Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings is a legal filing that allows a judgment debtor to claim an exemption from wage deduction proceedings for wages earned in the state. This motion can be used to protect a portion of a debtor’s wages from being garnished by creditors. The motion typically must be filed in the court that issued the judgment or in the county where the wage garnishment was served. There are two types of Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings: General Exemption and Special Exemption. The General Exemption allows the debtor to claim a portion of their wages as exempt from garnishment, up to the amount of the state’s exemption limit. The Special Exemption is more stringent and requires the debtor to provide evidence that the wages being garnished are necessary to support the debtor and their dependents.

Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings

Description

How to fill out Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings?

How much time and resources do you typically allocate to creating formal documents.

There’s a more advantageous way to obtain such forms rather than hiring legal professionals or spending hours looking online for an appropriate template.

Another advantage of our service is the ability to access previously downloaded documents that are securely stored in your profile in the My documents tab. Retrieve them at any time and repeat your paperwork as often as necessary.

Conserve time and effort preparing legal documents with US Legal Forms, one of the most dependable online solutions. Join us today!

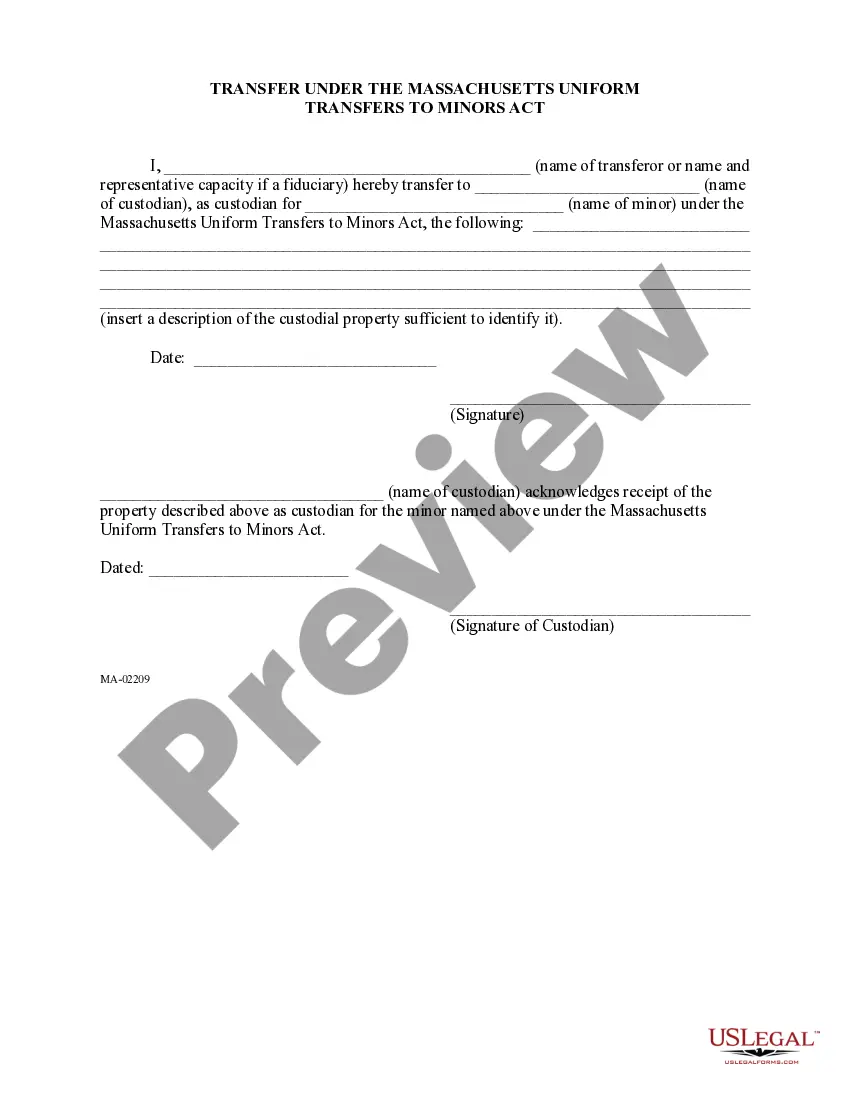

- Review the form details to confirm it satisfies your state stipulations. To do this, read the form outline or use the Preview option.

