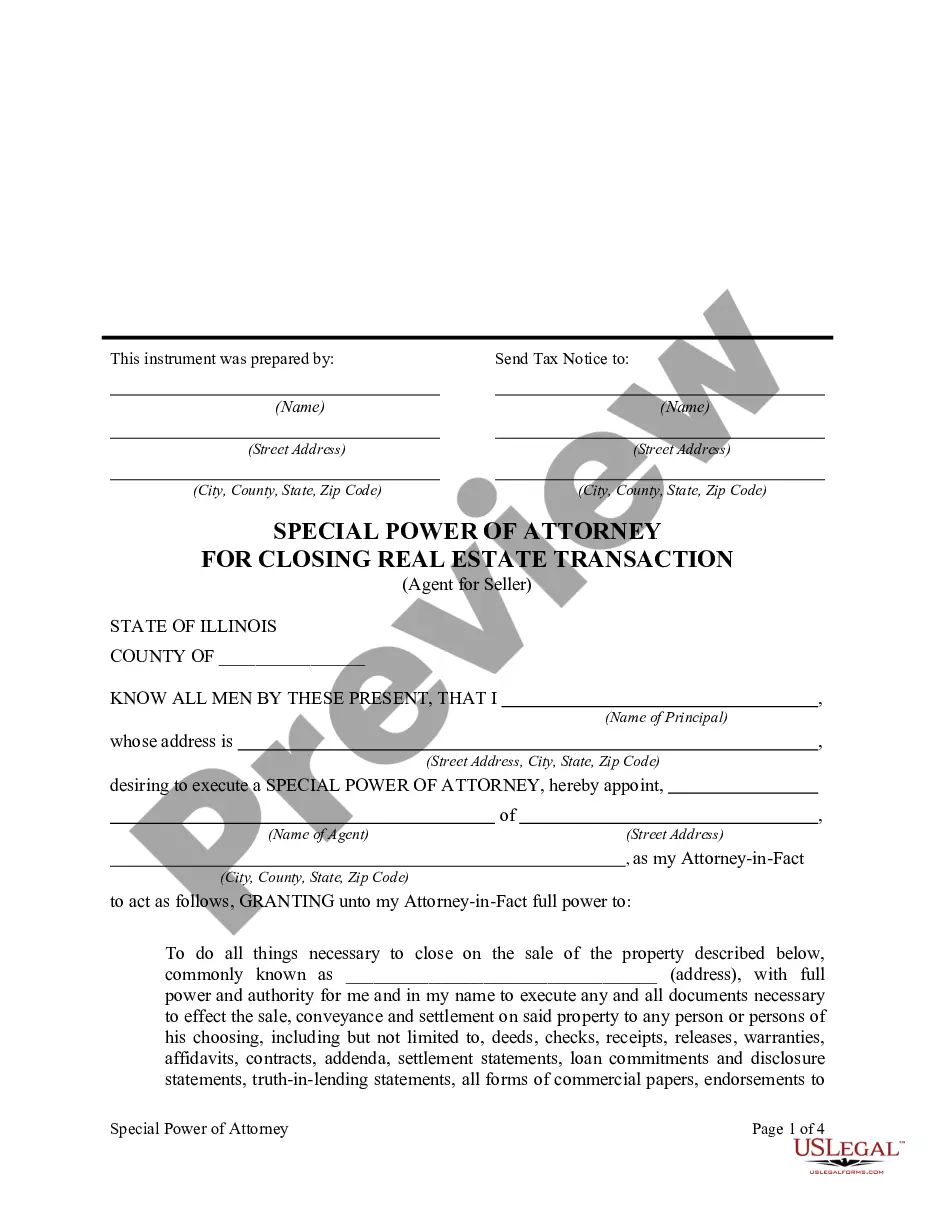

Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Description

Key Concepts & Definitions

Special or Limited Power of Attorney for Real Estate is a legal document that grants a specifically designated person the authority to handle real estate transactions on behalf of the grantor. Unlike a general power of attorney, which covers a broad range of actions, a special power of attorney focuses on specific tasks, typically related to property management, sale, or leasing.

