Illinois Class 9 Application Instructions are the instructions for applying for a Class 9 drivers license. This license is also known as a Motorcycle License and is necessary in order to legally operate a motorcycle in Illinois. There are two types of Class 9 application Instructions: • Standard Illinois Class 9 Motorcycle License Application: This application is for an individual who is 18 years of age or older and is not an Illinois resident. The individual must pass a vision screening, written and skills tests, and provide proof of identity. • Illinois Class 9 Motorcycle License Application for Under-18s: This application is for individuals who are under 18 years of age and are not an Illinois resident. The individual must pass a vision screening, written and skills tests, and provide proof of identity. They must also have parental or guardian consent for the application. In both cases, applicants must fill out the application form accurately, and provide the necessary documents and payment for the application fee. The applicant must pass a vision screening, written and skills tests in order to obtain a Class 9 Motorcycle License. Once the application is approved, applicants will receive their license in the mail.

Illinois Class 9 application Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Class 9 Application Instructions?

US Legal Forms is the simplest and most lucrative method to find appropriate official templates.

It features the largest online collection of business and personal legal papers created and verified by attorneys.

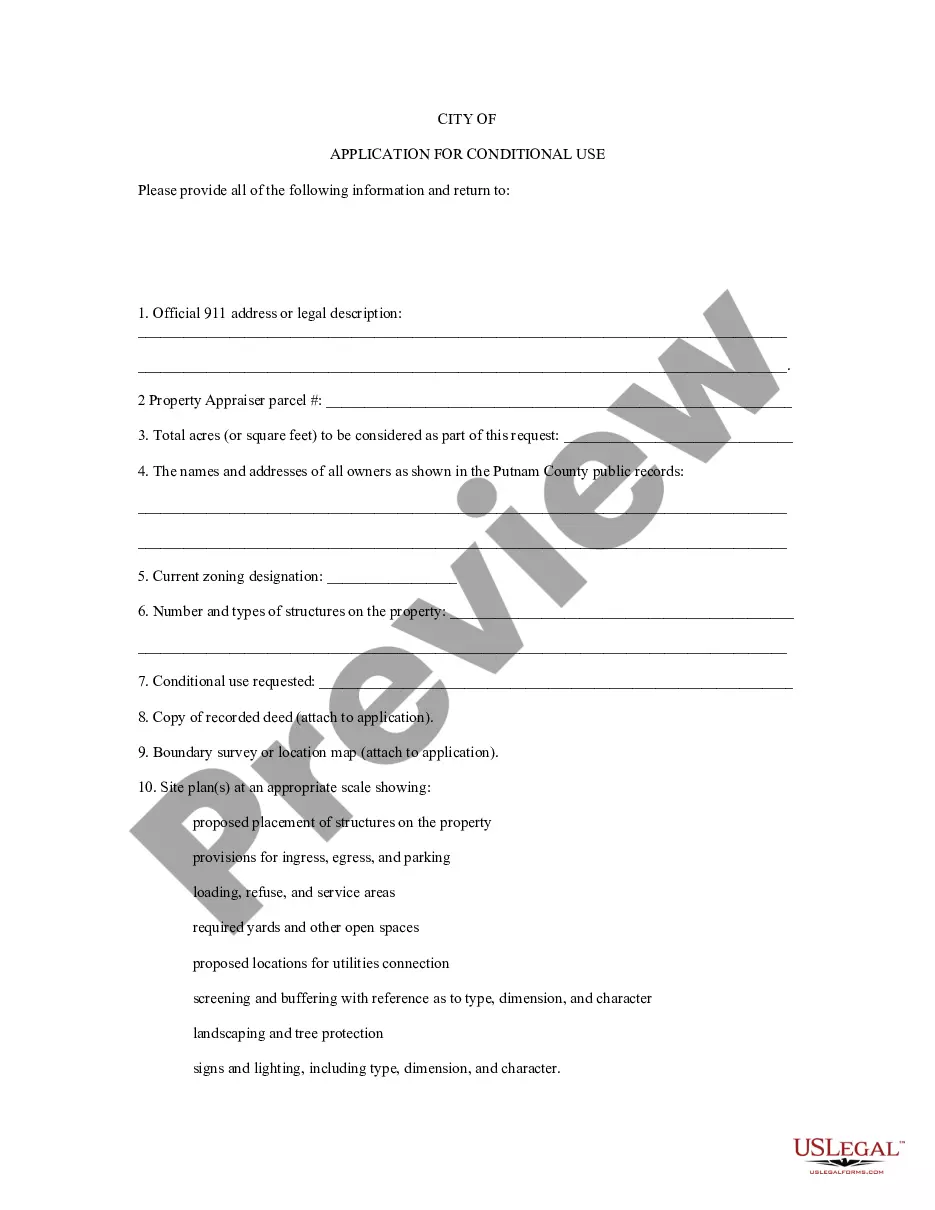

Here, you can discover printable and editable forms that adhere to federal and state regulations - just like your Illinois Class 9 application Instructions.

Review the form description or view the document to ensure it suits your needs, or find an alternative using the search feature above.

Click Buy now when you are confident of its alignment with all requirements, and choose the subscription option that appeals to you the most.

- Acquiring your template involves only a few straightforward steps.

- Users who already possess an account with an active subscription simply need to Log In to the online service and download the file onto their device.

- Subsequently, they can locate it within their profile under the My documents section.

- And here’s how you can procure a professionally crafted Illinois Class 9 application Instructions if you are accessing US Legal Forms for the first time.

Form popularity

FAQ

The Class 7b classification is designed to encourage commercial development throughout Cook County by offering a real estate incentive for the development of new commercial facilities, the rehabilitation of existing commercial structures, and the commercial reutilization of abandoned buildings on properties that have

Frequently Asked Questions $100,0002022 Estimated Fair Market Value-$8,0002022 Senior Exemption$21,1602022 Adjusted Equalized Assessed ValueX.082022 Tax Rate (example; your tax rate could vary)$1,692.80Estimated Tax Bill in dollar amount4 more rows

Class C. Designed to encourage industrial and commercial development throughout Cook County by offering a tax incentive for the remediation of contaminated properties including abandoned property or vacant land.

Incentive Benefits Properties receiving Class 6b will be assessed at 10% of market value for the first 10 years, 15% in the 11th year and 20% in the 12th year.

About the Class 8 Tax Incentive Qualifying buildings will be assessed at 10% of market value for 10 years, 15% in the 11th year and 20% in the 12th year. This is a significant reduction from the standard assessment level of 25% for industrial and commercial properties.

Cook County Class 9 Program offers a 50% reduction in assessments and taxes to developers who complete major rehab on multifamily buildings and keep rent below certain levels.

The Class 7c classification is designed to encourage commercial development throughout Cook County by offering a real estate incentive for the development of new commercial facilities, the rehabilitation of existing commercial structures, and the commercial reutilization of abandoned buildings.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.