Georgia Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

If you wish to have a thorough collection, download or print legal document templates, utilize US Legal Forms, the most significant collection of legal documents available online.

Take advantage of the site’s user-friendly and accessible search feature to find the documents you require.

Different templates for businesses and personal purposes are categorized by type and subject matter, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Select the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, print, or sign the Georgia Document Organizer and Retention.

- Utilize US Legal Forms to locate the Georgia Document Organizer and Retention with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to download the Georgia Document Organizer and Retention.

- You can also find templates you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review method to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative variations of the legal form template.

Form popularity

FAQ

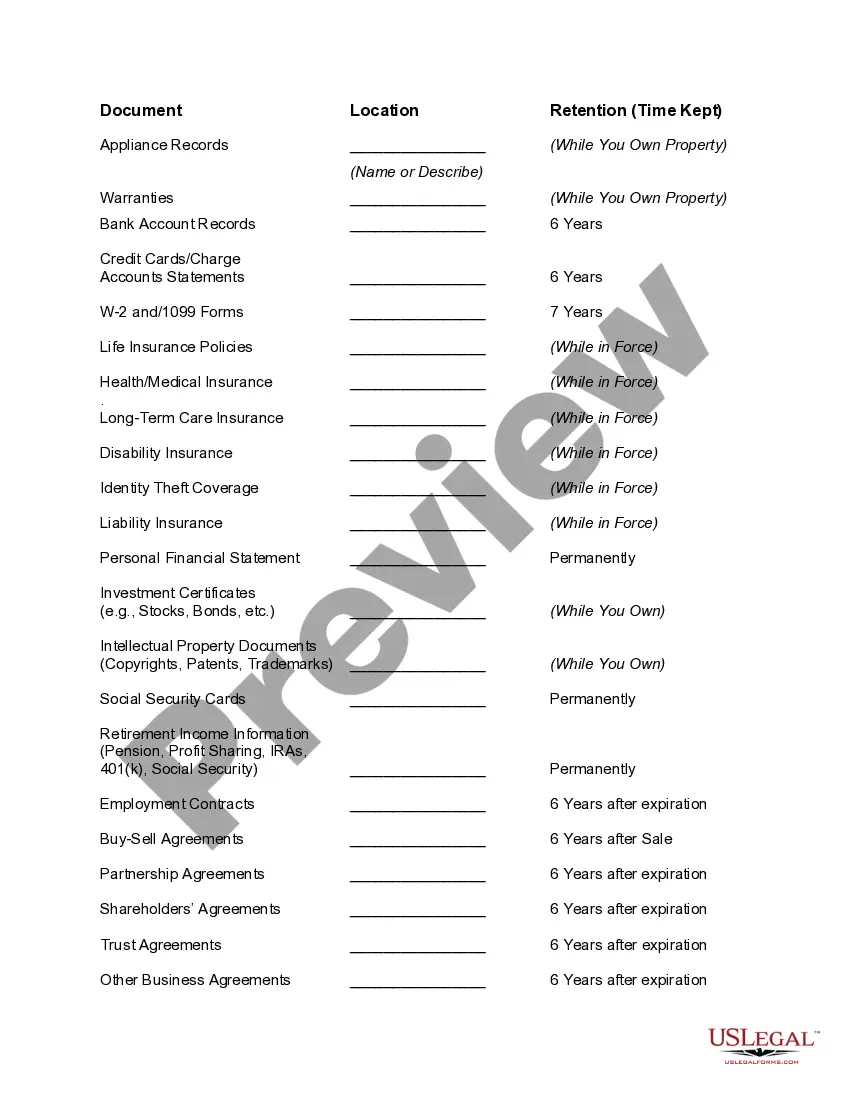

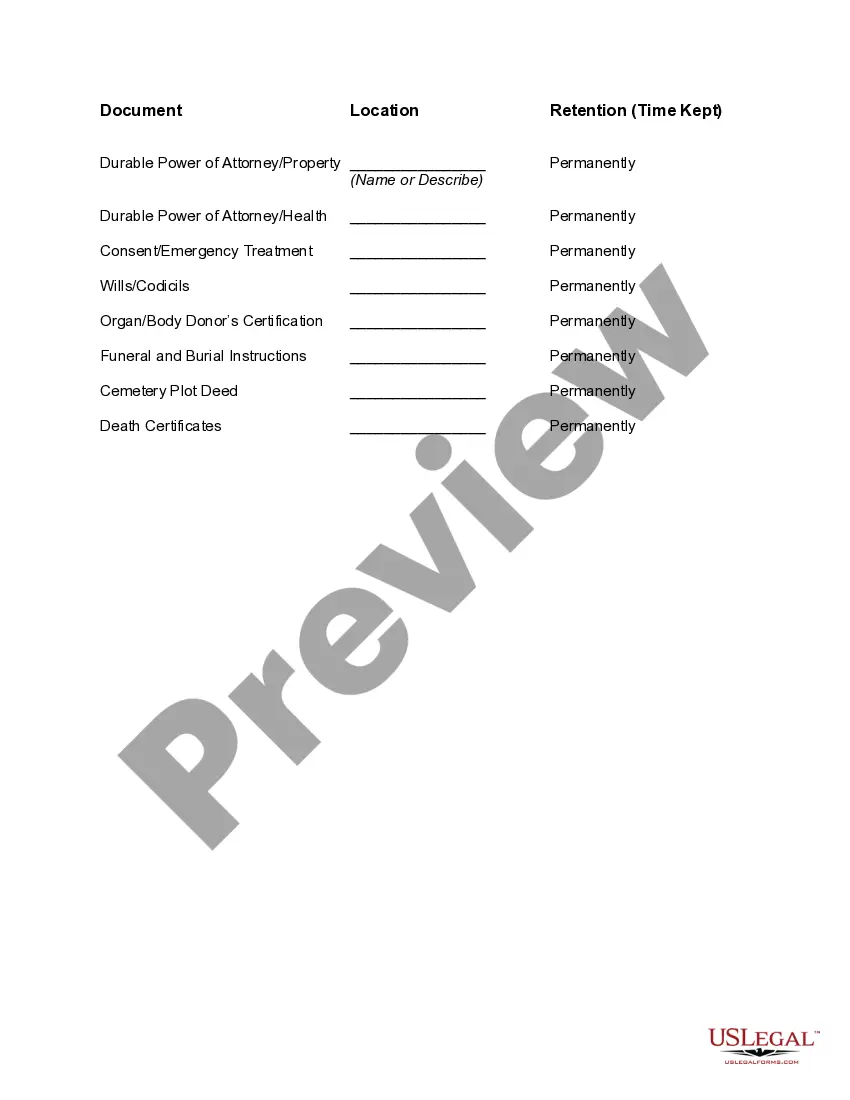

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

The general minimum amount of time to keep business records is a minimum of 7 years. The following documents and records should be kept; Business Tax Returns and other supporting documents: Until the IRS can no longer audit your return.

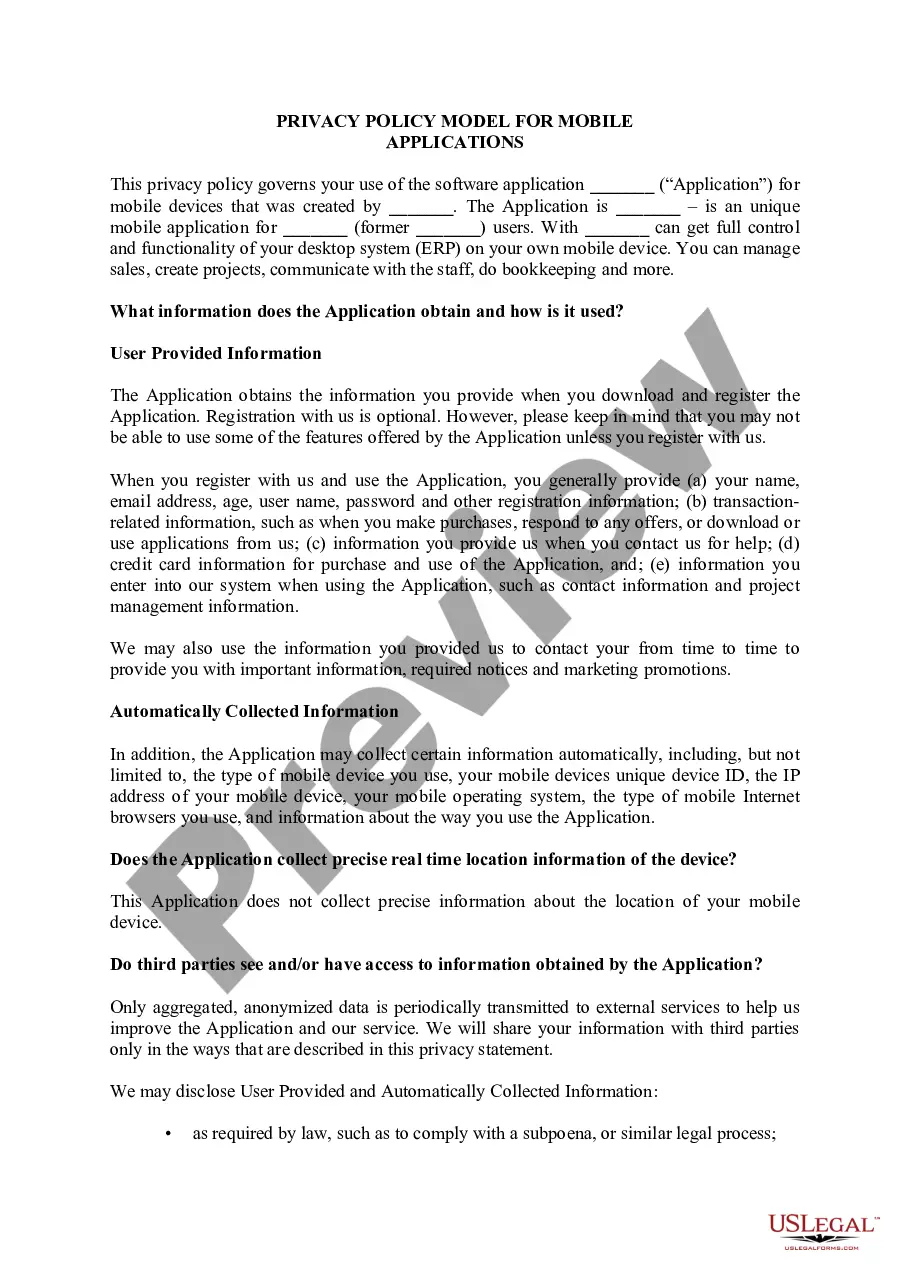

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.

