The Illinois Motion to Claim Exemption Under Wage Deduction Proceedings is a legal process that allows a debtor to protect their wages from garnishment. This motion is used to exempt certain types of income, such as Social Security benefits, veteran's benefits, or unemployment benefits, from being taken away by creditors in order to repay debts. The motion must be filed in the circuit court of the county in which the debtor resides in order for it to be considered. There are two types of Illinois Motion to Claim Exemption Under Wage Deduction Proceedings: an individual motion and a joint motion. An individual motion is filed by a single debtor, while a joint motion is filed by two or more debtors. In both cases, the debtor must provide proof of income and other supporting documents to the court in order to prove their eligibility for the exemption.

Illinois Motion To Claim Exemption Under Wage Deduction Proceedings

Description

How to fill out Illinois Motion To Claim Exemption Under Wage Deduction Proceedings?

US Legal Forms is the simplest and most economical method to discover suitable legal templates.

It boasts the largest virtual collection of business and personal legal documents crafted and verified by legal experts.

Here, you can access print-ready and fillable templates that adhere to federal and local laws - just like your Illinois Motion To Claim Exemption Under Wage Deduction Proceedings.

Review the form description or view a preview of the document to ensure you've selected one that meets your needs, or search for another using the search feature above.

Select Buy now when you are confident about its suitability with all your criteria and choose the subscription plan that best fits you.

- Obtaining your template involves just a few straightforward steps.

- Users who already hold an account with an active subscription need only to Log In to the platform and download the form onto their device.

- Afterward, they can locate it in their account under the My documents section.

- If this is your first time using US Legal Forms, here's how to obtain a correctly prepared Illinois Motion To Claim Exemption Under Wage Deduction Proceedings.

Form popularity

FAQ

A wage deduction summons in Illinois is a legal notice that orders your employer to withhold a portion of your wages to satisfy a debt. This process allows creditors to collect what you owe by directly accessing your paycheck. It's essential to respond appropriately, especially if you wish to file an Illinois Motion To Claim Exemption Under Wage Deduction Proceedings. Using US Legal Forms can help you understand your rights and respond effectively.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

For the most part, there are only two ways to stop wage garnishments in Illinois. First, you can pay off the judgment. You may be able to pay the judgment in a lump sum, or you may have to wait for the garnishment to run its course. The second way to stop a garnishment is by filing bankruptcy.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

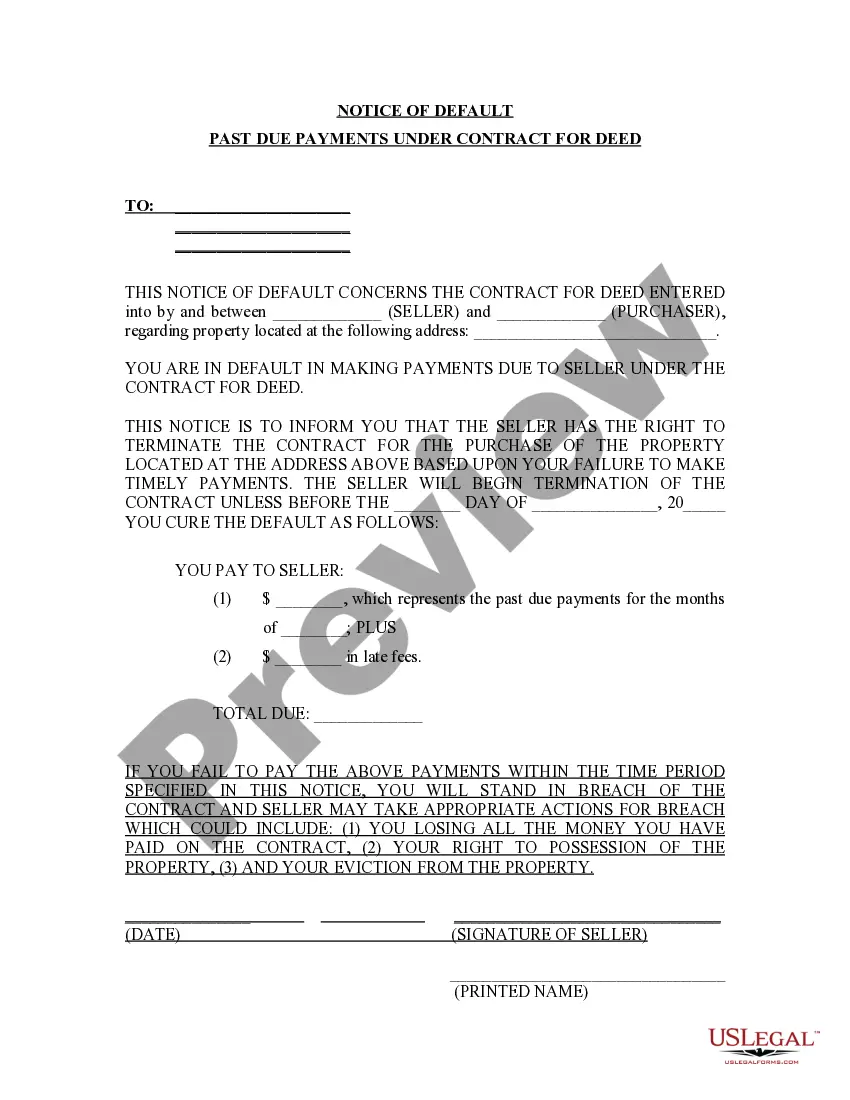

Respondent should deduct each pay period 15% of Defendant's non-exempt gross wages. If Defendant's disposable earnings are less than 45 times the greater of the state or federal minimum wage, no deductions may occur. All wages withheld shall be turned over to Plaintiff or Plaintiff's attorney on a monthly basis.

In the Illinois law books, the wage deduction law is located at 735 ILCS 5/12-801 through 735 ILCS 5/12-819. In a wage deduction proceeding, you serve a Summons on the Respondent/Respondent's Employer. The summons requires the employer to deduct money from the Respondent's pay and hold it for instructions from a judge.

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.