Step-by-Step Guide

- Identify the Need: Determine why you need a limited power of attorney and what specific real estate transactions it should cover.

- Choose an Agent: Select a trusted individual who understands real estate matters to act as your agent.

- Draft the Document: Create the power of attorney document, specifying the powers granted and any limitations. It is advisable to consult with a legal professional to ensure accuracy.

- Sign and Notarize: The power of attorney must be signed in the presence of a notary to be legally binding in most states.

- Record the Document: If the power of attorney relates to real estate transactions, it may need to be recorded with local government offices where the property is located.

Risk Analysis

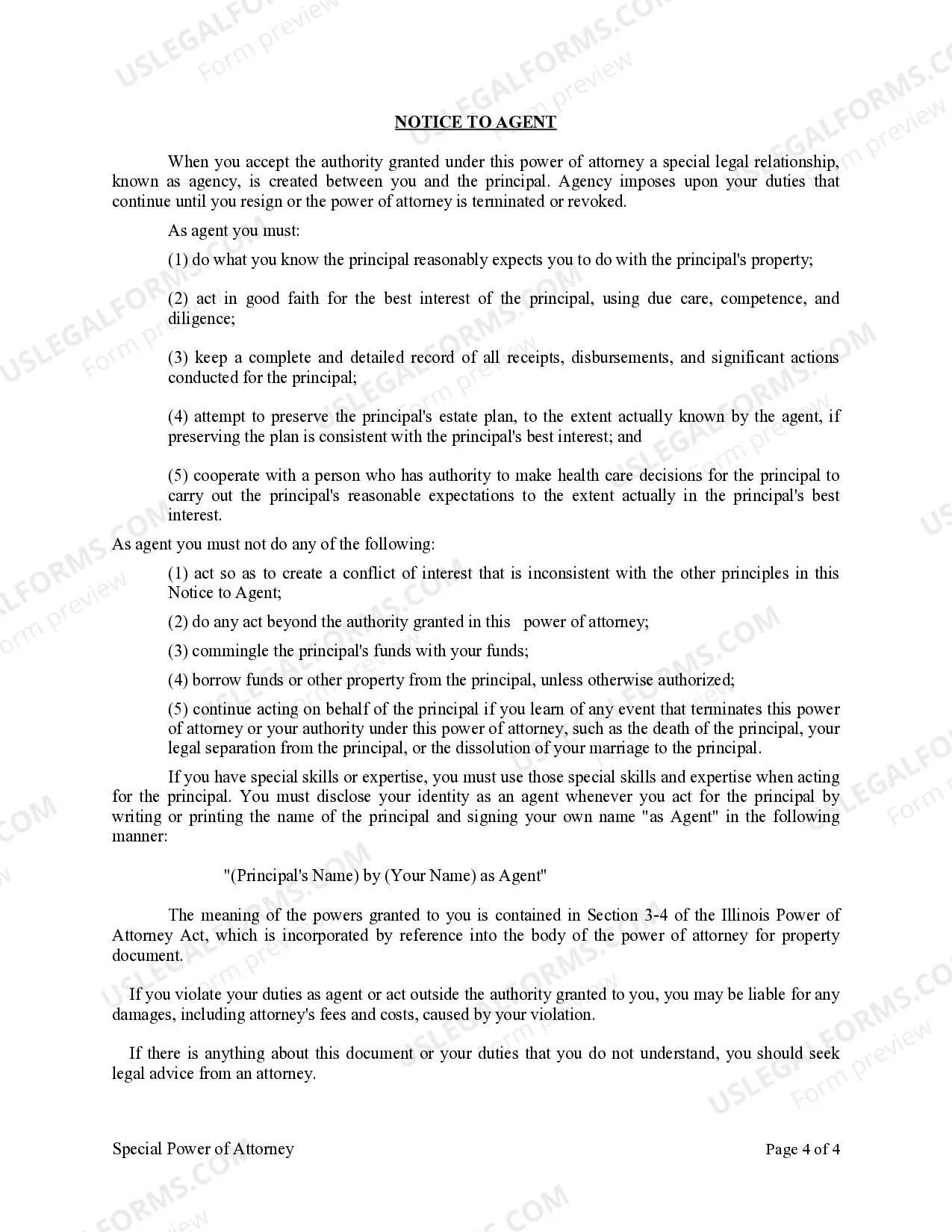

- Agent Mismanagement: If the agent mismanages the real estate transactions, it could result in financial losses or legal issues.

- Legal Compliance: Errors in the formulation of the document could render it invalid, leading to disputes or failed transactions.

- Revocation Issues: Failing to properly revoke the power when it's no longer needed can lead to unauthorized actions.

Best Practices

- Clear Documentation: Clearly outline the powers granted to the agent to avoid any ambiguity.

- Choose Wisely: Select an agent who is trustworthy and has relevant experience with real estate.

- Regular Reviews: Periodically review the power of attorney to ensure it still reflects your wishes and circumstances.

Common Mistakes & How to Avoid Them

- Vague Terms: Avoid using vague terms when defining the authority granted. Be specific to prevent misuse of power.

- Ignoring State Laws: Each state has its own requirements for drafting and executing a power of attorney. Ensure compliance with local laws.

- Failing to Update: Update the power of attorney as your situation changes or as needed legally.

FAQ

Q1: Can the powers in a special power of attorney for real estate be revoked?

A1: Yes, the grantor can revoke these powers at any time, provided they are mentally competent.

Q2: How long is a special power of attorney valid?

A2: It depends on the state laws and the specific conditions set in the document. It can be for a specified period or until the completion of the transaction.

How to fill out Illinois Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

Searching for Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction by Seller example and filling them out might pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the correct template specifically for your state within a few clicks.

Our attorneys prepare all documents, leaving you only to complete them. It truly is that easy.

You can now print the Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction by Seller form or fill it out using any online editor. Don't worry about errors since your template can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's web page to save the sample.

- Your downloaded templates are stored in My documents and are always accessible for future use.

- If you haven’t subscribed yet, registration is required.

- Review our detailed instructions on how to obtain your Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction by Seller form in just a few minutes.

- To acquire an approved form, verify its acceptance for your state.

- Review the example using the Preview option (if available).

- If there is a description, read it to understand the details.

- Click on the Buy Now button if you find what you're looking for.

- Select your plan on the pricing page and create an account.

- Choose your payment method via card or PayPal.

- Download the template in your preferred format.

Form popularity

FAQ

Choosing between a General Power of Attorney and a Special Power of Attorney depends on your needs. A General Power of Attorney grants broad authority, while a Special Power of Attorney limits the agent's powers to specific tasks. If you're focused solely on a real estate transaction, an Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller is often the better choice.