A maximum retention period tells you when to destroy a certain record. When this period has lapsed you are really not supposed to have the record anymore. It is time to say goodbye to it. In some countries, though, there are exceptions when you issue a legal hold notice or a tax hold notice.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

The minimum retention period is the shortest amount of time that a WORM file can be retained in a SnapLock volume. If the application sets the retention period shorter than the minimum retention period, Data ONTAP adjusts the retention period of the file to the volume's minimum retention period.

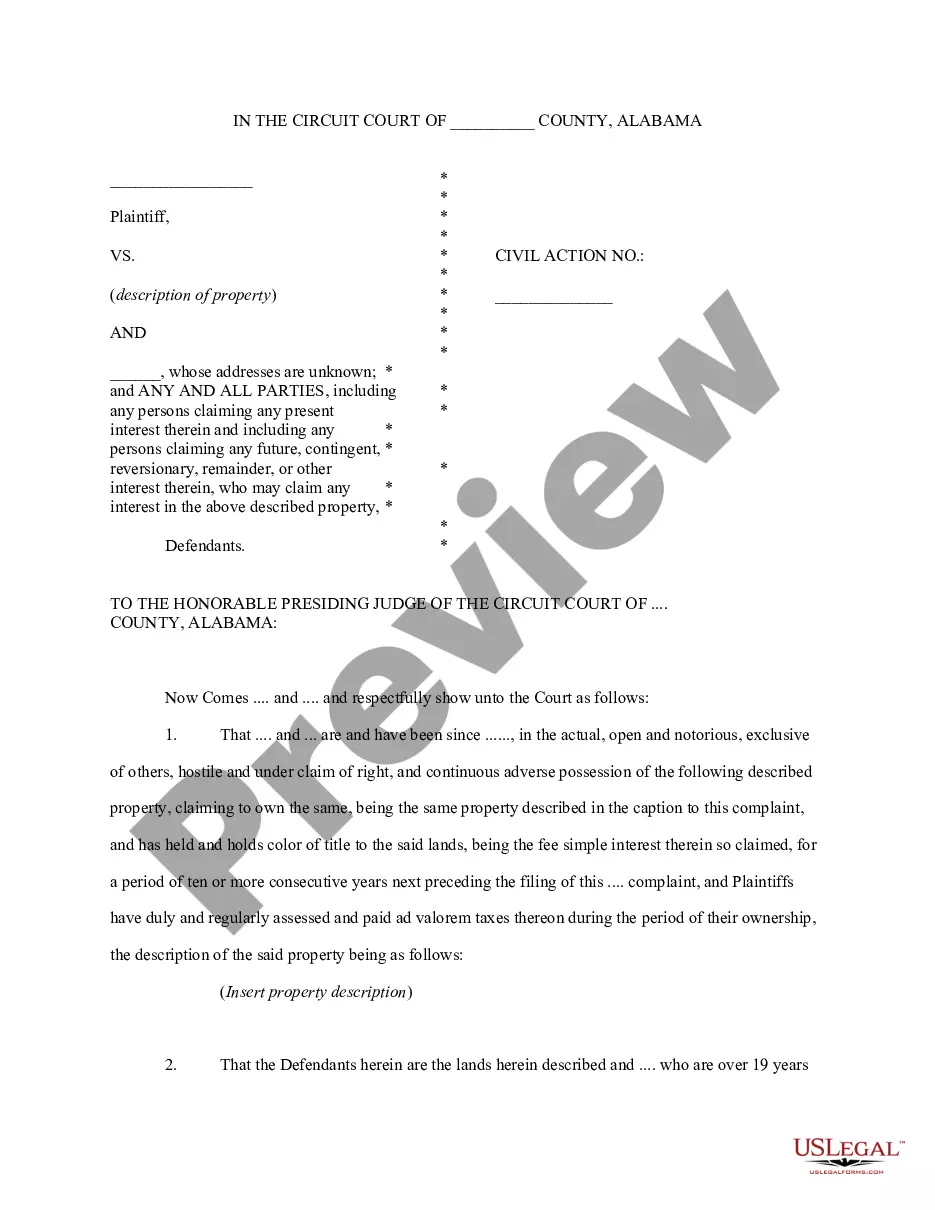

Any legal records, such as licenses, patents, registration forms and tax ID forms should also be kept throughout the business' life. Tax records have to be kept for a minimum of three years, however, these records may come in handy to your business in the long run so it does not hurt to hold on to them indefinitely.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever.