Illinois Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

Are you presently in a position that necessitates documentation for either professional or personal purposes almost every day.

There are numerous legal document templates available online, but locating trustworthy forms is not easy.

US Legal Forms provides a vast selection of document templates, including the Illinois Stock Dividend - Resolution Form - Corporate Resolutions, designed to meet state and federal requirements.

If you locate the appropriate form, click Get now.

Choose the pricing plan you wish, provide the necessary information to create your account, and pay for the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Stock Dividend - Resolution Form - Corporate Resolutions template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/location.

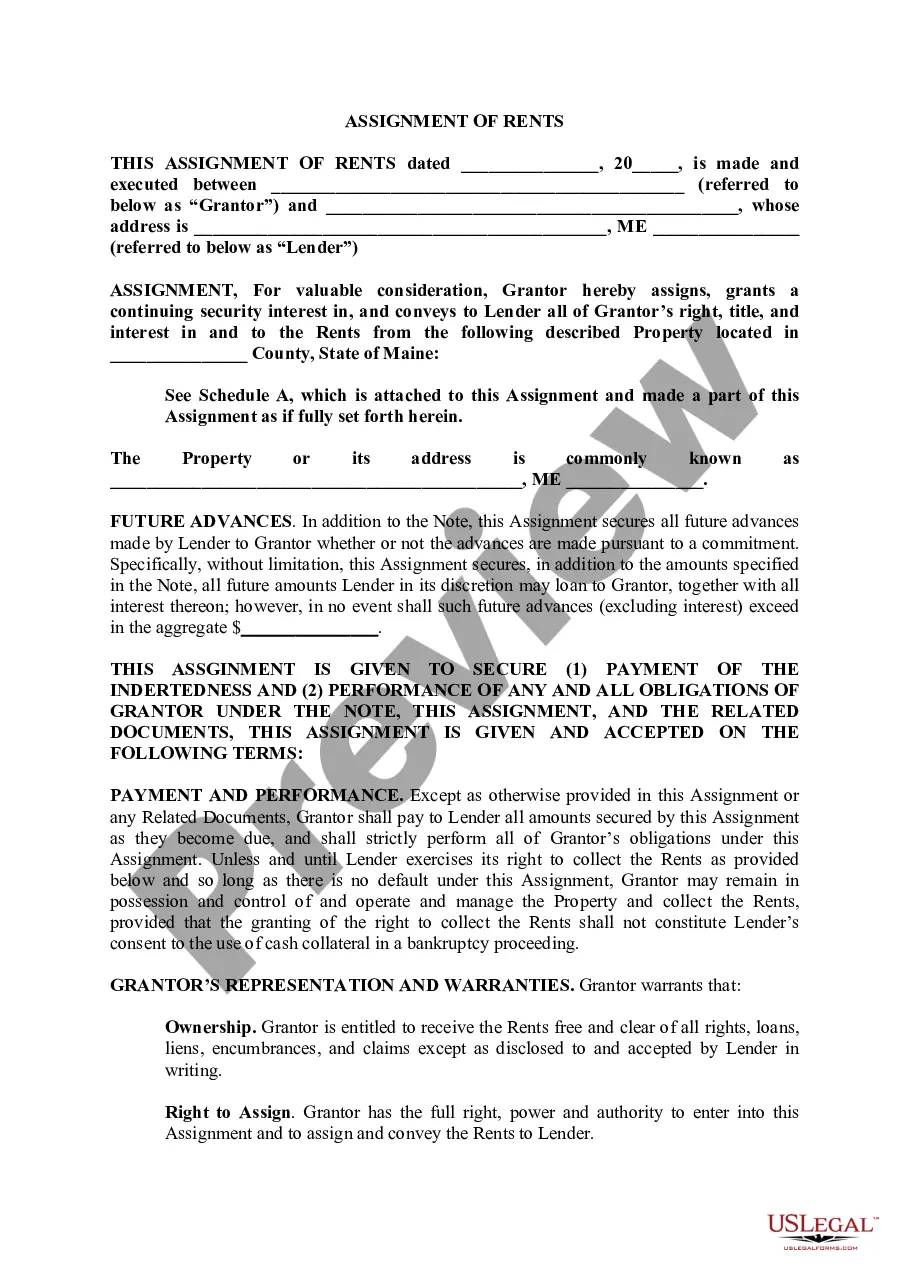

- Utilize the Review button to evaluate the form.

- Read the description to confirm you have chosen the correct document.

- If the form is not what you were looking for, use the Search section to find the form that fits your needs and requirements.

Form popularity

FAQ

To write a corporate resolution, begin by stating the company name and the specific issue the resolution addresses. Next, clearly outline the details of the resolution, including any actions being approved, and ensure it reflects the decision of the board or shareholders. Utilizing the Illinois Stock Dividend - Resolution Form - Corporate Resolutions can simplify this process, providing a clear template to follow. This form not only helps you stay organized but also ensures compliance with legal standards, making it easier to manage corporate documentation.

The board resolution for dividend distribution outlines the decision made by the company's board of directors regarding the payment of dividends to shareholders. This resolution details the amount and timing of the dividend, ensuring clarity and proper documentation. By using the Illinois Stock Dividend - Resolution Form - Corporate Resolutions, you can formalize this decision, streamlining the process for your corporation. This form provides the necessary structure to fulfill statutory requirements and maintain transparency with shareholders.

A shareholder resolution is necessary to ensure transparency and regulatory compliance within the corporation. It serves as a documented agreement among shareholders on significant issues, enhancing accountability. Using the Illinois Stock Dividend - Resolution Form - Corporate Resolutions helps formalize these agreements smoothly.

A corporate resolution is a formal decision made by a corporation's board or shareholders to take specific actions. This could involve decisions related to financial transactions, corporate governance, or operational changes. The Illinois Stock Dividend - Resolution Form - Corporate Resolutions ensures that these important decisions are recorded effectively.

Typically, any shareholder who holds a certain percentage of stock can file a shareholder resolution. This could include individual investors or institutional shareholders. Engaging with the Illinois Stock Dividend - Resolution Form - Corporate Resolutions can make the filing process comprehensive and efficient.

A shareholder resolution for the sale of shares outlines a proposal that shareholders must agree upon before shares can be sold. This encourages transparency and accountability within the organization. The Illinois Stock Dividend - Resolution Form - Corporate Resolutions is perfect for ensuring all required information is included.

A corporate resolution form is a legal document that records decisions made by a corporation's board of directors or shareholders. This form typically includes key details about the resolution, the parties involved, and the votes cast. Utilizing the Illinois Stock Dividend - Resolution Form - Corporate Resolutions simplifies your corporate record-keeping.

A corporate resolution for share transfer details the process for transferring ownership of shares from one individual or entity to another. This documentation is crucial for maintaining accurate records and ensuring compliance with corporate governance standards. The Illinois Stock Dividend - Resolution Form - Corporate Resolutions can facilitate this process easily.

Creating a shareholder resolution requires a clear understanding of the specific issue to be addressed. Typically, you'll need to draft the resolution, gather necessary approvals from shareholders, and document their votes. Using the Illinois Stock Dividend - Resolution Form - Corporate Resolutions can streamline this process, ensuring compliance with state regulations.

Another name for a corporate resolution is a board resolution. This term emphasizes the document's origin from the board of directors or management team. Properly executed, such documents like the Illinois Stock Dividend - Resolution Form - Corporate Resolutions, outline essential actions taken by the corporation. By integrating these resolutions into your business processes, you enhance transparency and accountability within your organization.