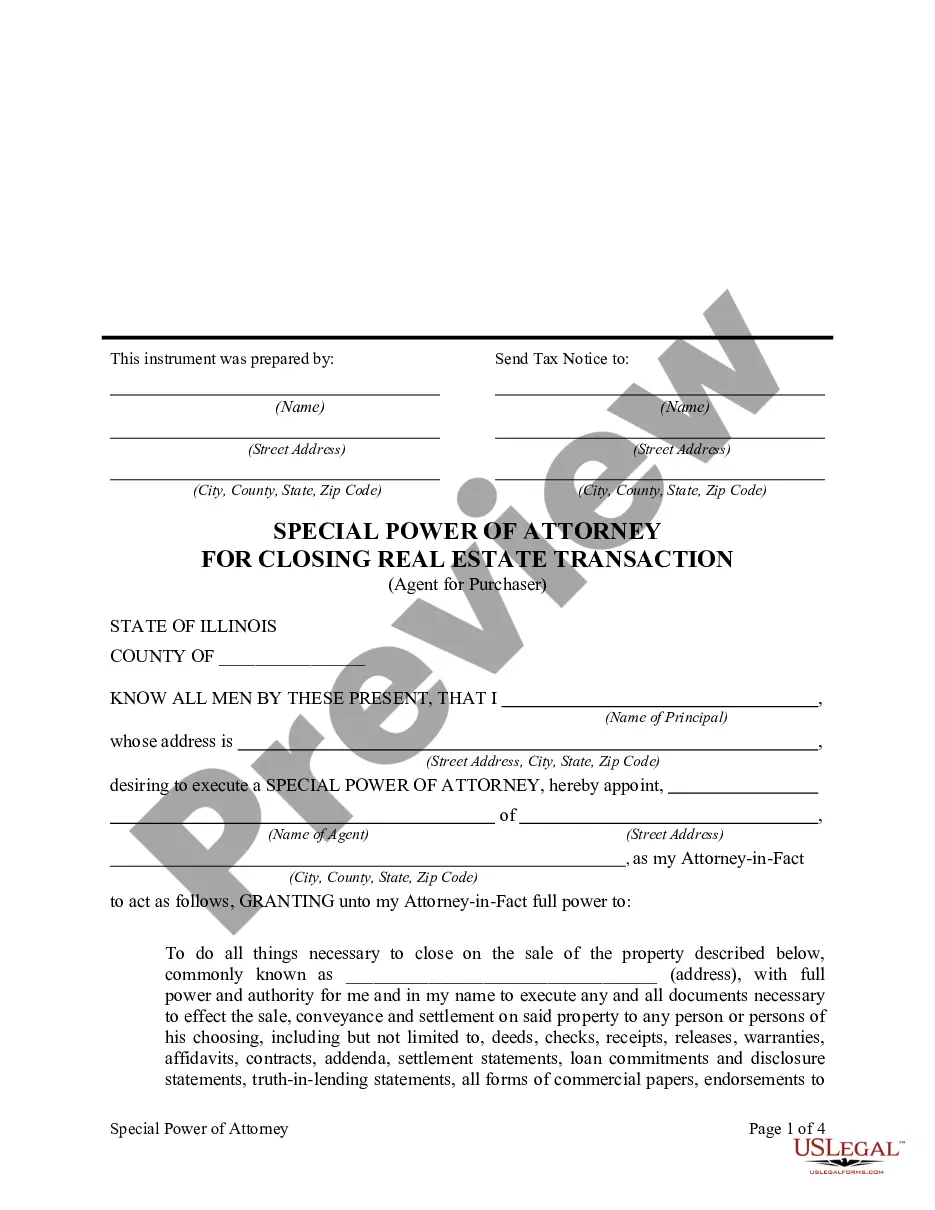

Illinois Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Understanding this form

The Special or Limited Power of Attorney for Real Estate Purchase Transaction is a legal document that allows a purchaser to designate an attorney-in-fact who can act on their behalf in buying a specific parcel of real estate. This form empowers the agent to execute necessary documents, including loan agreements, to complete the real estate transaction. It differs from a general power of attorney by granting limited authority specifically for real estate transactions.

Key parts of this document

- Identification of the principal (purchaser) and attorney-in-fact.

- Full description of the real estate being purchased.

- Authority granted to the attorney-in-fact, including collecting funds and executing documents.

- Statement of the obligations of the attorney-in-fact to act in the best interests of the principal.