- If your legal template does not fulfill your needs, search for an alternative using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings. If you don't, continue to the next steps.

- Click Buy now once you identify the correct blank form. Choose the subscription plan that best fits your needs to access our comprehensive library.

- Create an account and pay for your subscription. Payments can be made using your credit card or through PayPal - our service is exceptionally reliable for that.

- Download your Illinois Judgment Debtors Motion To Claim Exemption In Wage Deduction Proceedings onto your device and complete it either on a printed hard copy or electronically.

Form popularity

FAQ

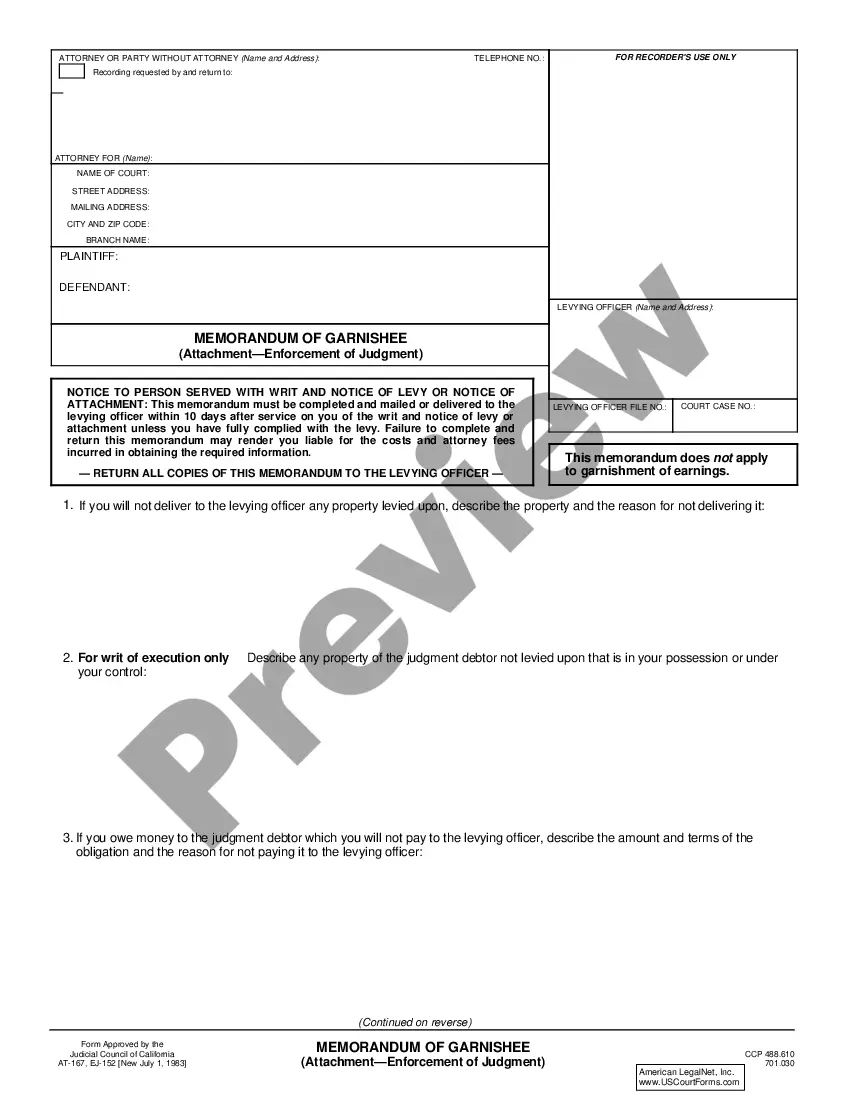

In the Illinois law books, the wage deduction law is located at 735 ILCS 5/12-801 through 735 ILCS 5/12-819. In a wage deduction proceeding, you serve a Summons on the Respondent/Respondent's Employer. The summons requires the employer to deduct money from the Respondent's pay and hold it for instructions from a judge.

In non-wage garnishments, 735 ILCS 5/12-701 requires the judgment creditor, or other person, to file an affidavit stating that the affiant believes the garnishee is indebted to the judgment debtor or has property of the judgment debtor. Failure to file such affidavit invalidates the garnishment.

What is a Citation to Discover Assets to Debtor? A Citation to Discover Assets to Debtor is a court document requiring the debtor to come to court and answer questions about their property and income. Then, the judgment creditor can try to get that property or income to pay the judgment, if it is not protected by law.

Step 1: File your forms with the Circuit Clerk in the county where the court case is filed. o Call the Circuit Clerk for a court date, time, and courtroom number for your Citation to Discover Assets to Debtor. This is the time and place where the debtor will show up to answer the questions.

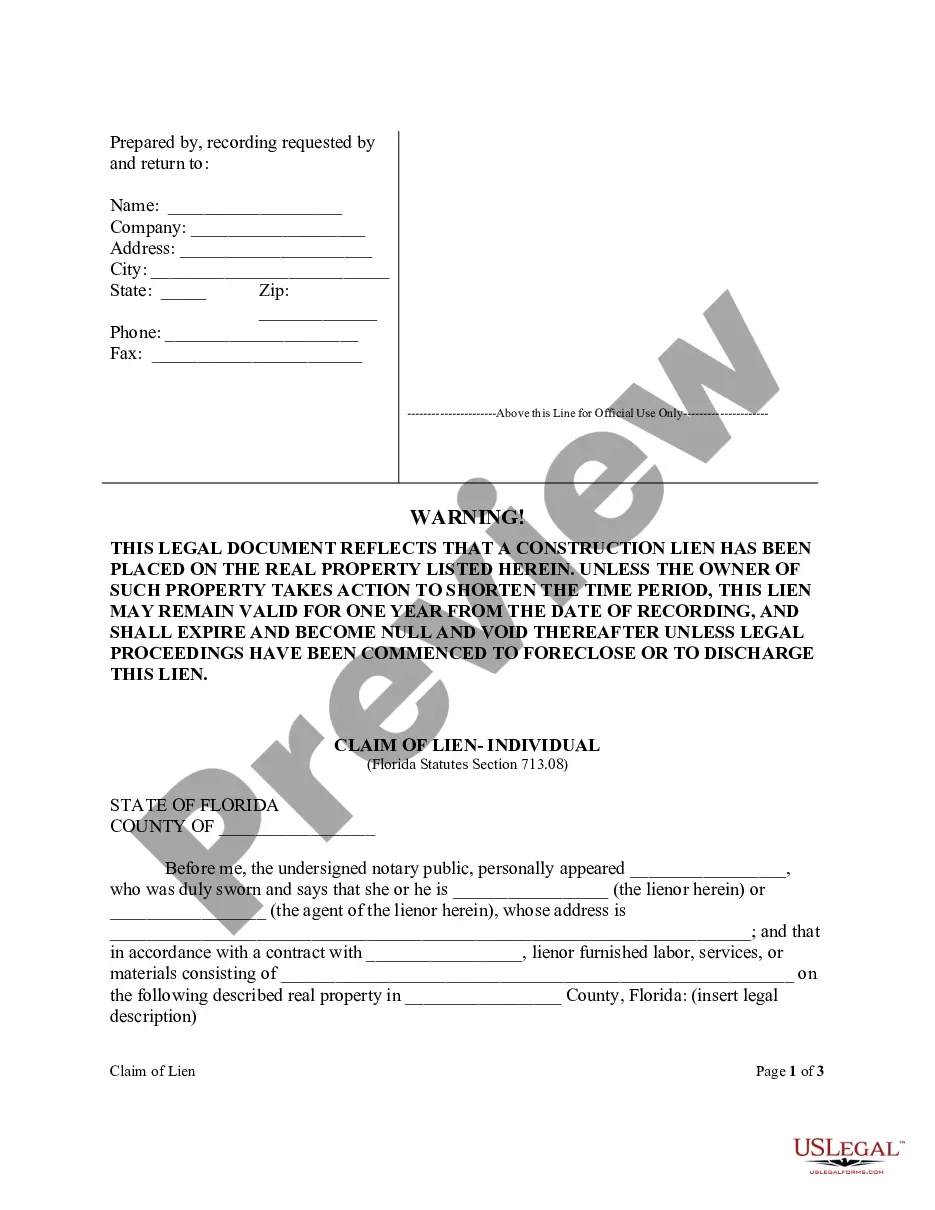

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.

If you have won a judgment for money against your debtor, you can file a citation to discover assets to a third party....The summons must be given to the third party by: The sheriff; or. Certified or registered mail. Restricted delivery if to an individual.

In Illinois, an unpaid judgment can become a lien on real estate. A judgment lien allows a creditor to force a sale of property owned by the debtor (you).

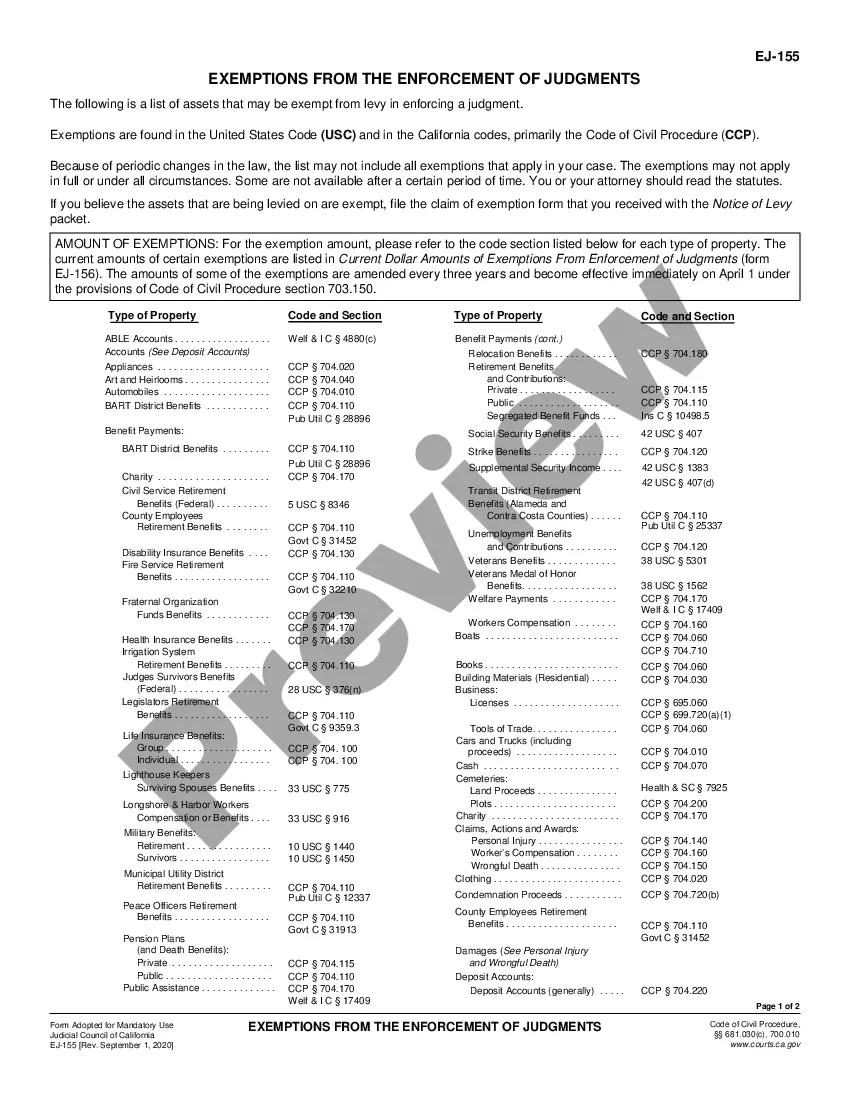

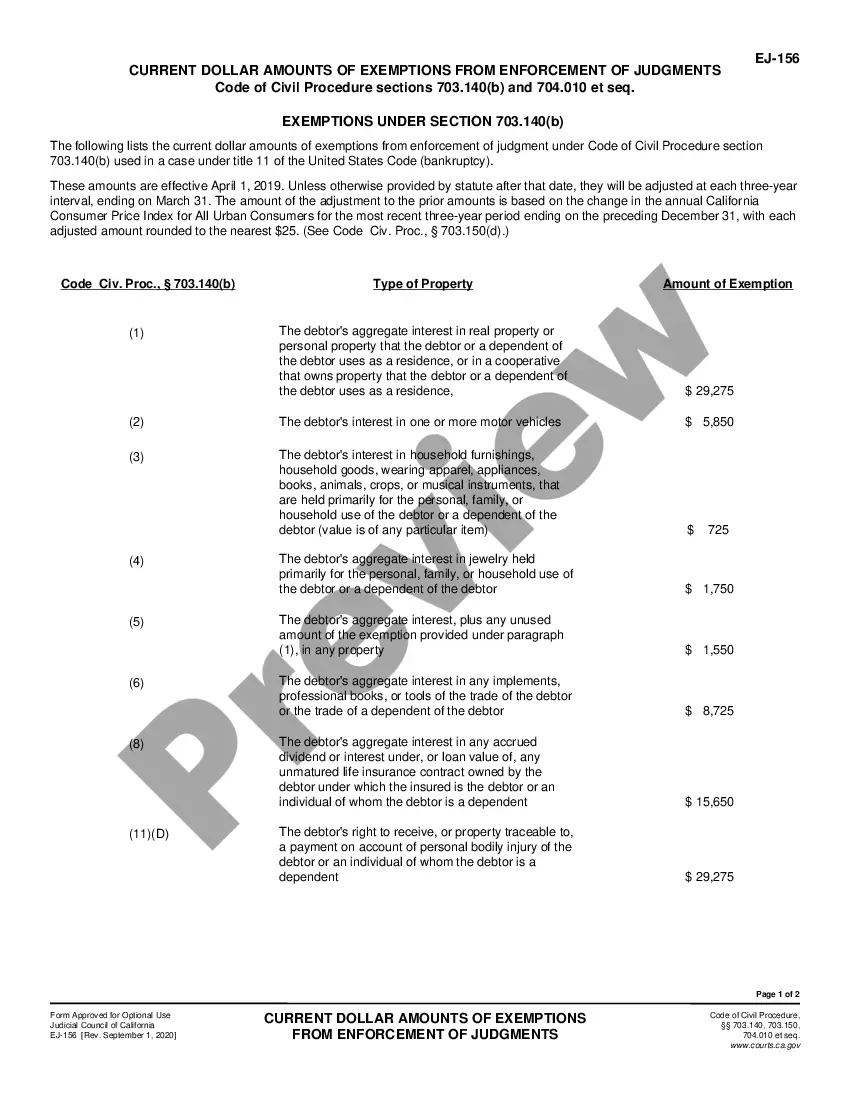

These are the major exemptions under Illinois law: Wages (exempt in part) ? 85 percent of an individual debtor's wages are exempt.Certain retirement funds ? Pension and individual retirement account (IRA) funds and individual retirement annuities are fully exempt from collections.