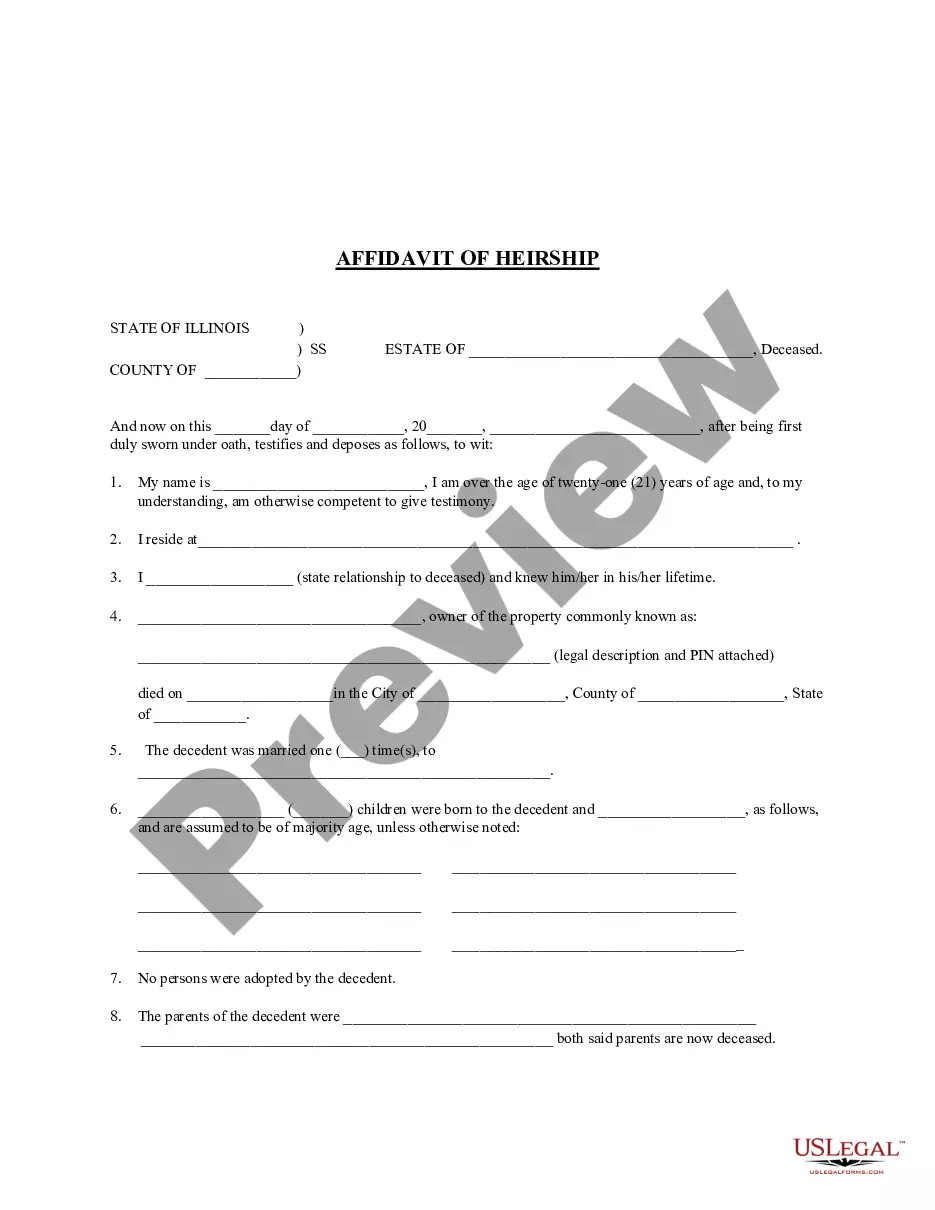

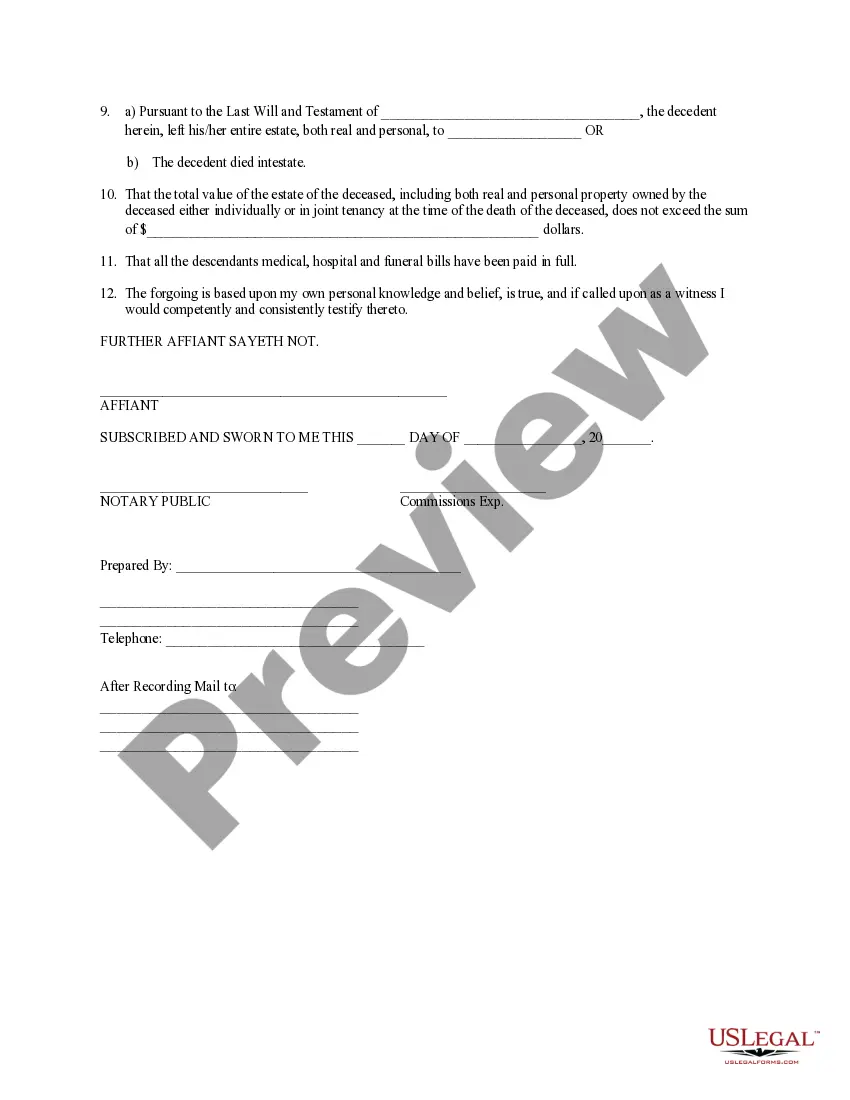

The Illinois Affidavit of Warship is a legal document used to determine the inheritance rights of individuals in the event of a death of a deceased person who dies without a Will. The Affidavit of Warship is used to appoint an individual, or individuals, to the estate of the deceased person and to determine who will receive the deceased person's assets. The Affidavit of Warship is not a substitute for a Will, but it provides the same legal effects of a Will if the situation meets the criteria. There are two types of Illinois Affidavit of Warship documents: (1) the standard Affidavit of Warship; and (2) the simplified Affidavit of Warship. The standard Affidavit of Warship is used when the deceased person is survived by a spouse, children, and/or grandchildren. The simplified Affidavit of Warship is used when the deceased person is survived by siblings, nieces/nephews, and/or cousins. The Illinois Affidavit of Warship must be completed and signed by two or more persons who have knowledge of the relevant facts and are not related to the deceased person. The Affidavit of Warship must be signed before a Notary Public or other authorized official and must include a detailed description of the deceased person's assets, the names and addresses of the heirs, and any other relevant information.

Illinois Affidavit of Heirship

Description

How to fill out Illinois Affidavit Of Heirship?

Managing legal paperwork necessitates focus, precision, and utilizing well-crafted templates. US Legal Forms has been assisting individuals across the country in doing just that for 25 years, so when you select your Illinois Affidavit of Heirship template from our service, you can be assured it adheres to federal and state regulations.

Utilizing our service is simple and swift. To acquire the required document, all you’ll need is an account with an active subscription. Here’s a quick guide for you to secure your Illinois Affidavit of Heirship in just a few minutes.

All documents are designed for versatile use, like the Illinois Affidavit of Heirship displayed on this page. If you require them again, you can fill them out without an additional fee - simply access the My documents section in your profile and complete your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents swiftly and in complete legal adherence!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative official document if the one initially accessed doesn’t fit your circumstances or state guidelines (the tab for that is located at the top page corner).

- Log in to your account and save the Illinois Affidavit of Heirship in your preferred format. If it’s your first time using our website, click Buy now to continue.

- Establish an account, pick your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you wish to receive your document and click Download. Print the document or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

What is an Affidavit of Heirship in Illinois? An affidavit of heirship is a written statement establishing the right of inheritance. To be valid, it must be signed under oath and witnessed by a third party.

What Does It Mean to be an Heir? Heirs are individuals who stand to inherit from a decedent ing to the Illinois laws of intestate succession, which set down how a decedent's assets must be distributed if they are not included in a valid will.

Probate is handled by the deceased person's executor, who must: prove in court that a deceased person's will is valid (usually a routine matter) identify and inventory the deceased person's assets. have those assets appraised.

An heir is someone who's legally entitled to your property if you don't have a will, while a beneficiary is someone you name in a legal document (your will or trust) to receive your assets.

What Does It Mean to be an Heir? Heirs are individuals who stand to inherit from a decedent ing to the Illinois laws of intestate succession, which set down how a decedent's assets must be distributed if they are not included in a valid will.

An heir is a person who may legally receive property or assets from a deceased person's estate when there is no will or trust in place; this is called dying intestate, and state laws then determine who the heirs are and how the assets are passed down.

If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.