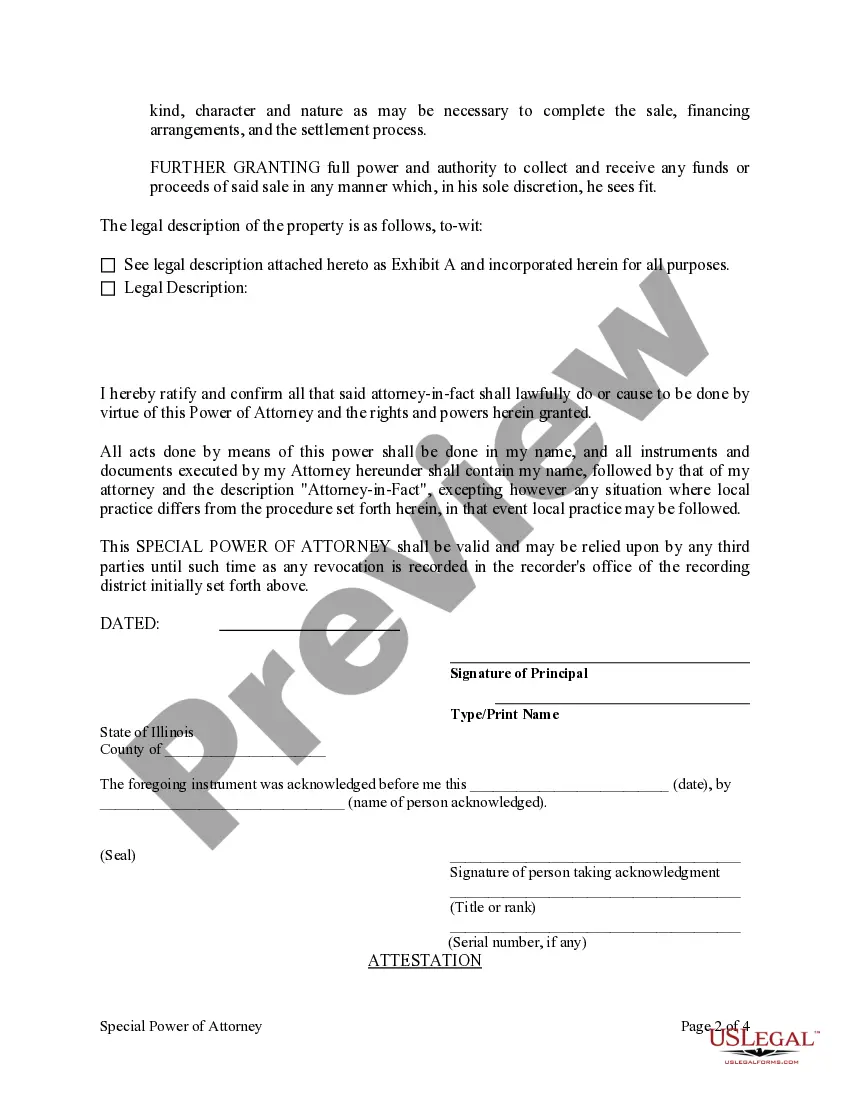

- Signatures of the principal and notary public for validation.

Common use cases

This form is useful when a purchaser is unable to attend the closing of a real estate transaction but still wants to authorize someone to complete the purchase on their behalf. It is ideal for situations where the purchaser is out of town, has scheduling conflicts, or needs assistance due to medical or other reasons.

Who should use this form

- Individuals purchasing real estate who cannot be present at the transaction.

- Those who trust another person to handle their real estate purchases.

- Buyers needing to execute multiple documents for a real estate deal.

How to complete this form

- Identify all parties involved, including the purchaser and the attorney-in-fact.

- Enter the full legal description of the property being purchased.

- Specify the powers granted to the attorney-in-fact, indicating any financial authority.

- Have both the principal and attorney-in-fact sign the document in the presence of a notary public.

- Ensure all completed signatures and notary seals are present before submission.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to specify the exact property being purchased.

- Not selecting the correct authority for the attorney-in-fact.

- Overlooking the need for notarization.

- Not including a full legal description of the property.

Why complete this form online

- Convenient access to legally drafted documents from licensed attorneys.

- Easily customizable to your specific needs and situation.

- Downloadable and printable format allows for quick completion.

- 24/7 availability means you can complete your form at your own pace.

Summary of main points

- The Special or Limited Power of Attorney for Real Estate Purchase enables a designated person to purchase property on your behalf.

- It is important to clearly define the authority granted to your attorney-in-fact.

- This document must be notarized to ensure its legality.

Form popularity

FAQ

A power of attorney letter bestows the Agent with powers to act over various transactions. Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal.The name, address, and signature of the person who witnesses the signing.

Finally, the power of attorney document requires the principal's notarized signature and at least one witness to be effective. Please note, according to Section 3-3.6 of the Illinois Power of Attorney Act, the requirement of at least one witness's signature applies to agencies created after June 9, 2000.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Draft the Power of Attorney for NRIs, print on a plain paper and sign it. Go to the Indian Embassy or Consulate in that country and get it stamped and sealed from the embassy.

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.