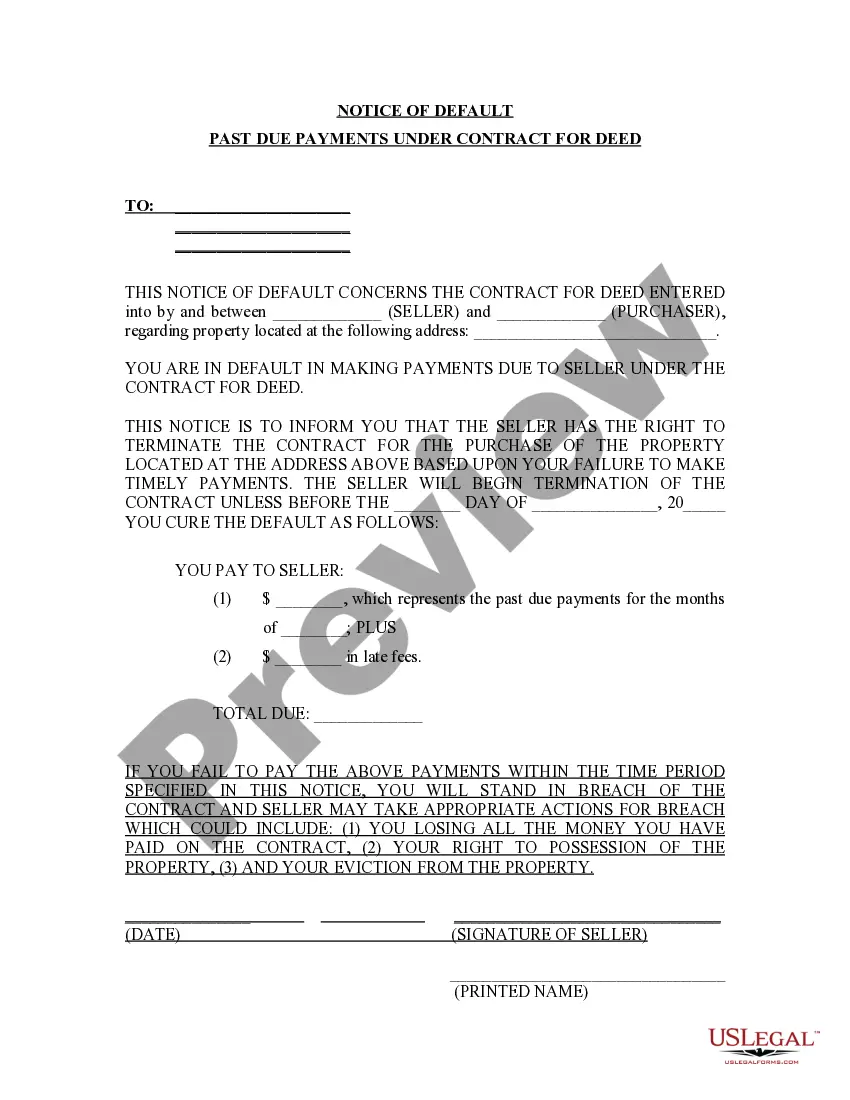

This is a Notice of Default for Past Due Payments in connection with a Contract for Deed. It is used in order to notify the Buyer that his/her payments are past due, and the account needs to be immediately brought up-to-date. This is the initial notice.

District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out District Of Columbia Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to secure a printable District of Columbia Notice of Default for Past Due Payments related to a Contract for Deed.

Our court-acceptable forms are crafted and frequently updated by qualified attorneys.

Ours is the most extensive Forms library available online and offers competitively priced and precise templates for clients, legal experts, and small to medium-sized businesses.

US Legal Forms offers an extensive range of legal and tax templates and packages for business and individual needs, including the District of Columbia Notice of Default for Past Due Payments in relation to Contract for Deed. Over three million users have successfully utilized our service. Select your subscription plan and acquire high-quality forms in just a few clicks.

- The documents are categorized based on state-specific categories.

- Several of these can be previewed prior to download.

- To access samples, users must hold a subscription and Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For users without a subscription, adhere to the following instructions to swiftly locate and download the District of Columbia Notice of Default for Past Due Payments concerning Contract for Deed.

- Ensure that you have the correct template in relation to the required state.

Form popularity

FAQ

A legal notice of default is a formal declaration from a lender indicating that a borrower has failed to meet their contract obligations, particularly regarding payment. In the context of the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed, it serves as a crucial legal step before foreclosure proceedings. Such notices protect the lender's rights and provide the borrower with an opportunity to rectify the situation before further legal actions occur. It is essential to understand this process to mitigate potential consequences.

Delivering a notice of default must be done accurately to meet legal requirements. Typically, it can be sent via certified mail, personal delivery, or electronic communication, depending on local regulations. When issuing a District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed, ensure that you maintain proof of delivery. This serves as critical documentation should future disputes arise.

A default notice must include specific information to be valid and effective. Essential elements are the details of the borrower, the nature of the default, and the amounts due. Additionally, referencing the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed helps align your notice with legal standards. Ensuring that all these components are included will enhance the notice's enforceability.

Filing a notice of default involves preparing the document and submitting it to the appropriate authority. In the District of Columbia, this typically includes sending the notice to the borrower and filing a copy with the court or relevant local agency. When drafting the notice, refer to the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed to comply with local requirements. This ensures that you follow the necessary legal processes effectively.

Writing a default notice requires clarity and specificity. Begin by stating the nature of the default, such as missed payments, and provide the specific dates and amounts involved. Clearly reference the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed to ensure that it aligns with local regulations. Always include a call to action, encouraging the recipient to rectify the situation by a specified date.

To write a notice of default, begin by clearly identifying the parties involved and referencing the contract in question. Specify the nature of the default, detailing the missed payments under the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed. Include a deadline for the borrower to respond and rectify the situation. Using platforms like US Legal Forms can streamline this process, providing templates and guidance to ensure compliance and clarity in your notice.

A written notice of default serves as an official communication that a party has failed to meet their obligations outlined in a contract. In the context of the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed, this document informs the borrower of their overdue payments. It outlines the amount due and requests immediate action to rectify the default. This notice is crucial for initiating any further legal actions, if necessary.

The primary purpose of a notice of default is to inform you of overdue payments and prompt action. It effectively serves as a last warning before potential foreclosure or other legal actions take place. In the case of the District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed, this document can have significant consequences if not addressed swiftly.

While both a notice of default and a demand letter seek to address overdue payments, they serve distinct purposes. A notice of default formally indicates that a payment default has occurred, whereas a demand letter requests payment directly. Understanding these differences is essential, especially in the context of a District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed.

To file a notice of default, you generally need to draft a formal document and submit it to the appropriate court or agency. This process often involves providing evidence of the overdue payments and ensuring all legal requirements are met. Using platforms like USLegalForms can streamline your filing process, particularly when dealing with a District of Columbia Notice of Default for Past Due Payments in connection with Contract for Deed.