and a revocable trust are often used interchangeably, as both are established during your lifetime and allow for modifications. The primary feature is that they can be altered or revoked as your circumstances change. Understanding the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help clarify your rights and options in managing these trusts.

Section 105 of the Illinois Trust Code outlines the requirements for the creation and operation of trusts in Illinois. This section is essential as it defines the legal framework for trustees and beneficiaries, ensuring that trusts adhere to state laws. When dealing with trust modifications, including the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, knowing this section can be invaluable.

Yes, upon your death, a revocable trust typically becomes irrevocable. This transition helps protect your assets and establishes how they will be managed and distributed according to your wishes. Understanding the implications of the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee ensures your intent remains clear and respected.

The greatest advantage of a revocable trust lies in its flexibility. You can modify or revoke your trust at any time, which allows you to adapt to changes in your life or financial situation. Furthermore, when utilizing the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, you maintain control while also providing clarity to your beneficiaries.

To revoke a revocable trust in Illinois, you typically need to follow the guidelines stated in the trust document itself. This often involves formally executing a written revocation document and notifying the trustee and beneficiaries. Utilizing the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee adds clarity and ensures compliance with state laws during this process.

A trustee can revoke a trust by following the specific procedures outlined in the trust document. This often requires the trustee to provide formal notice to beneficiaries and comply with any legal requirements. Understanding the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is crucial for a smooth revocation process, ensuring all actions align with the legal framework.

Putting your house in a trust in Illinois can provide greater control over your property and simplify the transfer process upon your passing. A trust can help avoid probate, ensuring that your wishes are carried out as you intended. Additionally, with the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, you can modify your trust if your circumstances change.

A sample revocation of a living trust typically includes a statement declaring your intention to revoke, the date of the act, and your signature. You will also want to notify any trustees and beneficiaries involved in the trust. By using a well-structured document that aligns with the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, you can ensure that all necessary details are included and legally binding.

A trustee generally cannot revoke a trust unless they are also the grantor or have been granted explicit authority to do so. Revocation typically requires the consent of the grantor or adherence to instructions set in the trust document. Sometimes, situations may arise where beneficiaries agree to a trust's modification, but a complete revocation usually depends on the terms of the trust. Understanding the Illinois Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can clarify these rights and responsibilities.