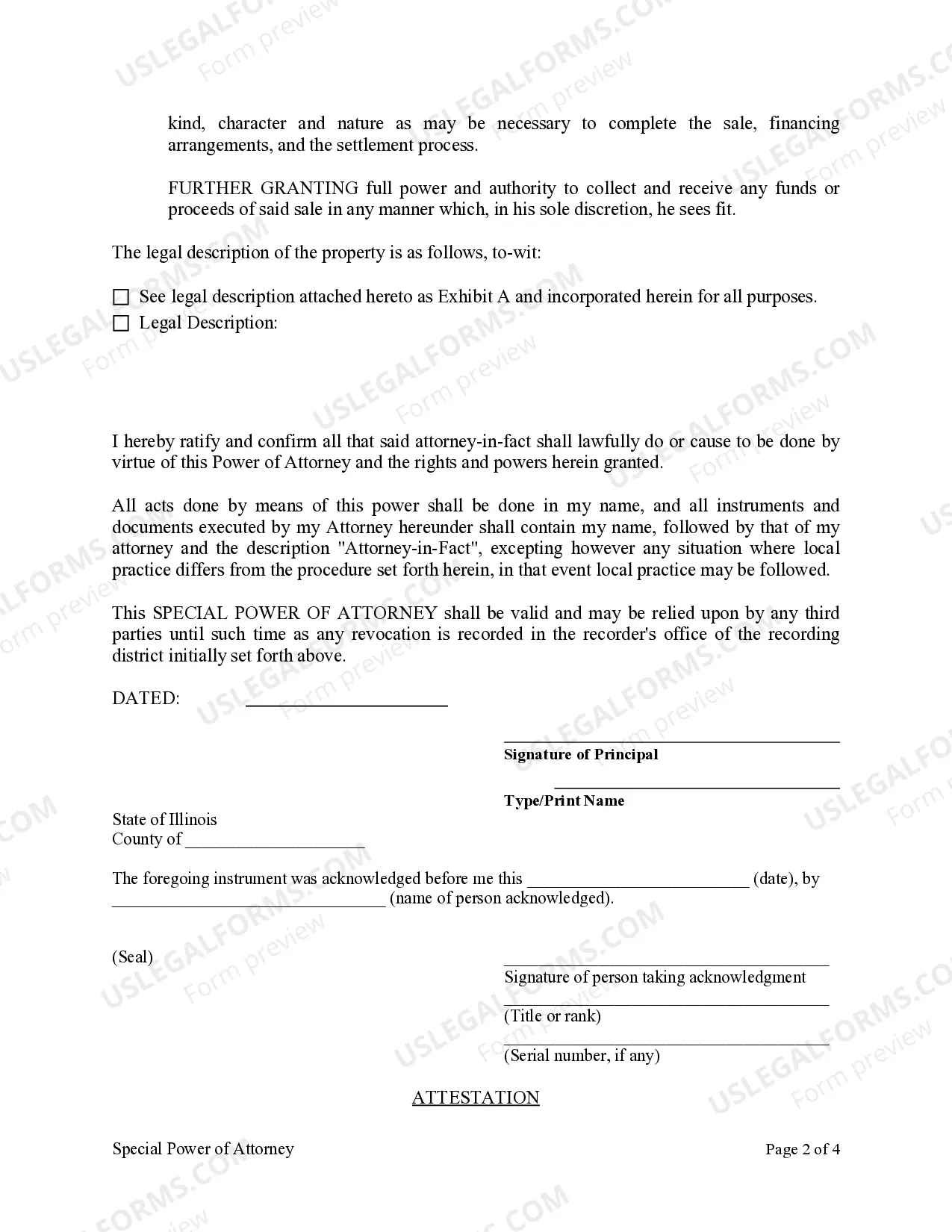

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

The POA can be a useful tool in residential real estate transactions when a necessary party will be unavailable to execute documents prior to or attend the closing.In order to be recorded, the POA presented must contain the original signature of the principal, and it must be notarized.

By giving someone the power to sign on their behalf, the Principal is giving the attorney-in-fact power to make decisions for them. When signing a POA, the Principal's signature must be notarized at the time and place it is signed. A local notary in any state of the U.S. is acceptable.

A power of attorney (POA) for a real estate closing is permissible if not all parties can make it to the settlement table, but is not to be used as a matter of convenience. A POA is written authorization to act in a legal capacity on another's behalf, in certain circumstances, which are laid out in the document.

Finally, the power of attorney document requires the principal's notarized signature and at least one witness to be effective. Please note, according to Section 3-3.6 of the Illinois Power of Attorney Act, the requirement of at least one witness's signature applies to agencies created after June 9, 2000.

Do I Need to Have My Will Notarized? No, in Illinois, you do not need to notarize your will to make it legal.However, Illinois allows your will to be self-proved without a self-proving affidavit, as long as you sign and witness it correctly.

Finally, the power of attorney document requires the principal's notarized signature and at least one witness to be effective. Please note, according to Section 3-3.6 of the Illinois Power of Attorney Act, the requirement of at least one witness's signature applies to agencies created after June 9, 2000.

After the principal's name, write by and then sign your own name. Under or after the signature line, indicate your status as POA by including any of the following identifiers: as POA, as Agent, as Attorney in Fact or as Power of Attorney.

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.